Photo from Unsplash

Photo from Unsplash

Originally Posted On: https://www.usgoldbureau.com/news/what-is-diversification-why-important

Most people want to diversify their portfolio, but what is diversification? Diversification is a time-tested strategy of investing in different assets to mitigate (reduce) risk. Some assets have less risk than others, but every investment carries some risk. Despite what an investment advisor may say, there is no such thing as a perfect investment that has zero risk. (If there were a perfect investment, you should put 100% of your money there). Also, please be aware that diversification reduces risk. It does not remove all risk.

The goal of diversification is to own assets that will not respond to the same event in the same way. For example, if you owned two restaurant stocks before the pandemic, they both would have likely suffered large losses when the virus hit. Now imagine you have two biomedical stocks, with no pandemic on the horizon, and the new technology they are both working on turns out not to be viable. Both of those stocks may not do so well.

However, if you had one biomedical stock and one restaurant stock, and a pandemic hits, the restaurant stock may go down, but the biomedical stock may shoot up, covering your losses in the restaurant sector. In these examples, you had diversification only in the last scenario. When the pandemic subsides, the restaurant stock would probably grow in value again, and the biomedical stock may cool back down. In other words, the goal is to not put all your eggs in one basket, so you are better protected, regardless of the current events.

Industry professionals use the term “correlation” or “correlated” to describe the degree to which different assets respond similarly to the same event. Correlation is described in a range of -1 to 1. A correlation of 1 would mean an identical response and a -1 is inversely correlated. This would mean the assets have the exact opposite response to an event. The lower the correlation number means better diversification and risk reduction no matter which way the market goes. The math is more complicated than this article allows but know that the two biomedical stocks would have a positive correlation and the biomedical/restaurant pairing would have a negative or neutral correlation. (Side note: It is almost impossible to have a true -1 correlation since most assets are priced in dollars so almost all assets carry the risks associated with the dollar being devalued or collapsing.)

The best diversification strategy is to allocate capital across asset classes and within asset classes. Most people would not put 100% of their money in Amazon stock, even though Amazon is a very profitable company. Most people have multiple stocks in different sectors. This is an example of diversifying within an asset class. In addition to stocks, most people also have bonds in their portfolios. Having stocks and bonds is an example of diversifying across asset classes.

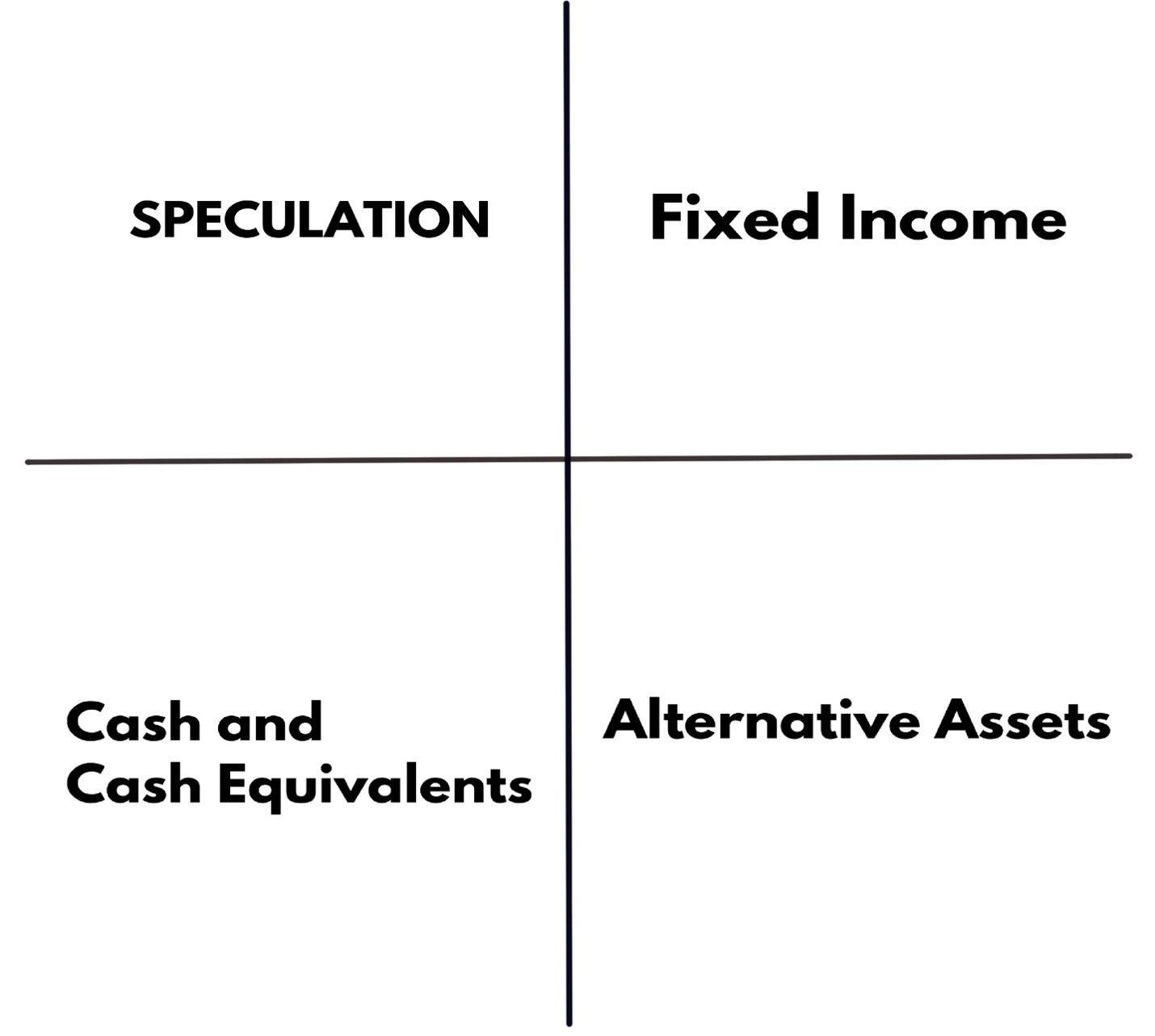

There are four primary asset classes: speculation, fixed income, cash or cash equivalents, and alternative assets.

Speculation:

Speculation assets are based on pure price appreciation. These assets tend to be higher risk and higher reward. These types of assets are best in the wealth accumulating stage of life, but are not the best in the wealth preservation stage of life. Some examples of speculation assets are stocks and cryptocurrencies. Most financial advisors recommend rebalancing your portfolio out of speculation assets as you get older. Therefore, most target-date retirement funds have lower amounts of stocks as it gets closer to the target date. A common formula many financial planners use to figure out how much of your portfolio should be in speculation is Target allocation percentage=100 – your age. For example, if you are 65 years old, you would apply the formula: 100-65=35, This reveals that a moderate risk portfolio can handle about 35% in speculative assets. Remember: this is not investment advice. Your number may be higher or lower, depending on your risk tolerance, liquidity needs, investment goals, time horizon, and a myriad of other factors. This is just information of a common way financial planners figure it out.

Fixed Income:

Fixed income assets have predictable cash flow at regular intervals. Fixed-income assets tend to carry less risk but have a lower yield. Some common examples are bonds, CDs, and annuities. Usually, the most important factor affecting fixed income assets is interest rates. Most employer retirement accounts are filled with a blend of speculative and fixed income assets (stocks and bonds).

Cash is available funds you have in a “liquid” position. Some examples of cash would be the money in your checking, savings, or brokerage account. Cash equivalents are assets that are like cash and are easily turned into cash. U.S. Treasuries, gold, and silver bullion are the best examples of cash equivalents. Bullion products are considered currency agnostic. This means there is a market for bullion everywhere on earth. This makes bullion very liquid (easy to turn back into cash). Everyone manages cash a little bit differently, but most savvy investors have a strategy for managing cash. To determine how much cash/equivalents they need, they either think in terms of a specific dollar amount or a percentage of their overall net worth. For example, the investor may want $10,000 in cash and $20,000 in cash equivalents or maybe 5% in cash and 10% in cash equivalents (or whatever their strategic numbers are).

Alternative Assets:

Alternative assets have intrinsic value outside of the stock market. Some examples include real estate, farmland, private businesses, antique automobiles, fine art and Investment Grade Coins. Alternative assets tend to be more attractive to investors who do not want to be too heavy in paper and have a longer-term, more conservative investment style.

Learn more about the different ways both bullion and Investment Grade Coins will fit into your portfolio.

Learn the basics of different ways to invest in precious metals.

A simple exercise to figure out your current portfolio allocation is to use the four-quadrant model above. First, write down the total money amounts you have in each quadrant. This may take a few minutes to think about all your different accounts and investments, but accurate numbers will help you best successfully strategize. Total all four quadrants and this is your total portfolio. Divide each quadrant by the total and you will see the percentage of each asset class to see if you are well diversified and if your assets align with your investment strategy.

For example, say our investor is 65 years old and her asset totals are as follows:

In this hypothetical portfolio, this person would be exposed to significant risk and is not well diversified across the different asset classes. This person should determine what percentages they want in each asset class. If they subscribe to the 100-age equation, the investor is more than twice as heavy in speculative assets as a moderate investor their age should be. To get to a more moderate, wealth preservation portfolio balance, they need to rebalance about $682,500 from speculation to the other asset classes. Some other strategies of portfolio allocation can be found by using our Portfolio Builder tool. After figuring out the percentages across asset classes, then it’s time for the decisions about individual investments within each asset class. Gold and silver bullion are considered cash equivalents. Investment Grade Coins are considered alternative assets. Since bullion and Investment Grade Coins are different asset classes, they are considered uncorrelated. Your financial planner can help you figure out your speculation and fixed income quadrants. The experts at the U.S. Gold Bureau can help recommend precious metals products that could be suitable for your cash/cash equivalent and alternative asset quadrants. Are you diversified across asset classes and within asset classes to minimize risk in any market condition? Call your personal U.S. Gold Bureau precious metal expert today to learn more. (800) 775-3504.

This article expresses the viewpoints of one of our precious metals specialists, based on recent news reports and opinion-based analysis of the situation. This information should in no way be taken as professional investment advice. As always, we encourage you to talk to your financial advisor before making any investment decisions.