Wall Street doesn’t always agree on which AI stocks are winners, and heavy short interest often highlights that divide. When a stock becomes popular, expectations rise quickly, leaving little room for mistakes.

That’s exactly what’s happening with several well-known AI-related names currently. Shares of SoundHound AI (SOUN), Applied Digital (APLD), and CleanSpark (CLSK) are among the most heavily shorted large-cap stocks, signaling that many traders are betting these companies will struggle to live up to the hype. Bears point to valuation concerns, uneven earnings, and execution risks. Still, high short interest can also create opportunity, if fundamentals improve.

Should investors follow Wall Street’s pessimism, or see this skepticism as a potential buying setup? Let's take a closer look.

AI Stock #1. SoundHound AI (SOUN)

SoundHound AI is a leader in voice and conversational AI, using proprietary speech-recognition and natural language processing (NLP) tech to deliver voice-enabled solutions for automakers, OEMs and enterprises, powering hands-free control, voice commerce and virtual assistants.

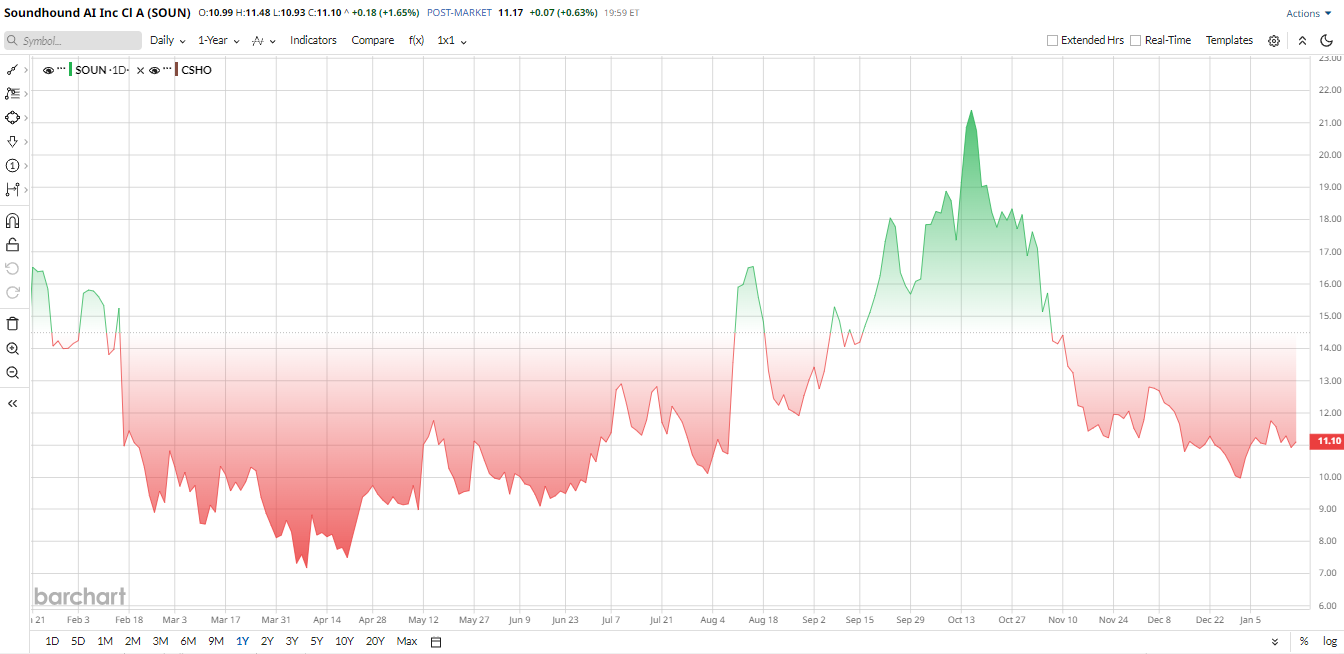

SOUN stock has been volatile over the past 12 months, dipping about 36%. However, shares are also up roughly 7% year-to-date (YTD).

The valuation also looks elevated. SOUN stock changes hands at about 28 times forward sales. That's a premium for a company still burning cash and a sign of aggressive growth expectations baked into the share price.

Operationally, SoundHound is growing fast but not yet profitable. The third quarter of 2025 saw revenue of $42 million, up 68% year-over-year (YOY), while net loss widened to $109.3 million from $21.8 million a year earlier. On a non-GAAP basis, the loss was roughly $13 million, and adjusted EBITDA was a loss of about $14.5 million. Still, the balance sheet is a strength — the company held $269 million in cash and carried no debt. Management framed the quarter as a milestone, citing strong contract wins and a tripling of the order backlog that supported a raised full-year revenue guide.

At CES 2026, SoundHound pushed deeper into in-vehicle commerce and multimodal AI with “Amelia 7,” a platform for agentic voice commerce (ordering food, booking reservations, paying for parking) and Vision AI for vehicles. Strategic partnerships, including an in-car OpenTable integration, tell a story of a clear path to monetizing voice interactions.

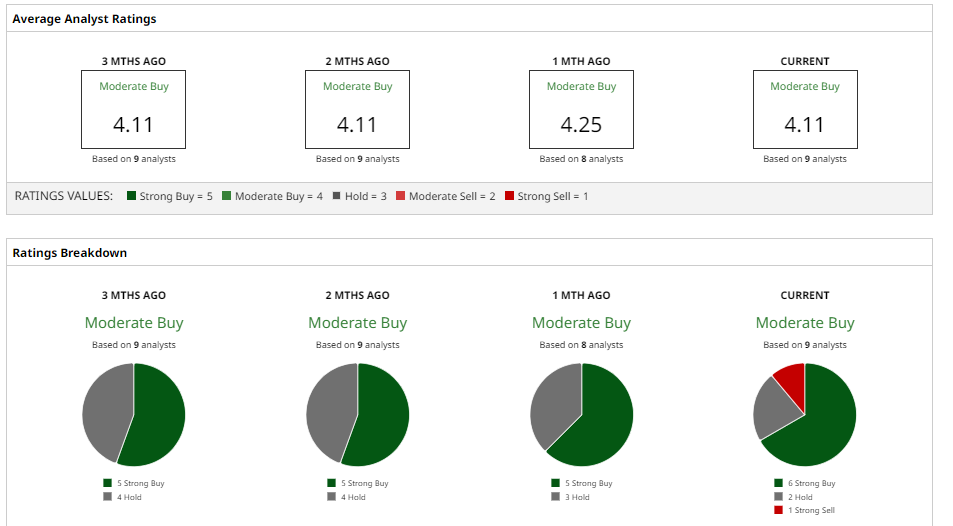

Analysts are largely bullish. Nine analysts rate SOUN stock as a consensus “Moderate Buy." The average 12-month target of $16.21 implies roughly 53% potential upside from here.

AI Stock #2. Applied Digital (APLD)

Applied Digital builds, owns and operates high-performance AI and cloud data centers, delivering custom-engineered GPU and HPC infrastructure and colocation services for enterprise AI, hyperscalers and crypto customers. Based in Dallas, Texas, the company emphasizes rapid, modular, energy-efficient “AI Factory” campus builds designed for scalable, sustainable capacity growth.

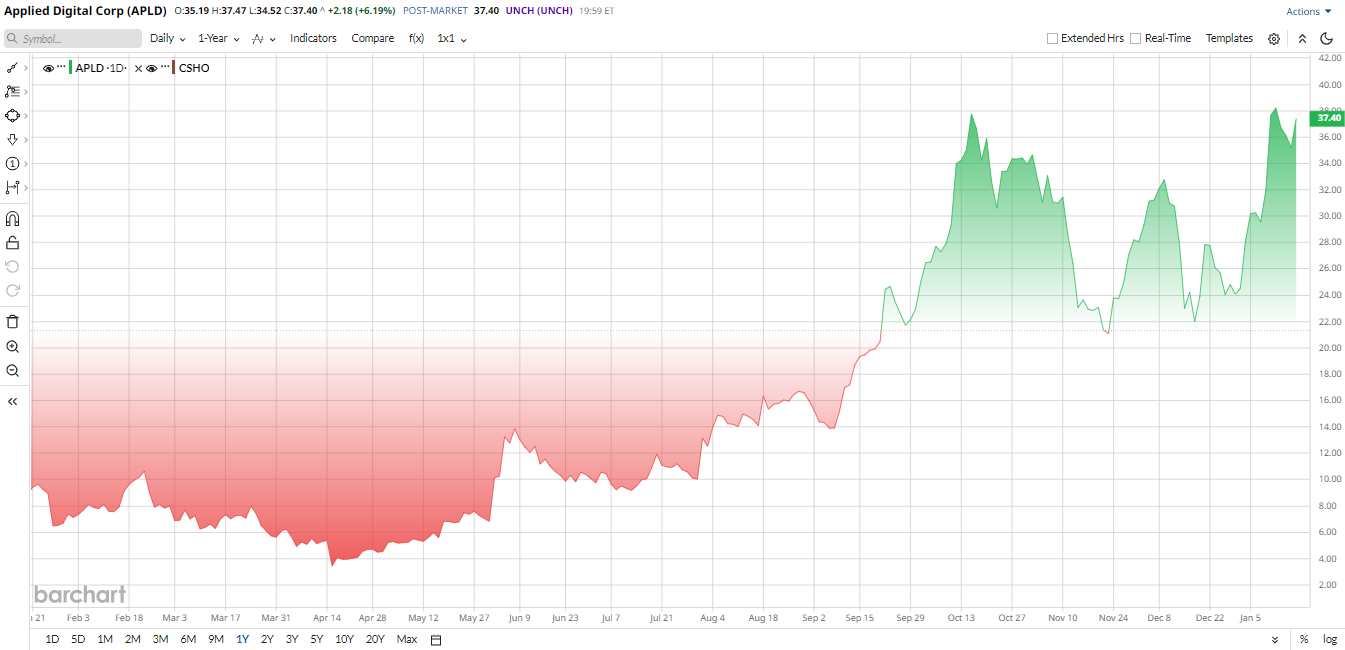

APLD stock has exploded. Shares more than quadrupled over the past year as investor enthusiasm around crypto and AI data-centre projects ran hot.

That rally pushed the valuation to premium levels. Applied Digital’s market capitalization is about $10 billion with a price-to-sales (P/S) multiple in the 72 range, a reflection of aggressive growth assumptions already priced into the shares.

Operationally, the company is scaling fast. In Q2 fiscal 2026, revenue jumped 250% YOY to $126.6 million, GAAP net loss narrowed to $31.2 million (down 76% YOY), and adjusted EBITDA turned positive at $20.2 million. Applied Digital energized 100 megawatts (MW) at its Polaris Forge 1 campus, signed a 15-year lease for 200 MW at Polaris Forge 2 (representing roughly $5 billion in contracted revenue), and raised $2.35 billion in project debt as well as drew $562.5 million in equity from Macquarie to finance builds. Management says total signed capacity now stands at about 600 MW — roughly $16 billion of future revenue — underscoring rapid hyperscaler-driven expansion at its North Dakota “AI factory” campuses.

In late 2025, the company announced a spinoff of its cloud computing unit, merging it with EKSO Bionics (EKSO) to form “ChronoScale,” an AI GPU compute platform. In January 2026, co-founder Jason Zhang was also named President of Applied Digital, securing his leadership as the firm deploys and builds out more infrastructure.

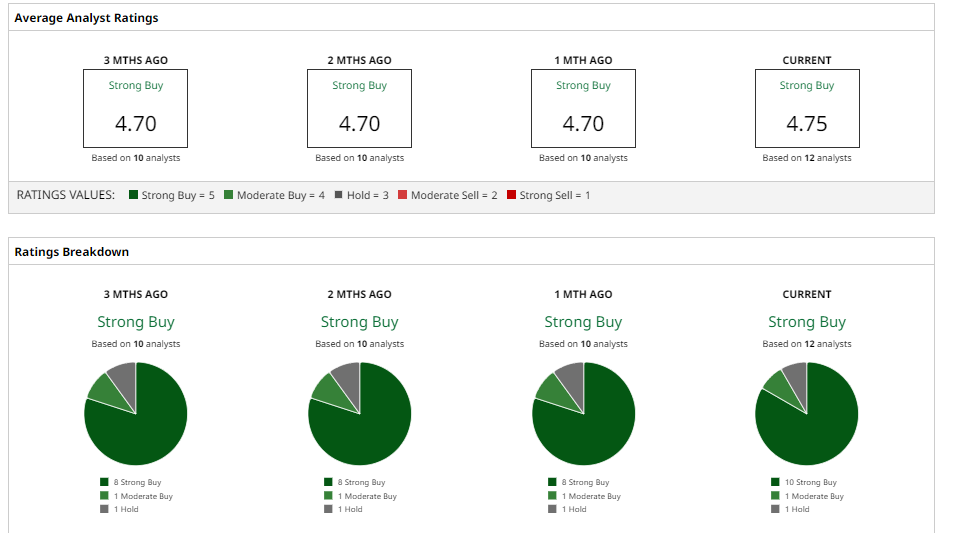

Analyst sentiment is generally bullish on APLD stock. Analysts tracked by Barchart have a consensus “Strong Buy” rating. The average 12-month target of $48.82 implies roughly 39% upside from current levels.

AI Stock #3. CleanSpark (CLSK)

CleanSpark is a Nevada-based data center developer known as “America’s Bitcoin Miner.” The firm owns 1.4 gigawatts of power and land, running large-scale facilities for cryptocurrency mining and expanding into high-performance AI computing workloads. The company leverages energy procurement expertise and blockchain infrastructure to produce low-cost “compute” as a critical resource.

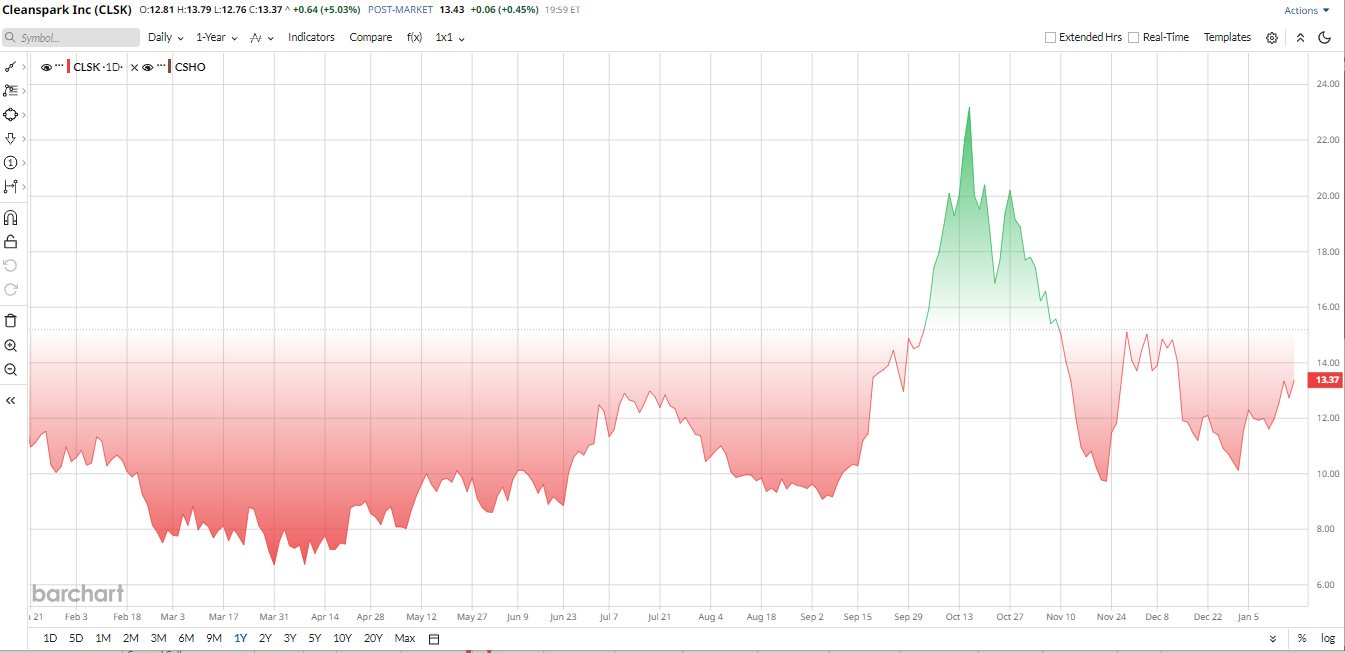

CLSK stock has seen wild swings lately, yet shares have been able to gain about 17% over the past 52 weeks. Shares peaked at $23.61 in October 2025 as Bitcoin (BTCUSD) and mining sentiment surged, then pulled back to the $13 level by mid-January as some investors took profits despite strong results.

Valuation is moderate for a growth company. With a market cap of about $3.3 billion, CleanSpark trades around 19 times trailing earnings and 4.5 times sales. This P/E reflects its profitable mining business; CLSK stock’s valuation is relatively modest given its growth trajectory.

Financially, the growth story is quite impressive. For fiscal 2025, revenue doubled to $766.3 million, and net income surged to $364.5 million from a $145.8 million loss in the prior year. Similarly, adjusted EBITDA reached $823.4 million.

In Q4, the company reported $1.12 EPS. It also mined around 8,000 BTC for the year. CleanSpark's balance sheet and asset base are notable as well. The company had roughly $43 million in cash and about $1.2 billion in BTC assets at year-end, plus over 1.4 GW of power/data assets across the United States. Management says the business is evolving into a broader “compute platform,” reinvesting mining cash flow into AI/HPC data-center expansion.

Recent corporate actions reinforce that strategy. For instance, last week, CleanSpark agreed to acquire 447 acres near Houston for an initial 300 MW data center expandable to 600 MW, bringing Houston-area capacity to 890 MW. In late 2025, the company also closed a $1.15 billion zero-coupon convertible note offering and reported continued mining gains. These moves are designed to fund and accelerate its AI-focused infrastructure growth while maintaining strong mining operations.

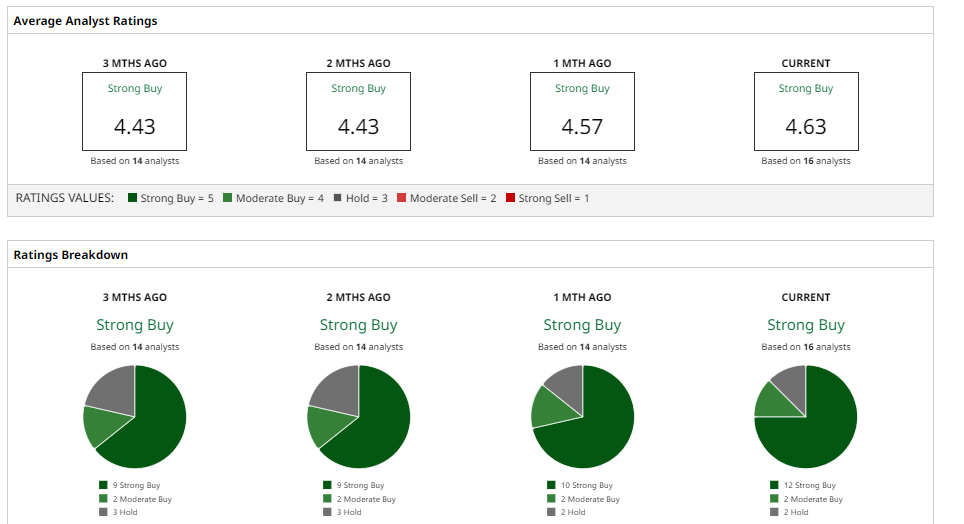

Analyst sentiment is overwhelmingly positive. CLSK stock has a “Strong Buy” consensus rating while the mean price target sits at $23.39. That suggests the stock could climb nearly 83% from here.

So, the bullish thesis with CleanSpark is straightforward — profitable BTC cash flow plus disciplined capex can underwrite rapid, hyperscaler-grade expansion into AI compute.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart