I am quick to point out the ETF industry’s flaws, oversights, exuberance, and even greed. But I am also quick to celebrate when the industry delivers on timely, potent ideas.

That’s the case with this brand-new pair of 2X ETFs.

In fact, they’re something I’ve been asking ETF industry execs about for a while. As in, “Why don’t we have more of these?” Those calls have been answered. The Direxion Daily Technology Top 5 Bull 2X ETF (TTXU) and the Direxion Daily Technology Top 5 Bear 2X ETF (TTXD) are not for everyone. They might not end up very popular at all. But they have something I have long wanted for ETF investors.

It’s Time to Concentrate

Concentration of holdings is more important now than ever. This is especially true in the tech sector, as I think we’ve seen plenty of evidence that these birds of a tech feather flock together.

That creates a false sense of security for traders who may think “I’m diversified across many stocks in the tech sector.” The S&P 500 Technology Sector SPDR (XLK) has 72 stocks.

However, the top five currently make up 48% of that ETF. Does the rest matter? Collectively, yes. Individually, no. So unless the little guys in the sector all perform well together at the same time the buy guys are tanking, the diversification here is just for show.

The Direxion Daily Technology Top 5 Bull and Bear 2X ETFs seek daily investment results, before fees and expenses, of 200%, or 200% of the inverse (or opposite), of the performance of the S&P 500 Information Technology (Sector) Top 5 Equal Capped Index.

I’ll focus from here on TTXU, but note that TTXD is simply the same concept in reverse. TTXU tries to capitalize on the continued price gains of the five biggest tech stocks, with that list refreshed regularly. TTXD essentially exists for those who want to bet against those giant stocks. This pair of ETFs is part of a new series Direxion launched in early October called the “Titans.”

Here’s a description from the fund company:

“Direxion’s Titan Leveraged & Inverse ETFs bring a new layer to the tactical trading toolkit. They bridge the gap between broad market and sector exposure and single-stock concentration. This allows traders to target the leaders of an industry. But just like any Leveraged or Inverse ETF, they are designed for short-term use and carry the same characteristics and risks, particularly due to the daily reset feature.”

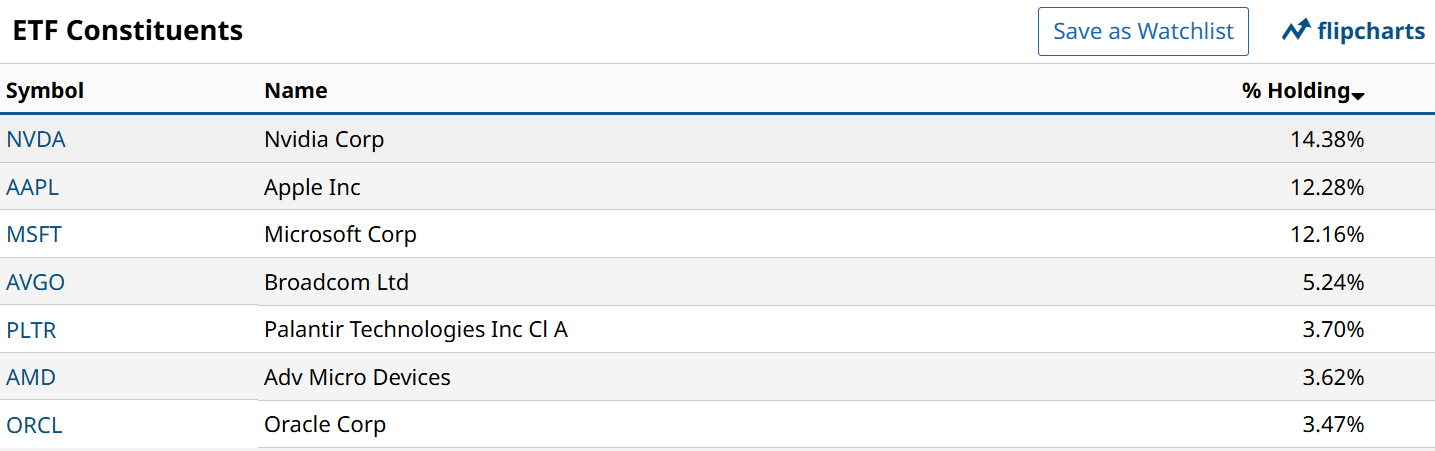

And here is what the top seven tech companies in XLK by market capitalization looked like as of Tuesday’s close. Note that the top three are all more than twice the size of the others. They dominate the sector’s price movement. And with so much money flooding into index ETFs, particularly those in technology, it makes sense that some traders want to simply know they own that basket of five big names. That avoids the risk of having the smaller ones get in the way.

The top five in TTXU as of Tuesday’s close are not a match with those listed above. That’s because after the big three, there’s some jostling for position among the next four. And TTXU only rebalances periodically. TTXU holds Apple (AAPL), Broadcom (AVGO), Microsoft (MSFT), Nvidia (NVDA), and Oracle (ORCL) in its top five.

TTXU owns shares of the 5 stocks. However, much of the ETF’s assets are held via swap contracts. That’s a modest level of opacity that doesn’t thrill me, but it tends to be the price of admission for many leveraged and inverse ETFs, including these TTXU and TTXD.

How to Use TTXD and TTXU

These ETFs are brand new, with just under a month of performance data. But this approach to ETF management, and the sponsor firm behind it, have been around long enough to conclude that we should expect them to operate as they say they will.

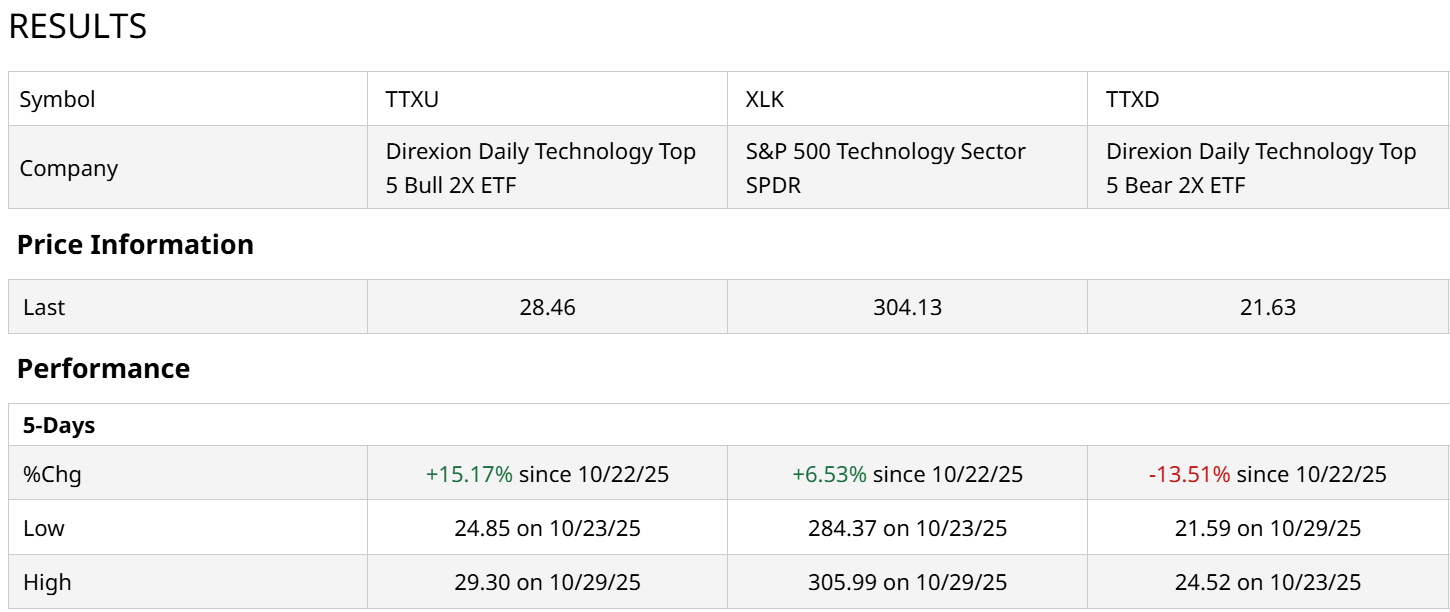

Above we see that at times of strong performance for tech stocks, such as this current month, TTXU can use the compounding effect of targeting the daily returns of the big five tech stocks and has a chance to outperform XLK by more than double. The flip side is that TTXD would likely underperform during such periods.

These ETFs and other leveraged long and inverse funds are essentially surrogates for using “deep in the money” options to me. That is, they will be much more volatile than buying the underlying stocks or ETFs normally. But they also require less capital outlay, given the 2x feature.

As with everything in investing, it is buyer beware, learn the craft if these interest you, and start with very small position sizes so you can figure out if you even like the volatility. And, wait until you have experienced some significant moves in both directions before committing more sizable assets.

That’s no different here than with any ETF. Because doing otherwise would just be speculating. And investing is not speculating. Not if risk management is as important to you as it is to me.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Pair of New 2X ETFs Goes Double or Nothing on Big Tech. Should You Chase the Volatility in Apple, Nvidia, and Microsoft Now?

- Analysts Say You Should Ignore ‘Short-Term Blips’ and Keep Buying Microsoft Stock

- This Penny Stock Just Reported a 1,000% Increase in Revenue. Should You Buy It Here?

- Netflix Just Announced a 10-for-1 Stock Split. Should You Buy NFLX Stock Here?