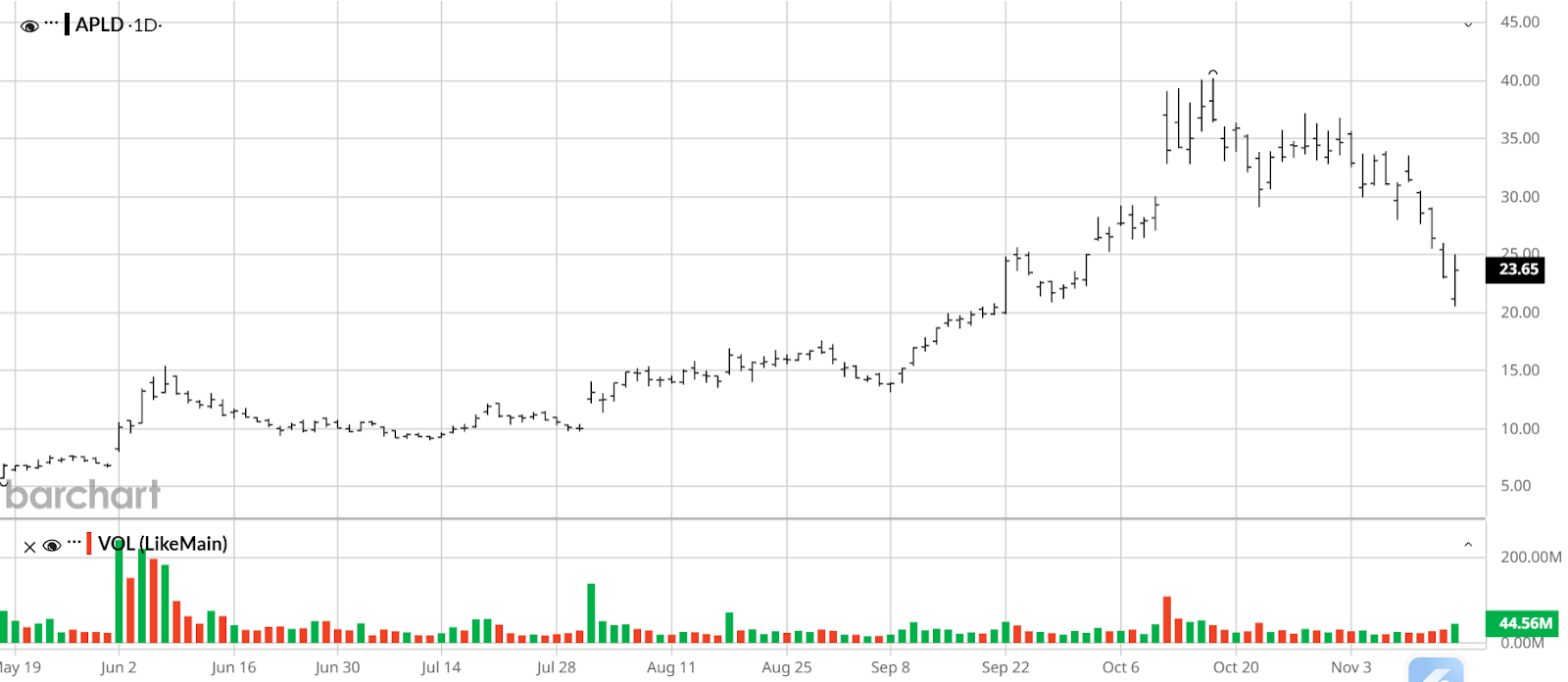

Applied Digital (APLD) has been one of the standout performers of the past year, surging more than 200% as investors reward its aggressive pivot into AI‑focused data‑center infrastructure.

But on Friday, Nov. 14, the stock attracted a different kind of attention. An unusually large block of call options hit the tape, thrusting APLD onto the radar of volatility traders and momentum watchers.

Unusual options activity rarely tells the whole story, but it can reveal how larger players are positioning. In this case, the sheer size of the order, combined with almost no existing open interest, suggested that someone was betting on a meaningful move (or a lack of one) into late November.

Unusual Options Activity Puts APLD in the Spotlight

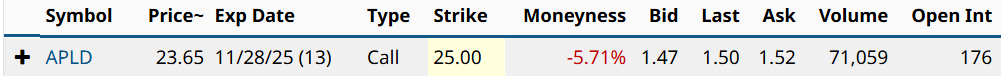

Shares of Applied Digital drew attention on Nov. 14 when an unusually large block of call options hit the tape. Roughly 71,000 contracts of the weekly $25 calls expiring Nov. 28 traded during a single session — a staggering jump from just 176 contracts of open interest heading into the day.

With shares of APLD closing at $23.65 on Nov. 14, and those calls settling near $1.50, that implies a breakeven around $26.50, or roughly 12% above the stock’s closing price. For a name already known for outsized moves, that’s an important development.

Unusual Options Activity (Nov. 14)

The volatility backdrop helps frame the trade more clearly. Implied volatility in the Nov. 28 weeklies stood near 114%, while 20-day historical volatility hovered around 97%. Both figures are elevated, but not extreme.The IV Rank of 47% reinforces that point — it suggests that while option premiums are expensive in absolute terms, they are not unusually high relative to APLD’s own 52-week history. That nuance matters, particularly when large orders land in a thin open-interest environment, because it tells traders that the options aren’t being scooped up purely due to an extreme in volatility.

The next question, of course, is intent.

At first glance, a trade of this size may appear bullish, perhaps a long-call position from a bullish trader looking for a snap-back rebound. But other interpretations are just as plausible. One possibility is a delta-neutral setup, such as a call sale paired with long stock. In this case, the $25 call carried a delta near 0.44, meaning a trader could sell the calls and simultaneously buy shares at that hedge ratio.

The goal in such a position would be to profit if the stock remains below the breakeven level during the life of the contract. This approach is frequently utilized when a trader expects limited upside over a defined period of time.

As of right now, however, it’s difficult to identify the trader’s true intent, because we don’t know whether there was an existing stock position. Or whether a stock position was added on Nov. 14 alongside the call position. What can be said with confidence is that the $25 strike is now a key reference point, and the $26.50 breakeven is another level that traders will be monitoring closely as the Nov. 28 expiration approaches.

APLD’s share volume also jumped on Nov. 14, reaching 44 million shares versus the 31 million average. Some of that activity was likely tied to hedging the call flow, but a portion almost certainly came from traders reacting to the spike in options volume. The size of the options trade pulled fresh attention into a stock that was already active and volatile heading into month-end.

Fundamental Backdrop and Recent Stock Sale Announcement

To better understand the context behind the aforementioned options activity, it helps to examine the stock’s recent trajectory, key announcements, and fundamental backdrop.

Applied Digital reported fiscal Q1 2026 results on Oct. 9, and the initial market reaction was positive. The stock jumped from around $29 to $37 over the next six trading sessions, a gain of nearly 28%. But that enthusiasm faded quickly. Since hitting those post-earnings highs, APLD has pulled back to roughly $23, a decline of nearly 40%.

Several factors likely contributed to the reversal in the stock. Part of the pullback may have stemmed from broad-based pressure on higher-valuation tech names, along with some routine profit-taking after a strong run. Market sentiment has also turned more cautious in recent sessions, with rising concern about a potential economic slowdown adding to the pressure.

On top of that, Applied Digital’s Nov. 12 announcement of a new financing deal with Macquarie Asset Management appears to have sparked renewed concern about dilution. The arrangement requires issuing additional shares, underscoring how dependent the company’s aggressive buildout strategy still is on external capital.

That funding need is closely tied to Applied Digital’s strategic pivot. Once primarily a blockchain-hosting company, it has spent the past two years repositioning itself around high-performance computing and AI infrastructure. The shift requires building specialized data centers capable of handling the heavy power, cooling, and networking demands of GPU-driven AI workloads. These types of facilities require substantial capital to bring online.

The pivot has also allowed Applied Digital to lock in long-term leasing agreements with hyperscalers — most notably CoreWeave (CRWV) — and raised its profile within the broader AI ecosystem. Nvidia’s (NVDA) previous disclosure of a 3% equity stake only reinforces that view, signaling that major players see APLD as a key part of the emerging AI infrastructure supply chain.

Financial Performance, Valuation and Analyst Outlook

Applied Digital remains deep in the buildout phase, but recent results show clear progress toward a more sustainable revenue model. In fiscal Q1 2026, the company reported $64.2 million in revenue, an 84% increase from the same quarter last year, driven largely by installation work tied to new AI clients. While those “fit-out” revenues are temporary and lower margin, they often precede long-term lease agreements, suggesting that more stable and higher-quality income is on the horizon.

Despite the top-line growth, APLD remains unprofitable on a GAAP basis, posting a net loss of $27.8 million for the quarter. That said, adjusted metrics improved year over year, and management continues to highlight the long-term potential of its Polaris Forge campuses in North Dakota. As more capacity comes online, the company aims to complete its transition into a recurring-revenue data center operator with more predictable cash flows and multi-year customer commitments. For investors, that tension between heavy upfront investment and future visibility goes a long way toward explaining the stock’s volatility.

The company’s valuation underscores just how much future growth is already priced in.

Since APLD isn’t yet profitable, traditional metrics like P/E offer little insight. But on a sales and book-value basis, the stock still carries a pronounced growth premium. Its P/S ratio is roughly 46x, far above a sector average near 3.4x, and its P/B ratio is around 6x versus roughly 3.5x for the broader group. Those figures make it clear that a substantial amount of future expansion is already embedded in the current price, even after the recent pullback. That means investors stepping into the name aren’t buying a value play. Instead, they’re leaning into a high-expectation infrastructure story tied to AI’s long-term demand curve.

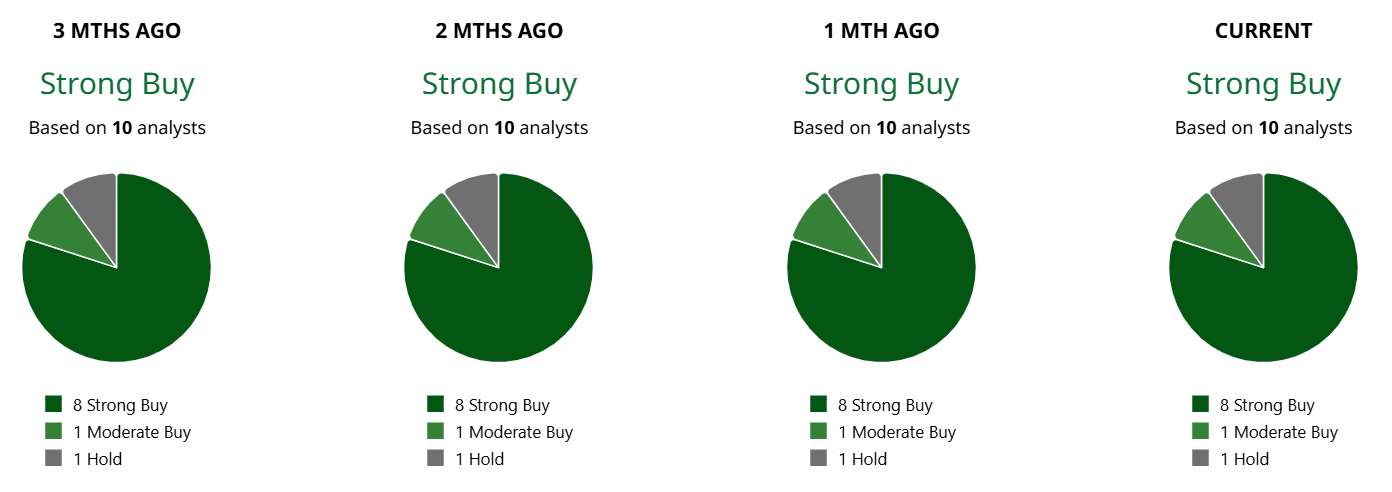

Despite the elevated valuation, Wall Street remains broadly constructive. Of the 10 analysts covering the stock, nine rate it a “buy” and one maintains a “hold.” The average price target is roughly $40 per share, suggesting substantial upside from the recent $23-$24 range. Taken together with the recent pullback and the surge in options activity, that backdrop helps explain why APLD has become a focal point for traders looking to express views on both volatility and direction into year-end.

Takeaways

After the recent volatility tied to the government shutdown, some traders appear to be positioning for a rebound in high-beta names. APLD, down roughly 36% from its October highs, fits that profile. After a strong post-earnings surge and an equally sharp pullback, the stock is now trading at levels where a short-term rebound looks increasingly plausible, especially if risk appetite improves.

There may also be a macro catalyst on the horizon. A pending Supreme Court decision that could limit the president’s authority on tariffs has the potential to spark a relief rally in the stock market. If that outcome materializes ahead of the Nov. 28 expiration, a 12% upside move in APLD becomes far more realistic, helping explain why some traders may be positioning early.

That said, anyone considering a similar options trade needs to assess the risk carefully. With an IV Rank near 47%, implied volatility is sitting close to the midpoint of its 52-week range, which suggests options are priced at fairly neutral levels. And since we don’t know the intent of the unusual options position, we don’t know whether it’s more directionally oriented or part of a broader volatility hedge. That uncertainty means traders have to rely on their own view of the stock rather than assuming the options flow signals a clear bias.

For bullish traders who think the recent selloff has run its course, the $25 strike and $26.50 breakeven offer a defined way to express that view. On the other hand, bearish traders, or investors already holding shares, may prefer a short-call or covered-call approach if they expect APLD to stay capped below key resistance into month-end.

For traders who choose to stay on the sidelines for now, the 71,000-contract surge is still worth noting. Large opening orders often act as early signals for future setups, and in this case the mix of defined price levels, moderate volatility, and a potential macro catalyst creates a situation worth watching. Whether the original flow was driven by momentum or a volatility play, APLD now stands out as a name that could present additional opportunities as Nov. 28 approaches.

On the date of publication, Andrew Prochnow did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Unusual Options Activity Shows 71,000 Calls Hit the Tape for Applied Digital Stock – How You Should Play APLD Here

- AMD Is Powering the New Steam Machine. Will It Move the Needle for AMD Stock?

- MicroStrategy Is Buying the Bitcoin Dip. Should You Buy the Dip in MSTR Stock?

- Should You Buy Netflix Stock Today After Its 10-for-1 Split?