It's always something . This week, " only " 113,964 people a day are catching Covid (2,306/day are still dying) and that's only a bit more than 1% of the population per month – so we should be (relatively) celebrating BUT NOOOOOOOO – now it's the Ukraine and the kind of " Will they or won't they? " thing that keeps TV viewers coming back for more every week . Putin already invaded Ukraine – in February of 2014, so this is the 8th anniversary of Putin's annexation of Crimea and in 2018, he built a bridge connecting it to Russia – so it's not like we thought he was going anywhere. Now Putin wants the rest, especially Kiev, which used to be the capital of Russia. More importantly, Putin has to pay Ukraine for land access for his oil and gas pipelines and THAT is the real reason all this is going on. Meanwhile, are you worred about the fate of the poor Ukranians or are you worried about the affect this has on your portfolio? Well, if 2014 is any guide – the market doesn't care. We had a great year in 2014, with the S&P climbing from 1,850 to 2,125 (15%) and oil topped out at $105 but collapsed all the way back to $50 by the end of the year. Our market is underperforming for other reasons (Inflation, Overvaluation, Supply Chain Issues, Government Gridlock, Lack of Stimulus, Fed Tapering, Rising Rates…), to start saying we are up and down based on the Ukraine is beyond over-simplifying things. Ukraine is just another excuse now to cover the dumping of shares by the Banksters that has been going on since the fall, where we've had endless cycles of low-volume "rallies" followed by high-volume sell-offs – which is what we expect to see when institutions try to dump their shares on retail investors, who are brainwashed to "buy the dips." Never forget that, in 2008, the Financial Media was telling us to " Buy the Dip " all the way from -10% to -66% and I'm not saying …

It's always something.

It's always something.

This week, "only" 113,964 people a day are catching Covid (2,306/day are still dying) and that's only a bit more than 1% of the population per month – so we should be (relatively) celebrating BUT NOOOOOOOO – now it's the Ukraine and the kind of "Will they or won't they?" thing that keeps TV viewers coming back for more every week.

Putin already invaded Ukraine – in February of 2014, so this is the 8th anniversary of Putin's annexation of Crimea and in 2018, he built a bridge connecting it to Russia – so it's not like we thought he was going anywhere. Now Putin wants the rest, especially Kiev, which used to be the capital of Russia. More importantly, Putin has to pay Ukraine for land access for his oil and gas pipelines and THAT is the real reason all this is going on.

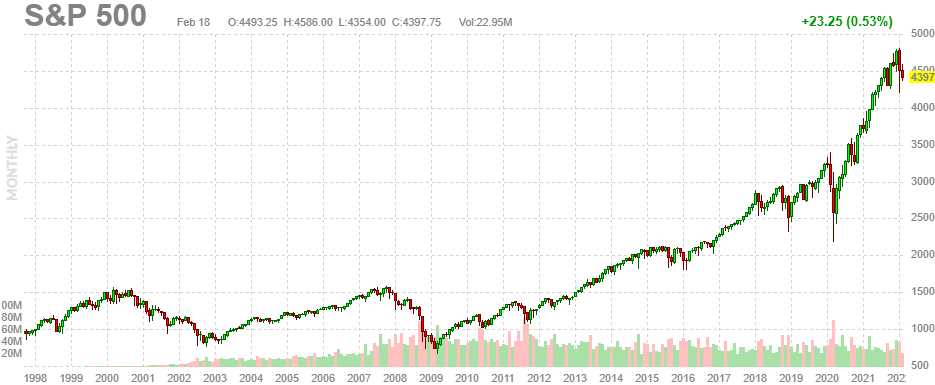

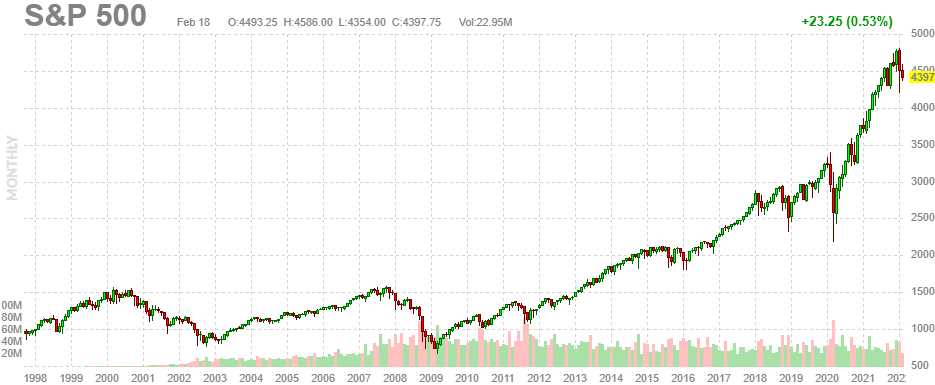

Meanwhile, are you worred about the fate of the poor Ukranians or are you worried about the affect this has on your portfolio? Well, if 2014 is any guide – the market doesn't care. We had a great year in 2014, with the S&P climbing from 1,850 to 2,125 (15%) and oil topped out at $105 but collapsed all the way back to $50 by the end of the year.

Our market is underperforming for other reasons (Inflation, Overvaluation, Supply Chain Issues, Government Gridlock, Lack of Stimulus, Fed Tapering, Rising Rates…), to start saying we are up and down based on the Ukraine is beyond over-simplifying things. Ukraine is just another excuse now to cover the dumping of shares by the Banksters that has been going on since the fall, where we've had endless cycles of low-volume "rallies" followed by high-volume sell-offs – which is what we expect to see when institutions try to dump their shares on retail investors, who are brainwashed to "buy the dips."

Never forget that, in 2008, the Financial Media was telling us to "Buy the Dip" all the way from -10% to -66% and I'm not saying…

It's always something.

It's always something.