Headquartered in Vancouver, Canada, Teck Resources Limited (TECK) explores for, acquires, develops, and produces natural resources in Asia, Europe, and North America. It operates through Steelmaking Coal, Copper, Zinc, Energy, and Corporate segments. The company’s principal products include steelmaking coal, copper, gold, blended bitumen, lead, silver, molybdenum, zinc and zinc concentrates, chemicals, fertilizers, and other metals. It also produces indium and germanium.

Commodity prices have surged so far this year due to the rising demand, and supply disruptions. Supply is expected to be disrupted further due to the Ukraine-Russia war and extended COVID-19 lockdowns in China. However, the Biden Administration's infrastructure bill is focusing on improving the country’s creaking infrastructure, which is expected to increase the demand for various metals. So, metal prices are expected to remain inflated, and the rising demand and prices of TECK’s products should benefit the stock.

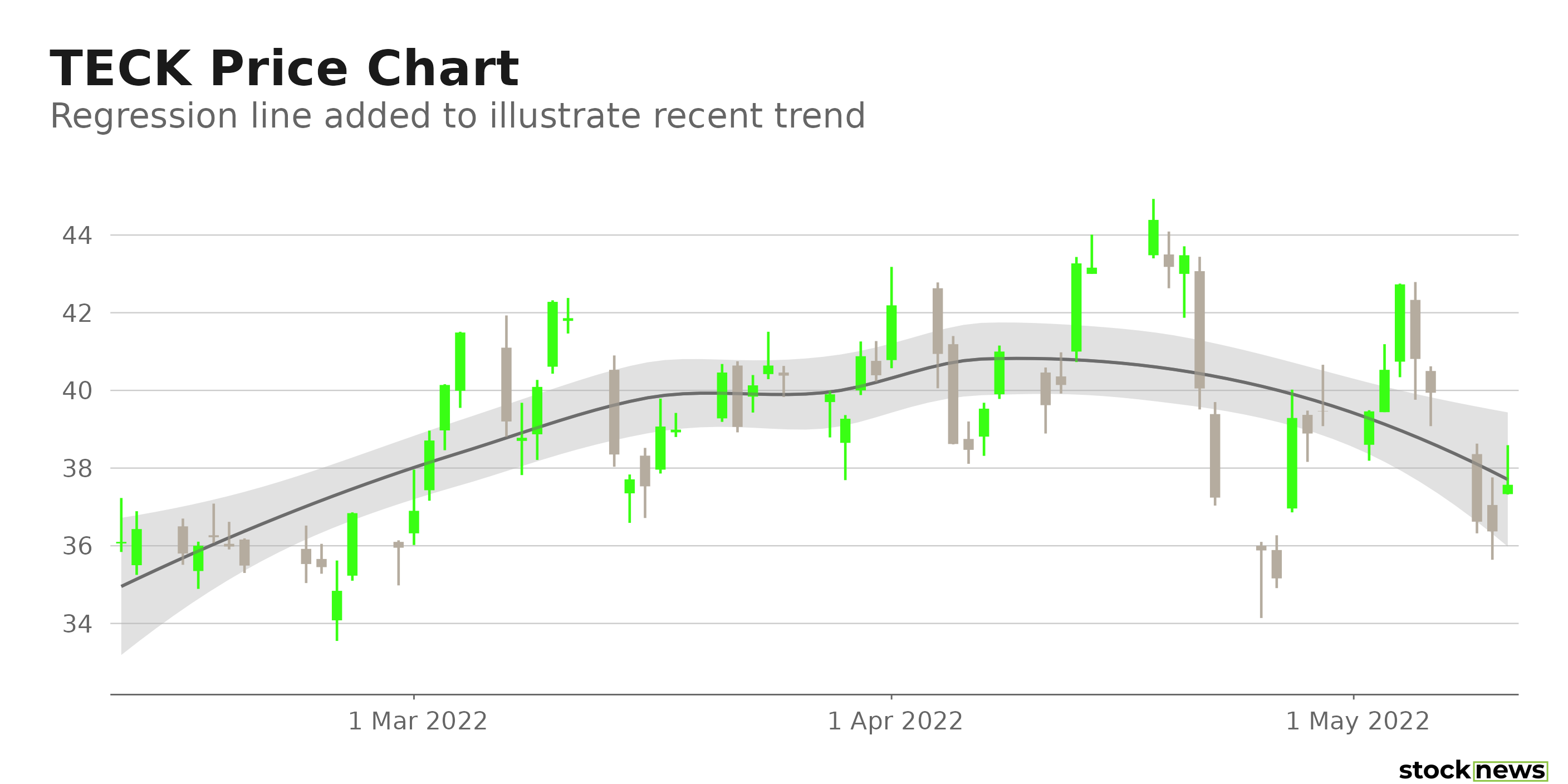

TECK has gained 27.4% in price year-to-date and 45.1% over the past year to close the last trading session at $36.37.

Here is what could influence TECK’s performance in the upcoming months:

Robust Financials

TECK’s revenues have increased 97.5% year-over-year to CAN5.03 billion ($3.86 billion) for the first quarter, ended March 31, 2022. The company’s adjusted EBITDA increased 214.7% year-over-year to CAN3.04 billion ($2.33 billion). Also, its adjusted profit attributable to its shareholders increased 396.9% year-over-year to CAN1.62 billion ($1.24 billion). In addition, its adjusted EPS came in at CAN2.96, representing an increase of 385.2% year-over-year.

Favorable Analyst Estimates

Analysts expect TECK’s EPS and revenue for the quarter ending June 30, 2022, to increase 384% and 109%, respectively, year-over-year to $2.42 and $4.23 billion. It surpassed the consensus EPS estimates in three of the trailing four quarters. Its EPS is expected to increase 54.6% per annum over the next five years.

Discounted Valuation

In terms of forward EV/EBITDA, TECK’s 2.96x is 57.6% lower than the 6.99x industry average. Its 4.34x forward non-GAAP P/E is 61% lower than the 11.14x industry average. Also, the stock’s 0.92x forward P/B is 55.7% lower than the 2.07x industry average.

Higher-than-industry Profitability

In terms of trailing-12-month gross profit margin, TECK’s 43.81% is 38.2% higher than the 31.69% industry average. And its 50.81% trailing-12-month EBITDA margin is 139.3% higher than the 21.23% industry average. Furthermore, the stock’s trailing-12-month EBIT margin and ROCE of 41.87% and 18.55%, respectively, are higher than the 14.31% and 13.16%industry averages. POWR Ratings Show Promise

TECK has an overall B rating, equating to a Buy in our POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. TECK has a B grade for Growth. This is justified given its revenue and earnings growth over the past year.

TECK also has a B grade for Value, which is consistent with its 5.76x trailing-12-month non-GAAP P/E , which is 55.7% lower than the 13.02x industry average.

It has a B grade for Quality, in sync with its 25.89% trailing-12-month net income margin, which is 195.6% higher than the industry average of 8.76%.

TECK is ranked #8 of 37 stocks in the Industrial - Metals industry. Click here to access TECK’s Momentum, Stability, and Sentiment ratings.

Click here to checkout our Infrastructure Report for 2022

Bottom Line

The prices of metals are expected to remain strong this year due to lingering supply chain issues and soaring demand. Given TECK’s discounted valuation, higher-than-industry profitability, robust financials, and impressive revenue and earnings growth estimates, we think adding this stock to one’s portfolio now could be wise.

How Does Teck Resources Limited (TECK) Stack Up Against its Peers?

TECK has an overall POWR Rating of B, which equates to a Buy rating. Check out these other stocks within the Industrial - Metals industry with an A (Strong Buy) or B (Buy) rating: BHP Group Ltd. ADR (BHP), Rio Tinto Group (RIO), and Atkore Inc. (ATKR).

Note that ATKR is one of the few stocks handpicked by our Chief Growth Strategist, Jaimini Desai, currently in the POWR Growth portfolio. Learn more here.

Click here to check out our Industrial Sector Report for 2022

TECK shares were trading at $37.60 per share on Wednesday afternoon, up $1.23 (+3.38%). Year-to-date, TECK has gained 32.02%, versus a -15.83% rise in the benchmark S&P 500 index during the same period.

About the Author: Dipanjan Banchur

Since he was in grade school, Dipanjan was interested in the stock market. This led to him obtaining a master’s degree in Finance and Accounting. Currently, as an investment analyst and financial journalist, Dipanjan has a strong interest in reading and analyzing emerging trends in financial markets.

The post Teck Resources: A Metals & Mining Stock That Deserves a Place in Your Portfolio appeared first on StockNews.com