3D printing company Stratasys (NASDAQ: SSYS) announced better-than-expected revenue in Q1 CY2025, but sales fell by 5.6% year on year to $136 million. The company’s full-year revenue guidance of $577.5 million at the midpoint came in 1.1% above analysts’ estimates. Its non-GAAP profit of $0.04 per share was $0.03 above analysts’ consensus estimates.

Is now the time to buy Stratasys? Find out by accessing our full research report, it’s free.

Stratasys (SSYS) Q1 CY2025 Highlights:

- Revenue: $136 million vs analyst estimates of $134.6 million (5.6% year-on-year decline, 1.1% beat)

- Adjusted EPS: $0.04 vs analyst estimates of $0.02 ($0.03 beat)

- Adjusted EBITDA: $8.17 million vs analyst estimates of $6.79 million (6% margin, 20.3% beat)

- The company reconfirmed its revenue guidance for the full year of $577.5 million at the midpoint

- Management raised its full-year Adjusted EPS guidance to $0.33 at the midpoint, a 6.3% increase

- EBITDA guidance for the full year is $47 million at the midpoint, above analyst estimates of $44.64 million

- Operating Margin: -9.1%, up from -17% in the same quarter last year

- Market Capitalization: $811 million

Dr. Yoav Zeif, Stratasys’ Chief Executive Officer, stated, “We delivered another quarter of net profitability on an adjusted basis and positive cash from operating activities. It's particularly encouraging to see 7% sequential growth in our recurring revenue Consumables, demonstrating continued solid utilization of existing systems by our customers. Our ongoing strategic efforts to streamline the business are proving successful, and we are positioned to deliver improved profitability, while maintaining our ability to scale when capital spending recovers.”

Company Overview

Born from the Founder’s idea of making a toy frog with a glue gun, Stratasys (NASDAQ: SSYS) offers 3D printers and related materials, software, and services to many industries.

Sales Growth

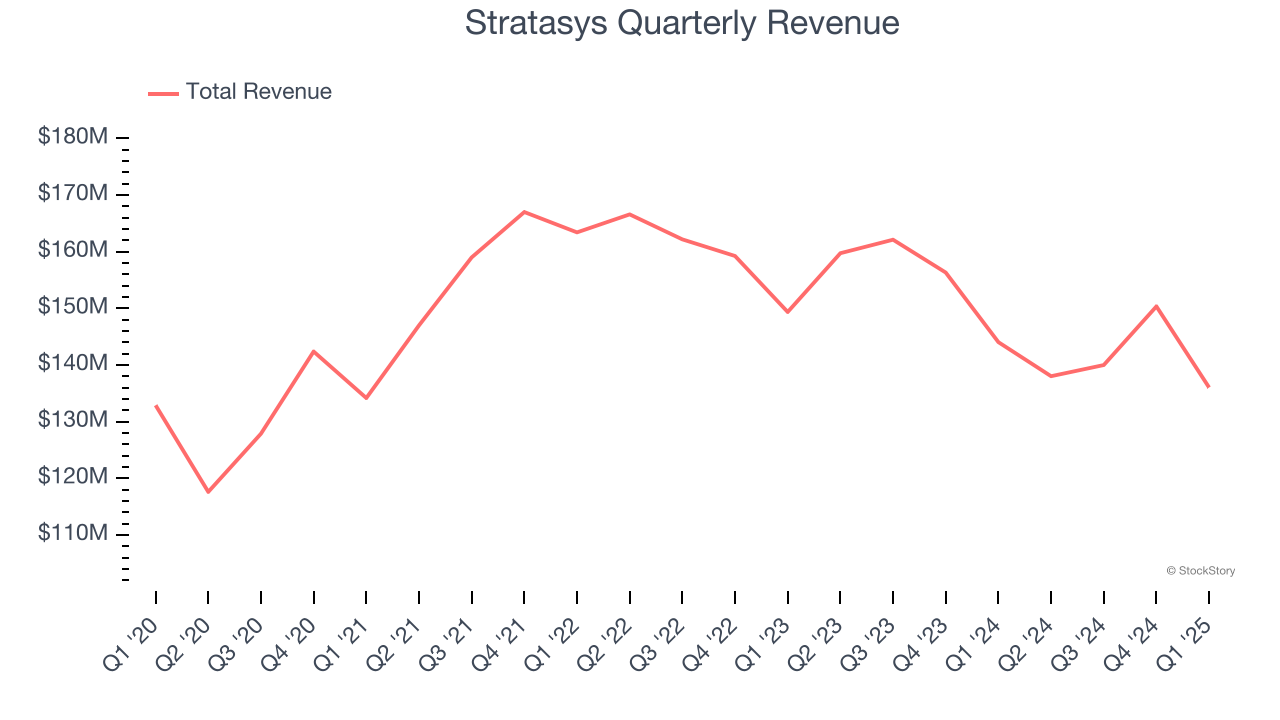

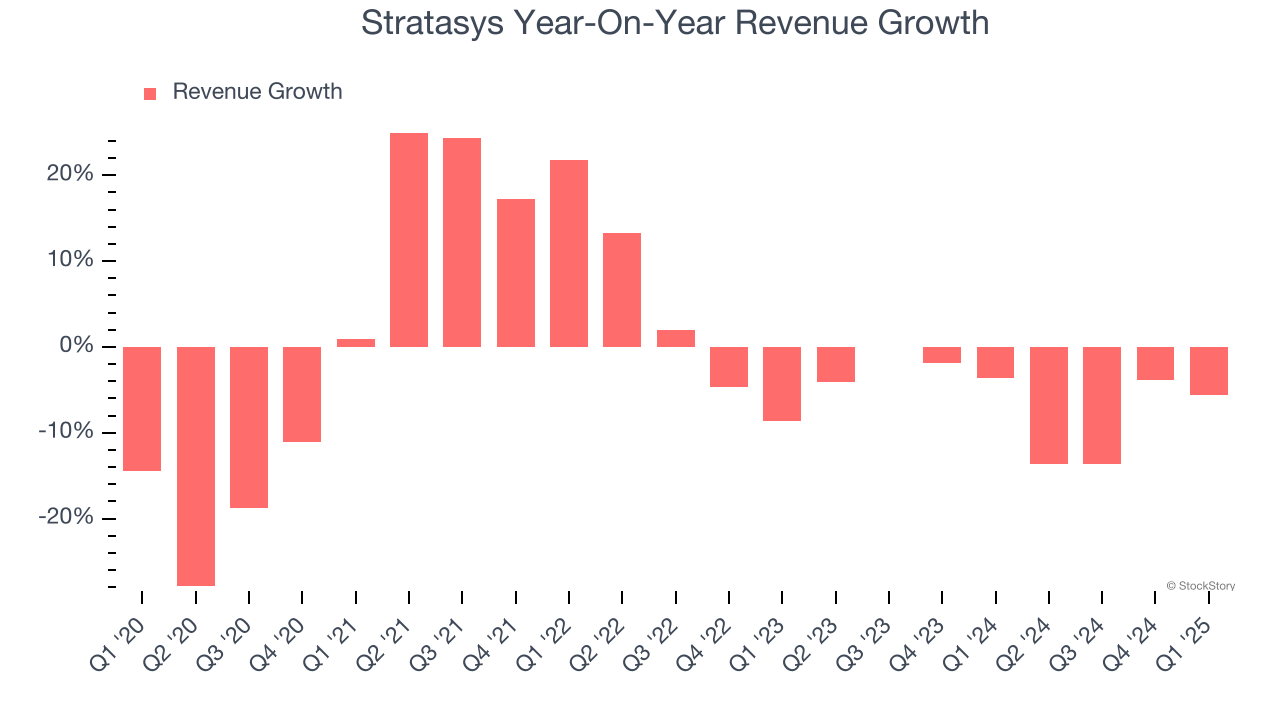

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Stratasys struggled to consistently generate demand over the last five years as its sales dropped at a 1.7% annual rate. This wasn’t a great result and is a sign of poor business quality.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Stratasys’s recent performance shows its demand remained suppressed as its revenue has declined by 5.9% annually over the last two years.

This quarter, Stratasys’s revenue fell by 5.6% year on year to $136 million but beat Wall Street’s estimates by 1.1%.

Looking ahead, sell-side analysts expect revenue to grow 2% over the next 12 months. While this projection suggests its newer products and services will fuel better top-line performance, it is still below average for the sector.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

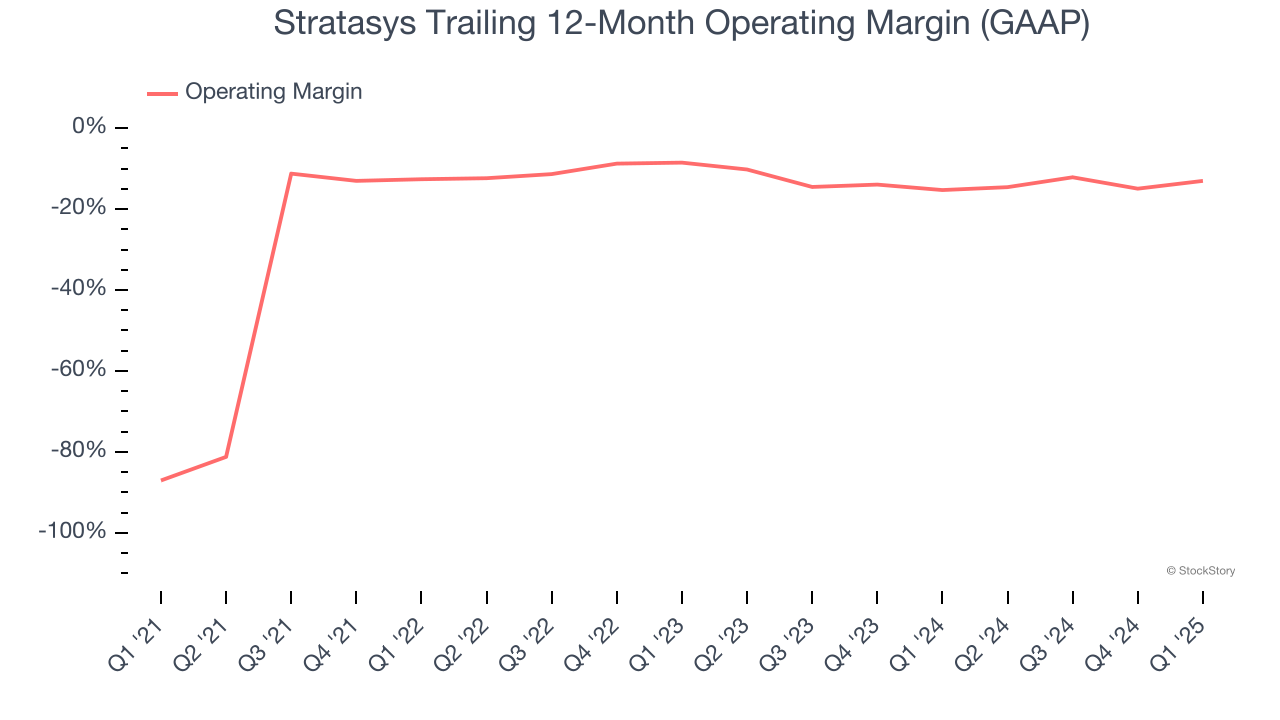

Stratasys’s high expenses have contributed to an average operating margin of negative 25.4% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Stratasys’s operating margin rose by 74 percentage points over the last five years. Still, it will take much more for the company to reach long-term profitability.

In Q1, Stratasys generated a negative 9.1% operating margin. The company's consistent lack of profits raise a flag.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

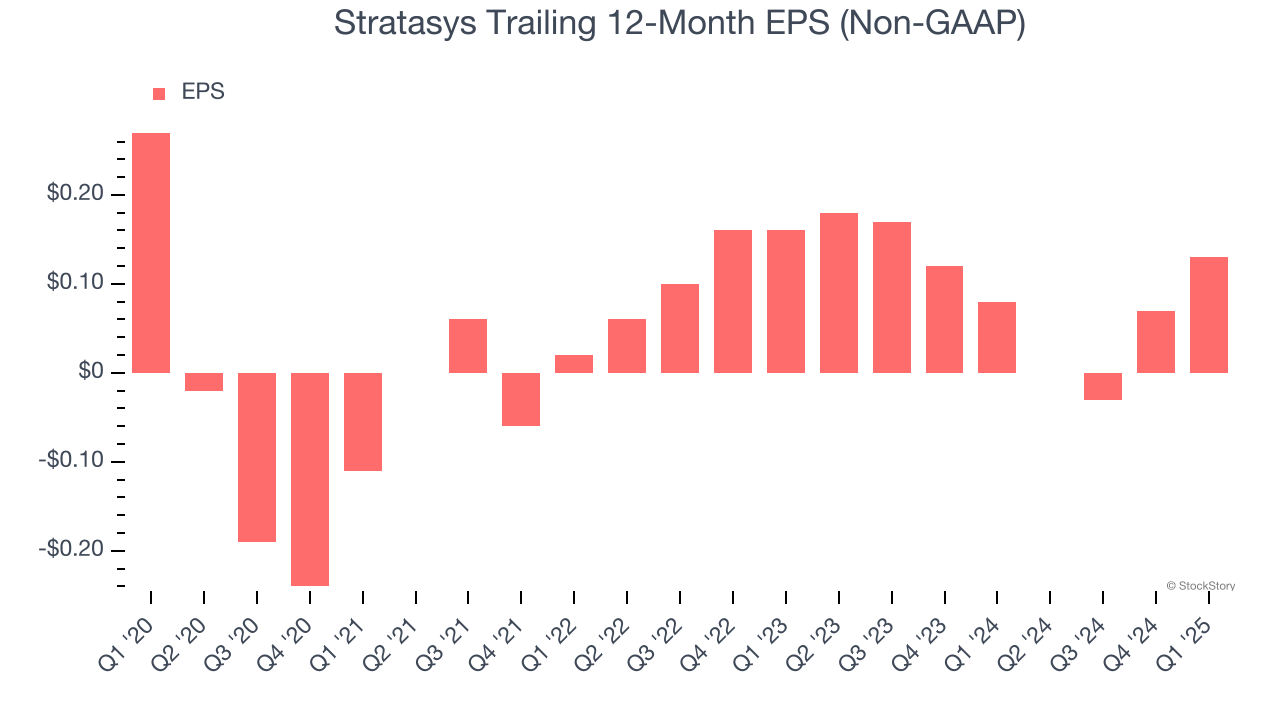

Sadly for Stratasys, its EPS declined by 13.6% annually over the last five years, more than its revenue. However, its operating margin actually expanded during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

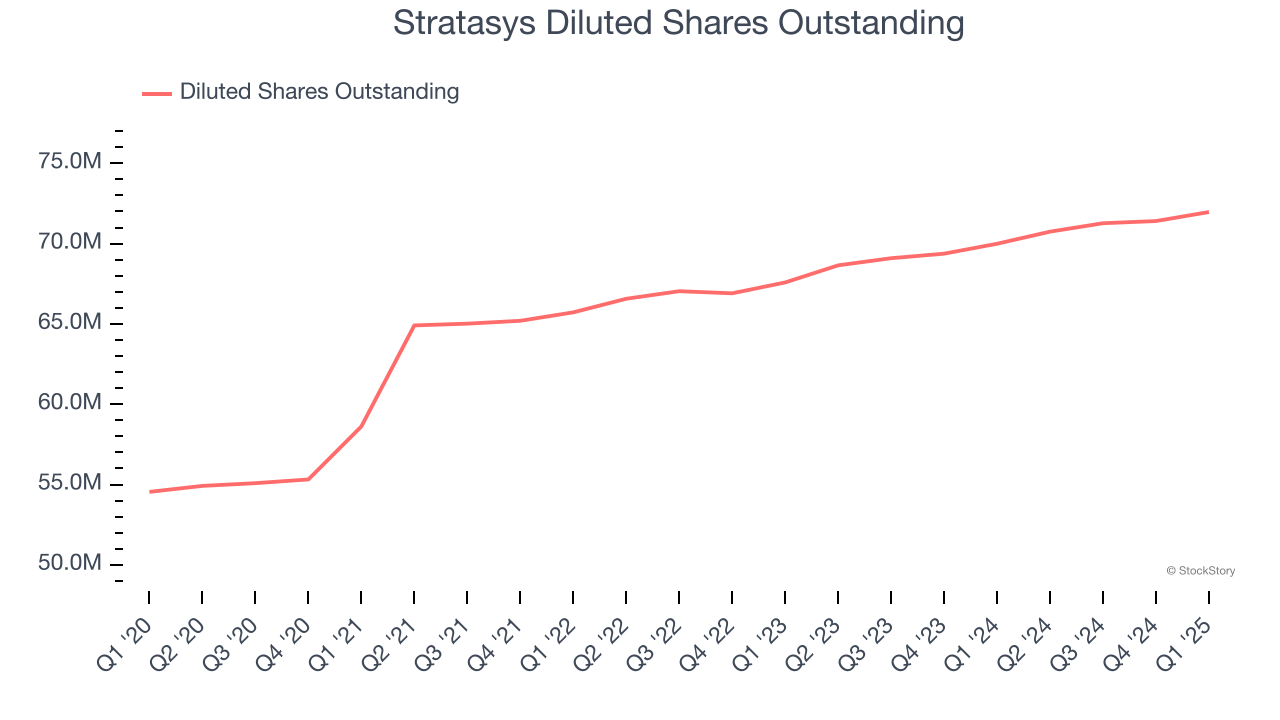

We can take a deeper look into Stratasys’s earnings to better understand the drivers of its performance. A five-year view shows Stratasys has diluted its shareholders, growing its share count by 31.9%. This dilution overshadowed its increased operating efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Stratasys, its two-year annual EPS declines of 9.9% show it’s still underperforming. These results were bad no matter how you slice the data.

In Q1, Stratasys reported EPS at $0.04, up from negative $0.02 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Stratasys to perform poorly. Analysts forecast its full-year EPS of $0.13 will hit $0.32.

Key Takeaways from Stratasys’s Q1 Results

We were impressed by how significantly Stratasys blew past analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid print. The stock traded up 5.2% to $10.23 immediately following the results.

Sure, Stratasys had a solid quarter, but if we look at the bigger picture, is this stock a buy? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.