In Part one of this series, I explained how economists and health experts were optimistic about the end of the pandemic in 2021 and the best economic growth in 36 years.

- this is the backdrop for what Goldman Sachs thinks could trigger a 25% two-year rally

- and JPMorgan thinks could lead to a 25% stock rally in 2021 alone

But there is one final catalyst that is the most important of all and could make or break the S&P 500 in 2021.

Reason 3: Corporate Earnings Are Justifying More Of This Rally Than Many People RealizeAt the start of January FactSet's John Butters noted something remarkable.

Normally, before every earnings season, analysts cut earnings growth forecasts by 4.2% to 5.2%.

- this is why 75% of companies on average, beat expectations by about 5% '

- and management teams look good and stock prices tend to do well during earnings season

Only when unique secular events, such as 2017's tax cuts or the end of this pandemic, are likely to cause companies to still blow out results, are analysts confident enough to raise expectations.

That's what's been happening for the past month. With consensus S&P earnings growth steadily rising week after week. Yet despite those rising expectations, this earnings season is proving one for the record books.

- so far FactSet reports 86% of companies are beating expectations vs the 5-year average of 74%

- so far companies are beating expectations by 22% vs 6% 5-year average

This is with analysts steadily raising the bar for Q4 results, which so far corporate America is crushing.

The $750 billion to $1.1 trillion in stimulus that most economists expect in March, is expected to be matched by $1 to $1.5 trillion in infrastructure spending starting in June.

That spending will take several years (Moody's estimates three) to fully work its way through the economy. But by the time it does, America's unemployment rate is expected to be around 4.0%, one of the lowest levels in 50 years.

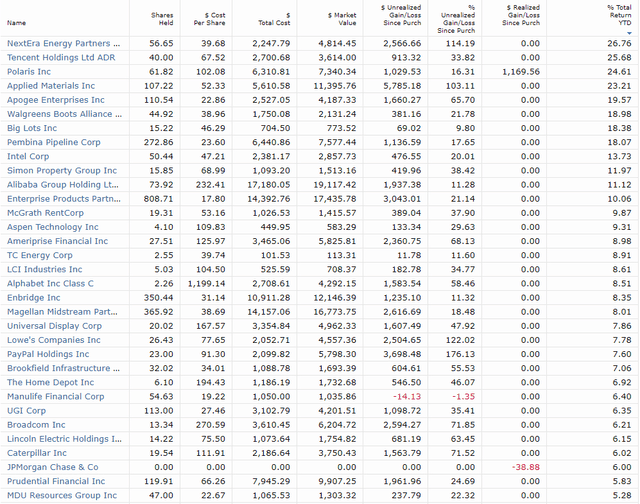

How I'm Going To Profit From The Economic Boom TimesThere are a lot of huge winners in 2021 that I and the Dividend Kings Phoenix portfolio already own.

33 Phoenix Portfolio Companies Are Up 5+% In The Last 3 Weeks(Source: Morningstar)

Value stocks are off like a rocket this year

- Dividend Aristocrats: +0.9% YTD

- Large Cap Value: +2.4% YTD

- S&P: + 2.4% YTD

- Nasdaq: +3.7% YTD

- DK Phoenix portfolio: +4.6% YTD

- DK Fortress: +5.3% YTD (aristocrats are its benchmark)

- DK High-Yield Blue-Chip portfolio: + 5.9% YTD

- DK Deep Value Blue-Chip portfolio is up 8.2% YTD

However, the key to not just making money, but keeping it, is sound risk management.

(Source: Imgflip)

Here is a perfect example of what Mr. Housel is talking about.

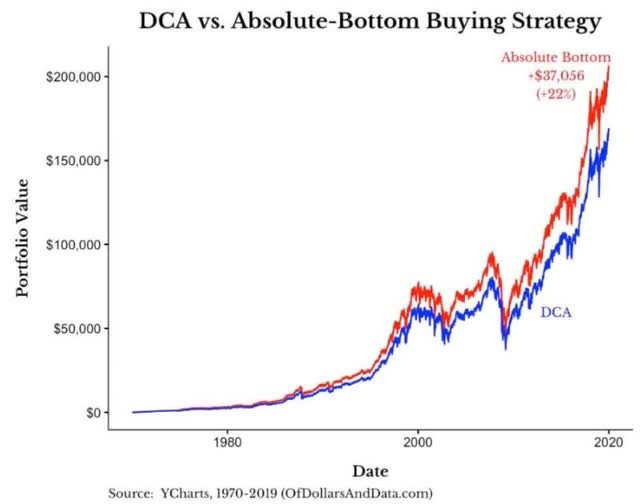

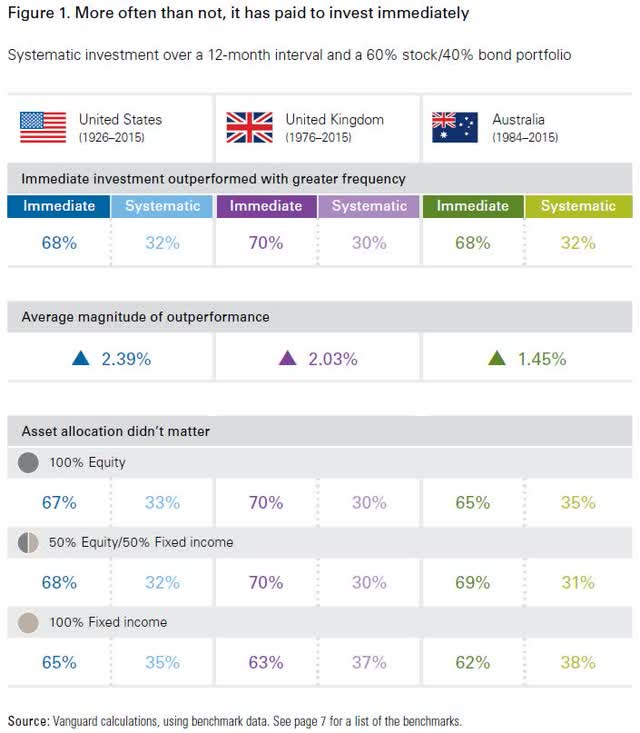

A Vanguard study looking at 160 years of market data in the US, UK, and Australia found that 68% to 70% of the time being fully invested all the time was the optimal strategy resulting in 1.5% to 2.4% CAGR better returns.

Compared to market timing, merely remaining fully invested all of the time delivers about 2% CAGR better returns over the decades.

Here is how much better perfect market timing would have done for investors from 1970 to 2019.

- assuming you only every bought at the exact bottom you would have earned 22% higher total returns after 39 years

- 0.5% better annualized returns

- if you could predict every market bottom

In contrast, calling the exact bottom of the market every time would have delivered 4X smaller alpha.

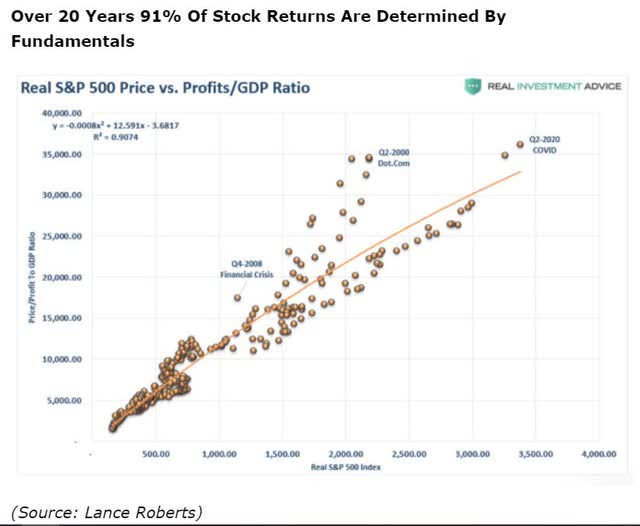

Over 12 months or less, fundamentals have very little to do with stock returns. Over 10 years, they are 10X to 11X as powerful as sentiment and luck.

This is how you can earn up to 45% CAGR returns on 7% yielding British American Tobacco over the next two years.

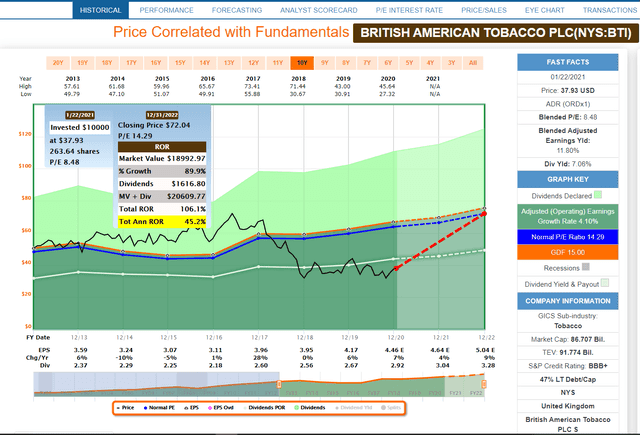

British American 2022 Consensus Return Potential(Source: F.A.S.T Graphs, FactSet Research)

If BTI grows as analysts expect through 2022, and returns to historical fair value, then investors could expect

- 106% total returns

- 45.2% CAGR returns

- vs -4.6% CAGR S&P 500

Of course, over the long-term total returns will track yield + growth.

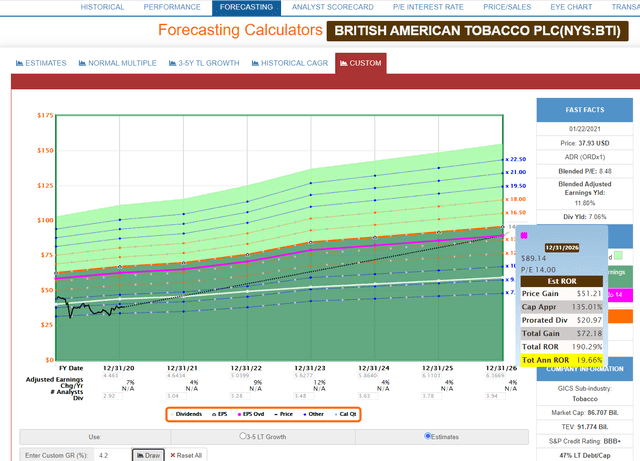

British American 2026 Consensus Return Potential(Source: F.A.S.T Graphs, FactSet Research)

If BTI grows as analysts expect through 2026, and returns to historical fair value, then you could expect

- 190% total returns basically doubling your investment

- 19.7% CAGR returns

- vs 4.1% CAGR S&P 500

Over the very long-term, here's what analysts expect.

- 7.0% yield + 4.2% CAGR growth = 11.2% CAGR total returns (9% to 14% CAGR range)

- vs 8.0% CAGR S&P 500 and 10.1% CAGR dividend aristocrats

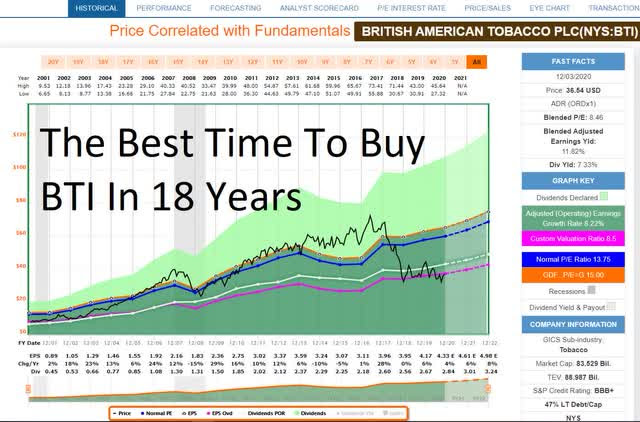

(Source: F.A.S.T Graphs, FactSet Research)

(Source: Portfolio Visualizer)

- the best time in almost 20 years to buy BTI

- BTI isn't for everyone, but if you like the company, and don't buy during this bear market, then you are wrong;)

- from bear market lows 15 year returns as strong as 25% CAGR (2,742% total returns)

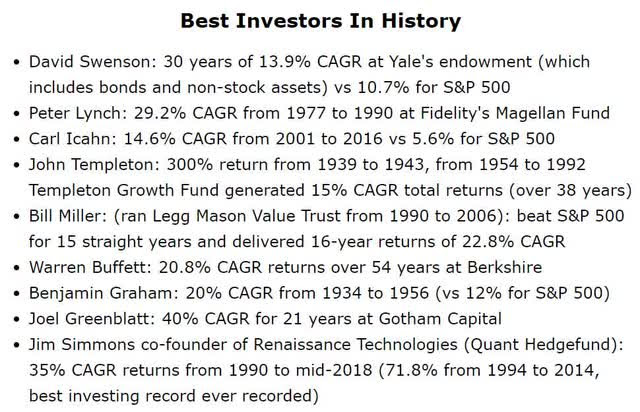

- BTI's historical bear market returns on par with the greatest investors in history

But not from some complex or risky asset you have to manage and tie up your money in for seven to 15 years (as with hedge funds), but a 100% liquid world-class (though speculative) blue-chip investment.

- blue-chip dividend growth investing at its finest

- high-probability/low risk buys that are 91% likely to meet our goals over the long-term

(Source: Imgflip)

Bottom Line: 2021 Is Potentially Going To Be The Best Year For Value In History...So Be Ready For ProfitSome of the value stocks I bought in 2020 are up over 30% in less than a month so far in 2021.

But such gains are 100% justified by fundamentals this year, which is why I'm optimistic that the party is just getting started.

I highlighted BTI as one example, among many, of the kind of incredible bargains still available for those who know where to look.

Whether you're seeking to maximize safe yield or pure growth at an attractive price, something great is always on sale.

By maxing out your investment fundamentals, starting yield + long-term growth + changes in long-term valuation, that's how you can achieve legendary investing results.

Not for just a few months, as many Robinhood speculators are doing today with red hot companies. I'm talking about the ability to deliver market-smashing returns over 10+ years, while showering you with a river of generous, safe, and steadily growing dividends.

That's what I plan to do for not just 2021, but 2022 and far beyond. And rest assured that I'm investing my hard-earned money right alongside you.

- 100% of my life savings are invested via the Dividend Kings' Phoenix strategy

- and I'm up 47% CAGR since I started in April

9 “MUST OWN” Growth Stocks for 2021

#1 Ingredient for Picking Winning Stocks

7 Best ETFs for the NEXT Bull Market

5 WINNING Stocks Chart Patterns

SPY shares were trading at $380.01 per share on Thursday morning, up $5.60 (+1.50%). Year-to-date, SPY has gained 1.64%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles.

The post 3 Reasons to be Bullish in 2021: Part 2 appeared first on StockNews.com