Meat company Tyson Foods (NYSE: TSN) missed Wall Street’s revenue expectations in Q1 CY2025, with sales flat year on year at $13.07 billion. Its non-GAAP profit of $0.92 per share was 12.2% above analysts’ consensus estimates.

Is now the time to buy Tyson Foods? Find out by accessing our full research report, it’s free.

Tyson Foods (TSN) Q1 CY2025 Highlights:

- Revenue: $13.07 billion vs analyst estimates of $13.16 billion (flat year on year, 0.7% miss)

- Adjusted EPS: $0.92 vs analyst estimates of $0.82 (12.2% beat)

- Adjusted EBITDA: $866 million vs analyst estimates of $813.4 million (6.6% margin, 6.5% beat)

- Operating Margin: 0.8%, down from 2.4% in the same quarter last year

- Free Cash Flow was -$378 million compared to -$390 million in the same quarter last year

- Market Capitalization: $21.65 billion

"We delivered another solid quarter with growth in both sales and adjusted operating income, driven by strong execution across the business. Our consistent focus on operational excellence, winning with customer and consumers, leveraging data and digital, and enhancing our financial strength has resulted in four consecutive quarters of year-over-year improvements in our top and adjusted bottom lines," stated Donnie King, President & CEO of Tyson Foods.

Company Overview

Started as a simple trucking business, Tyson Foods (NYSE: TSN) is one of the world’s largest producers of chicken, beef, and pork.

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $53.62 billion in revenue over the past 12 months, Tyson Foods is one of the most widely recognized consumer staples companies. Its influence over consumers gives it negotiating leverage with distributors, enabling it to pick and choose where it sells its products (a luxury many don’t have). However, its scale is a double-edged sword because there are only so many big store chains to sell into, making it harder to find incremental growth. To accelerate sales, Tyson Foods likely needs to optimize its pricing or lean into new products and international expansion.

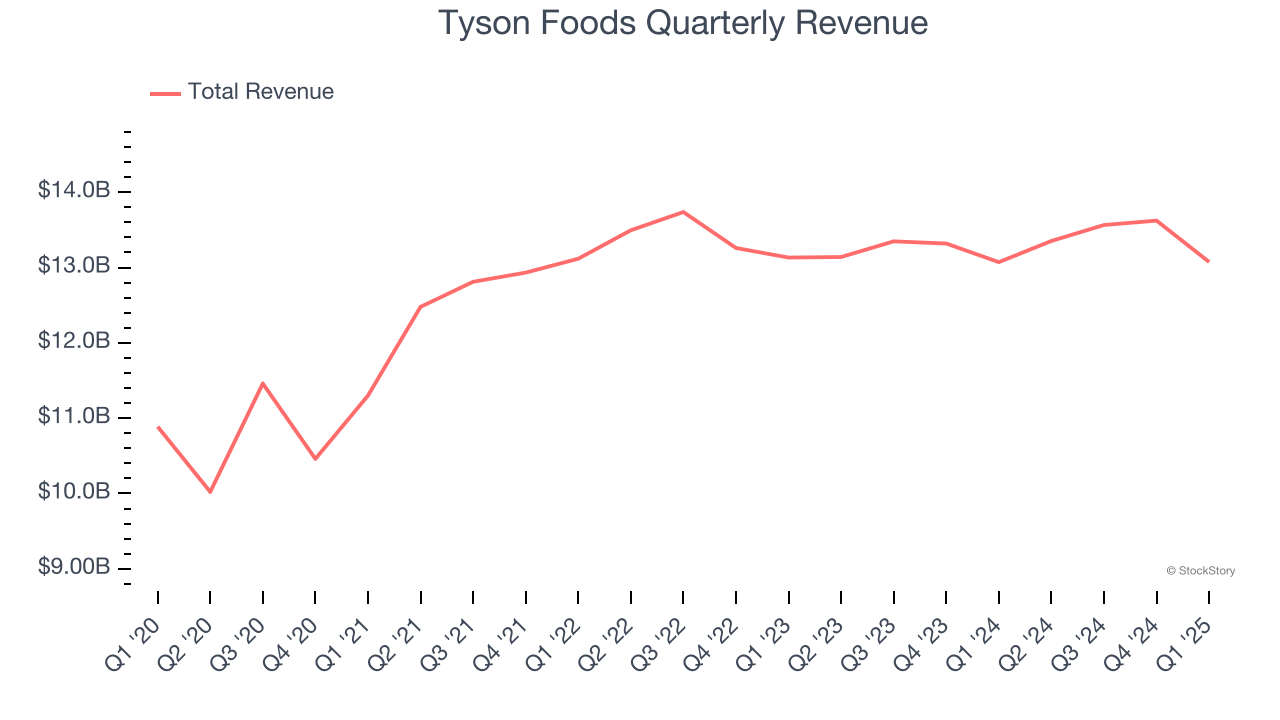

As you can see below, Tyson Foods’s sales grew at a sluggish 1.5% compounded annual growth rate over the last three years, but to its credit, consumers bought more of its products.

This quarter, Tyson Foods’s $13.07 billion of revenue was flat year on year, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. This projection doesn't excite us and suggests its newer products will not lead to better top-line performance yet.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Tyson Foods has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.9%, subpar for a consumer staples business.

Taking a step back, an encouraging sign is that Tyson Foods’s margin expanded by 1.1 percentage points over the last year. We have no doubt shareholders would like to continue seeing its cash conversion rise as it gives the company more optionality.

Tyson Foods burned through $378 million of cash in Q1, equivalent to a negative 2.9% margin. The company’s cash burn was similar to its $390 million of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, indicating it is a seasonal business that must build up inventory during certain quarters.

Key Takeaways from Tyson Foods’s Q1 Results

We enjoyed seeing Tyson Foods beat analysts’ EBITDA expectations this quarter. We were also happy its EPS outperformed Wall Street’s estimates. On the other hand, its revenue and gross margin missed. Overall, this print was mixed but still had some key positives. The market seemed to be hoping for more, and the stock traded down 2.3% to $59.41 immediately after reporting.

Should you buy the stock or not? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.