Cardinal Health, Inc. (CAH), headquartered in Dublin, Ohio, operates as a healthcare services and products company. Valued at $48.8 billion by market cap, the company's services include pharmaceutical distribution, health-care product manufacturing, distribution and consulting services, drug delivery systems development, pharmaceutical packaging, automated dispensing systems manufacturing, and retail pharmacy franchising. The healthcare giant is expected to announce its fiscal second-quarter earnings for 2026 in the near term.

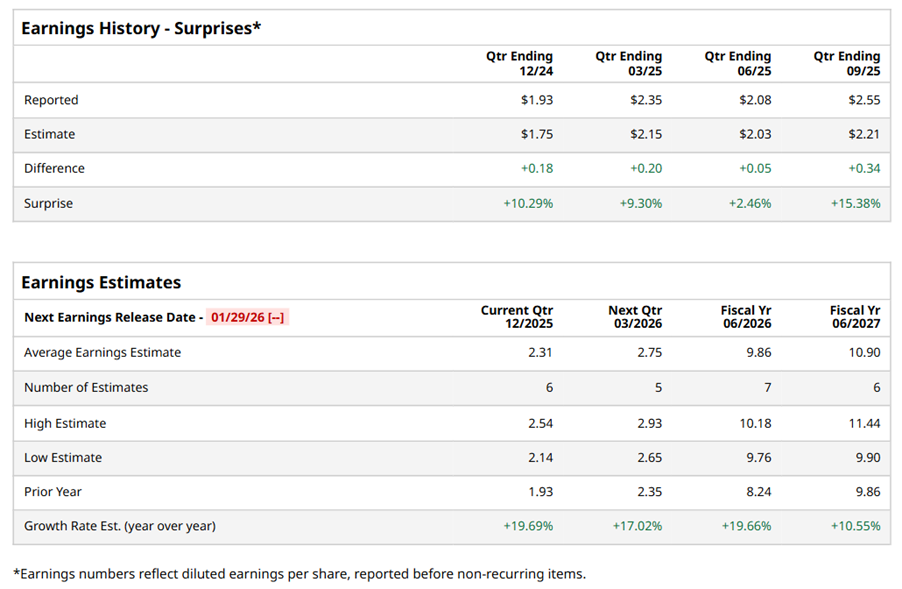

Ahead of the event, analysts expect CAH to report a profit of $2.31 per share on a diluted basis, up 19.7% from $1.93 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect CAH to report EPS of $9.86, up 19.7% from $8.24 in fiscal 2025. Its EPS is expected to increase 10.6% year over year to $10.90 in fiscal 2027.

CAH stock has significantly outperformed the S&P 500 Index’s ($SPX) 16.4% gains over the past 52 weeks, with shares up 74.3% during this period. Similarly, it considerably outperformed the Health Care Select Sector SPDR Fund’s (XLV) 12.8% returns over the same time frame.

CAH's strong performance is driven by the Solaris Health acquisition, adding 750+ providers to its MSO platform, and solid organic growth in pharmaceuticals, generics, and specialty solutions. New customer wins, cost controls, and investments in automation and logistics are boosting profits, with double-digit growth expected in specialty platforms like autoimmune, urology, and oncology. With strong generic performance and a focus on MSO platforms and biopharmaceutical solutions, management is confident in sustained demand, as reflected in updated guidance.

On Oct. 30, CAH shares closed up more than 15% after reporting its Q1 results. Its adjusted EPS of $2.55 surpassed Wall Street expectations of $2.21. The company’s revenue was $64 billion, beating Wall Street forecasts of $59.1 billion. CAH expects full-year adjusted EPS in the range of $9.65 to $9.85.

Analysts’ consensus opinion on CAH stock is bullish, with a “Strong Buy” rating overall. Out of 16 analysts covering the stock, 12 advise a “Strong Buy” rating, and four give a “Hold.” CAH’s average analyst price target is $216.19, indicating a potential upside of 5.2% from the current levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Stock Index Futures Climb in Strong Start to 2026

- FTAI Aviation Is Getting into the Data Center Game. Should You Buy FTAI Stock Here?

- CrowdStrike Insiders Are Offloading CRWD Stock. Should You?

- After Record Runs for Western Digital and Sandisk in 2025, Consider This 1 Data Center Storage Stock for 2026