SentinelOne has gotten torched over the last six months - since November 2024, its stock price has dropped 30.6% to $18.96 per share. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Given the weaker price action, is now a good time to buy S? Find out in our full research report, it’s free.

Why Does S Stock Spark Debate?

With roots in the Israeli cyber intelligence community, SentinelOne (NYSE: S) provides software to help organizations efficiently detect, prevent, and investigate cyber attacks.

Two Positive Attributes:

1. ARR Surges as Recurring Revenue Flows In

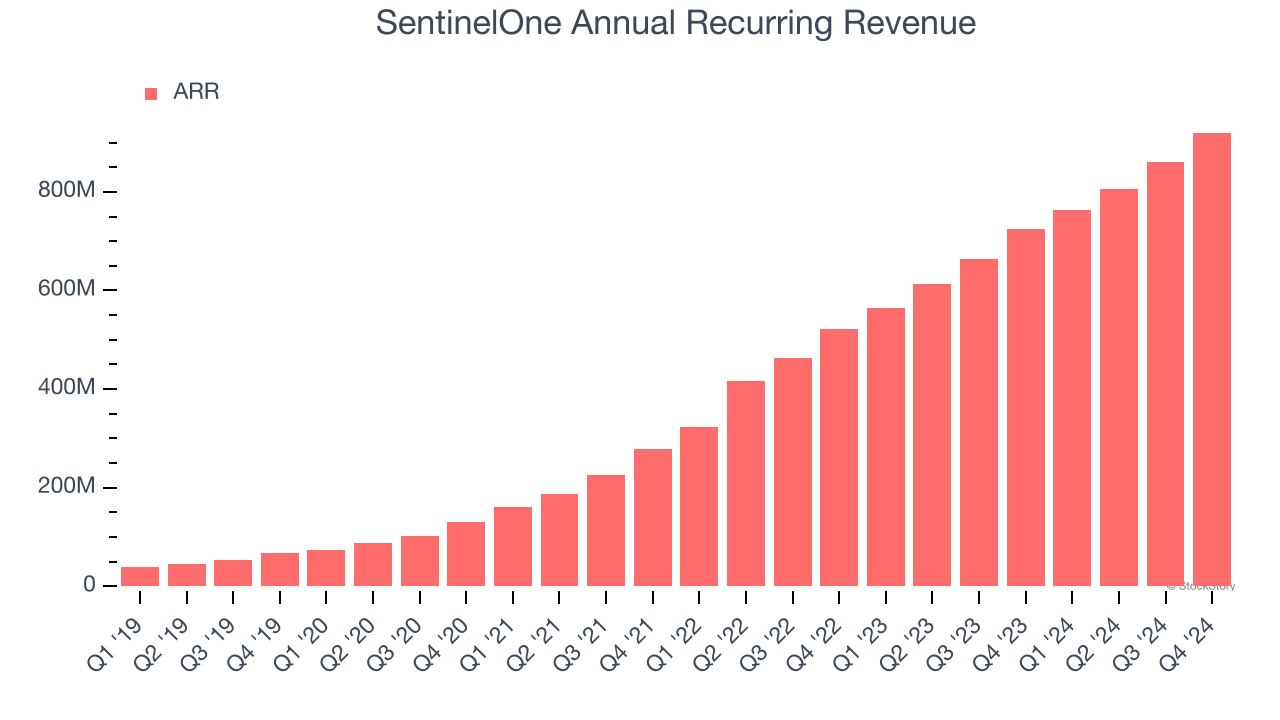

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

SentinelOne’s ARR punched in at $920.1 million in Q4, and over the last four quarters, its year-on-year growth averaged 30.9%. This performance was fantastic and shows that customers are willing to take multi-year bets on the company’s technology. Its growth also makes SentinelOne a more predictable business, a tailwind for its valuation as investors typically prefer businesses with recurring revenue.

2. Projected Revenue Growth Is Remarkable

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses become larger.

Over the next 12 months, sell-side analysts expect SentinelOne’s revenue to rise by 22.9%. While this projection is below its 58.9% annualized growth rate for the past three years, it is admirable and implies the market is baking in success for its products and services.

One Reason to be Careful:

Operating Losses Sound the Alarms

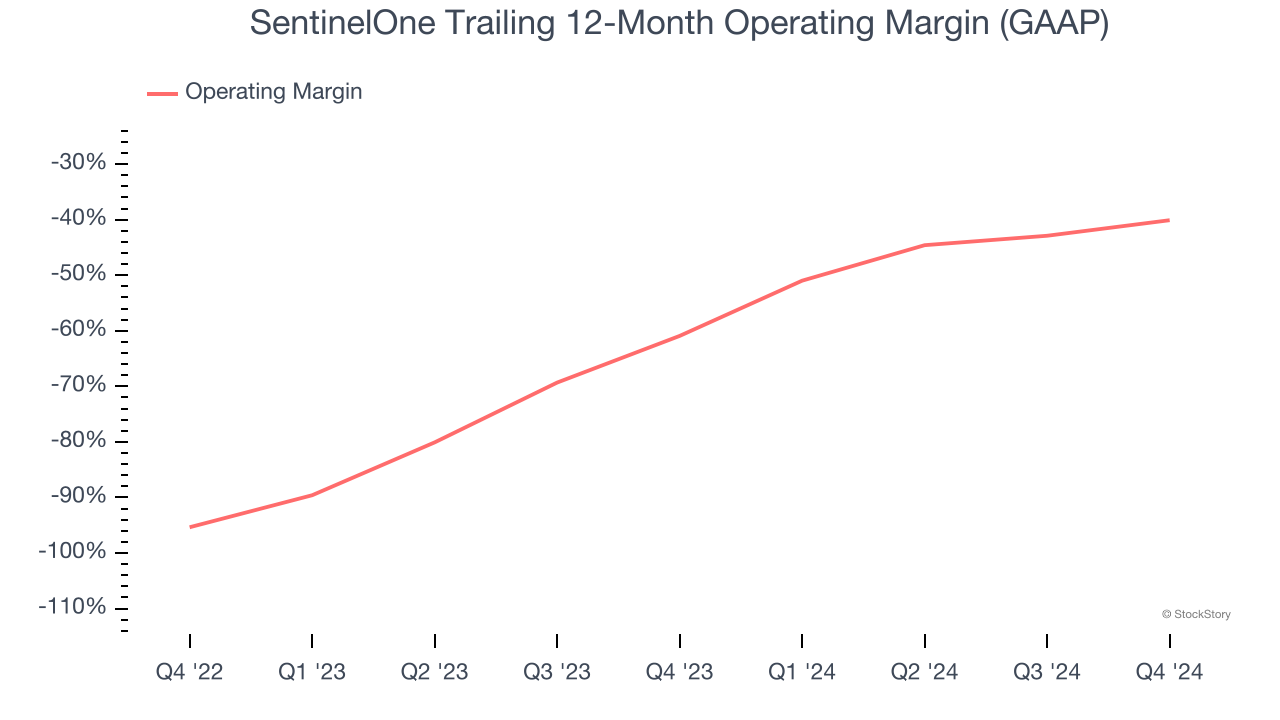

While many software businesses point investors to their adjusted profits, which exclude stock-based compensation (SBC), we prefer GAAP operating margin because SBC is a legitimate expense used to attract and retain talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

SentinelOne’s expensive cost structure has contributed to an average operating margin of negative 40.1% over the last year. This happened because the company spent loads of money to capture market share. As seen in its fast revenue growth, the aggressive strategy has paid off so far, and Wall Street’s estimates suggest the party will continue. We tend to agree and believe the business has a good chance of reaching profitability upon scale.

Final Judgment

SentinelOne has huge potential even though it has some open questions. After the recent drawdown, the stock trades at 6× forward price-to-sales (or $18.96 per share). Is now a good time to buy? See for yourself in our in-depth research report, it’s free.

Stocks That Overcame Trump’s 2018 Tariffs

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today.