Energy drink company Celsius (NASDAQ: CELH) fell short of the market’s revenue expectations in Q1 CY2025, with sales falling 7.4% year on year to $329.3 million. Its non-GAAP profit of $0.18 per share was 5.9% below analysts’ consensus estimates.

Is now the time to buy Celsius? Find out by accessing our full research report, it’s free.

Celsius (CELH) Q1 CY2025 Highlights:

- Revenue: $329.3 million vs analyst estimates of $342.3 million (7.4% year-on-year decline, 3.8% miss)

- Adjusted EPS: $0.18 vs analyst expectations of $0.19 (5.9% miss)

- Adjusted EBITDA: $69.69 million vs analyst estimates of $72.12 million (21.2% margin, 3.4% miss)

- Operating Margin: 15.8%, down from 23.4% in the same quarter last year

- Market Capitalization: $8.73 billion

John Fieldly, Chairman and CEO of Celsius Holdings, said: “Celsius navigated a dynamic operating environment in the first quarter while continuing to invest in our core brand, product innovation and operational scale. We saw business fundamentals strengthen through the quarter and are encouraged by the positive momentum heading into Q2. With the Alani Nu acquisition now closed, continued gains in retail shelf space, and strong international growth across both legacy and new markets, we are confident in our growth strategy, and we believe that we are well-positioned as a leader in modern energy.”

Company Overview

With its proprietary MetaPlus formula as the basis for key products, Celsius (NASDAQ: CELH) offers energy drinks that feature natural ingredients to help in fitness and weight management.

Sales Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $1.33 billion in revenue over the past 12 months, Celsius is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers. On the bright side, it can grow faster because it has a longer list of untapped store chains to sell into.

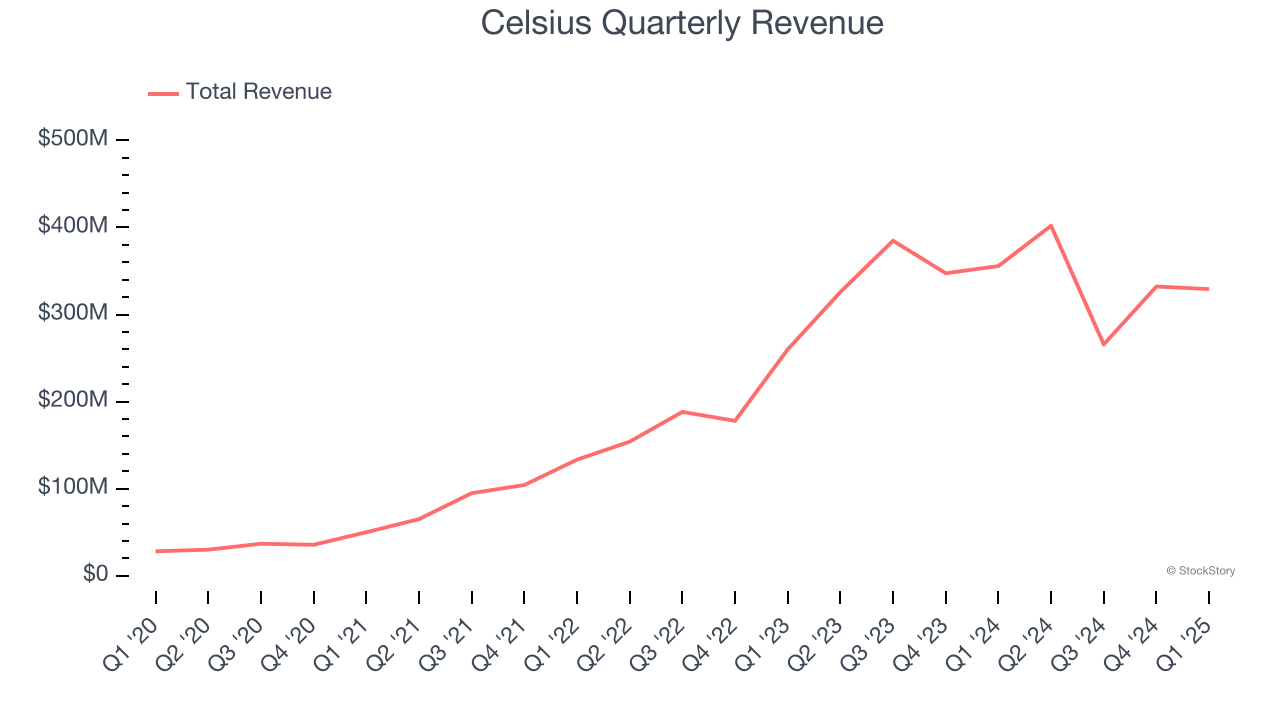

As you can see below, Celsius grew its sales at an incredible 49.5% compounded annual growth rate over the last three years. This is an encouraging starting point for our analysis because it shows Celsius’s demand was higher than many consumer staples companies.

This quarter, Celsius missed Wall Street’s estimates and reported a rather uninspiring 7.4% year-on-year revenue decline, generating $329.3 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 77.2% over the next 12 months, an acceleration versus the last three years. This projection is eye-popping and suggests its newer products will catalyze better top-line performance.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

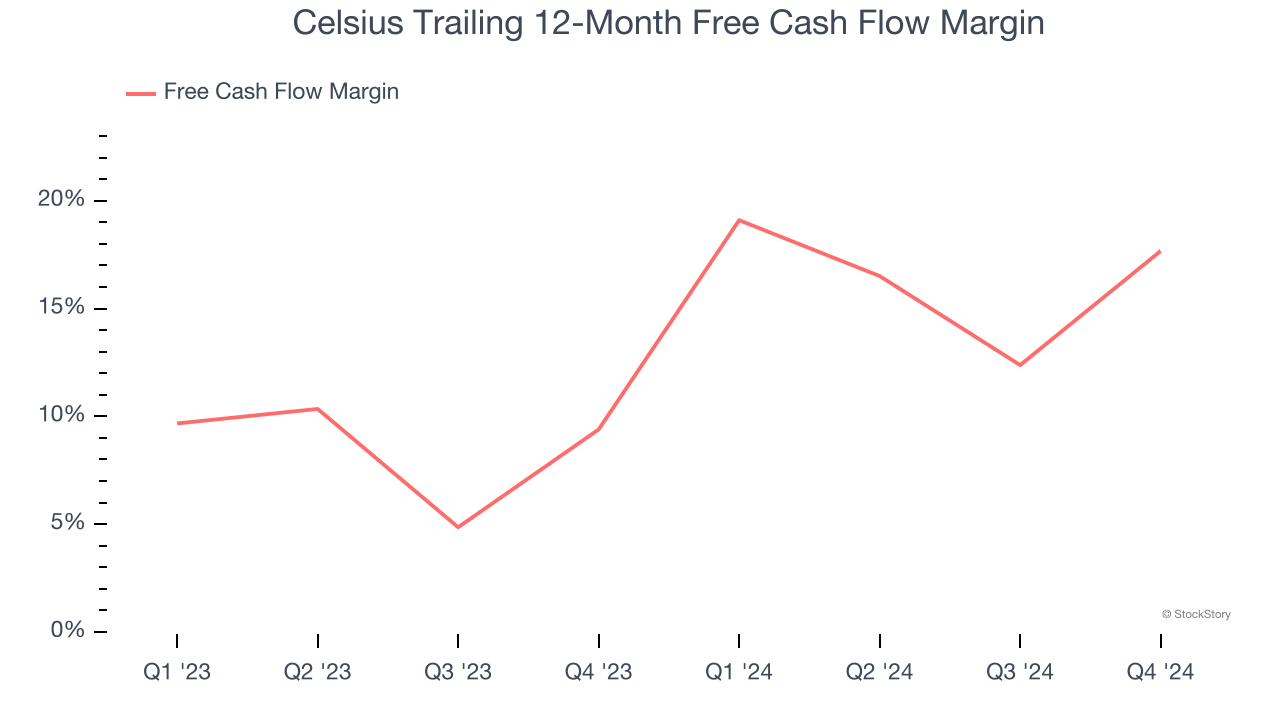

Celsius has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the consumer staples sector, averaging 15.7% over the last two years.

Key Takeaways from Celsius’s Q1 Results

We enjoyed seeing Celsius beat analysts’ gross margin expectations this quarter. On the other hand, its revenue missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 8.1% to $31.20 immediately following the results.

Celsius underperformed this quarter, but does that create an opportunity to invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.