Human capital management provider Alight (NYSE: ALIT) beat Wall Street’s revenue expectations in Q1 CY2025, but sales fell by 2% year on year to $548 million. The company expects the full year’s revenue to be around $2.35 billion, close to analysts’ estimates. Its non-GAAP profit of $0.10 per share was in line with analysts’ consensus estimates.

Is now the time to buy Alight? Find out by accessing our full research report, it’s free.

Alight (ALIT) Q1 CY2025 Highlights:

- Revenue: $548 million vs analyst estimates of $541.4 million (2% year-on-year decline, 1.2% beat)

- Adjusted EPS: $0.10 vs analyst estimates of $0.10 (in line)

- Adjusted EBITDA: $118 million vs analyst estimates of $115.4 million (21.5% margin, 2.3% beat)

- The company reconfirmed its revenue guidance for the full year of $2.35 billion at the midpoint

- Adjusted EPS guidance for Q2 CY2025 is $0.61 at the midpoint, above analyst estimates of $0.11

- EBITDA guidance for the full year is $632.5 million at the midpoint, above analyst estimates of $627.2 million

- Operating Margin: -1.5%, up from -7.2% in the same quarter last year

- Free Cash Flow Margin: 8%, down from 11.4% in the same quarter last year

- Market Capitalization: $2.78 billion

“Our first quarter performance met expectations and we are off to a strong start to the year,” said CEO Dave Guilmette.

Company Overview

Born from a corporate spinoff in 2017 to focus on employee experience technology, Alight (NYSE: ALIT) provides human capital management solutions that help companies administer employee benefits, payroll, and workforce management systems.

Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

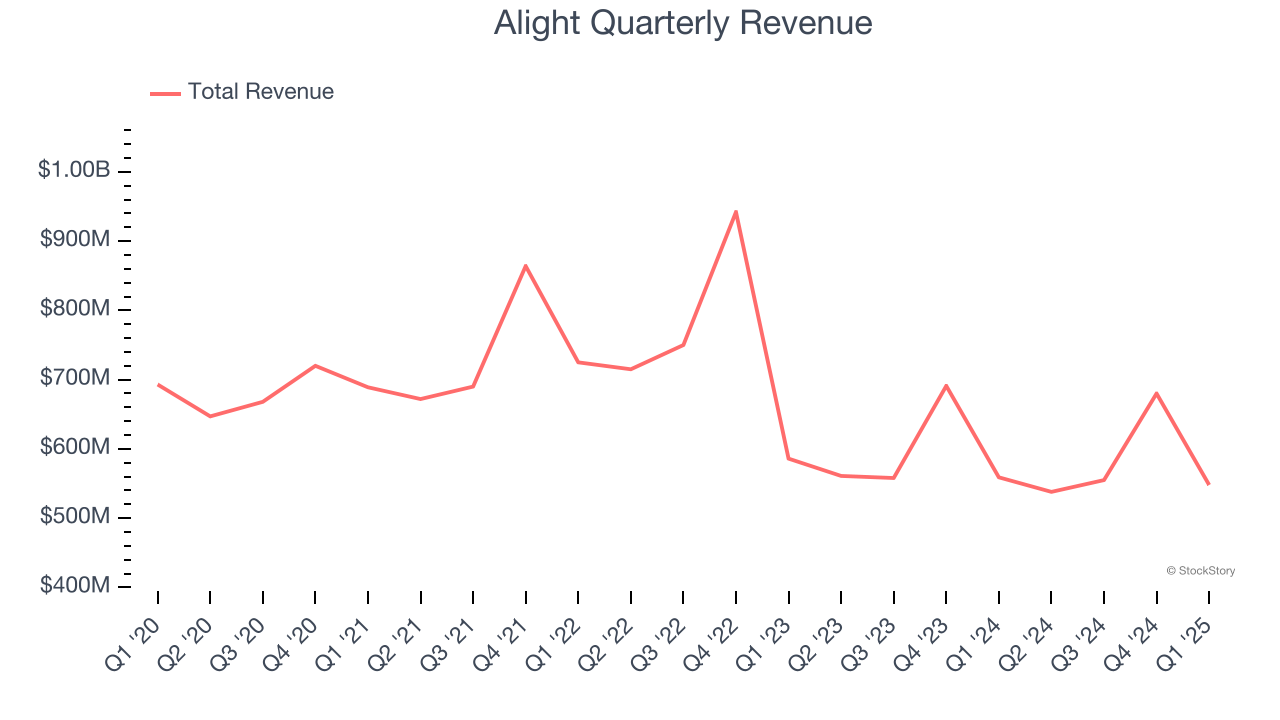

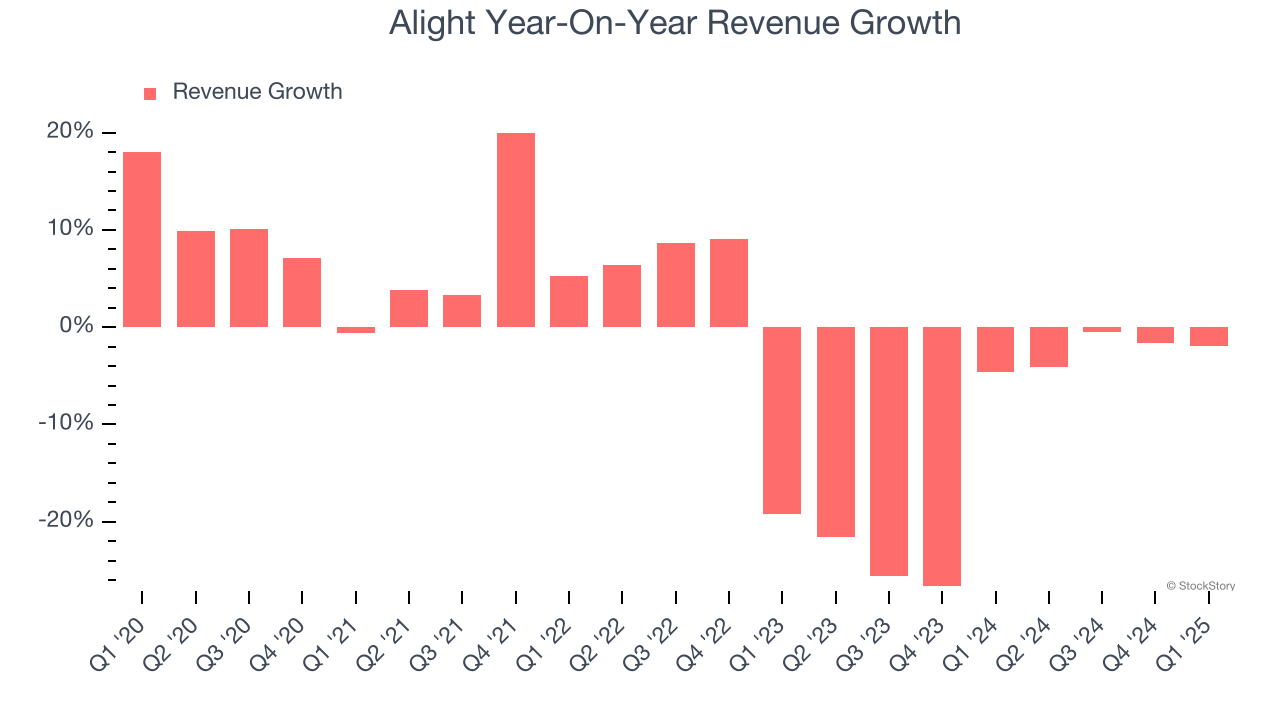

With $2.32 billion in revenue over the past 12 months, Alight is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

As you can see below, Alight’s revenue declined by 1.9% per year over the last five years, a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Alight’s recent performance shows its demand remained suppressed as its revenue has declined by 11.9% annually over the last two years.

This quarter, Alight’s revenue fell by 2% year on year to $548 million but beat Wall Street’s estimates by 1.2%.

Looking ahead, sell-side analysts expect revenue to grow 2.1% over the next 12 months. Although this projection implies its newer products and services will fuel better top-line performance, it is still below the sector average.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

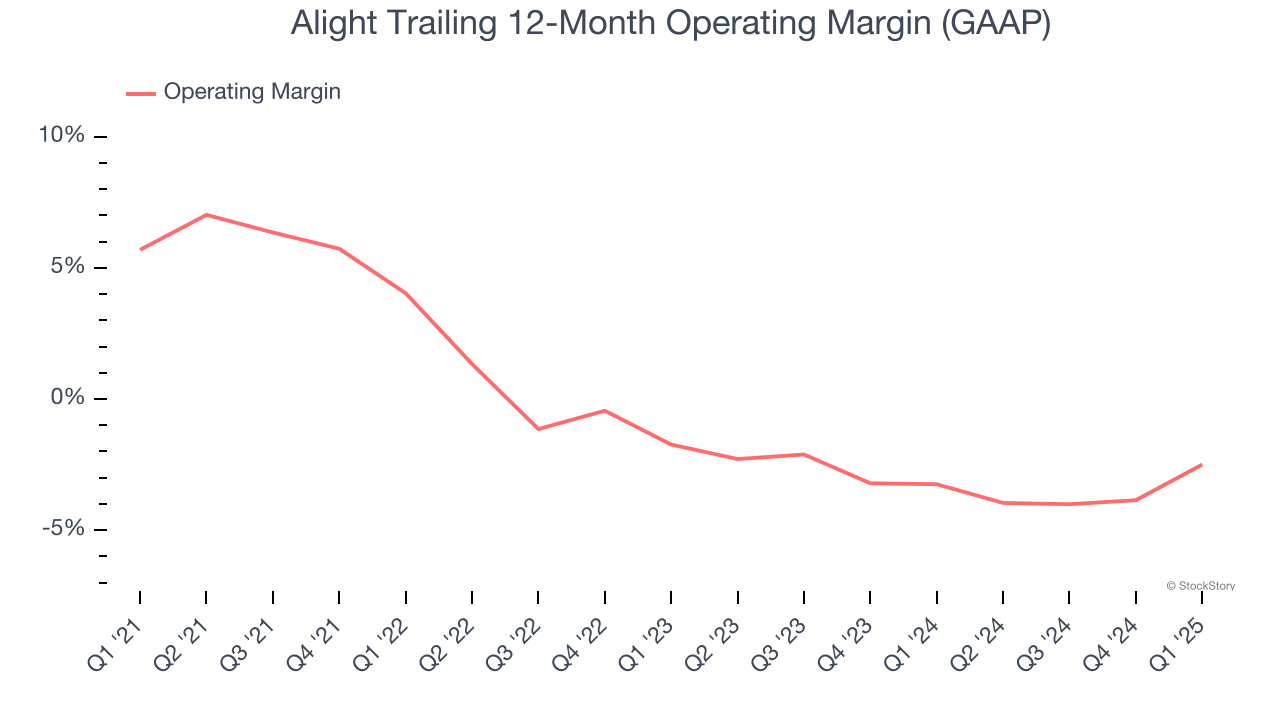

Alight was roughly breakeven when averaging the last five years of quarterly operating profits, inadequate for a business services business.

Looking at the trend in its profitability, Alight’s operating margin decreased by 8.2 percentage points over the last five years. Alight’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, Alight generated an operating profit margin of negative 1.5%, up 5.7 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Alight’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q1, Alight reported EPS at $0.10, down from $0.14 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Alight’s full-year EPS of $0.53 to grow 18.9%.

Key Takeaways from Alight’s Q1 Results

We were impressed by how significantly Alight blew past analysts’ EPS guidance for next quarter expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. Overall, we think this was still a solid quarter with some key areas of upside. The stock traded up 4.7% to $5.48 immediately following the results.

Indeed, Alight had a rock-solid quarterly earnings result, but is this stock a good investment here? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.