The past six months have been a windfall for Aris Water’s shareholders. The company’s stock price has jumped 68.8%, hitting $25.40 per share. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Following the strength, is ARIS a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Are We Positive On Aris Water?

Primarily serving the oil and gas industry, Aris Water (NYSE: ARIS) is a provider of water handling and recycling solutions.

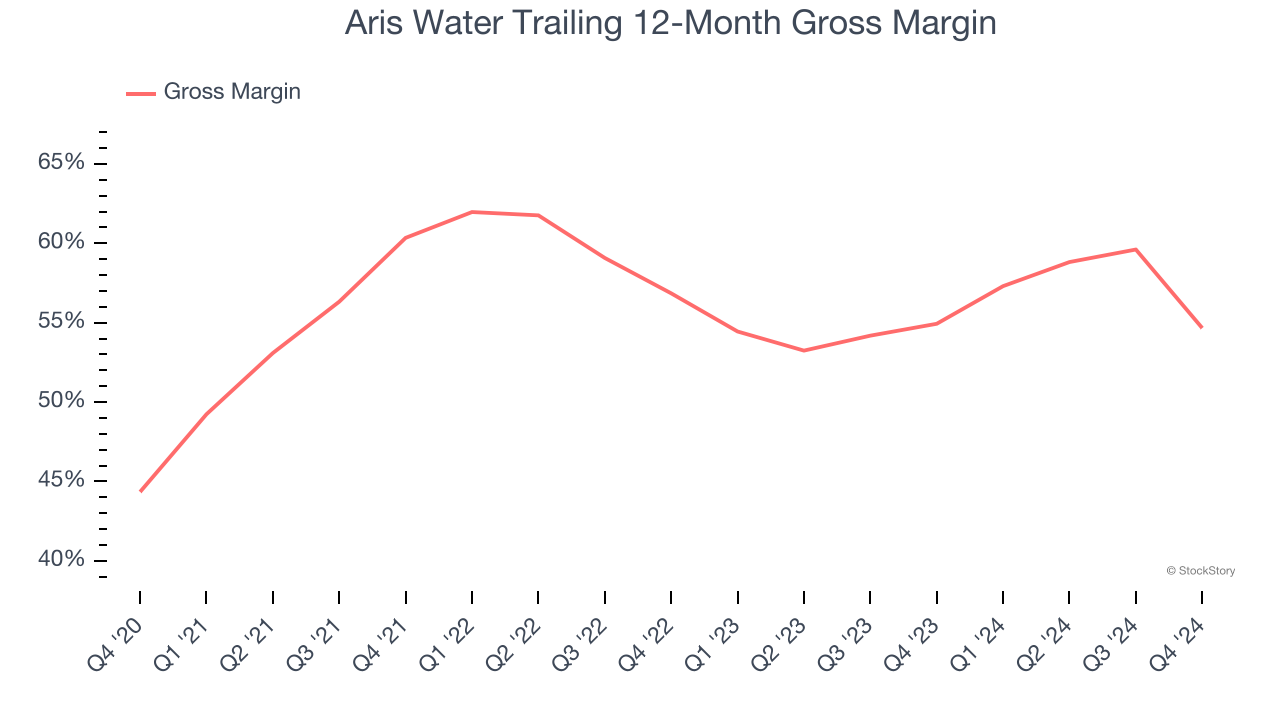

1. Elite Gross Margin Powers Best-In-Class Business Model

At StockStory, we prefer high gross margin businesses because they indicate the company has pricing power or differentiated products, giving it a chance to generate higher operating profits.

Aris Water has best-in-class unit economics for an industrials company, enabling it to invest in areas such as research and development. Its margin also signals it sells differentiated products, not commodities. As you can see below, it averaged an elite 54.9% gross margin over the last five years. Said differently, roughly $54.88 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

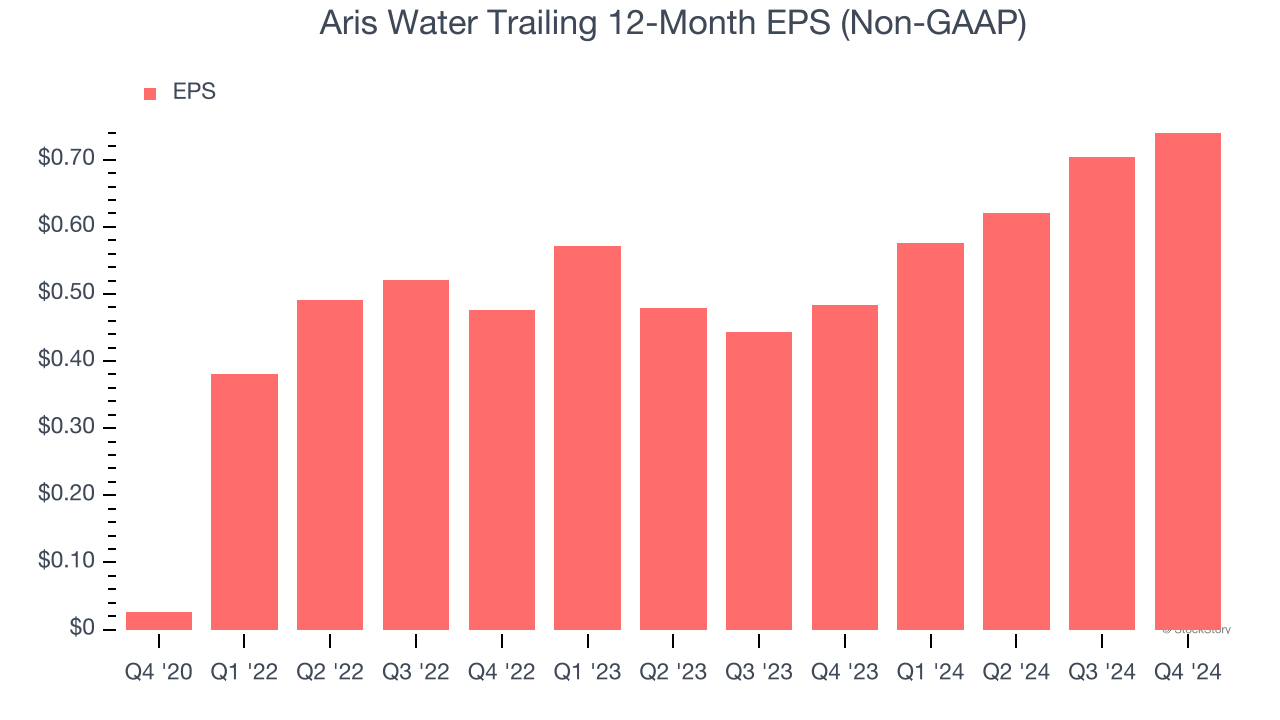

2. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Aris Water’s EPS grew at an astounding 132% compounded annual growth rate over the last four years, higher than its 26.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

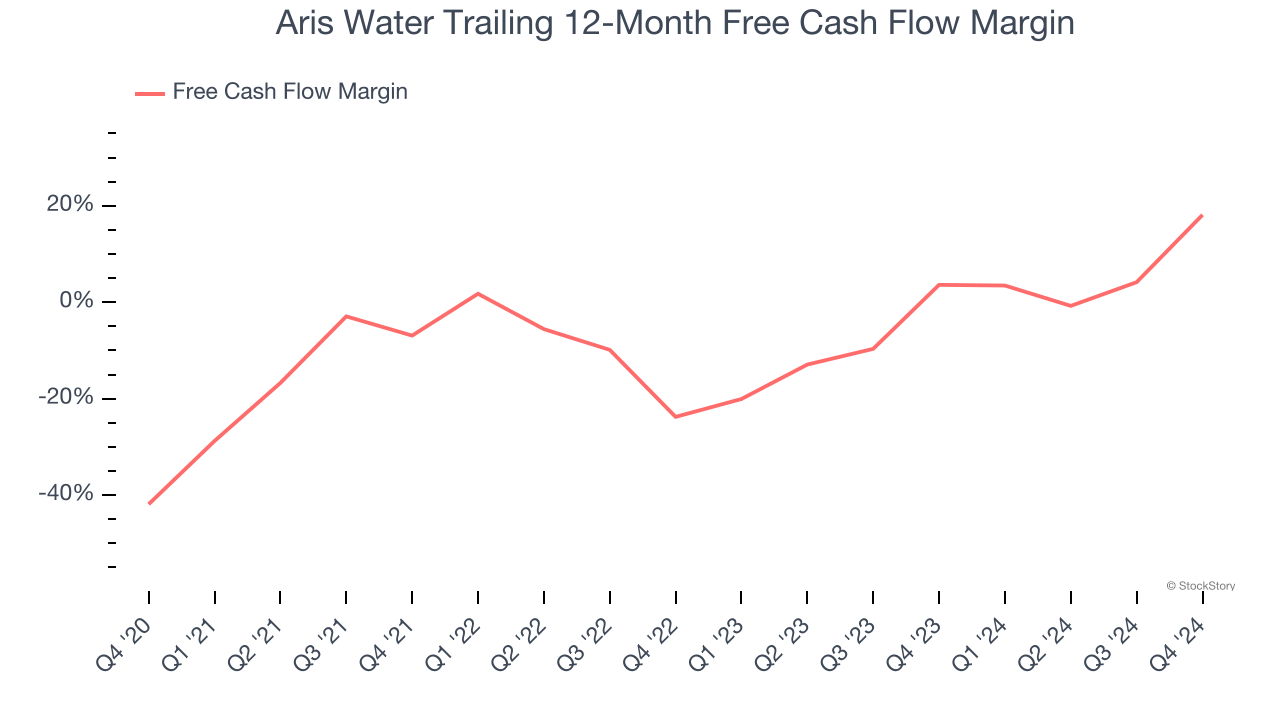

3. Increasing Free Cash Flow Margin Juices Financials

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Aris Water’s margin expanded by 60 percentage points over the last five years. Aris Water’s free cash flow margin for the trailing 12 months was 18.1%.

Final Judgment

These are just a few reasons why we think Aris Water is an elite industrials company, and after the recent rally, the stock trades at 14.5× forward price-to-earnings (or $25.40 per share). Is now the time to buy despite the apparent froth? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Aris Water

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.