Theme park operator United Parks & Resorts (NYSE: PRKS) fell short of the market’s revenue expectations in Q1 CY2025, with sales falling 3.5% year on year to $286.9 million. Its GAAP loss of $0.29 per share was 26.7% below analysts’ consensus estimates.

Is now the time to buy United Parks & Resorts? Find out by accessing our full research report, it’s free.

United Parks & Resorts (PRKS) Q1 CY2025 Highlights:

- Revenue: $286.9 million vs analyst estimates of $294.1 million (3.5% year-on-year decline, 2.4% miss)

- EPS (GAAP): -$0.29 vs analyst expectations of -$0.23 (26.7% miss)

- Adjusted EBITDA: $67.4 million vs analyst estimates of $72.26 million (23.5% margin, 6.7% miss)

- Operating Margin: 5.9%, down from 7.4% in the same quarter last year

- Free Cash Flow was -$31.19 million compared to -$15.84 million in the same quarter last year

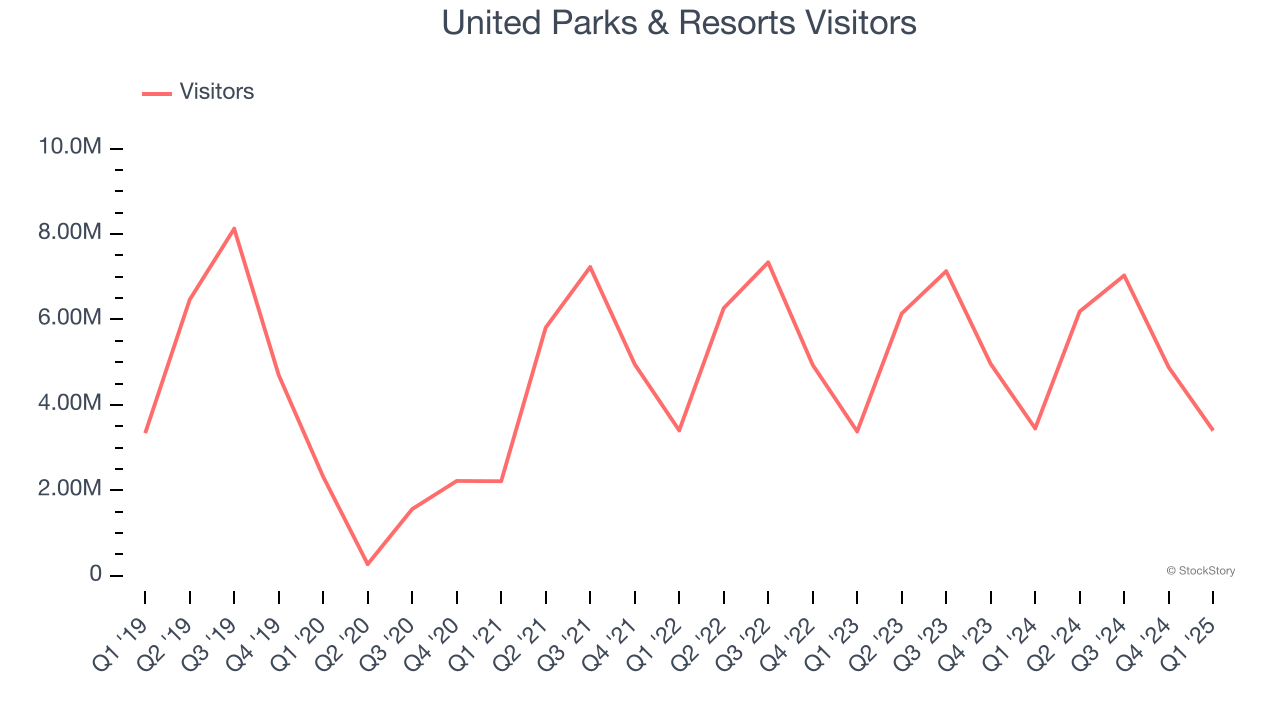

- Visitors: 3.4 million, down 50,000 year on year

- Market Capitalization: $2.59 billion

"We are pleased to report another quarter of strong financial results," said Marc Swanson, Chief Executive Officer of United Parks &

Company Overview

Parent company of SeaWorld and home of the world-famous Shamu, United Parks & Resorts (NYSE: PRKS) is a theme park chain featuring marine life, live entertainment, roller coasters, and waterparks.

Sales Growth

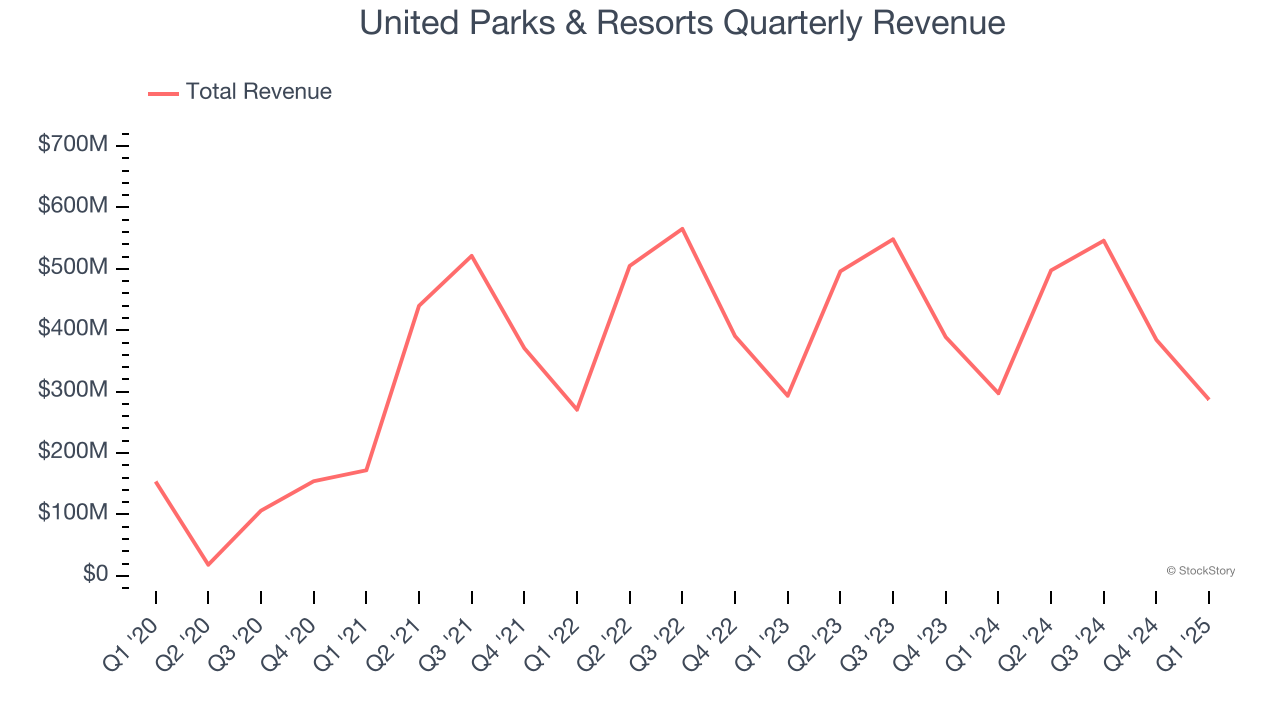

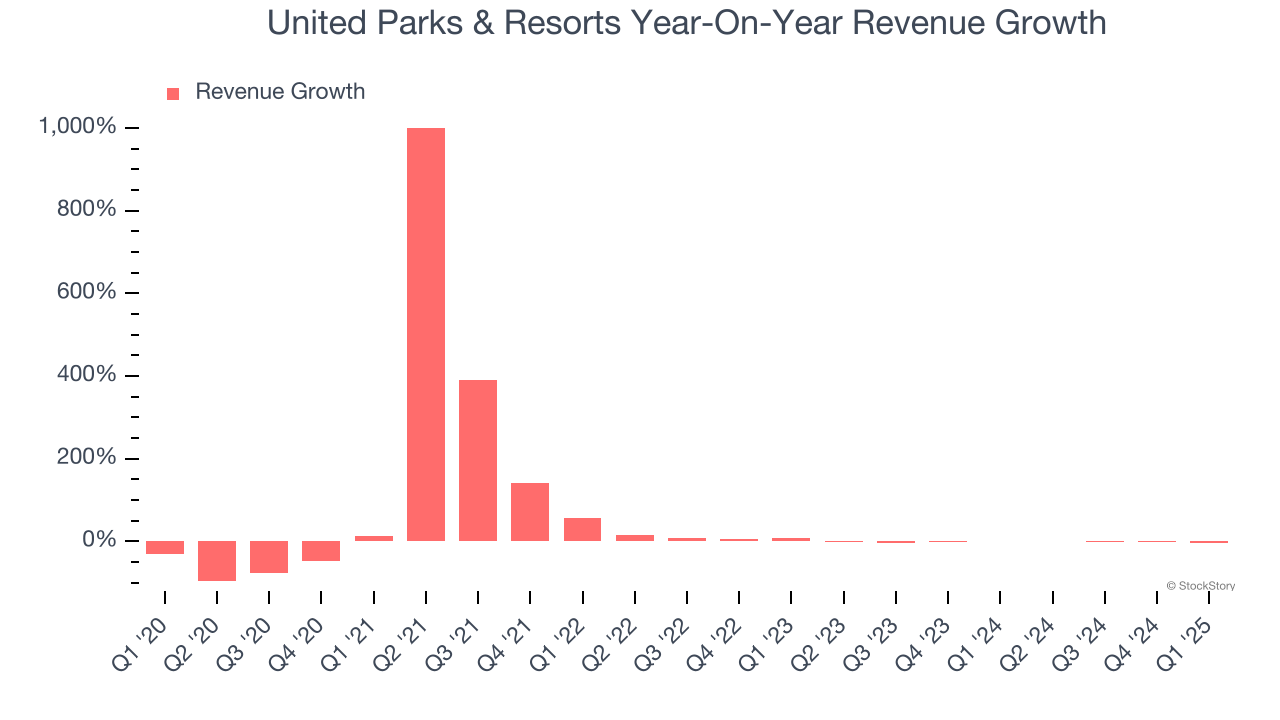

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, United Parks & Resorts’s sales grew at a sluggish 5.2% compounded annual growth rate over the last five years. This wasn’t a great result compared to the rest of the consumer discretionary sector, but there are still things to like about United Parks & Resorts.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. United Parks & Resorts’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 1.1% annually. Note that COVID hurt United Parks & Resorts’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

United Parks & Resorts also discloses its number of visitors, which reached 3.4 million in the latest quarter. Over the last two years, United Parks & Resorts’s visitors were flat. Because this number aligns with its revenue growth during the same period, we can see the company’s monetization was fairly consistent.

This quarter, United Parks & Resorts missed Wall Street’s estimates and reported a rather uninspiring 3.5% year-on-year revenue decline, generating $286.9 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 2.3% over the next 12 months. Although this projection indicates its newer products and services will fuel better top-line performance, it is still below average for the sector. At least the company is tracking well in other measures of financial health.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

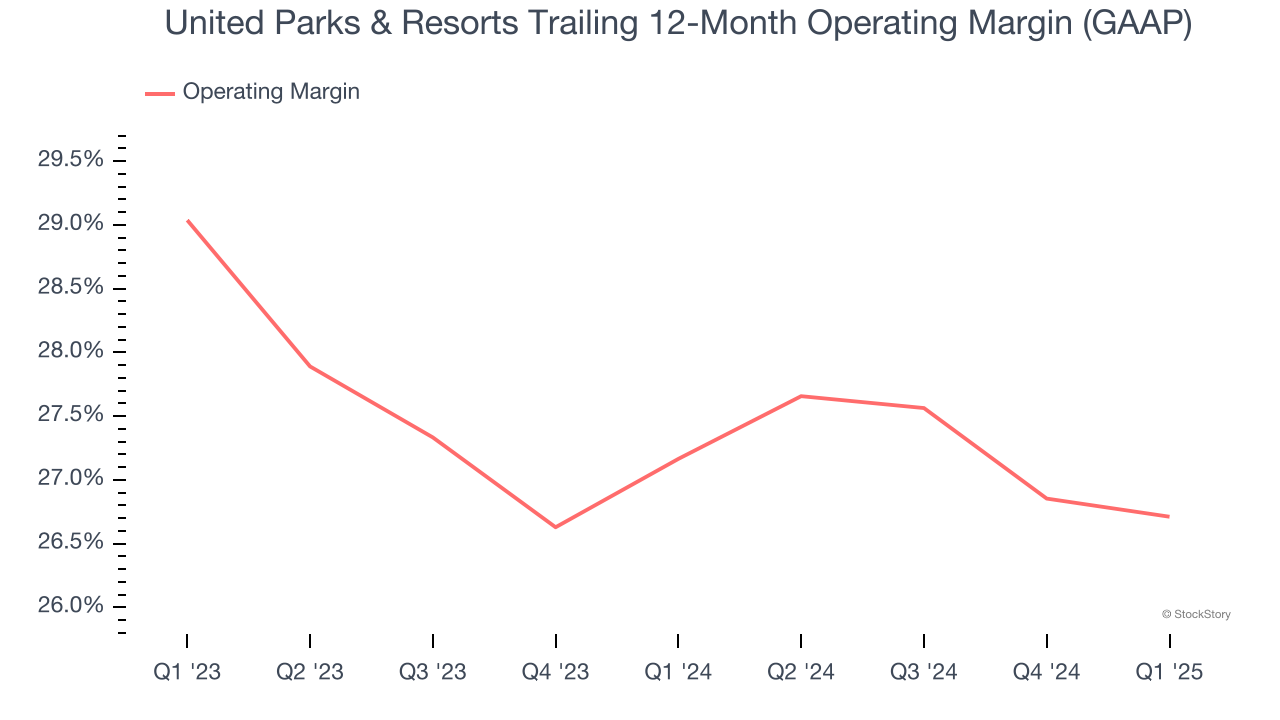

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

United Parks & Resorts’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 26.9% over the last two years. This profitability was elite for a consumer discretionary business thanks to its efficient cost structure and economies of scale.

In Q1, United Parks & Resorts generated an operating profit margin of 5.9%, down 1.6 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

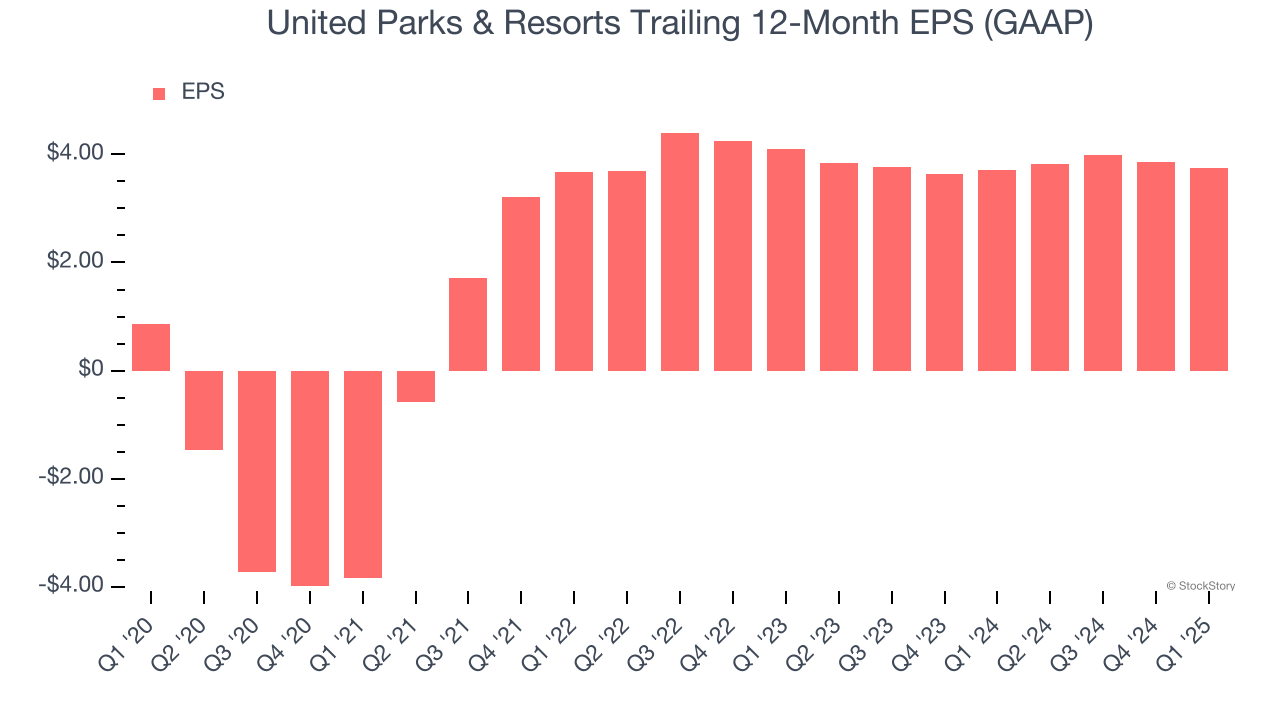

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

United Parks & Resorts’s EPS grew at an astounding 34.5% compounded annual growth rate over the last five years, higher than its 5.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q1, United Parks & Resorts reported EPS at negative $0.29, down from negative $0.17 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects United Parks & Resorts’s full-year EPS of $3.75 to grow 20.4%.

Key Takeaways from United Parks & Resorts’s Q1 Results

We struggled to find many positives in these results. Its EPS missed significantly and its revenue fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded up 1.1% to $47.69 immediately following the results.

Is United Parks & Resorts an attractive investment opportunity right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.