GW Pharmaceuticals (GWPH) is a British pharmaceutical company that made history in 2010 when its drug nabiximols, a multiple sclerosis treatment, received market approval from the U.K. government, representing the first time that prescription medication derived from the cannabis plant was given the green light for commercial sale.

Although nabiximols is widely available in Canada and Europe under the brand name Sativex, it has yet to receive approval from the U.S. Food and Drug Administration (FDA) – it is currently in U.S. Phase 3 clinical tests, and the company is hoping to enter a submission for an initial New Drug Application to the FDA in 2021. The FDA has already approved GWPH’s cannabidiol (CBD)-derived drug Epidiolex in 2018 for the treatments of two forms of epilepsy.

GWPH was founded in 1998 and was listed on AIM, the junior market of the London Stock Exchange, in 2001; its NASDAQ listing occurred in 2013.

In its Q3 earnings report, GWPH recorded $137.1 million in total quarterly revenue, up from $91 million from one year earlier. Total revenue for the first nine months of 2020 was $378.6 million, compared to $202.3 million in the same period in 2019. While the company recorded a net loss in Q3 of $12.2 million, it was lower than net loss of $13.8 million for Q3 2019.

Darren Cline, U.S. chief commercial officer at GWPH, used the Q3 earnings call to acknowledge the company has been operating this year under difficult circumstances beyond its control.

“These are not normal times and COVID inevitably impacts our sales efforts, as it is doing more broadly in the field of neurology,” Cline said. “While patient office visits have improved from Q2, it continued to be down relative to pre-COVID levels, especially in our pediatric population. For our sales team, our overall face-to-face healthcare professional interactions have increased from the second quarter. They remained far below pre-COVID levels. Clearly, there is a difference between the benefits of an office face-to-face interactions versus virtual engagements, rapidly due to the virtual environment.”

Here’s how our proprietary POWR Ratings system evaluates GWPH:

Trade Grade: B

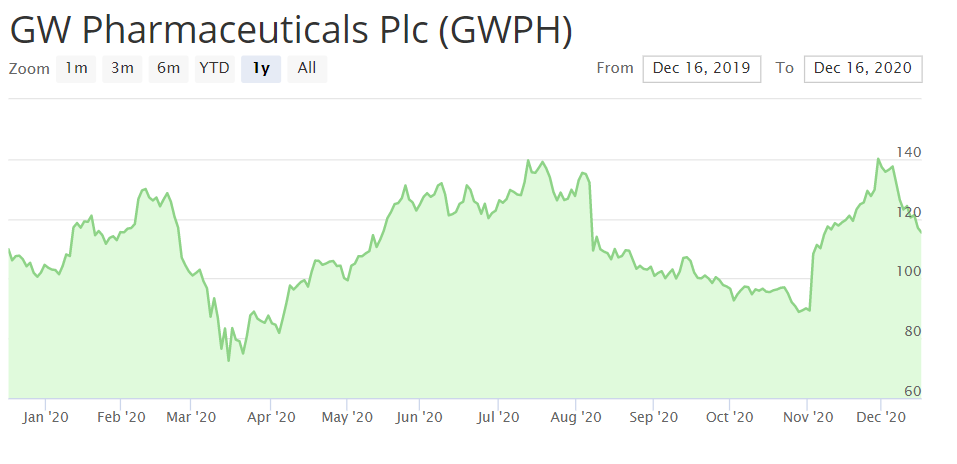

GWPH is trading at $115.40, closer to its 52-week high of $144.00 than its 52-week low of $67.98. The stock took two abrupt nosedives earlier this year following the disappointing numbers in the February release of its Q4 2019 earnings and the August release of its Q2 2020 earnings. However, the stock bounced back from both tumbles and started to rise further in November with an optimistic Q3 report and news of the Phase 3 clinical tests for nabiximols.

Buy and Hold Grade: C

Although the GWPH stock took on oscilloscope-type behavior in the past few months, it is currently holding steady as the company makes progress in the U.S. market. As Darren Cline stated in the Q3 earnings call, GWPH achieved $122 million in U.S. Epidiolex net sales, up from $86 million in third quarter of 2019.

“Year-to-date, U.S. revenue through Sept. 30 was $339 million, compared to $188 million in the same period last year, representing an 80% increase,” Cline added. “During the quarter, Epidiolex continued to deliver the benefits that our patients and their caregivers have come to depend on. Patient persistency continues to be a cornerstone of the brand.”

Peer Grade: B

GWPH ranks #31 out of 240 stocks in the Medical – Pharmaceuticals category. It is two berths below #29-ranked Canopy Growth Corp. (CGC). In a category where the highest rankings are occupied by pharmaceuticals with wide and diverse product lines, niche-focused GWPH is more than holding its own against the XL-size competition.

Industry Rank: A

The Medical – Pharmaceuticals category ranks #14 out of 123 stock categories and its average POWR Rating is B.

Overall Ranking: B

The ongoing pandemic has been difficult for pharmaceutical companies not involved in the race for a COVID vaccine, as a great level of medical research went on the proverbial back burner while the healthcare sector was focused on mitigating the unprecedented crisis that unfolded over the year. Complicating matters for GWPH is the U.S. federal policy on cannabis commerce – and the fact the U.S. is years behind Canada and Europe in approving nabiximols says less about GWPH and more about how Washington operates. Still, the company’s persistence is indefatigable and the wobbles from earlier this year seem to have abated.

Bottom Line

GWPH is a sturdy pharmaceutical company stock. The company’s patience and eyes-on-the-prize drive to expand in the U.S. market despite formidable federal policy obstacles deserves respect.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

GWPH shares were trading at $114.95 per share on Wednesday morning, down $2.00 (-1.71%). Year-to-date, GWPH has gained 9.94%, versus a 16.55% rise in the benchmark S&P 500 index during the same period.

About the Author: Phil Hall

Phil is an experienced financial journalist responsible for generating original content on the weekly Fairfield County Business Journal and Westchester County Business Journal, plus their respective daily online news sites, podcasts and video interview series. He is the winner of 2018, 2019 and 2020 Connecticut Press Club Awards and 2019 and 2020 Connecticut Society of Professional Journalists Award for editorial output.

The post Why GW Pharmaceuticals is a Cannabis Stock to Watch appeared first on StockNews.com