HubSpot currently trades at $602.90 and has been a dream stock for shareholders. It’s returned 297% since April 2020, more than tripling the S&P 500’s 91.2% gain. The company has also beaten the index over the past six months as its stock price is up 6.6%.

Is it too late to buy HUBS? Find out in our full research report, it’s free.

Why Do Investors Watch HubSpot?

Started in 2006 by two MIT grad students, HubSpot (NYSE: HUBS) is a software-as-a-service platform that helps small and medium-sized businesses market themselves, sell, and get found on the internet.

Three Positive Attributes:

1. ARR Surges as Recurring Revenue Flows In

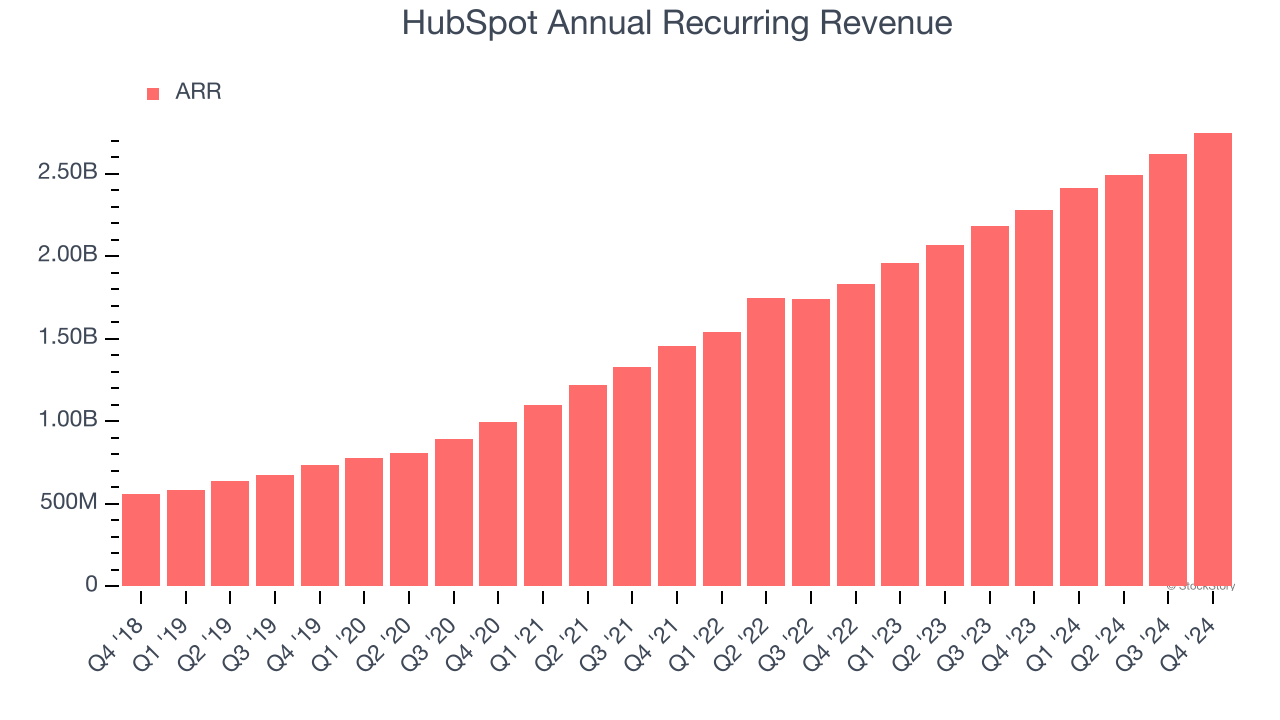

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

HubSpot’s ARR punched in at $2.75 billion in Q4, and over the last four quarters, its year-on-year growth averaged 21.1%. This performance was impressive and shows that customers are willing to take multi-year bets on the company’s technology. Its growth also makes HubSpot a more predictable business, a tailwind for its valuation as investors typically prefer businesses with recurring revenue.

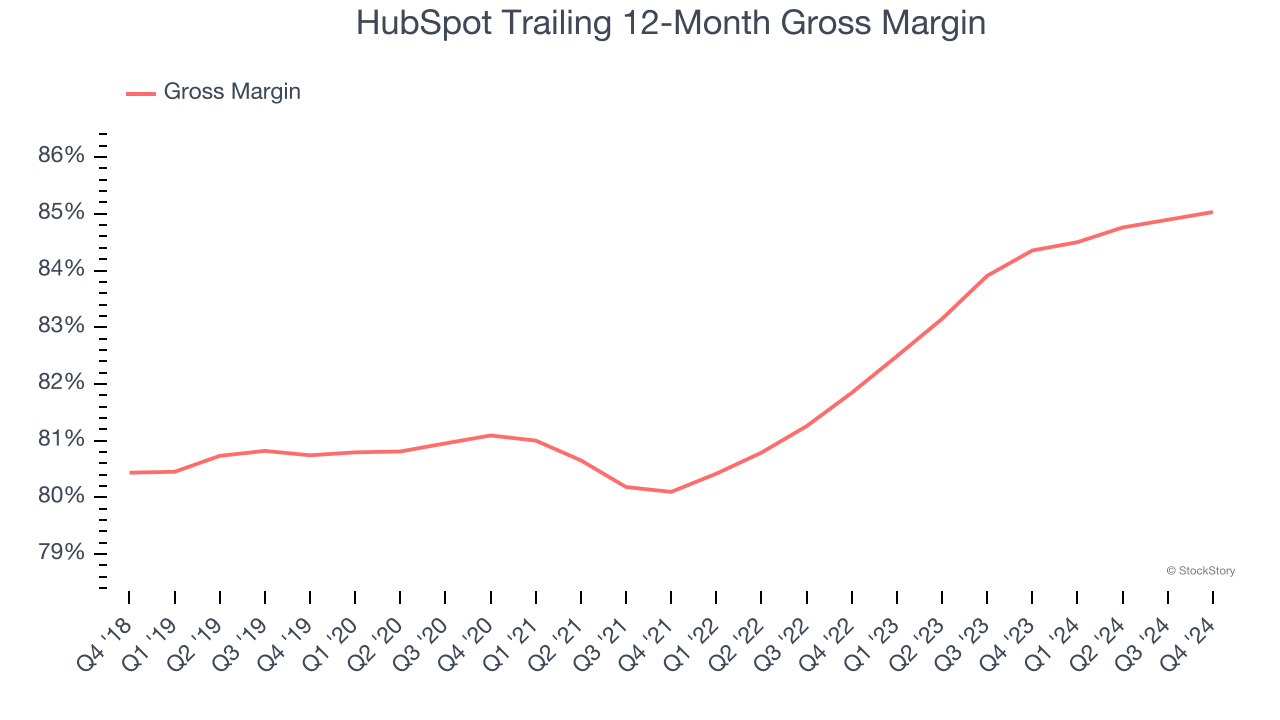

2. Elite Gross Margin Powers Best-In-Class Business Model

What makes the software-as-a-service model so attractive is that once the software is developed, it usually doesn’t cost much to provide it as an ongoing service. These minimal costs can include servers, licenses, and certain personnel.

HubSpot’s gross margin is one of the highest in the software sector, an output of its asset-lite business model and strong pricing power. It also enables the company to fund large investments in new products and sales during periods of rapid growth to achieve outsized profits at scale. As you can see below, it averaged an elite 85% gross margin over the last year. That means HubSpot only paid its providers $14.97 for every $100 in revenue.

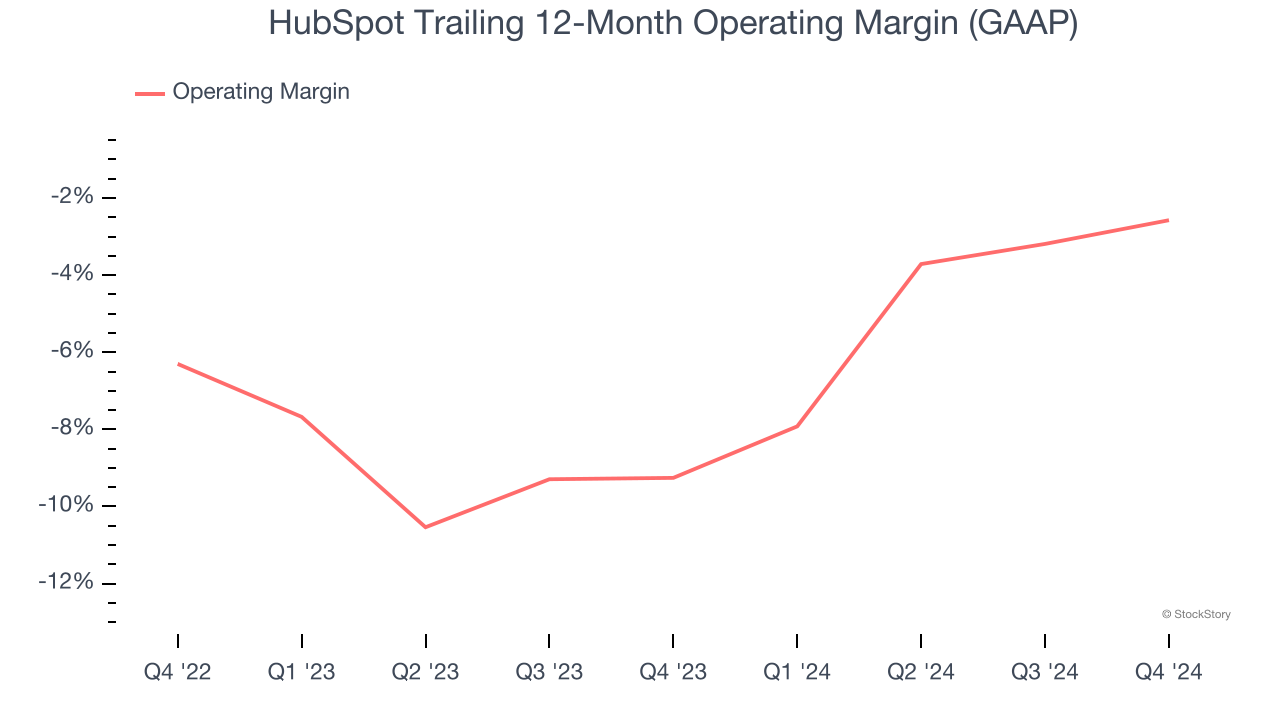

3. Operating Margin Rising, Profits Up

While many software businesses point investors to their adjusted profits, which exclude stock-based compensation (SBC), we prefer GAAP operating margin because SBC is a legitimate expense used to attract and retain talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

Over the last year, HubSpot’s expanding sales gave it operating leverage as its margin rose by 6.7 percentage points. Although its operating margin for the trailing 12 months was negative 2.6%, we’re confident it can one day reach sustainable profitability.

Final Judgment

HubSpot is an interesting business with potential, and with its shares beating the market recently, the stock trades at 10.5× forward price-to-sales (or $602.90 per share). Is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than HubSpot

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.