Food and beverage supplier MGP Ingredients (NASDAQ: MGPI) beat Wall Street’s revenue expectations in Q1 CY2025, but sales fell by 28.7% year on year to $121.7 million. The company expects the full year’s revenue to be around $530 million, close to analysts’ estimates. Its non-GAAP profit of $0.36 per share was 3.7% below analysts’ consensus estimates.

Is now the time to buy MGP Ingredients? Find out by accessing our full research report, it’s free.

MGP Ingredients (MGPI) Q1 CY2025 Highlights:

- Revenue: $121.7 million vs analyst estimates of $117.5 million (28.7% year-on-year decline, 3.5% beat)

- Adjusted EPS: $0.36 vs analyst expectations of $0.37 (3.7% miss)

- Adjusted EBITDA: $21.76 million vs analyst estimates of $19.54 million (17.9% margin, 11.3% beat)

- The company reconfirmed its revenue guidance for the full year of $530 million at the midpoint

- Management reiterated its full-year Adjusted EPS guidance of $2.60 at the midpoint

- EBITDA guidance for the full year is $110 million at the midpoint, above analyst estimates of $107.9 million

- Operating Margin: -0.6%, down from 17% in the same quarter last year

- Free Cash Flow was $24.76 million, up from -$2.4 million in the same quarter last year

- Market Capitalization: $626.8 million

“We are pleased with first quarter results that keep us on track to meet our full-year guidance. While elevated industry-wide barrel whiskey inventories and a cautious consumer environment remain as headwinds, we saw signs of positive progress across all three of our business segments. These early signs of stabilization give us confidence that the proactive actions we are taking are beginning to take hold,” said Brandon Gall, Interim President and CEO, and CFO.

Company Overview

Headquartered in Atchison, Kansas, MGP Ingredients (NASDAQ: MGPI) is a leading supplier of high-quality ingredients to the food and beverage industry

Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $654.7 million in revenue over the past 12 months, MGP Ingredients is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

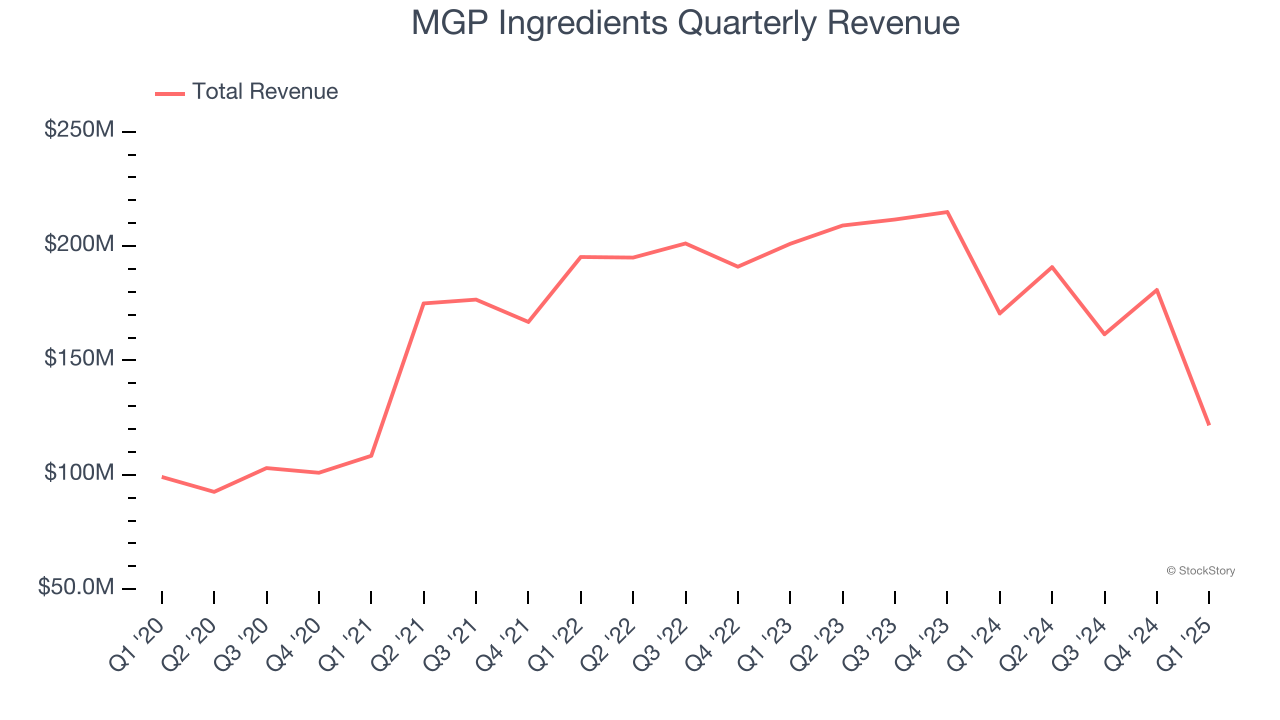

As you can see below, MGP Ingredients’s revenue declined by 2.8% per year over the last three years, a tough starting point for our analysis.

This quarter, MGP Ingredients’s revenue fell by 28.7% year on year to $121.7 million but beat Wall Street’s estimates by 3.5%.

Looking ahead, sell-side analysts expect revenue to decline by 20% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and implies its products will see some demand headwinds.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

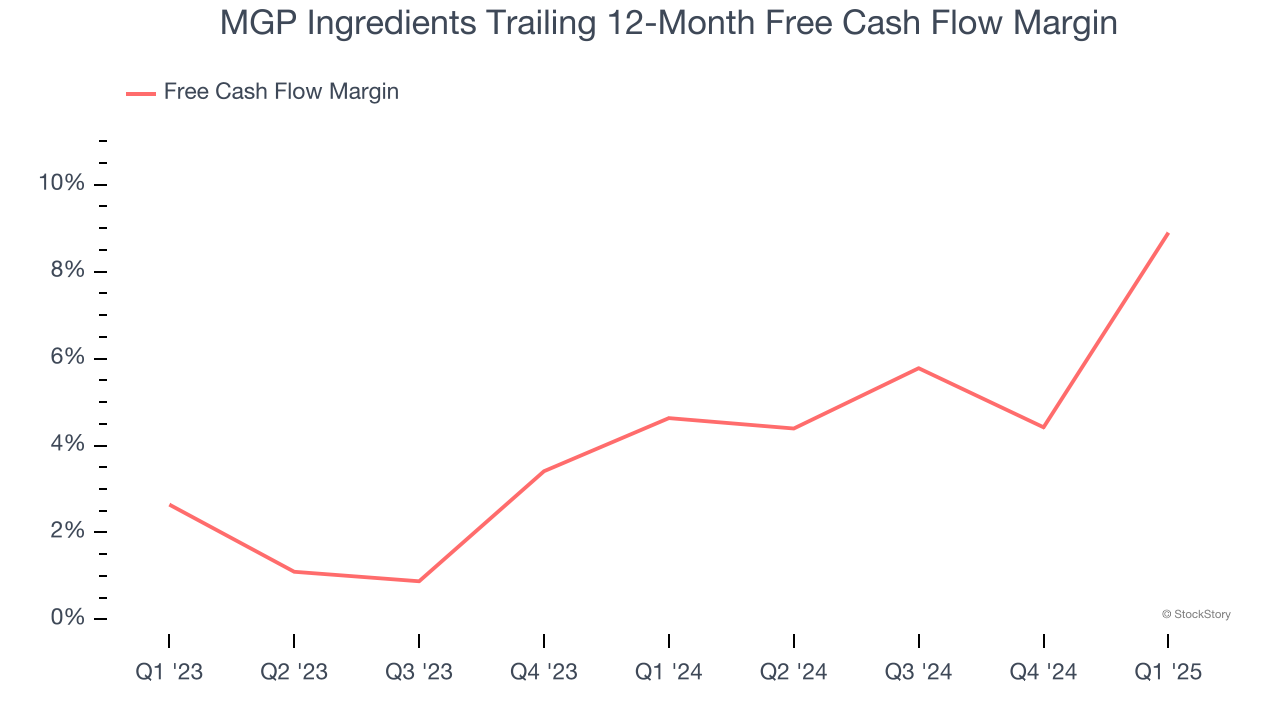

MGP Ingredients has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 6.5% over the last two years, slightly better than the broader consumer staples sector.

Taking a step back, we can see that MGP Ingredients’s margin expanded by 4.3 percentage points over the last year. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

MGP Ingredients’s free cash flow clocked in at $24.76 million in Q1, equivalent to a 20.4% margin. Its cash flow turned positive after being negative in the same quarter last year, building on its favorable historical trend.

Key Takeaways from MGP Ingredients’s Q1 Results

We were impressed by how significantly MGP Ingredients blew past analysts’ EBITDA expectations this quarter. We were also glad its gross margin outperformed Wall Street’s estimates. On the other hand, its EPS missed. Overall, this quarter had some key positives. The stock traded up 3.3% to $30.42 immediately after reporting.

MGP Ingredients had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.