Bryan Taylor (Chief Economist) & Michelle Kangas, (Founder) Global Financial

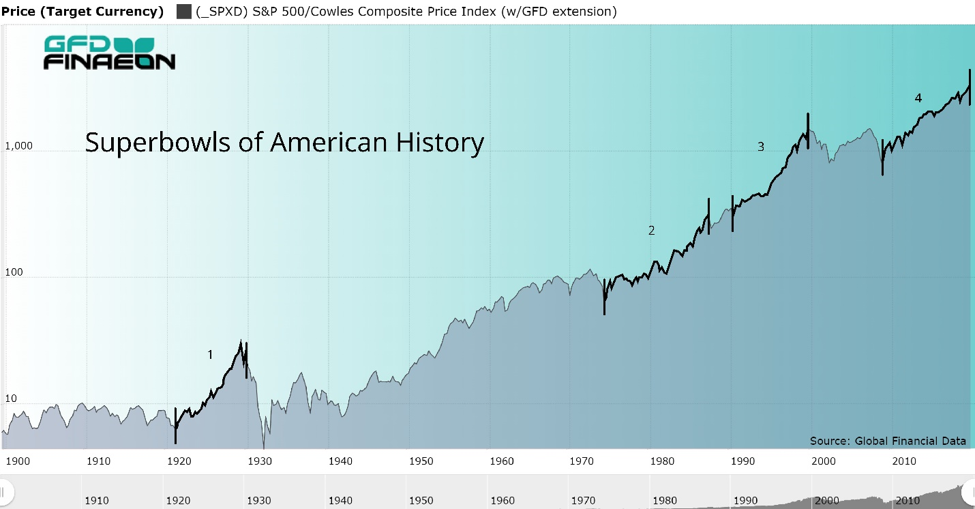

San Juan Capistrano, Feb 26, 2020 (Issuewire.com) - We can call the current bull market, as seen in Figure 1, the Superbowl market since it has now increased by more than 400%. On February 19, 2020, the S&P 500 closed at 3386.15 meaning that the current bull market has increased by over 400% from its closing low of 676.53 on March 9, 2009. Who would have guessed that the 2009 bear market, that declined over 50%, created the foundation for the greatest bull market in history? The current bull market has fought slow growth, political uncertainty, trade wars, the current Coronavirus and still has emerged the winner over these obstacles of economic growth. If these barriers can't slow this bull market, what can?

As detailed in the blog "Is This the Greatest Bull Market of All Time?", there have only been three other times when the S&P Composite went through a 400% bull market. The S&P Composite rose 409% between 1921 and 1929, rose 442% between 1974 and 1987and rose 418% between 1990 and 2000, as seen in Figure 2.

The S&P 500 declined 19.78% in 2018, just shy of qualifying as a bear decline, but it bounced back and continues its bull run. To beat the 1974-1987 bull market in nominal terms, the S&P 500 Index would need to rise to 3675. At that point, another milestone would be achieved: the stock market's capitalization would be twice GDP for the first time in history.

The real challenge will be for the current bull market to rise to 4060. If this were to occur, the S&P Composite would have increased in value by 500% without a bear market for the first time in history, and the bull market would have increased by 400% after inflation. How much higher can the bull market go before it finally is defeated by the dreaded bear? We predict that by the time the bear finally shows up, it will have been the greatest Superbowl market in the past 235 years of American history.

About Global Financial Data

Global Financial Data provides the most comprehensive, historical economic and financial information available anywhere. GFD specializes in providing Financial and Economic Data that extends from the 1000s to the present--beyond what any other data provider has ever delivered.

For over twenty-five years Global Financial Data has been accumulating and transcribing rare data sources into research-quality databases. This was a time when the word "alternative" was not used to define unique data content.

GFD combines daily market data from traditional data feeds with historical values we have collected from print sources to generate complete, unabridged data series. These original source documents include academic journals, newspapers, periodicals, books and numerous other archival sources that were once only recorded by a quill pen. The data Global Financial Data offers is verified, cross-referenced and accurate. Global Financial Data content supports all types of internal, commercial and academic analysis.

Media Contact

Global Financial Data

1-877-DATA-999

Source :globalfinancialdata.com