iShares 7-10 Year Treasury Bond ETF (NQ:IEF)

All News about iShares 7-10 Year Treasury Bond ETF

Via Stocktwits

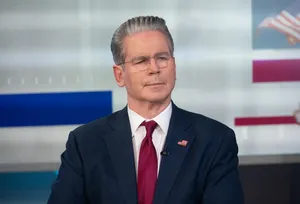

Why Wharton's Jeremy Siegel Believes Powell's Conceptual Shift On Inflation ‘Matters Enormously' ↗

December 16, 2025

Via Stocktwits

Topics

Economy

Jobless Claims Fall To Lowest Level Since September 2022 ↗

December 04, 2025

Via Stocktwits

Trump Says He Had A ‘Very Good’ Call With Xi On Trade – State Visits Scheduled For 2026 ↗

November 24, 2025

Via Stocktwits

Topics

Government

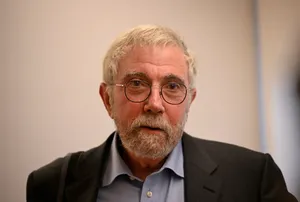

El-Erian Highlights Disappointments In Latest Consumer Confidence Data As Job, Income Concerns Loom Large ↗

November 25, 2025

Via Stocktwits

Topics

Stocks

Via Stocktwits

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.