Shares of work management software provider Monday.com (MNDY) recently took another hit as investors reacted sharply to its latest quarterly report. On Nov. 10, the cloud-based app development and project management specialist unveiled its third-quarter results, and at first glance, everything looked fine.

Revenue climbed 26% year-over-year (YOY) to $316.9 million, while adjusted EPS jumped 36% to $1.16. The company comfortably topped Wall Street’s estimates across the board, turning in its strongest non-GAAP operating profit to date.

Yet, shares of MNDY stock slid 12.3% that very day, weighed down by management’s cautious guidance. Investors have seen this play out before. Back in August, a similarly modest outlook for the third quarter triggered a sharp selloff, despite otherwise solid fundamentals.

This time, Monday.com trimmed the upper end of its full-year revenue guidance, which was enough to spark another wave of selling. Still, those who have followed the company’s journey know its playbook well. Monday.com has a long history of offering conservative forecasts only to outperform them later.

If that pattern holds, the correction may not signal weakness but rather the market’s short-term impatience.

About Monday.com Stock

Based in Tel Aviv, Israel, Monday.com runs a cloud-based platform that helps businesses create custom apps and manage their workflows. Its flagship product, the Work Operating System (Work OS), gives teams modular building blocks to design the tools they need, which includes everything from project tracking to automation.

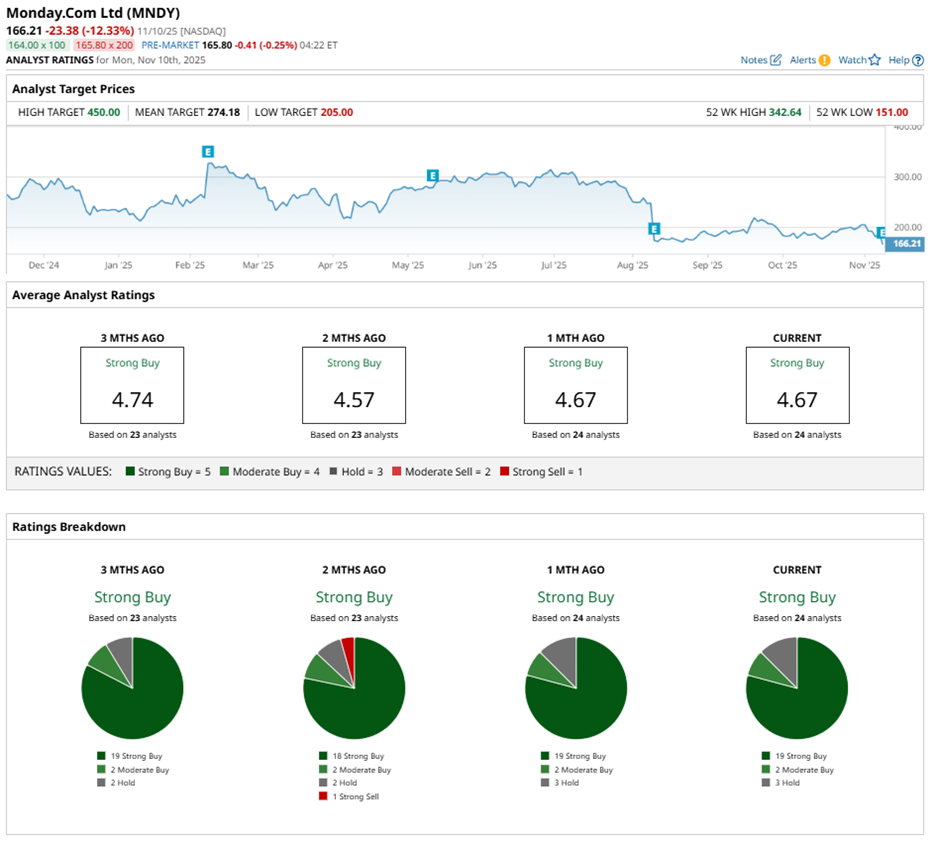

With a market capitalization of nearly $8.4 billion, the company has built a strong global footprint. But lately, its stock performance has tested investors’ nerves. After touching a 52-week high of $342.64 early this year, MNDY shares have fallen 39% over the past 52 weeks.

In fact, the stock is down almost 8% in the last three months and 17% just in the past five days. Meanwhile, the broader S&P 500 Index ($SPX) has gained 14% over the same year, climbed 6% in the past three months, and barely blinked in the past five days.

MNDY stock currently trades at 216.8 times forward adjusted earnings, reflecting a premium relative to the broader industry’s multiple.

Monday.com Surpasses Q3 Earnings

Monday.com turned in a strong Q3 performance that once again proved its ability to balance growth with profitability. Revenue climbed about 26% YOY to $316.9 million, comfortably ahead of analyst estimates of $312.4 million. Non-GAAP EPS rose roughly 36% to $1.16, beating the Street's expectations of $0.88.

Non-GAAP operating income reached $47.5 million, while non-GAAP net income increased to $61.9 million, both showing gains of 48% and 38% from the prior year’s quarter. Retention metrics remained healthy as the overall net dollar retention rate stood at 111%, while the figure for customers generating more than $100,000 in annual recurring revenue (ARR) was 117%.

The company’s growth engine is also diversifying. New products contributed more than 10% of total ARR in the third quarter, led by artificial intelligence (AI) tools such as the Monday Vibe app coding platform and the Agent Factory, which enables agentic AI programs to automate business workflows.

While Monday.com’s Q3 performance met expectations, management’s guidance for the coming quarters introduced a more cautious note. The company raised its full-year outlook for adjusted operating income and adjusted free cash flow but trimmed the upper end of its revenue forecast.

For Q4 2025, Monday.com projects total revenue between $328 million and $330 million. Non-GAAP operating income is expected to range from $36 million to $38 million, with an operating margin between 11% and 12%.

On a full-year basis, the firm now anticipates total revenue between $1.226 billion and $1.228 billion, compared with its prior guidance range of $1.224 billion to $1.229 billion. Non-GAAP operating income is forecast to come in between $167 million and $169 million, reflecting an expected operating margin of roughly 14%.

Meanwhile, analysts expect GAAP profitability to soften in the near term, with Q4 GAAP EPS projected to fall 78% YOY to $0.11 and full-year EPS expected to fall 28% to $0.77. However, fiscal 2026 forecasts point to a strong rebound, with GAAP EPS surging 104% to $1.57.

What Do Analysts Expect for Monday.com Stock?

Analysts remain largely optimistic about MNDY stock’s long-term trajectory. The consensus rating stands at a “Strong Buy,” underscoring continued confidence in the company’s fundamentals and growth strategy. Out of 24 analysts covering the stock, 19 have a “Strong Buy,” two call it a “Moderate Buy,” and three recommend a “Hold" rating.

The average price target for MNDY sits at $248.36, suggesting potential upside of 56%. The Street-high target of $450 represents an even greater potential gain of 183% from current price levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Cisco Sets a New 20-Year High. Will CSCO Stock Climb Even Higher?

- Should You Buy the Post-Earnings Dip in Monday.com Stock?

- The ARKK ETF Is Leaking, and the Tech Stock Flood Could Reach Biblical Proportions. What Should You Do With Cathie Wood’s Fund Here?

- 1 Outperforming Growth Stock to Buy as the Government Shutdown Ends