Zoe Financial takes a look back at everything experienced in 2020 and how the market responded helps provide some insight into the current state of the markets and the economy, as well as how it could be changing in the near future. In 2020, the market experienced the fastest decline in history, the quickest resurgence since 1933, and a global pandemic in scale and severity not seen in over a century.

Unprecedented Market Volatility

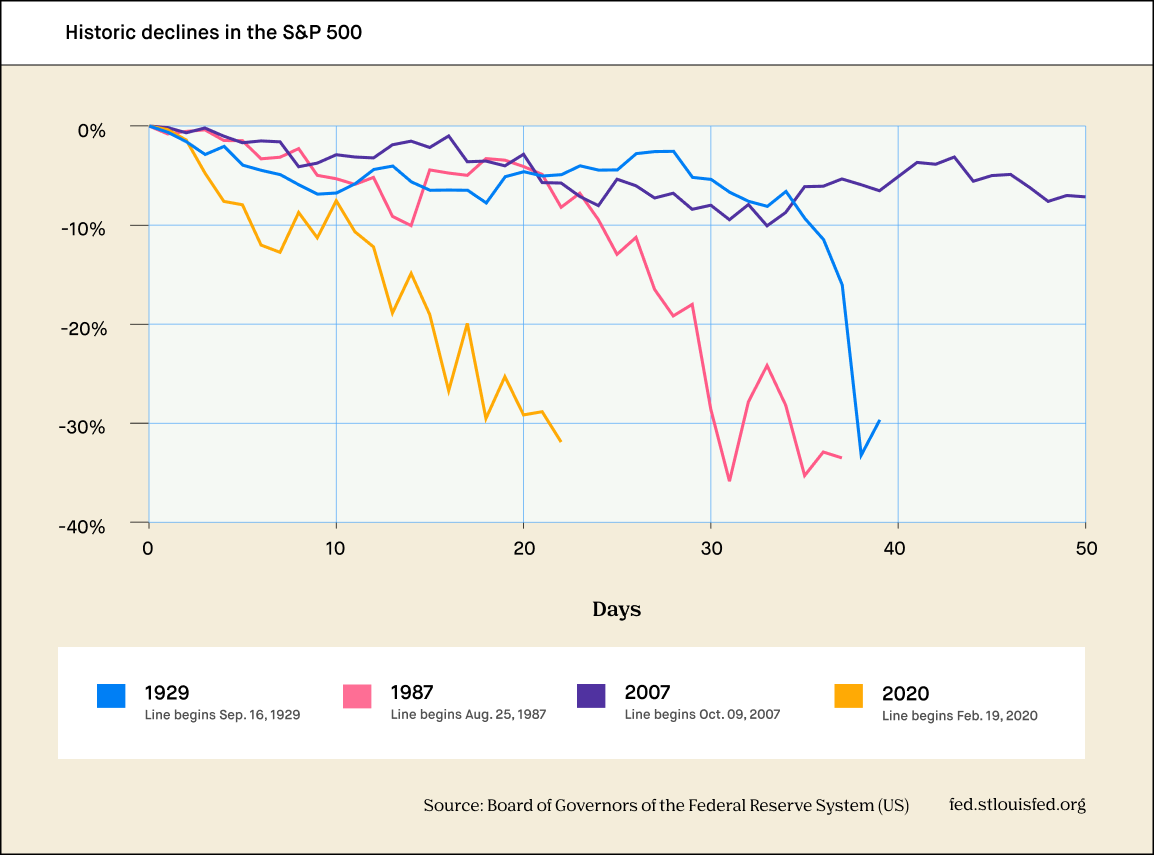

The market started out strong in 2020, with 71% of companies beating their expected earnings through February 7th. The S&P 500 continued to grow and peaked at 3386 on February 19, 2020. However, the COVID-19 pandemic swept through the nation in February. From February 19, 2020 to March 20, 2020, the S&P 500 dropped nearly 32%, which was a faster decline than the market experienced during the Great Depression, the market crash in 1987, and the 2008 financial crisis.

Bonds Rally

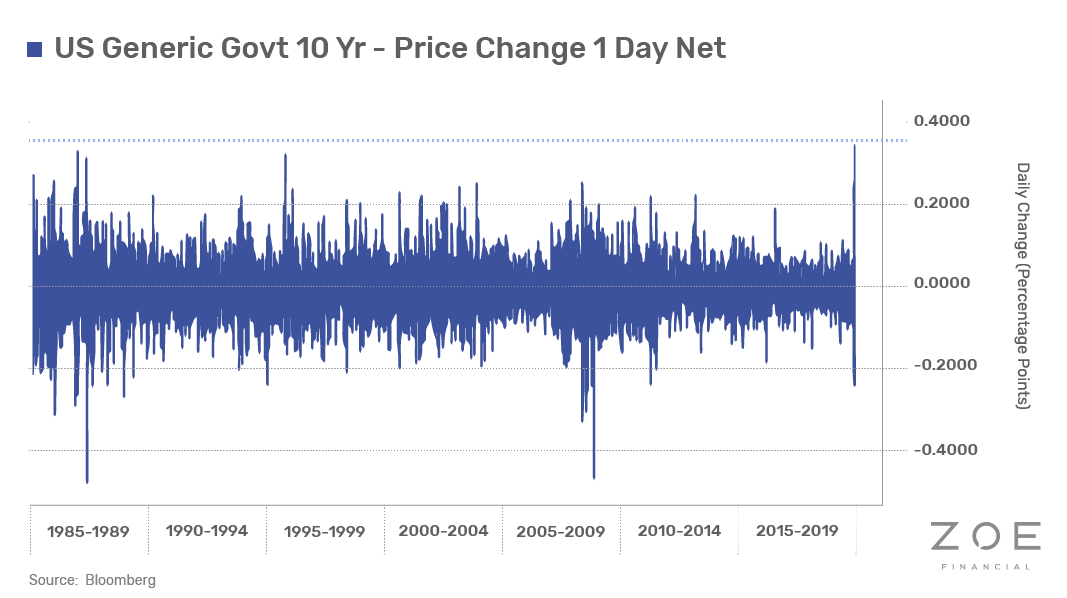

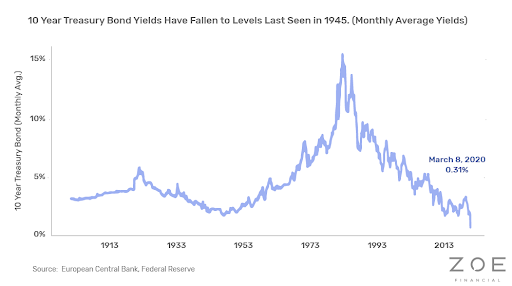

The Bond market did not escape the volatility, with the treasury market seeing the largest intraday moves in over 35 years in March. The combination of a flight to safety and the anticipation that both monetary and fiscal policy were going to use every tool in their arsenal led to a massive Treasury bond rally.

In fact, the 10-year Treasury bond yield hit a new all-time low of 0.31% on March 8.

Although the rate of decline the market experienced this year was unprecedented, the market bounced back quicker than anyone expected. By June 5, 2020, the S&P 500 was only down 2% from the beginning of the year, and the Dow Jones Industrial Average was down only 4.5% from the start of the year. In fact, by late March, the Dow saw the best surge in a single day since 1933.

After the resurgence, the market began to slow again, slightly falling throughout September and October. This was most likely due to the rise in COVID-19 cases and the resulting fears of a "double dip recession" and the uncertainty surrounding the presidential election that was approaching. In October, the S&P 500 experienced its worst week since March, falling 3.5%.

In November, the S&P 500 rose 10.75%, the Dow Jones Industrial Average rose 11.84%, and the Nasdaq rose 11.8%. This jump in the market was mostly driven by the positive results of the COVID-19 vaccine trials that suggested the vaccine could be available by the first half of 2021. The possibility of the vaccine meant that economic activity could resume quicker than expected. The presidential election was also in November, which many investors were waiting for to determine their investment decisions.

The Winners and Losers

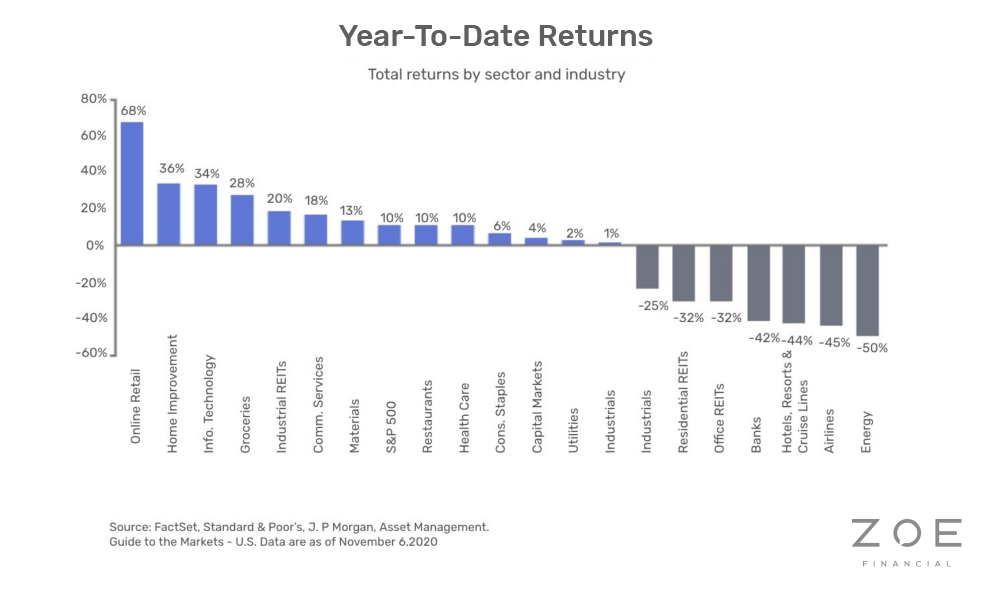

Despite the fact that broad indexes rallied back to double digits, the market did discriminate between Covid winners and losers. Sectors that benefited from the shift of consumers to digital channels such as Online retail and Tech stocks rose significantly while "off-line" sectors like Airlines and Energy suffered significant losses.

The Global Economy Halted…and Bounced Back

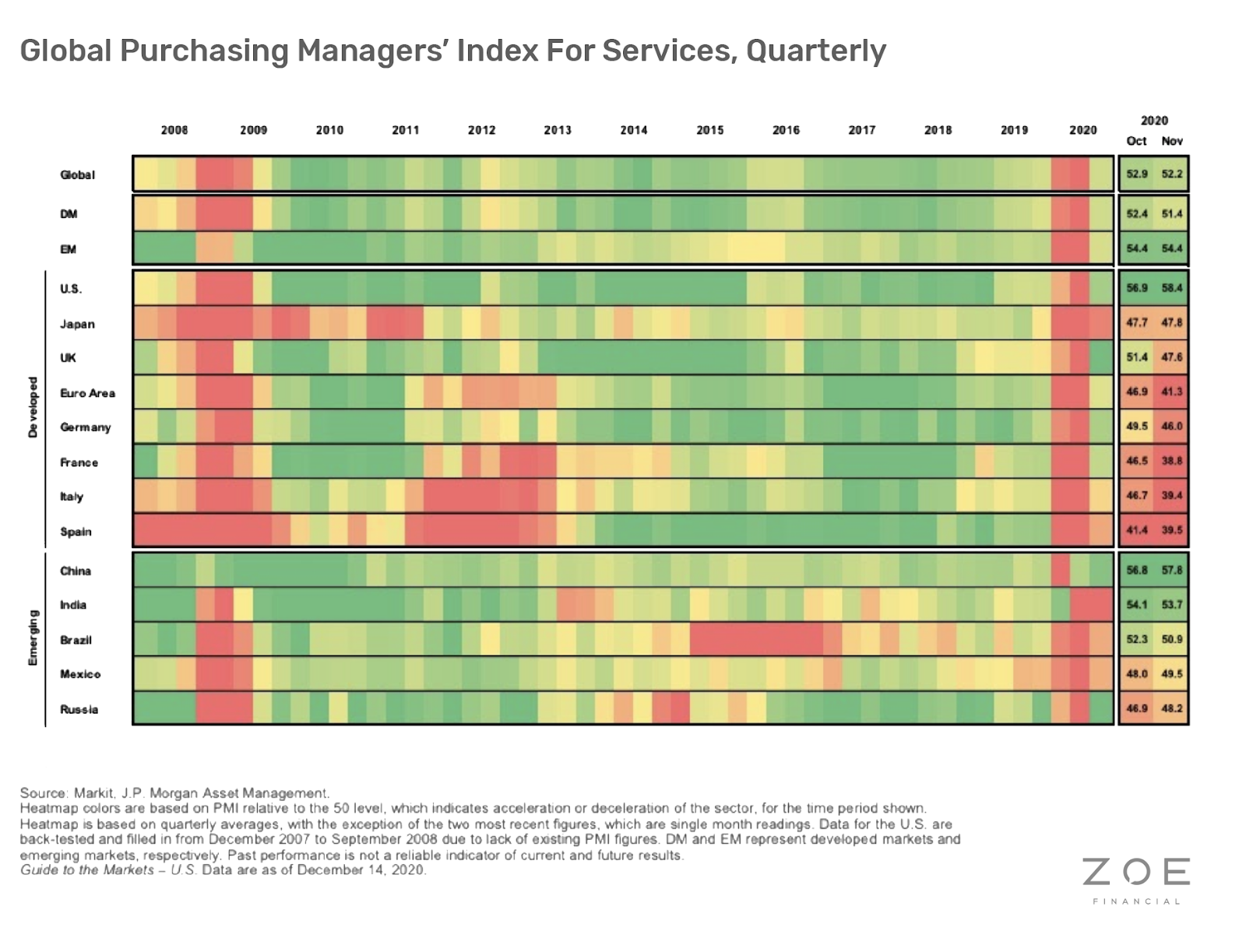

From an economic standpoint, it is fair to say that the global economy grinded to a halt. For instance, the Global Purchasing Manager (PMI) Index for services around the world all fell to the worst levels seen since 2008. As the below chart shows, equally surprising is the significant improvement as the year progresses with Global PMI ending up in expansion territory as of November.

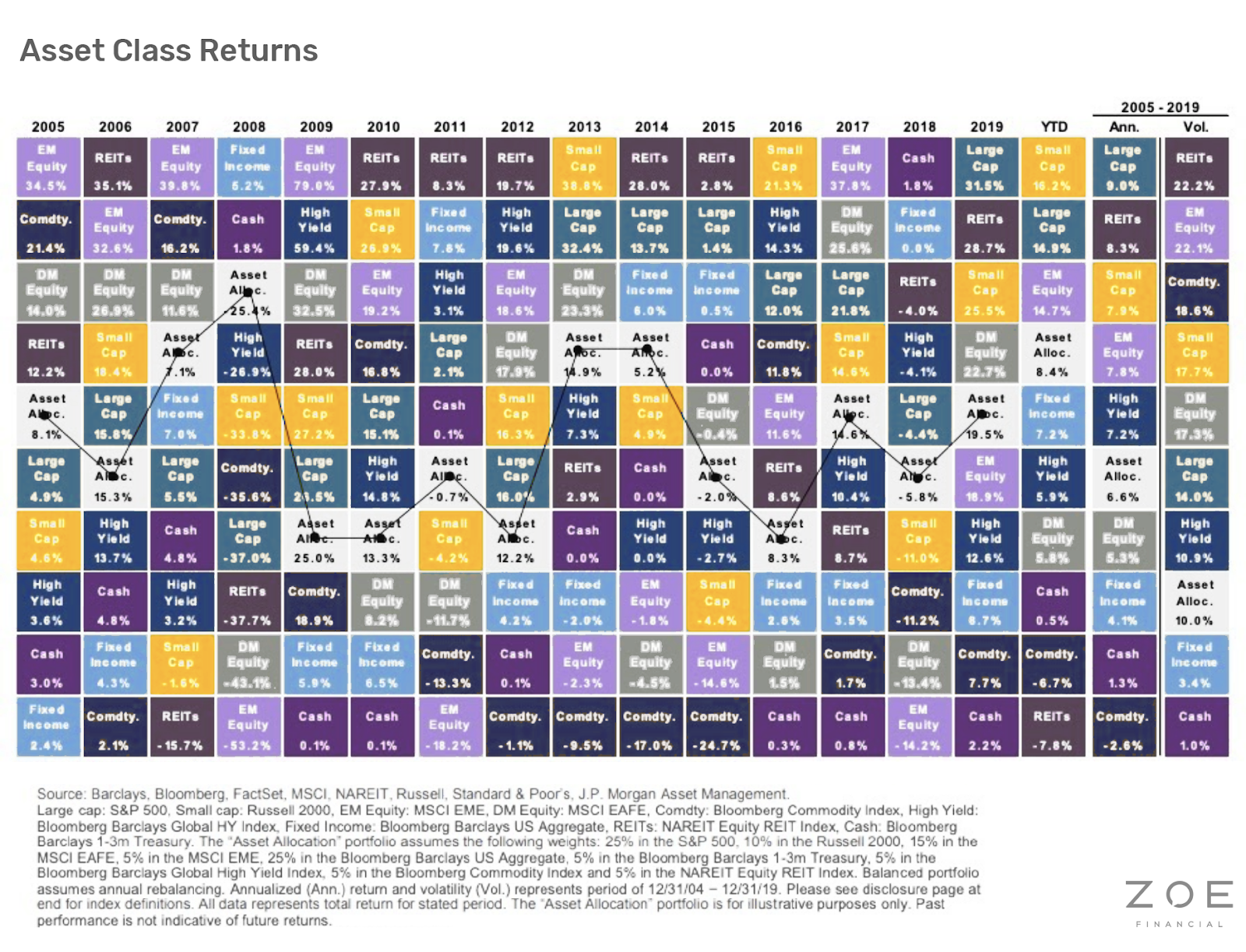

Needless to say, 2020 was a standout year due to its unpredictability. From starting the year with a global pandemic to ending it with a vaccine, the markets up in double digits, and an economic recovery underway; it is fair to say the year delivered a decade into 12 months. Looking at 2020 in review, this past year taught us that predicting the markets when investing is a fool's errand. 2020 also reinforced the value of maintaining a diversified portfolio. A well-diversified portfolio (as seen in the Asset Class Returns chart below) that holds stocks, bonds, and even commodities would have yielded approximately 8% returns with much lower volatility, than just owning stocks.

Needless to say, 2020 was a standout year due to its unpredictability. From starting the year with a global pandemic to ending it with a vaccine, the markets up in double digits, and an economic recovery underway; it is fair to say the year delivered a decade into 12 months. Looking at 2020 in review, this past year taught us that predicting the markets when investing is a fool's errand. 2020 also reinforced the value of maintaining a diversified portfolio. A well-diversified portfolio (as seen in the Asset Class Returns chart below) that holds stocks, bonds, and even commodities would have yielded approximately 8% returns with much lower volatility, than just owning stocks.

About Zoe Financial

Zoe Financial's award-winning algorithm enables individuals to discover and connect with highly vetted, top fiduciary advisors in their area. All financial advisors in the Zoe Network are vetted and verified fiduciaries, along with having top credentials, education, and experience. Zoe's service provides support from start to finish during an individual's financial advisor search. All consultation calls and interviews with Zoe's network of advisors are completely free and are offered via video chat or traditional phone call depending on an individual's preference.

Press Contact:

Press Release Service by Newswire.com

Original Source: Market Wrap-Up: What We Learned in 2020