Diversified science and technology company Danaher (NYSE: DHR) reported Q1 CY2025 results beating Wall Street’s revenue expectations, but sales were flat year on year at $5.74 billion. Guidance for next quarter’s revenue was better than expected at $5.92 billion at the midpoint, 1.9% above analysts’ estimates. Its non-GAAP profit of $1.88 per share was 14.4% above analysts’ consensus estimates.

Is now the time to buy Danaher? Find out by accessing our full research report, it’s free.

Danaher (DHR) Q1 CY2025 Highlights:

- Revenue: $5.74 billion vs analyst estimates of $5.59 billion (flat year on year, 2.7% beat)

- Adjusted EPS: $1.88 vs analyst estimates of $1.64 (14.4% beat)

- Revenue Guidance for Q2 CY2025 is $5.92 billion at the midpoint, above analyst estimates of $5.81 billion

- Adjusted EPS guidance for the full year is $7.68 at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 22.2%, in line with the same quarter last year

- Free Cash Flow Margin: 18.4%, down from 25% in the same quarter last year

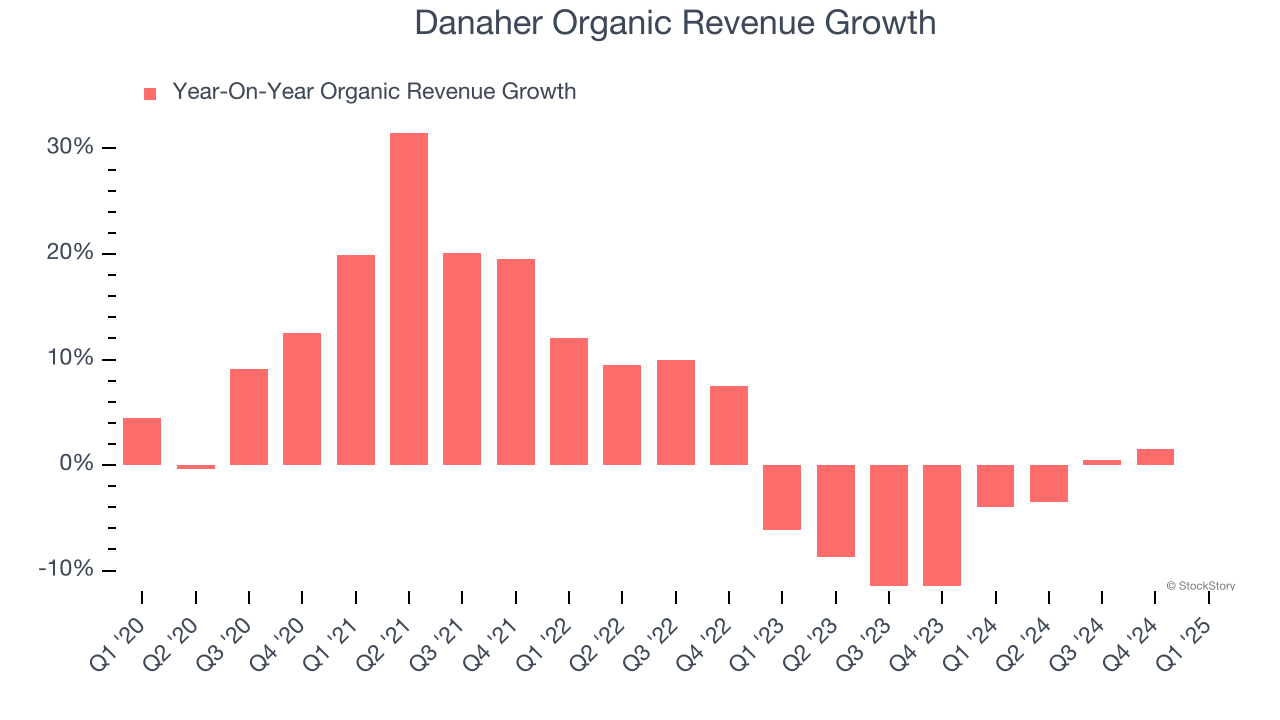

- Organic Revenue was flat year on year (-4% in the same quarter last year)

- Market Capitalization: $132.3 billion

Company Overview

Born from a real estate investment trust that transformed into a manufacturing powerhouse, Danaher (NYSE: DHR) is a global science and technology company that provides specialized equipment, software, and services for biotechnology, life sciences, and diagnostics.

Research Tools & Consumables

The life sciences subsector specializing in research tools and consumables enables scientific discoveries across academia, biotechnology, and pharmaceuticals. These firms supply a wide range of essential laboratory products, ensuring a recurring revenue stream through repeat purchases and replenishment. Their business models benefit from strong customer loyalty, a diversified product portfolio, and exposure to both the research and clinical markets. However, challenges include high R&D investment to maintain technological leadership, pricing pressures from budget-conscious institutions, and vulnerability to fluctuations in research funding cycles. Looking ahead, this subsector stands to benefit from tailwinds such as growing demand for tools supporting emerging fields like synthetic biology and personalized medicine. There is also a rise in automation and AI-driven solutions in laboratories that could create new opportunities to sell tools and consumables. Nevertheless, headwinds exist. These companies tend to be at the mercy of supply chain disruptions and sensitivity to macroeconomic conditions that impact funding for research initiatives.

Sales Growth

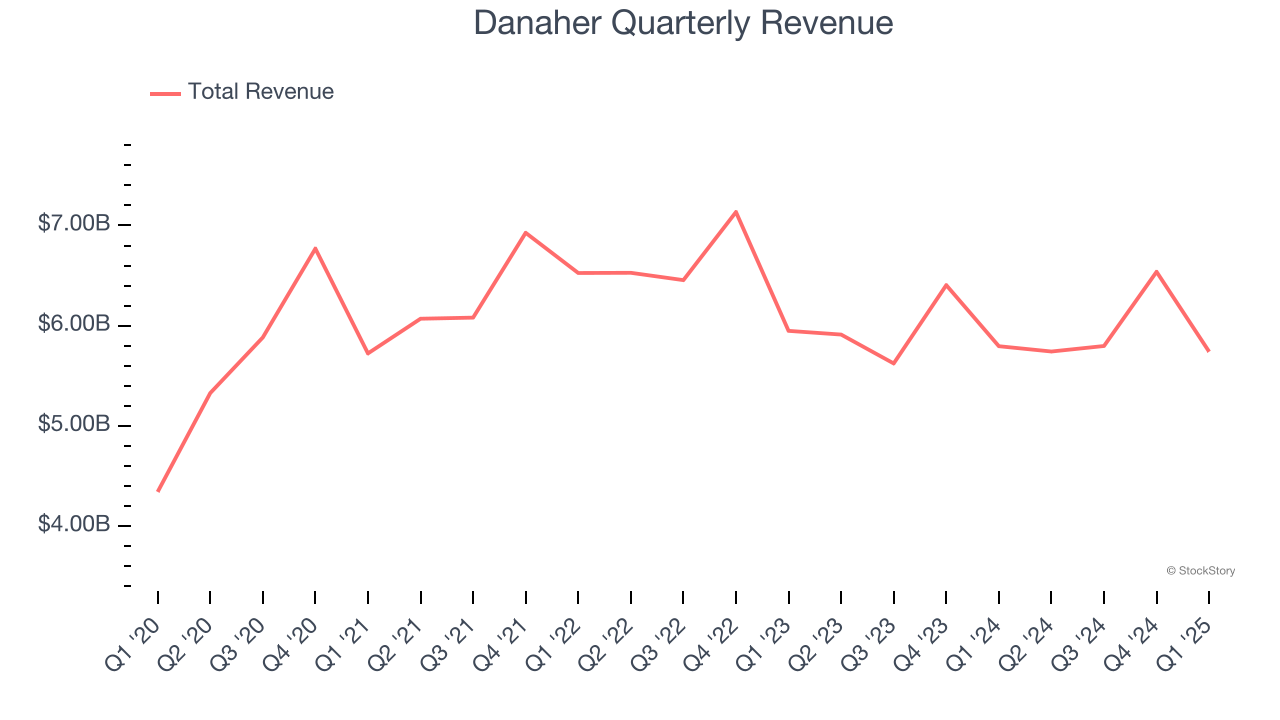

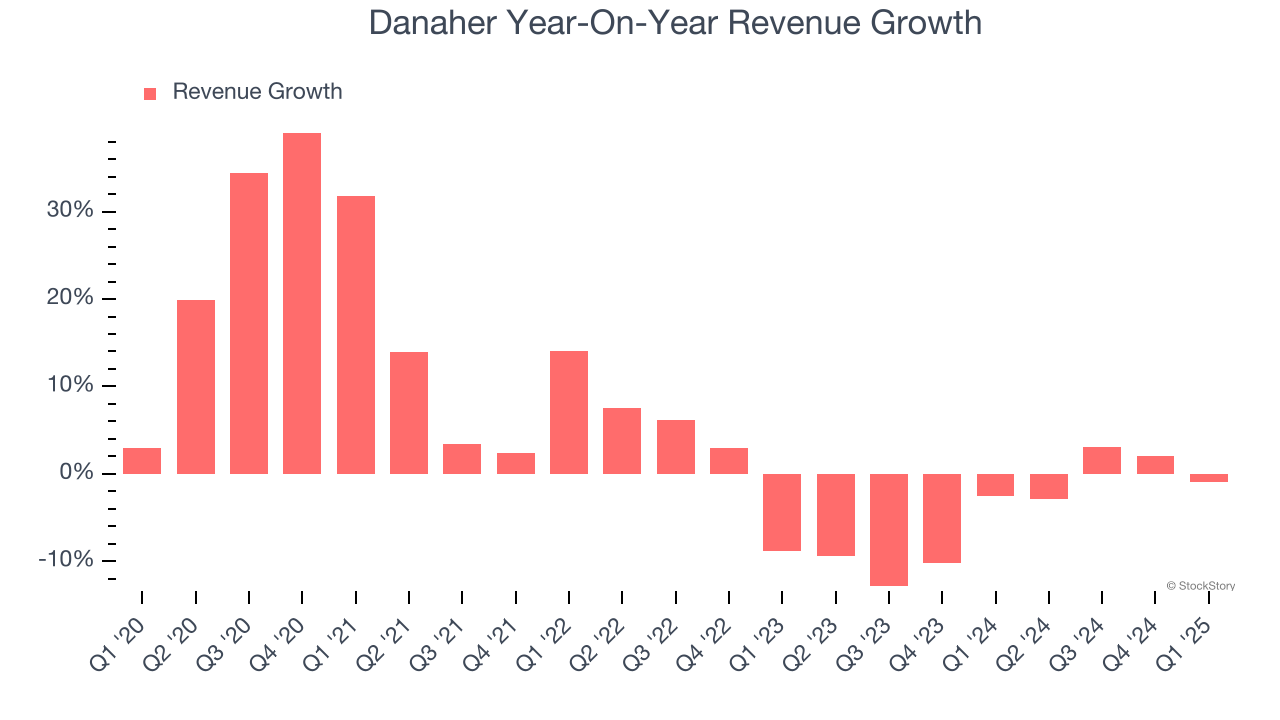

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Danaher grew its sales at a mediocre 5.7% compounded annual growth rate. This fell short of our benchmark for the healthcare sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Danaher’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 4.4% annually.

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Danaher’s organic revenue averaged 4.6% year-on-year declines. Because this number aligns with its normal revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Danaher’s $5.74 billion of revenue was flat year on year but beat Wall Street’s estimates by 2.7%. Company management is currently guiding for a 3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 3.1% over the next 12 months. While this projection indicates its newer products and services will fuel better top-line performance, it is still below the sector average.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

Danaher has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average operating margin of 25.2%.

Looking at the trend in its profitability, Danaher’s operating margin decreased by 3.1 percentage points over the last five years. This performance was caused by more recent speed bumps as the company’s margin fell by 9.4 percentage points on a two-year basis. We’re disappointed in these results because it shows its expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Danaher generated an operating profit margin of 22.2%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Danaher’s EPS grew at a remarkable 10.7% compounded annual growth rate over the last five years, higher than its 5.7% annualized revenue growth. However, we take this with a grain of salt because its operating margin didn’t expand and it didn’t repurchase its shares, meaning the delta came from reduced interest expenses or taxes.

In Q1, Danaher reported EPS at $1.88, down from $1.92 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Danaher’s full-year EPS of $7.44 to grow 6.2%.

Key Takeaways from Danaher’s Q1 Results

We enjoyed seeing Danaher beat analysts’ organic revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 2.8% to $190 immediately after reporting.

Danaher may have had a good quarter, but does that mean you should invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.