Cathie Wood is among the growth fund managers who continue to garner plenty of attention among investors large and small in the markets. That's partly because during the 2021 bull market rally driven by euphoria around the levels of growth we saw coming out of the pandemic, Wood's actively managed ETFs outperformed the market by a vast margin.

Since then, her performance across her flagship funds, which include the ARK Innovation ETF (ARKK) and ARK Space Exploration & Innovation ETF (ARKX), has come back down to earth. Some of this may have to do with her daily rebalancing strategy, which often results in some selling of winners to fund losing bets within her portfolios. However, Wood has remained steadfast in certain names, such as Tesla (TSLA), for many years, and she's not one to back down from an underlying thesis.

That said, Cathie Wood made some intriguing moves this past week in her portfolio. Here's one of the most prescient moves I think investors want to pay attention to right now.

A Shift Toward Air Mobility and Autonomous Transport

In addition to boosting her bets on gene editing stocks, Cathie Wood added significant positions in both Joby Aviation (JOBY) and Archer Aviation (ACHR) within her ARKX fund this past week. Notably, one lesser-known name she also added is one I think is worth focusing on—Japan-based Komatsu (KMTUY), a maker of construction and mining equipment that's begun to heavily invest in automation and smart infrastructure.

Indeed, if we're going to see the air mobility and autonomous driving thesis play out, we'll need the infrastructure to support these movements. Importantly, Asian markets such as Japan have become hotbeds for testing this technology and putting forward the infrastructure to ultimately support a future that involves these vehicles.

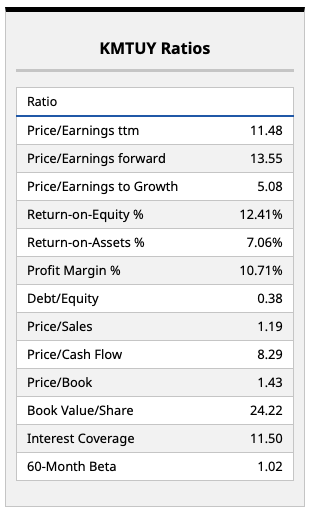

Komatsu is a company that does have very compelling underlying fundamentals, shown above. That's traditionally been the case for Japanese and Asian stocks in general, at least relative to the sky-high valuations we're seeing in most other developed markets like the U.S. (at least on a historical basis).

Now, earnings growth could continue to outperform in the U.S. relative to Japan. But that shouldn't mean that a company like Komatsu with a solid core construction/infrastructure buildout thesis (and future autonomous transport business) should be trading at proverbial pennies on the dollar.

With a forward price-earnings ratio under 14 times and a price-sales ratio just above 1 time, this is a stock that looks very reasonably valued for investors like Wood who believe that the market isn't discounting enough future growth into this stock right now.

What Do Other Wall Street Analysts Think About Komatsu?

Interestingly, there are currently five Wall Street analysts covering KMTUY stock, with a consensus price target of just $31.70 per share put on this name.

This price target implies a downside of around 10% from current levels and really is a shocking departure from this company's fundamentals and core valuation metrics. Indeed, Komatsu currently looks like a stock I'd suggest Cathie Wood has a better handle on than many of the analysts covering this name, considering the reality that future growth forecasts for Komatsu appear to be lower than what we saw this past year (on the forward/trailing price-earnings multiple alone).

I maintain that this company, which has a decent operating margin and impressive return on equity fundamentals, should be valued at a significantly higher multiple. It certainly would be if this was a stock doing business in the U.S. and trading on an American exchange. But that's just where the market is right now.

So, for investors looking to follow in Cathie Wood's footsteps and follow her into a trade, this would be one I don't think would be a bad pick. I do think the future of transportation will be autonomous, though there is some dispute as to the timeline. But as for a company on the cutting edge of bringing this futuristic technology into the present, Komatsu is one compelling option to consider right now.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Cathie Wood May Be Trimming Her Tesla Stake, But She Still Thinks the Company Is on Track for 70%-80% Gross Margins

- Lockheed Martin Stock Hits New 52-Week High as the Greenland Crisis Heats Up

- Trump Bought CoreWeave’s Debt. What Does That Mean for CRWV Stock?

- Magnificent 7 State of the Union: How It Started, How It's Going, And What's Next for the Mag 7 in 2026