Camden Property Trust (CPT), headquartered in Houston, Texas, is a leading real estate investment trust (REIT) focused on multifamily apartments. The company owns, develops, manages, and acquires apartment communities in high-growth markets across the U.S. Camden emphasizes resident-focused amenities such as modern fitness centers and pools, and is expanding into thriving urban and suburban areas. The company has a market capitalization of $11.58 billion.

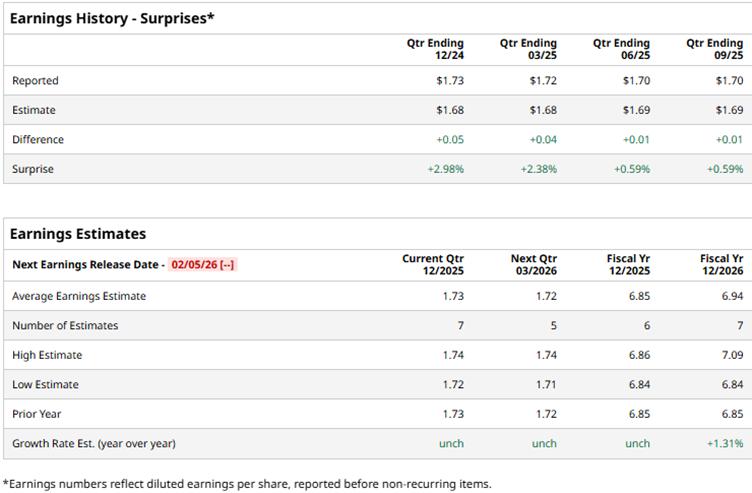

Camden is set to report its fourth-quarter results for fiscal 2025 soon. Ahead of the results, Wall Street analysts expect the company’s profit to remain flat year-over-year (YOY) at $1.73 per diluted share for Q4. Camden Property Trust has a solid record of earnings surprises, exceeding estimates in all four trailing quarters.

Analysts expect the company’s bottom line to remain unchanged for fiscal 2025. For the year 2025, Wall Street analysts expect CPT’s diluted EPS to be $6.85, followed by a 1.3% YOY improvement to $6.94 in fiscal 2026.

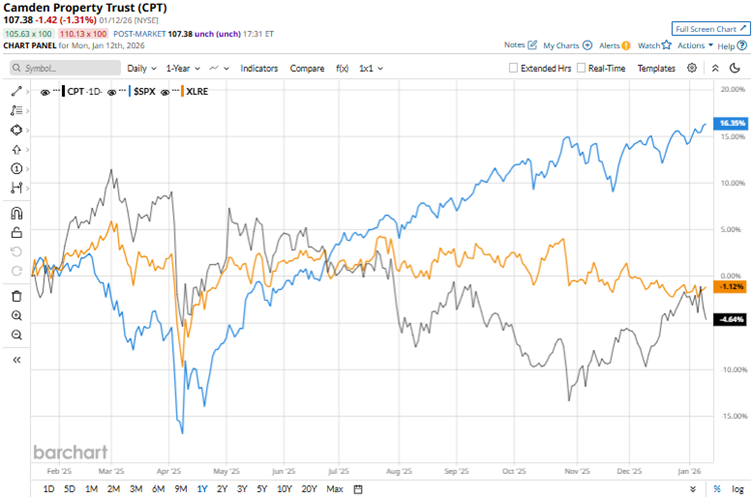

Due to mixed quarterly results and weakness in the core funds from operations (FFO) trajectory, the stock has been under some pressure. Over the past 52 weeks, the stock has declined 1.6%, and over the past six months, 5.6%. On the other hand, the broader S&P 500 Index ($SPX) has increased by 19.7% and 11.5% over the same periods, respectively. Therefore, the stock has underperformed the broader market.

We now compare Camden’s performance with that of its sector. The State Street Real Estate Select Sector SPDR ETF (XLRE) has increased 3.7% over the past 52 weeks but dropped 2.3% over the past six months. Therefore, CPT has underperformed its sector over these periods.

On Nov. 6, 2025, Camden reported its third-quarter results for fiscal 2025. The company’s property revenues increased by a modest 2.2% YOY to $395.68 million. However, this fell short of Street’s expected $399.40 million. The REIT’s core FFO dropped marginally YOY to $1.70 per diluted share, but managed to top the $1.69 per share expected figure. Based on these mixed results, Camden’s shares dropped 2.5% intraday on Nov. 6, but gained 2.5% the next day.

Wall Street analysts have been bullish about Camden Property Trust’s future. Among the 26 analysts covering the stock, the consensus rating is “Moderate Buy.” The rating configuration is less bullish than it was two months ago, with eight “Strong Buy” ratings now, down from nine. The ratings are rounded off by one “Moderate Buy,” 16 “Holds,” and one “Strong Sell.” The mean price target of $116.06 implies an 8.1% upside from current levels, while the Street-high price target of $134 implies 24.8% upside.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Rocket Stock Just Hit a New 3-Year High as Trump Touts Plan for Home Affordability. Should You Buy RKT Here?

- How to Trade Venezuela 10 Days Later: Oil Prices, Energy Stocks, and the Biggest Winners and Losers

- Is PennyMac Stock a Buy, Sell, or Hold for January 2026?

- This Under-$10 Growth Stock May Be Better Positioned Than Investors Realize