Portage, Michigan-based Stryker Corporation (SYK) offers innovative products and services in MedSurg, Neurotechnology, Orthopaedics, and Spine that help improve patient and healthcare outcomes. With a market cap of $143.4 billion, Stryker operates as one of the world’s leading medical technology companies.

Companies worth $10 billion or more are generally described as "large-cap stocks." Stryker fits this bill perfectly. Given that the company impacts over 150 million patients annually, its valuation above this mark is not surprising. The company’s operations span nearly 75 countries in the Americas, Indo-Pacific, and EMEA and employ nearly 53,000 people.

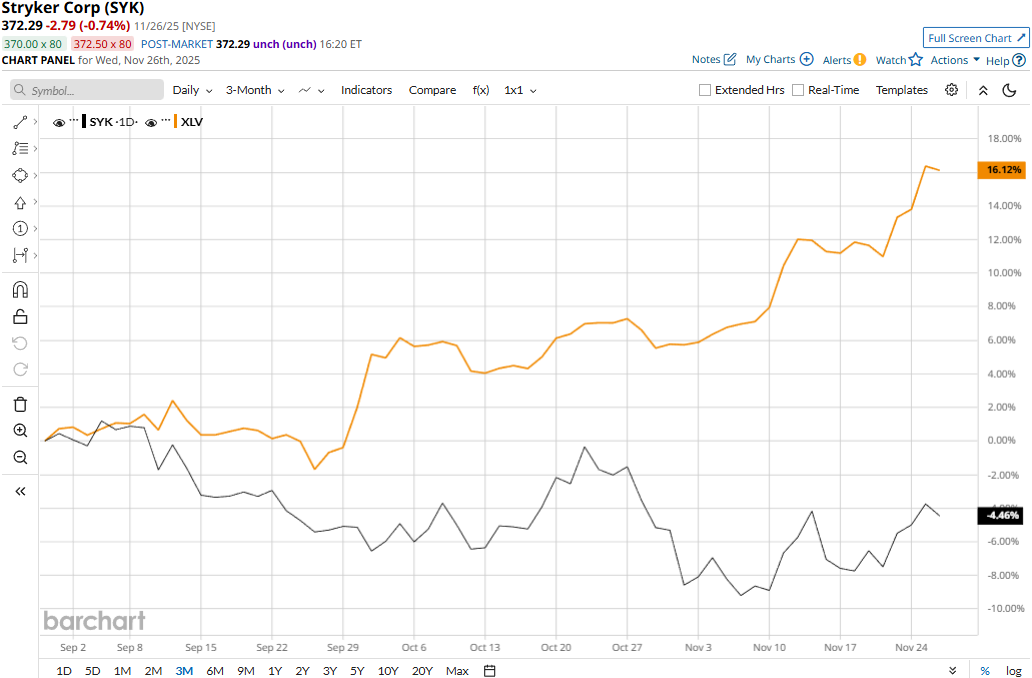

Stryker touched its all-time high of $406.19 on Jan. 28 and is currently trading 8.3% below that peak. Meanwhile, the stock has dropped 5.6% over the past three months, significantly underperforming the Health Care Select Sector SPDR Fund’s (XLV) 15.6% surge during the same time frame.

Stryker has underperformed over the longer term as well. SYK stock prices have gained 3.4% on a YTD basis and dipped 4.5% over the past 52 weeks, compared to XLV’s 15.2% surge in 2025 and 8.4% gains over the past year.

SKY stock has remained mostly below its 50-day moving average since early August and below its 200-day moving average since mid-September, underscoring its downturn.

Despite reporting better-than-expected results, Stryker’s stock prices dropped 3.5% in the trading session following the release of its Q3 results on Oct. 30. Driven by a 9.1% increase in volumes and a 40 bps increase in prices, the company’s organic sales increased 9.5% compared to the year-ago quarter. Meanwhile, its overall net sales increased 10.3% year-over-year to $6.1 billion, exceeding the Street’s expectations by 24 bps. Meanwhile, its adjusted EPS surged 11.1% year-over-year to $3.19, surpassing the consensus estimates by 1.6%. Following the initial dip, SYK stock maintained a positive momentum for two subsequent trading sessions.

Meanwhile, Stryker has lagged behind its peer Boston Scientific Corporation’s (BSX) 13% gains on a YTD basis and 11.9% returns over the past year.

Among the 27 analysts covering the SYK stock, the consensus rating is a “Moderate Buy.” As of writing, its mean price target of $434.32 suggests a 16.7% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- With a 6.7% Yield and 27 Years of Dividend Hikes, Is This Stock a Buy Today?

- Marvell Stock Is Down 25% in 2025, and This Analyst Says Investors Should Stay Away from the MRVL Dip

- These Stock Charts Filter Out the Noise So You Can Focus on Price. Here’s What Trend Traders Need to Know.

- Cathie Wood Is Buying the Dip in BitMine Immersion Stock. Should You?