Life sciences company Thermo Fisher (NYSE: TMO) reported Q1 CY2025 results beating Wall Street’s revenue expectations, but sales were flat year on year at $10.36 billion. Its non-GAAP profit of $5.15 per share was 0.9% above analysts’ consensus estimates.

Is now the time to buy Thermo Fisher? Find out by accessing our full research report, it’s free.

Thermo Fisher (TMO) Q1 CY2025 Highlights:

- Revenue: $10.36 billion vs analyst estimates of $10.23 billion (flat year on year, 1.3% beat)

- Adjusted EPS: $5.15 vs analyst estimates of $5.10 (0.9% beat)

- Adjusted EBITDA: $2.42 billion vs analyst estimates of $2.55 billion (23.4% margin, 5.2% miss)

- Operating Margin: 16.6%, in line with the same quarter last year

- Free Cash Flow Margin: 3.5%, down from 8.7% in the same quarter last year

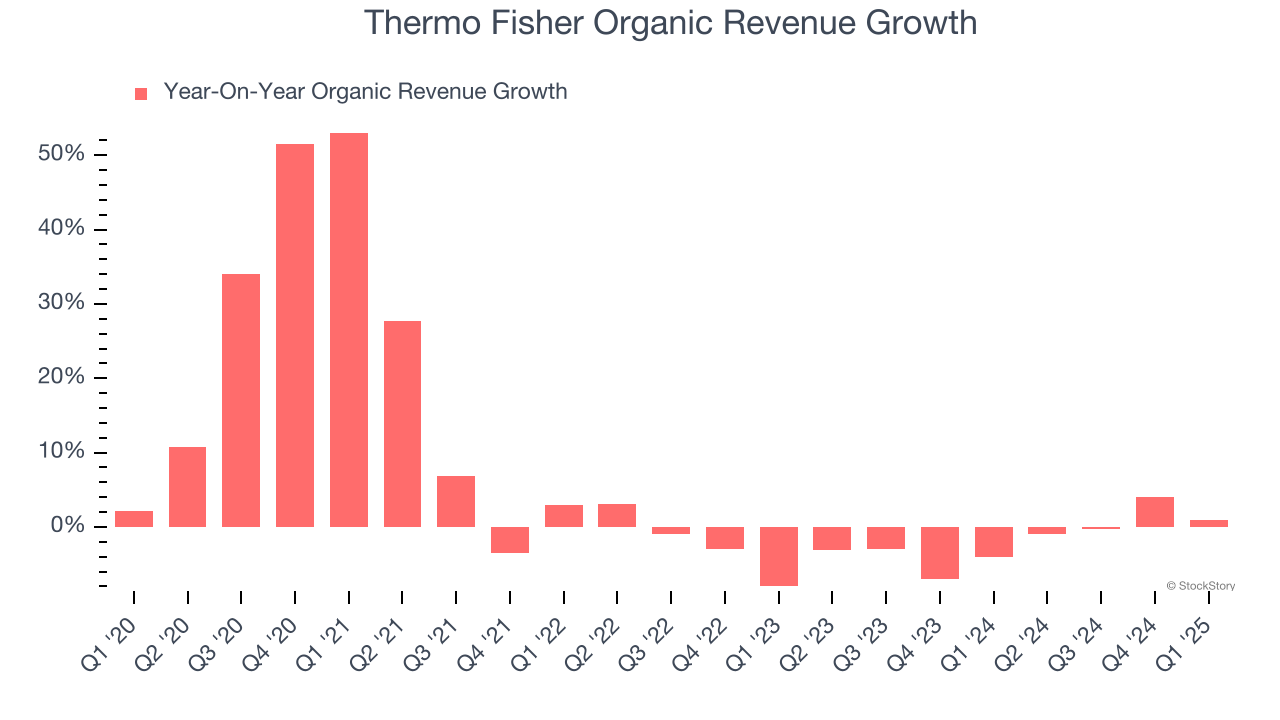

- Organic Revenue rose 1% year on year (-4% in the same quarter last year)

- Market Capitalization: $164.1 billion

“We delivered very strong performance in the first quarter in a more uncertain macroeconomic environment, and I’m incredibly proud of our team's execution,” said Marc N. Casper, chairman, president, and chief executive officer of Thermo Fisher Scientific.

Company Overview

With over 14,000 sales personnel and a portfolio spanning more than 2,500 technology manufacturers, Thermo Fisher Scientific (NYSE: TMO) provides scientific equipment, reagents, consumables, software, and laboratory services to pharmaceutical, biotech, academic, and healthcare customers worldwide.

Research Tools & Consumables

The life sciences subsector specializing in research tools and consumables enables scientific discoveries across academia, biotechnology, and pharmaceuticals. These firms supply a wide range of essential laboratory products, ensuring a recurring revenue stream through repeat purchases and replenishment. Their business models benefit from strong customer loyalty, a diversified product portfolio, and exposure to both the research and clinical markets. However, challenges include high R&D investment to maintain technological leadership, pricing pressures from budget-conscious institutions, and vulnerability to fluctuations in research funding cycles. Looking ahead, this subsector stands to benefit from tailwinds such as growing demand for tools supporting emerging fields like synthetic biology and personalized medicine. There is also a rise in automation and AI-driven solutions in laboratories that could create new opportunities to sell tools and consumables. Nevertheless, headwinds exist. These companies tend to be at the mercy of supply chain disruptions and sensitivity to macroeconomic conditions that impact funding for research initiatives.

Sales Growth

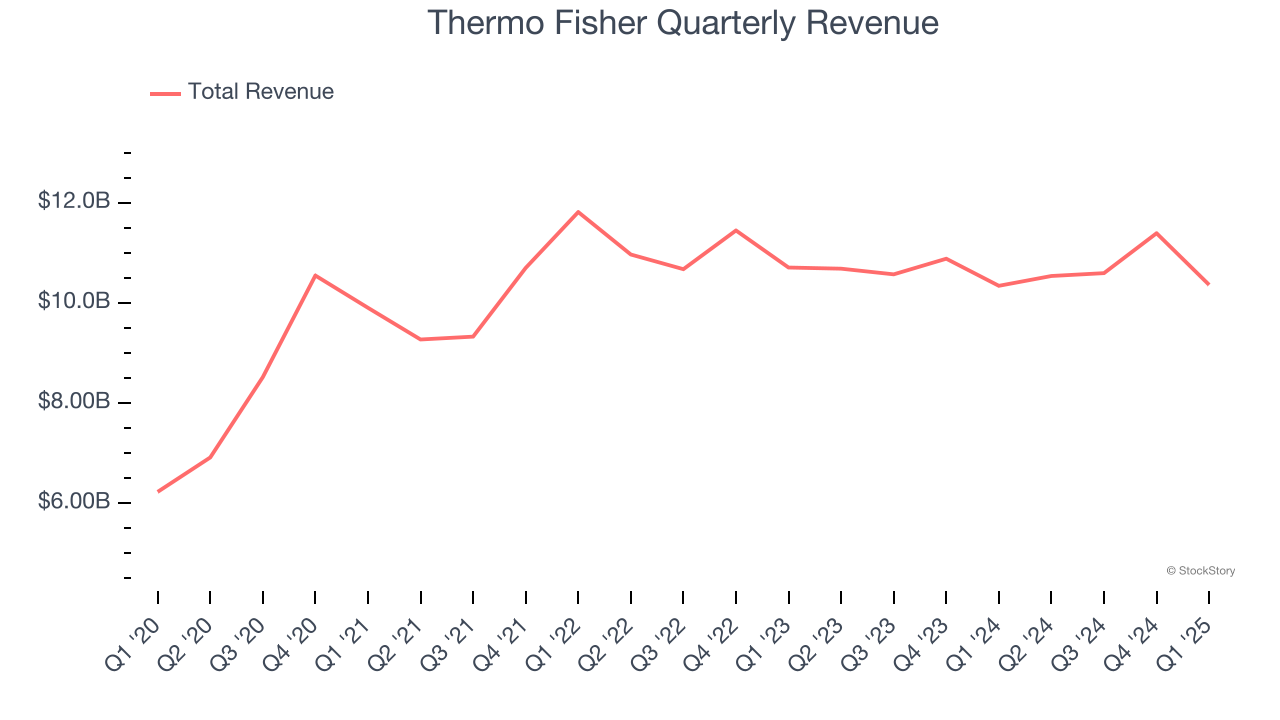

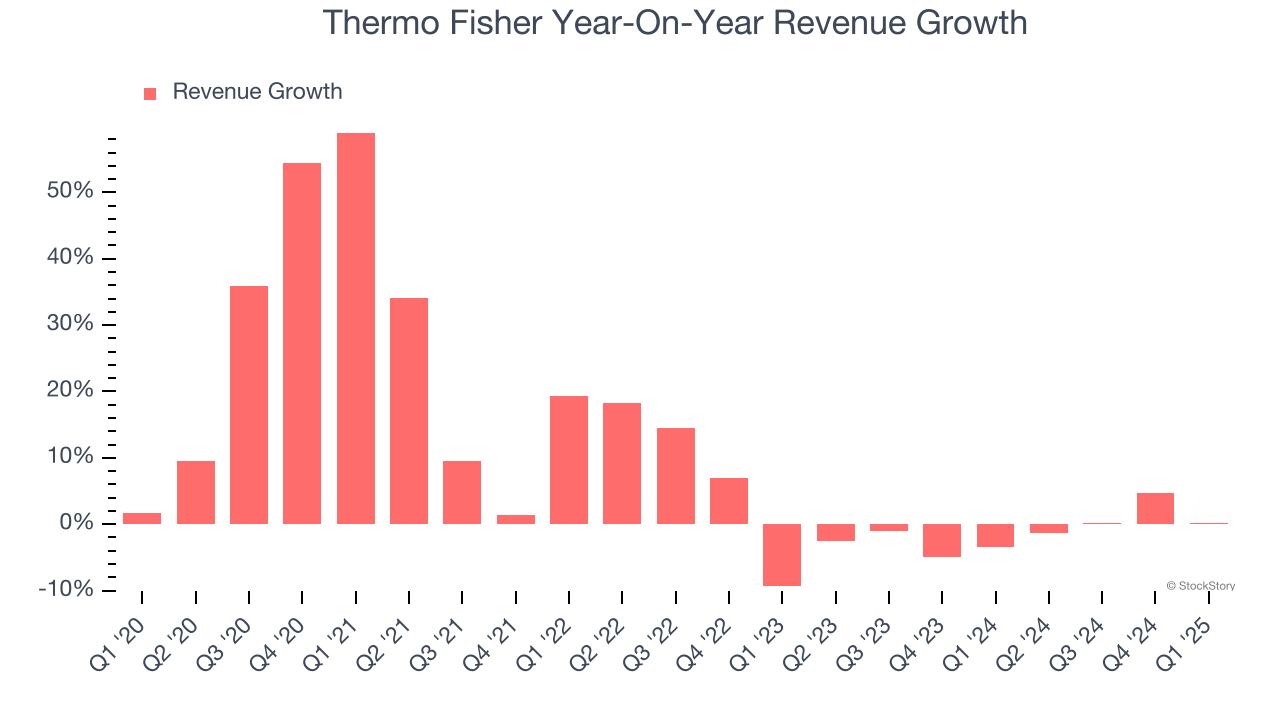

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, Thermo Fisher’s 10.8% annualized revenue growth over the last five years was decent. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Thermo Fisher’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 1% over the last two years.

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Thermo Fisher’s organic revenue averaged 1.7% year-on-year declines. Because this number aligns with its normal revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Thermo Fisher’s $10.36 billion of revenue was flat year on year but beat Wall Street’s estimates by 1.3%.

Looking ahead, sell-side analysts expect revenue to grow 3.6% over the next 12 months. Although this projection indicates its newer products and services will catalyze better top-line performance, it is still below the sector average.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

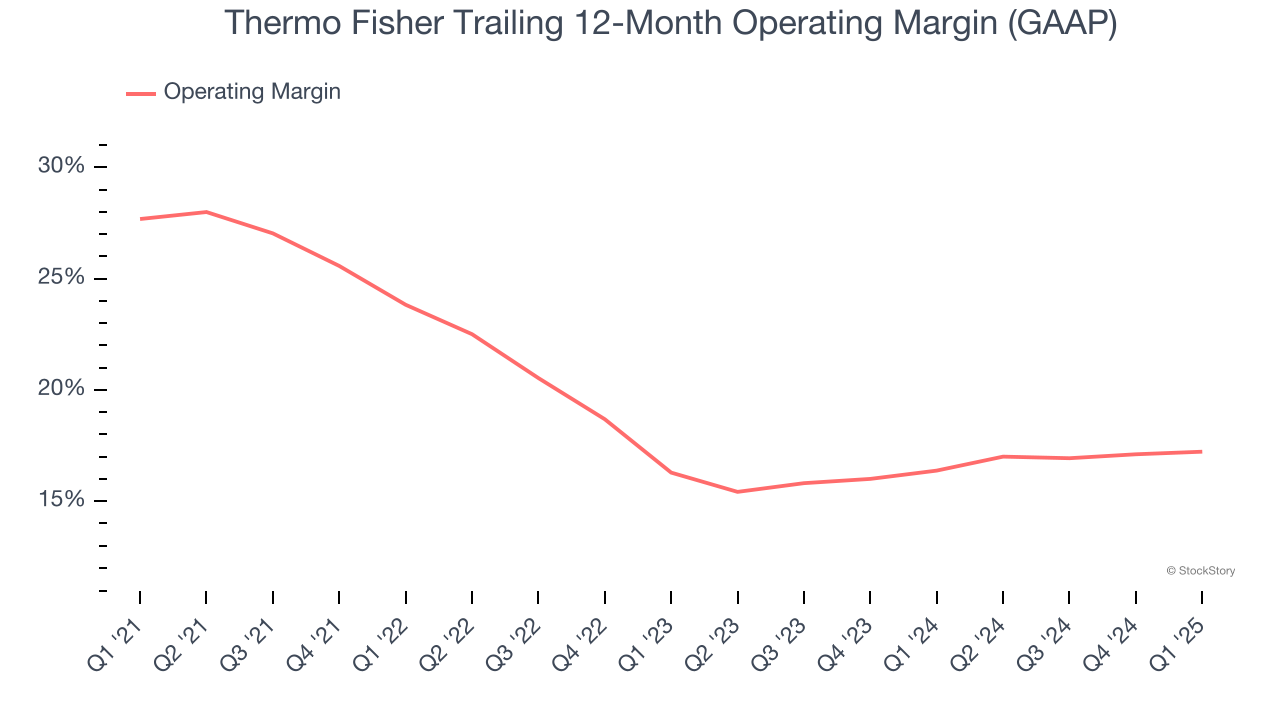

Thermo Fisher has managed its cost base well over the last five years. It demonstrated solid profitability for a healthcare business, producing an average operating margin of 20%.

Analyzing the trend in its profitability, Thermo Fisher’s operating margin decreased by 10.5 percentage points over the last five years. A silver lining is that on a two-year basis, its margin has stabilized. Still, shareholders will want to see Thermo Fisher become more profitable in the future.

In Q1, Thermo Fisher generated an operating profit margin of 16.6%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

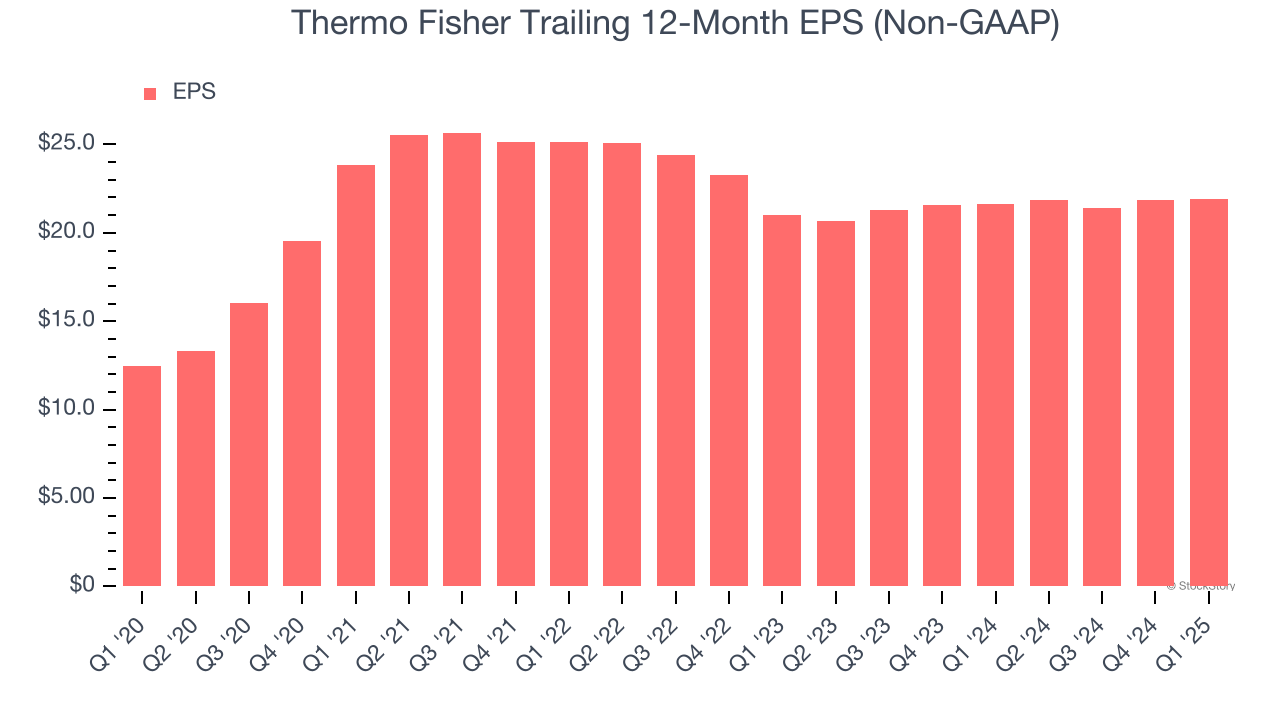

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

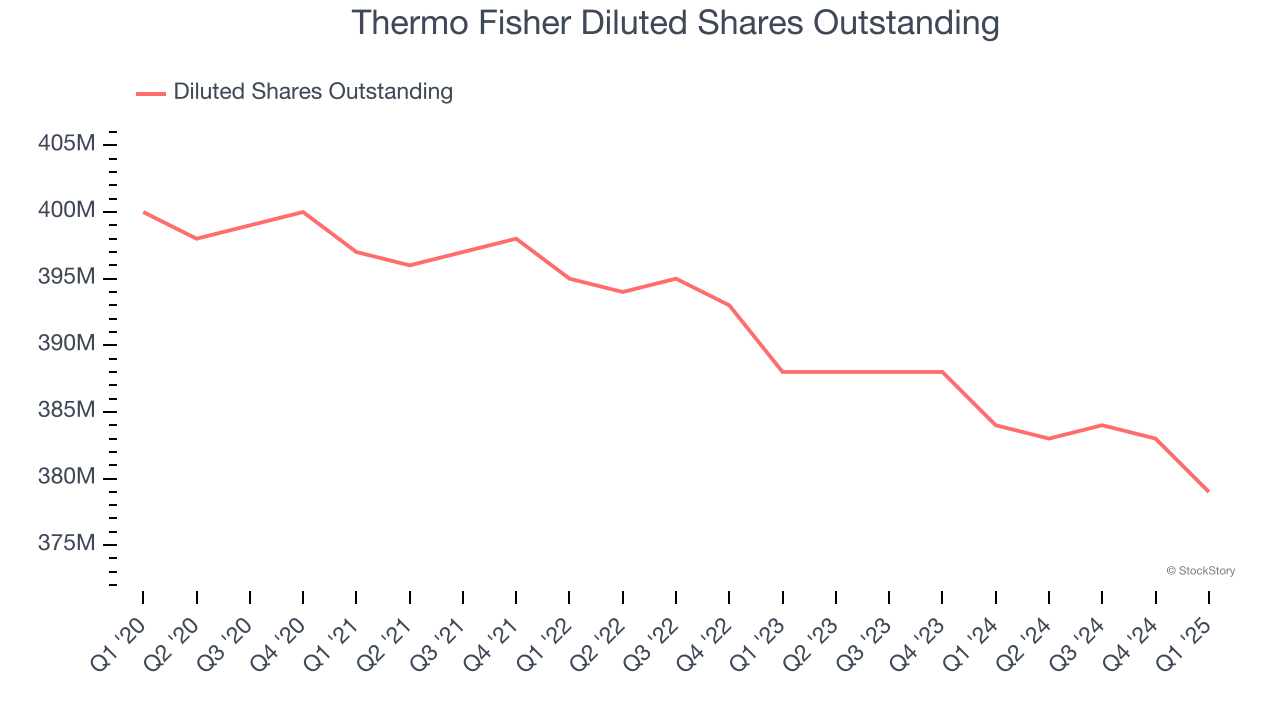

Thermo Fisher’s EPS grew at a remarkable 11.9% compounded annual growth rate over the last five years, higher than its 10.8% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t expand.

Diving into the nuances of Thermo Fisher’s earnings can give us a better understanding of its performance. A five-year view shows that Thermo Fisher has repurchased its stock, shrinking its share count by 5.2%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q1, Thermo Fisher reported EPS at $5.15, up from $5.11 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Thermo Fisher’s full-year EPS of $21.90 to grow 8%.

Key Takeaways from Thermo Fisher’s Q1 Results

It was good to see Thermo Fisher narrowly top analysts’ organic revenue expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates, leading to an EPS beat. Zooming out, we think this was a decent quarter. The stock traded up 1.6% to $441 immediately after reporting.

So do we think Thermo Fisher is an attractive buy at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.