KLA Corporation (KLAC) has reentered the market conversation at a moment when semiconductor spending priorities are quietly, but decisively, shifting. Brokerage firm TD Cowen has upgraded the stock to “Buy” from “Hold,” citing its outsized exposure to advanced foundry manufacturing.

As capital spending pivots toward cutting-edge processes, KLA stands better positioned than the broader equipment market. TD Cowen linked this optimism to the accelerating push toward artificial intelligence (AI)-focused chips. Rising design complexity, faster memory upgrade cycles, and a surge in custom silicon are intensifying demand for process control.

KLA already dominates this niche, allowing it to outgrow overall equipment spending through 2027, not merely keep pace. The brokerage also stressed that AI-driven capital expenditure remains early in its lifecycle. Although AI chips contribute a growing share of revenue, they still represent a modest portion of total wafer output.

Risks remain visible. Memory spending volatility, pauses in AI investment, and geopolitical uncertainty could disrupt momentum. Still, the brokerage firm argued that the balance now tilts toward upside. Against this backdrop, let us discuss whether KLA’s setup justifies stepping into the shares now.

About KLA Corporation Stock

Based in Milpitas, California, KLA Corporation supplies process control and yield management solutions to semiconductor and electronics manufacturers. With a market cap of nearly $206 billion, its inspection, metrology, software, and services support research, development, and production of integrated circuits, wafers, and reticles.

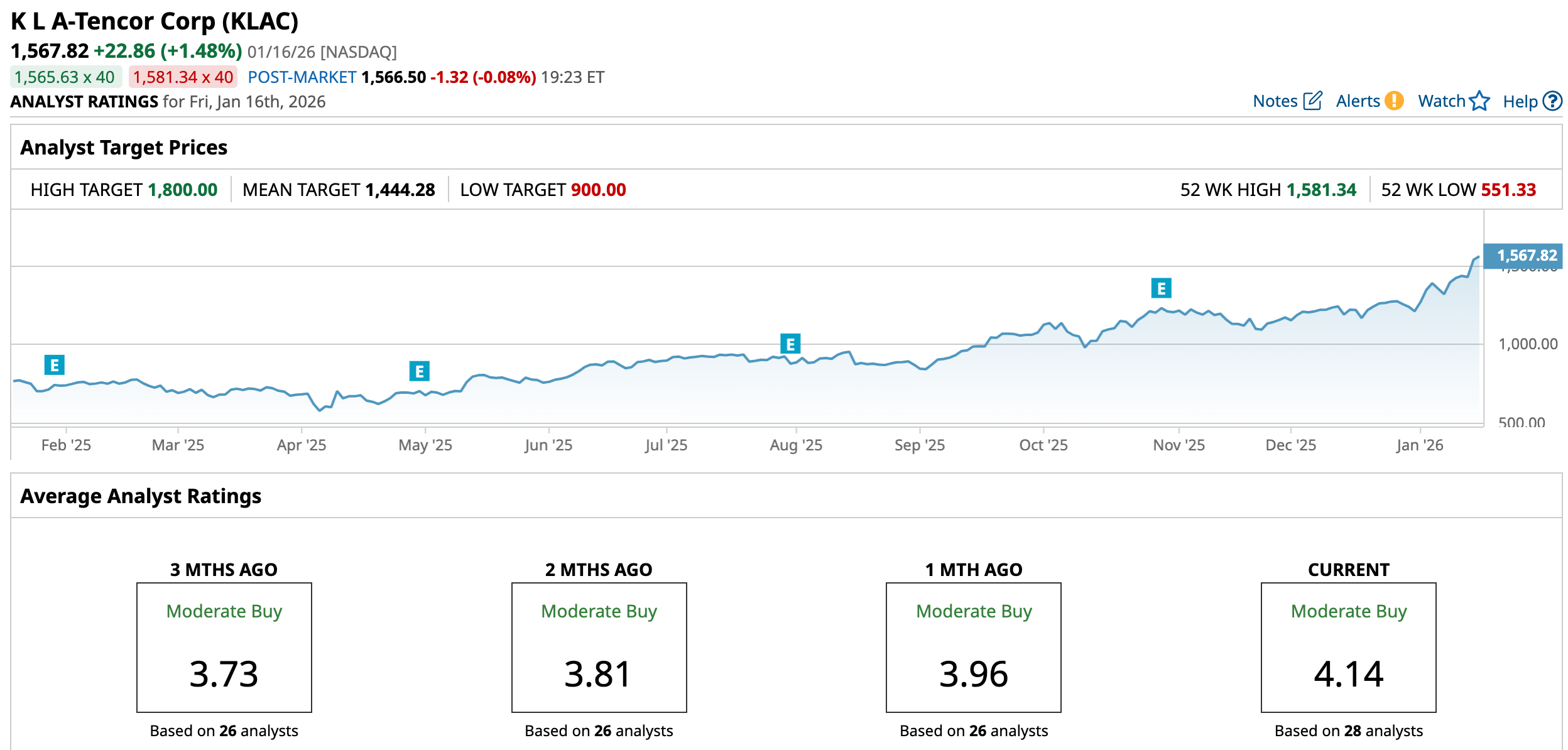

KLAC stock has climbed roughly 109.81% over the past 52 weeks, gained 67.95% in six months, and advanced 28.16% in the past month. The sustained momentum reflects investor belief that KLA remains structurally aligned with the industry’s most complex growth drivers.

Valuation, however, commands attention. KLAC stock is currently trading at 43.39 times forward adjusted earnings and 15.68 times sales. Both sit well above industry averages and KLA’s own five-year norms, signaling a premium.

However, shareholder returns add a layer of stability. KLA has raised its dividend for 16 consecutive years and pays $7.60 annually per share, yielding 0.53%. Its most recent quarterly dividend of $1.90 per share was paid on Dec. 2, 2025, to shareholders of record on Nov. 17, 2025.

KLA Corporation Surpasses Q1 Earnings

On Oct. 29, 2025, KLA shares rose 2.4% after the company delivered Q1 fiscal 2026 results above expectations. Revenue increased 12.9% year-over-year (YOY)to $3.21 billion, surpassing estimates of $3.18 billion, driven by sustained investment in leading-edge logic and DRAM tied to high-bandwidth memory.

Profitability also improved, with adjusted net income rising 18.1% YOY to $1.2 billion and adjusted EPS growing 20.2% from the year-ago value to $8.81, beating expectations of $8.62. Demand for semiconductor process control remained robust, while advanced packaging and AI-related infrastructure emerged as key growth engines.

Looking forward, management has anchored guidance to expanding investment in leading-edge logic and memory, particularly high-bandwidth memory (HBM) advanced packaging for AI and premium mobile applications.

For the second quarter of fiscal 2026, KLA expects revenue of $3.225 billion, +/- $150 million, reflecting steady demand visibility. And, management guided to a non-GAAP gross margin of 62.0%, +/- 1.0%, while non-GAAP diluted EPS is projected at $8.70, +/- $0.78.

Analysts broadly align with that outlook, forecasting Q2 fiscal 2026 EPS to rise 6.7% YOY to $8.75. Looking beyond the quarter, Wall Street expects full-year fiscal 2026 EPS to grow 6.97% to $35.60, followed by a sharper 23.48% increase in fiscal 2027 to $43.96.

What Do Analysts Expect for KLA Corporation Stock?

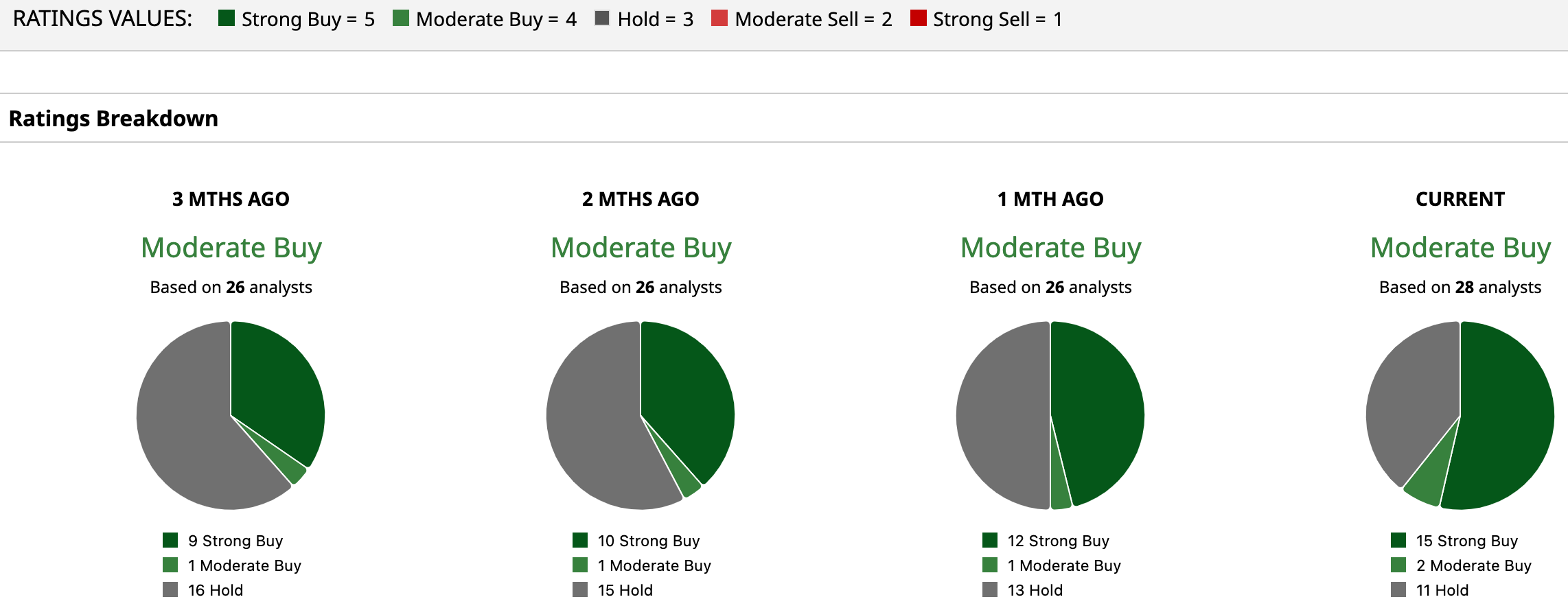

Wall Street continues to project confidence in KLA Corporation’s long-term outlook, reflected in the stock’s “Moderate Buy” consensus rating. Among the 28 analysts covering KLAC stock, 15 recommend “Strong Buy,” two assign a “Moderate Buy,” and 11 advise “Hold.”

From a pricing perspective, KLAC stock is already trading above its mean price target of $1,444.28. At the upper end, the Street-high target of $1,800 set by Cantor Fitzgerald analyst C.J. Muse points to a possible gain of 14.8% from current levels.

Further strengthening the bull case, TD Cowen analyst Krish Sankar upgraded KLAC stock from “Hold” to “Buy” and raised his price target from $1,300 to $1,800. The upgrade reflects growing conviction that KLA’s exposure to advanced manufacturing and AI-driven complexity can continue to support above-industry growth.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart