The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don't buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Sell equities*

- Trend Model signal: Neutral*

- Trading model: Neutral*

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

Curb your enthusiasmDoes the soft October CPI report mark the start of a fresh bull? Not so fast!

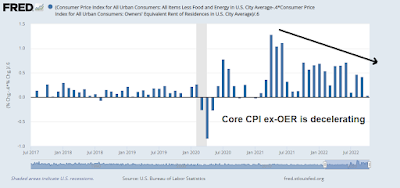

To be sure, the report was positive in many ways. Most of the strength in core CPI was in services and Owners' Equivalent Rent (OER) in particular. Rents are a lagging component of CPI and it has been weakening. Eventually, it will show up in actual CPI metrics. In the meantime, monthly core CPI ex-OER continues to show a trend of deceleration.

Mark Hulbert advised investors to curb their enthusiasm. He pointed out that the stock market's outsized one-day return in response to the softer than expected CPI report is an indication that the bear market is still alive and well.Despite Thursday’s explosive rally in stocks, it’s likely we’re still mired in a bear market.

In fact, the magnitude of the surge itself suggests the bear is still alive and well.

Consider all trading days since the Nasdaq Composite Index was created in 1971 in which it gained — as it did Thursday — more than 6%. Twenty of 26 of those days prior to Thursday occurred during a bear market, or 77% of the time, according to Ned Davis Research.The full post can be found here.