Leading investment banking giant The Goldman Sachs Group (GS) is reportedly working with the real estate advisory firm Newmark Group (NMRK) to develop private power campuses for artificial intelligence (AI). According to GridFree AI, the investment banking firm is raising both equity and debt financing for the project to build modular natural-gas-fired power plants serving a group of data centers in South Dallas.

GS CEO David Solomon sees potential in AI, believing that recent AI advancements free up space to invest “more in people,” which in turns helps scale the business.

Given this scenario, should you consider investing in Goldman Sachs’ stock now?

About Goldman Sachs Stock

Goldman Sachs is a leading global investment-banking, securities, and asset-management firm headquartered in New York City. The firm delivers a broad suite of financial services, including advisory, financing, trading, and wealth management. Its operations are organized into core businesses that collectively mobilize capital, insights, and expertise to serve clients across markets and industries. The firm plays a central role in global capital markets and has a massive market capitalization of $263.64 billion.

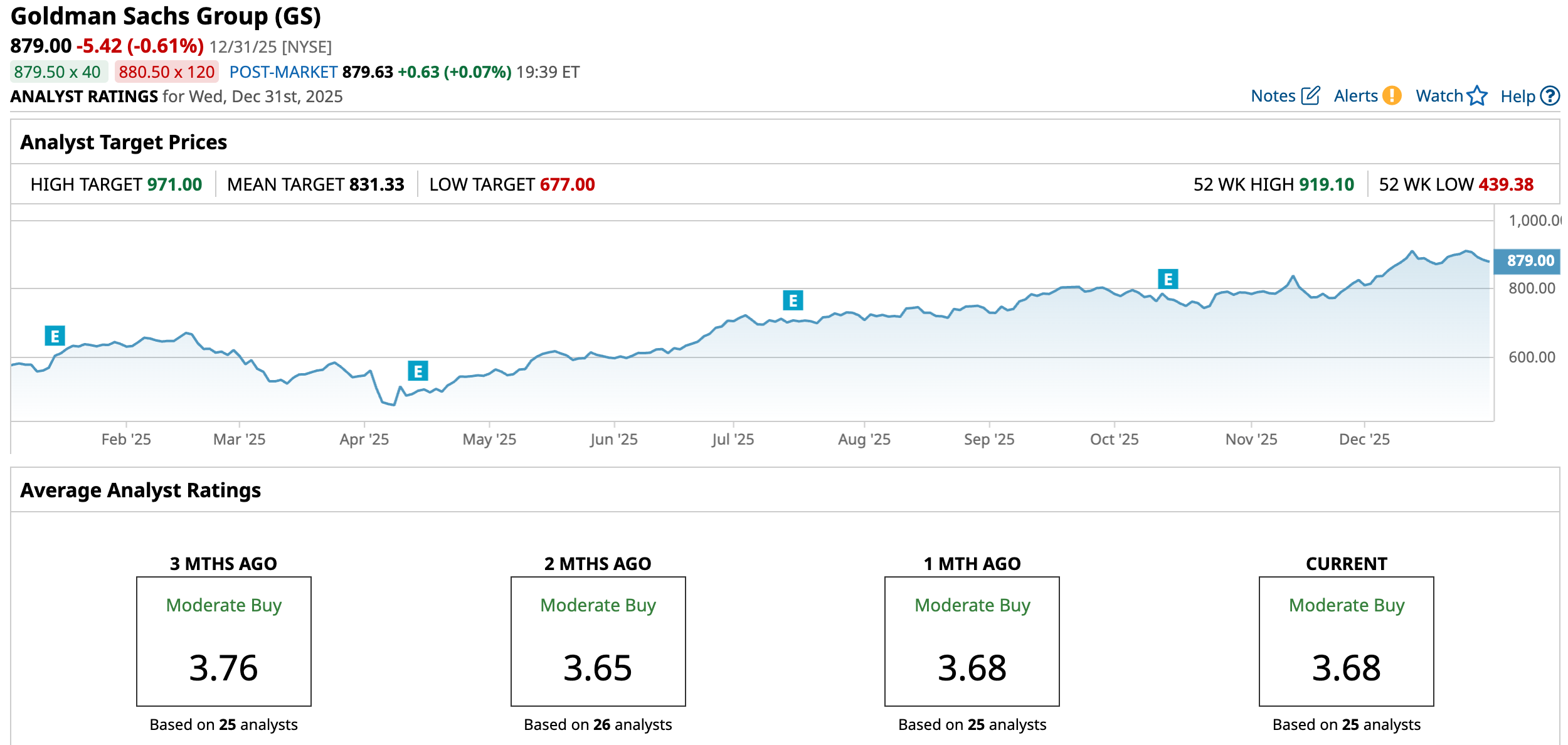

Based on strong earnings, a recovering investment-banking environment, and confidence in the company’s diversified model, Goldman’s stock has gained 53.26% over the past 52 weeks and about 24.2% over the past six months.

The financial firm has also benefited from higher interest rates, which boosted its net interest income, and from higher underwriting fees driven by solid M&A and capital markets activity. The stock reached a 52-week high of $919.10 on Dec. 11, but is down 4.56% from that level.

Goldman’s stock is trading at a price-to-earnings ratio of 18.05x, higher than the industry average of 12.31x.

Goldman Sachs Delivered Strong Results In The Third Quarter

On Oct. 14, Goldman reported solid results for the third quarter of fiscal 2025. The company’s total net revenues increased by 20% year-over-year (YOY) to $15.18 billion. This was higher than the $14.1 billion that Wall Street analysts had expected. Goldman’s net interest income grew by 64% from the prior year’s period to $3.85 billion.

The company was firing on all cylinders, with all its segments exhibiting robust growth. Goldman’s global banking and markets segment reported a net revenue of $10.12 billion, up 18% YOY. This was due to investment banking fees increasing 42% YOY to $2.66 billion, as advisory and underwriting fees rose. In the asset and wealth management segment, net revenues climbed 17% from the year-ago value in Q3 to $4.40 billion based on robustness in private banking and lending.

On the back of this top line strength, Goldman’s bottom line also increased. The company’s EPS increased 46% YOY to $12.25, exceeding the $11 figure that Wall Street analysts had expected.

Wall Street analysts have a mixed view about Goldman’s bottom line trajectory. For the current fiscal quarter (to be reported on Jan. 15, 2026, before the market opens, EPS is expected to decline 2.6% YOY to $11.64. On the other hand, for fiscal 2025, the company’s EPS is projected to increase by 20.8% annually to $48.99, followed by a 12.8% increase to $55.24 in fiscal 2026.

What Do Analysts Think About Goldman Sachs Stock?

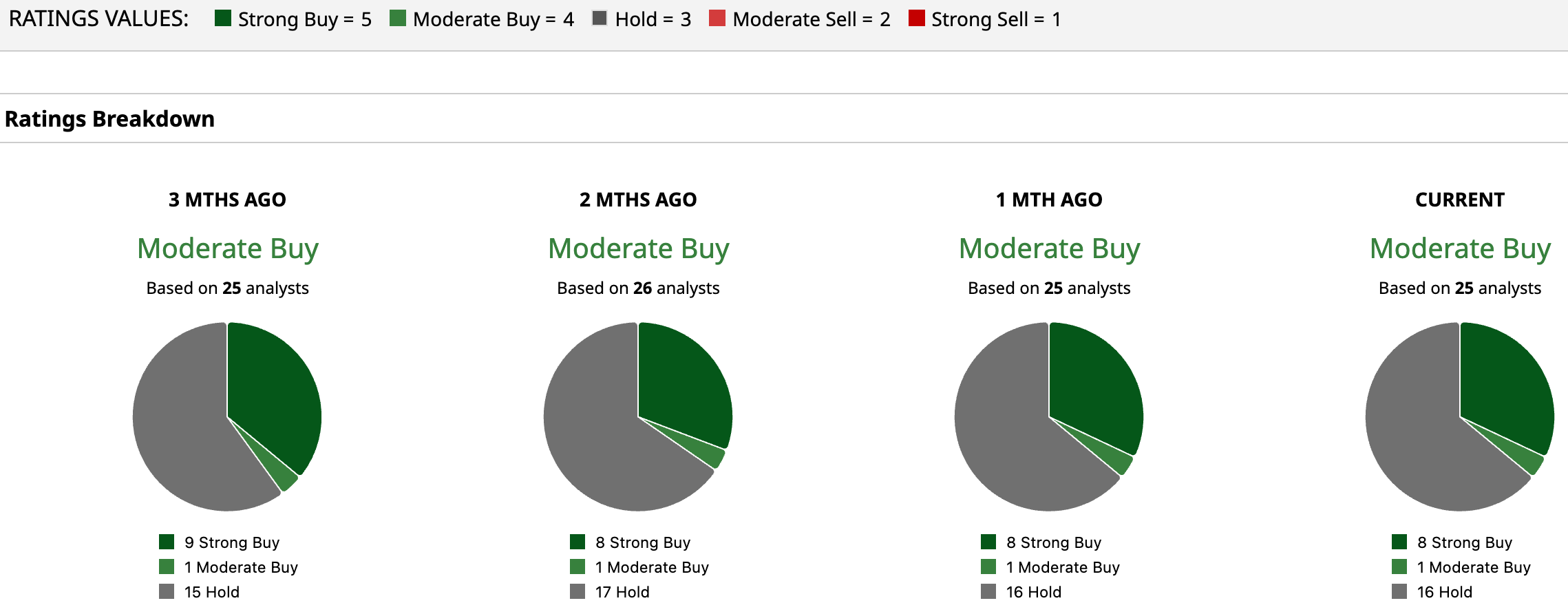

Wall Street analysts still seem to have faith in Goldman Sachs’ widespread business. This month, analysts at Keefe, Bruyette & Woods raised the stock price target from $870 to $971 following discussions at a conference and meetings with management. However, these same analysts maintained a “Market Perform” rating on its shares.

In October, following the company’s third-quarter earnings release, Barclays analyst Jason Goldberg reiterated an “Overweight” rating on Goldman Sachs’ stock and raised the price target from $720 to $850. This showed that Barclays analysts are optimistic about the financial giant’s prospects.

In the same month, analysts at Freedom Capital Markets upgraded the stock from “Sell” to “Hold” and raised the price target on its shares from $633 to $794, after Goldman Sachs’ Q3 release. Additionally, Freedom Capital Markets analysts identified three main drivers of the quarterly growth: a rebound in investment banking activity, higher asset management fees, and consistent trading results.

GS remains a sound favorite on Wall Street, with analysts awarding it a consensus “Moderate Buy” rating overall. Of the 25 analysts rating the stock, eight analysts have rated it a “Strong Buy,” one analyst suggests a “Moderate Buy,” while 16 analysts are playing it safe with a “Hold” rating. The consensus price target of $831.33 represents a 5.42% downside from current levels. However, the Street-high Keefe, Bruyette. & Woods price target of $971 indicates a 10.47% upside.

Key Takeaways

While Goldman Sachs is experiencing an upsurge due to solid investment banking activity and strength in capital markets, it's also keeping an eye on the future through funding AI operations. Therefore, this fintech stock may be considered for investment at this time.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- After Record Runs for Western Digital and Sandisk in 2025, Consider This 1 Data Center Storage Stock for 2026

- As Goldman Sachs Funds the Next Era of AI, Should You Buy, Sell, or Hold the Iconic Bank Stock?

- NVDA, NKE, and CM: Bet on These 3 Stocks With Surging Unusual Options Activity for 2026 Gains

- AI Is Transforming This Once-Boring Blue-Chip Stock. Is It a Buy for 2026?