Wrapping up Q4 earnings, we look at the numbers and key takeaways for the leisure facilities stocks, including Vail Resorts (NYSE: MTN) and its peers.

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

The 12 leisure facilities stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1% while next quarter’s revenue guidance was 0.6% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 13.4% since the latest earnings results.

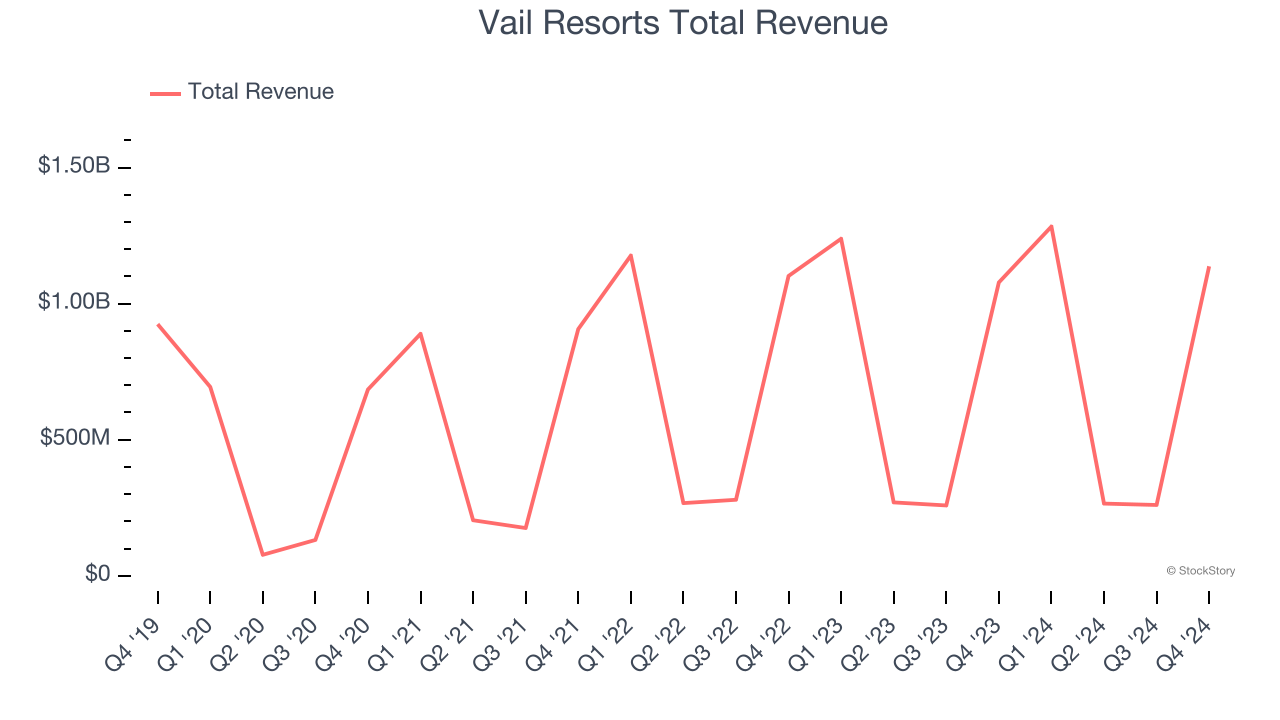

Vail Resorts (NYSE: MTN)

Founded by two Aspen, Colorado ski patrol guides, Vail Resorts (NYSE: MTN) is a mountain resort company offering luxury experiences in over 30 locations across the globe.

Vail Resorts reported revenues of $1.14 billion, up 5.5% year on year. This print was in line with analysts’ expectations, but overall, it was a mixed quarter for the company with a decent beat of analysts’ skier visits estimates.

Commenting on the Company's fiscal 2025 second quarter results, Kirsten Lynch, Chief Executive Officer, said, "We are pleased with our overall results for the quarter, with 8% growth in Resort Reported EBITDA compared to the prior year. Our results reflect the stability provided by our season pass program, our investments in the guest experience, and the strong execution of our teams across all of our mountain resorts."

The stock is down 8.4% since reporting and currently trades at $140.79.

Is now the time to buy Vail Resorts? Access our full analysis of the earnings results here, it’s free.

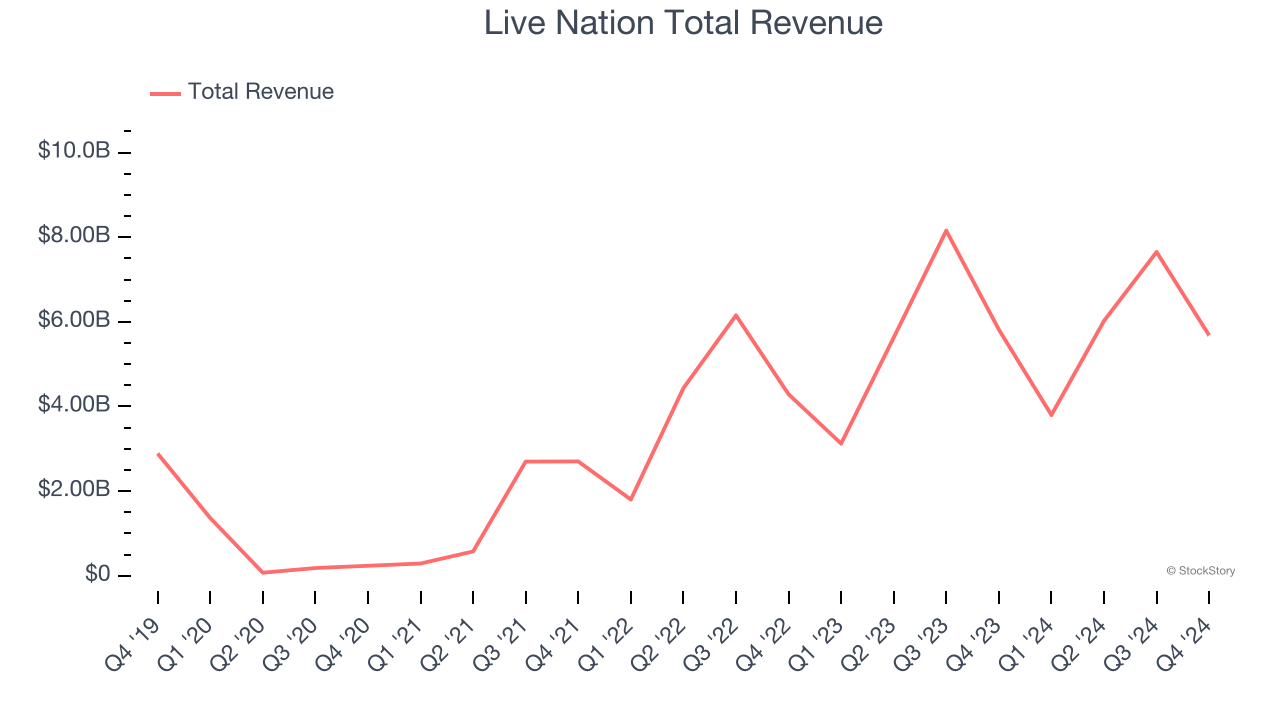

Best Q4: Live Nation (NYSE: LYV)

Owner of Ticketmaster and operator of music festival EDC, Live Nation (NYSE: LYV) is a company specializing in live event promotion, venue management, and ticketing services for concerts and shows.

Live Nation reported revenues of $5.68 billion, down 2.4% year on year, outperforming analysts’ expectations by 1.4%. The business had an exceptional quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 13.3% since reporting. It currently trades at $132.02.

Is now the time to buy Live Nation? Access our full analysis of the earnings results here, it’s free.

Slowest Q4: Lucky Strike Entertainment (NYSE: LUCK)

Born from the transformation of traditional bowling alleys into modern entertainment destinations, Lucky Strike Entertainment (NYSE: LUCK) operates bowling alleys and other entertainment venues with upscale amenities, arcade games, and food and beverage services across North America.

Lucky Strike Entertainment reported revenues of $300.1 million, down 1.8% year on year, falling short of analysts’ expectations by 4.9%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income and EPS estimates.

As expected, the stock is down 20.2% since the results and currently trades at $8.71.

Read our full analysis of Lucky Strike Entertainment’s results here.

Dave & Buster's (NASDAQ: PLAY)

Founded by a former game parlor and bar operator, Dave & Buster’s (NASDAQ: PLAY) operates a chain of arcades providing immersive entertainment experiences.

Dave & Buster's reported revenues of $534.5 million, down 10.8% year on year. This print lagged analysts' expectations by 2%. Overall, it was a slower quarter as it also recorded a miss of analysts’ same-store sales estimates and a slight miss of analysts’ adjusted operating income estimates.

The stock is up 19.6% since reporting and currently trades at $19.37.

Read our full, actionable report on Dave & Buster's here, it’s free.

United Parks & Resorts (NYSE: PRKS)

Parent company of SeaWorld and home of the world-famous Shamu, United Parks & Resorts (NYSE: PRKS) is a theme park chain featuring marine life, live entertainment, roller coasters, and waterparks.

United Parks & Resorts reported revenues of $384.4 million, down 1.2% year on year. This number topped analysts’ expectations by 1%. More broadly, it was a slower quarter as it produced a significant miss of analysts’ EPS estimates.

The stock is down 20.3% since reporting and currently trades at $43.51.

Read our full, actionable report on United Parks & Resorts here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.