Meta Platforms (META) finds itself at a critical crossroads. Earlier this month, the tech giant announced it was pausing the international rollout of its much-anticipated Ray-Ban Display smart glasses, citing unprecedented demand in the U.S. and limited global inventory as the key reasons for the delay.

Originally slated for release across Europe and Canada in early 2026, the ambitious wearable, which fuses augmented reality with everyday eyewear, will now remain U.S.-centric as Meta works to meet domestic orders and refine its production strategy. While the move underscores strong consumer interest, it also highlights supply chain constraints and execution challenges that could reverberate through Meta’s broader hardware and artificial intelligence (AI) strategy.

Meta has been developing smart glasses with Ray-Ban owner EssilorLuxottica since 2019 and renewed their long-term partnership in 2024. CEO Mark Zuckerberg unveiled the $799 Meta Ray-Ban Display glasses last year, marking Meta’s first consumer-ready AI glasses, which allow users to watch videos and reply to messages using a neural-technology wristband.

Against this backdrop, is META stock a buy, sell, or hold right now?

About Meta Stock

Meta Platforms is a technology conglomerate headquartered in Menlo Park, California, best known for owning and operating some of the world’s most influential social media and communication platforms, including Facebook, Instagram, WhatsApp, Messenger and Threads. Originally founded as Facebook in 2004, the company rebranded to Meta in 2021 to reflect its strategic pivot toward immersive technologies such as virtual reality, augmented reality, and the metaverse.

In addition to its flagship apps, Meta develops hardware and AI-driven products through divisions like Reality Labs, spanning VR headsets and smart glasses. Meta’s market cap stands at nearly $1.65 trillion, ranking it among the largest technology companies globally.

However, Meta’s stock price has seen significant volatility over the past year, as investors weigh its core advertising strength against elevated spending on AI and infrastructure.

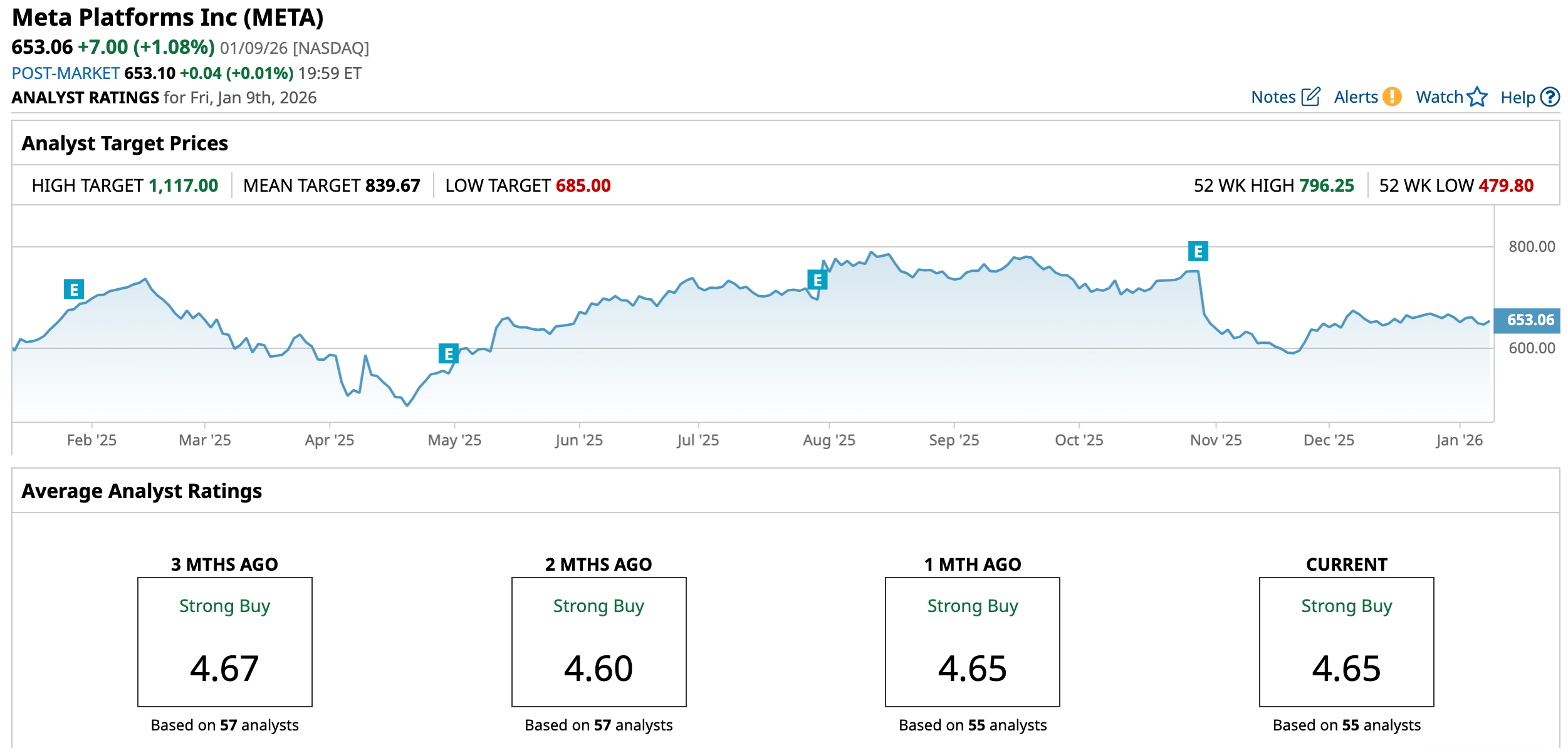

Over the past 52 weeks, META shares have traded in a wide range, reaching a high of about $796.25 in Aug. 2025 and a low of around $479.80 in Apr. 2025, illustrating the stock’s substantial swings amid shifting market sentiment. The current share price sits 21.93% below its 52-week high, with the stock closing around $653.06 in the last session. Meta’s trailing 12-month return has been relatively modest compared with the broader benchmarks, with just 5% gains.

Looking back over longer horizons, Meta’s stock has delivered significant multi-year gains, delivering 376.76% returns over the past three years as the company expanded its dominance in digital advertising and invested in next-generation technologies.

META currently trades at a premium compared to the sector median at 21.09 times forward earnings.

Mixed Q3 Performance

Meta released its third-quarter 2025 earnings on Oct. 29, 2025, reporting robust top line growth but a mixed bottom line picture. For the quarter ended Sept. 30, 2025, Meta’s total revenue surged to $51.2 billion, representing about 26% year-over-year (YOY) growth from $40.6 billion in Q3 2024, driven largely by continued expansion in digital advertising and stronger engagement across its family of apps. Advertising impressions climbed by about 14% and the average price per ad jumped around 10%, underscoring the effectiveness of Meta’s monetization strategies.

Despite the impressive revenue growth, net income fell sharply to roughly $2.7 billion, an 83% decline from $15.7 billion in the year-ago quarter, primarily due to a one-time, non-cash tax charge of roughly $15.9 billion. Nevertheless, adjusted figures excluding the tax impact reflect an adjusted EPS of $7.25, a significant beat over estimates.

Operating income remained healthy at about $20.5 billion (an increase of 18%), though operating margins contracted slightly as total costs and expenses climbed roughly 32% YOY to around $30.7 billion amid increased infrastructure and R&D spending.

Capital expenditures in Q3 were substantial, driven by investment in servers, data centers, and AI infrastructure, with full-year 2025 capex guidance raised to roughly $70 to $72 billion, reflecting the company’s aggressive push into artificial intelligence and supporting technologies. Guidance for the fourth quarter indicated expected revenue growth in the range of $56 billion to $59 billion.

Analysts remain optimistic as they predict EPS to be around $29.40 for fiscal 2025, up 23.2% YOY, before surging by another 4.2% annually to $30.63 in fiscal 2026.

What Do Analysts Expect for Meta Stock?

Recently, Cantor Fitzgerald raised its price target on Meta to $750 from $720 while reaffirming an “Overweight” rating, citing strong advertising momentum and a robust AI-driven growth pipeline.

Also, Jefferies reiterated a “Buy” rating on Meta with a $910 price target, amid the company’s long-term growth potential driven by its core social media platforms and continued investments in AI and metaverse technologies.

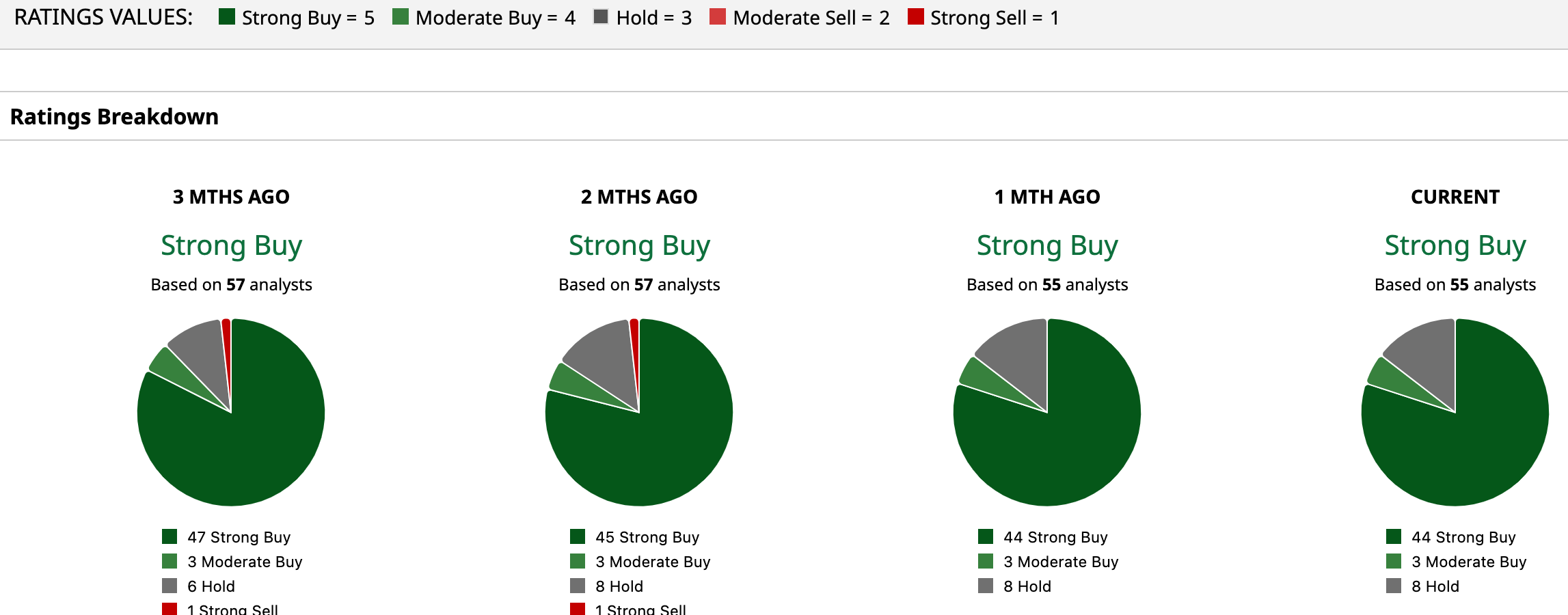

Wall Street is majorly bullish on META. Overall, META has a consensus “Strong Buy” rating. Of the 55 analysts covering the stock, 44 advise a “Strong Buy,” three suggest a “Moderate Buy,” and the remaining eight analysts are on the sidelines, giving it a “Hold” rating.

The average analyst price target for META is $839.67, indicating a potential upside of 29.58%. The Street-high target price of $1,117 suggests that the stock could rally as much as 71%.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart