Cleveland, Ohio-based Parker-Hannifin Corporation (PH) manufactures and sells motion and control technologies and systems. Valued at $110.9 billion by market cap, PH is a leading diversified industrial manufacturer offering motion-control and fluid systems, industrial components, flight control, hydraulic, fluid conveyance, thermal management, pneumatic, and lubrication systems, and components for aerospace markets. The industrial giant is expected to announce its fiscal second-quarter earnings for 2026 in the near term.

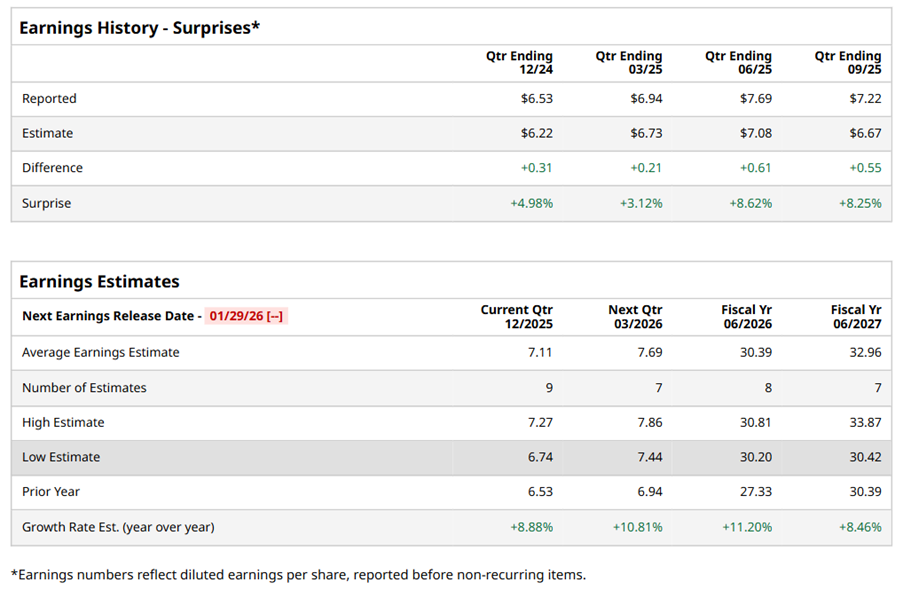

Ahead of the event, analysts expect PH to report a profit of $7.11 per share on a diluted basis, up 8.9% from $6.53 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect PH to report EPS of $30.39, up 11.2% from $27.33 in fiscal 2025. Its EPS is expected to rise 8.5% year over year to $32.96 in fiscal 2027.

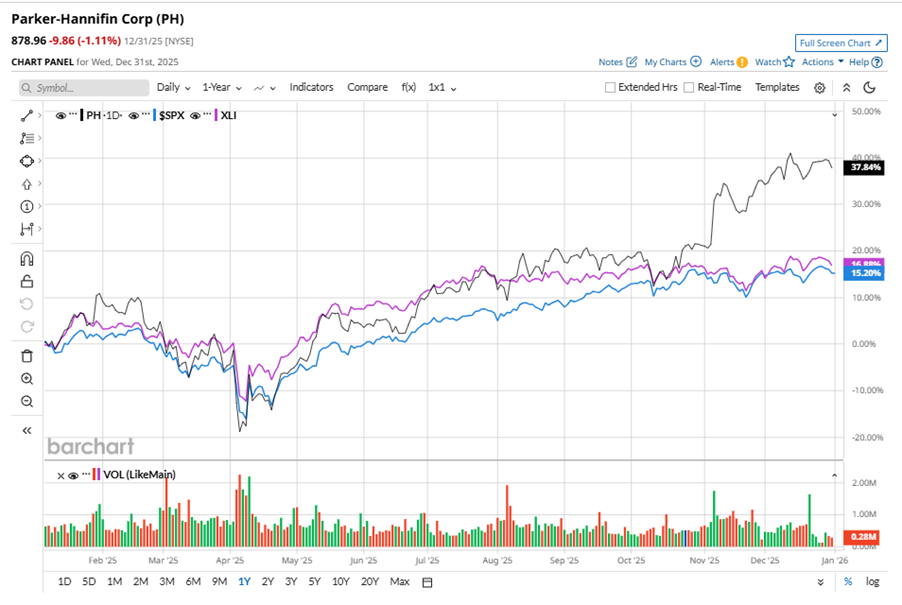

PH stock has outperformed the S&P 500 Index’s ($SPX) 16.4% gains over the past 52 weeks, with shares up 38% during this period. Similarly, it outperformed the Industrial Select Sector SPDR Fund’s (XLI) 17.6% gains over the same time frame.

Parker-Hannifin outperformed due to strong organic growth, driven by aerospace and defense strength, and a return to positive territory in North America industrial operations. Its key factors include commercial and aftermarket aerospace growth, improved productivity, cost controls, and successful integration of Curtis Instruments. The aerospace segment delivered 11 consecutive quarters of double-digit growth, along with strong commercial OEM orders, supported by strong demand in HVAC and filtration markets.

On Nov. 6, PH shares closed up by 7.8% after reporting its Q1 results. Its adjusted EPS of $7.22 exceeded Wall Street expectations of $6.67. The company’s revenue was $5.1 billion, exceeding Wall Street's $4.9 billion forecast. PH expects full-year adjusted EPS in the range of $29.60 to $30.40.

Analysts’ consensus opinion on PH stock is bullish, with a “Strong Buy” rating overall. Out of 23 analysts covering the stock, 16 advise a “Strong Buy” rating, one suggests a “Moderate Buy,” and six give a “Hold.” PH’s average analyst price target is $940.95, indicating a potential upside of 7.1% from the current levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Stock Index Futures Climb in Strong Start to 2026

- FTAI Aviation Is Getting into the Data Center Game. Should You Buy FTAI Stock Here?

- CrowdStrike Insiders Are Offloading CRWD Stock. Should You?

- After Record Runs for Western Digital and Sandisk in 2025, Consider This 1 Data Center Storage Stock for 2026