Since September 2024, Herc has been in a holding pattern, posting a small loss of 3.7% while floating around $127.35. The stock also fell short of the S&P 500’s 5.2% gain during that period.

Does this present a buying opportunity for HRI? Or is its underperformance reflective of its story and business quality? Find out in our full research report, it’s free.

Why Does HRI Stock Spark Debate?

Formerly a subsidiary of Hertz Corporation and with a logo that still bears some similarities to its former parent, Herc Holdings (NYSE: HRI) provides equipment rental and related services to a wide range of industries.

Two Positive Attributes:

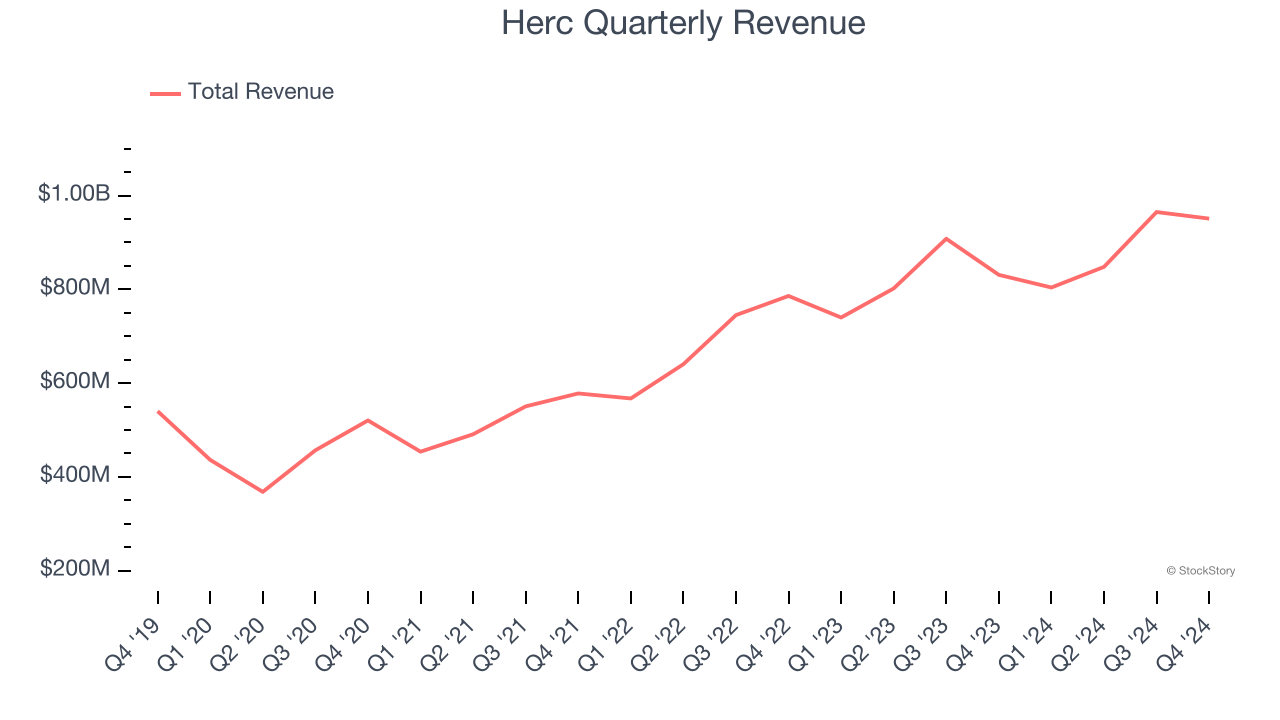

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, Herc’s sales grew at an excellent 12.3% compounded annual growth rate over the last five years. Its growth surpassed the average industrials company and shows its offerings resonate with customers.

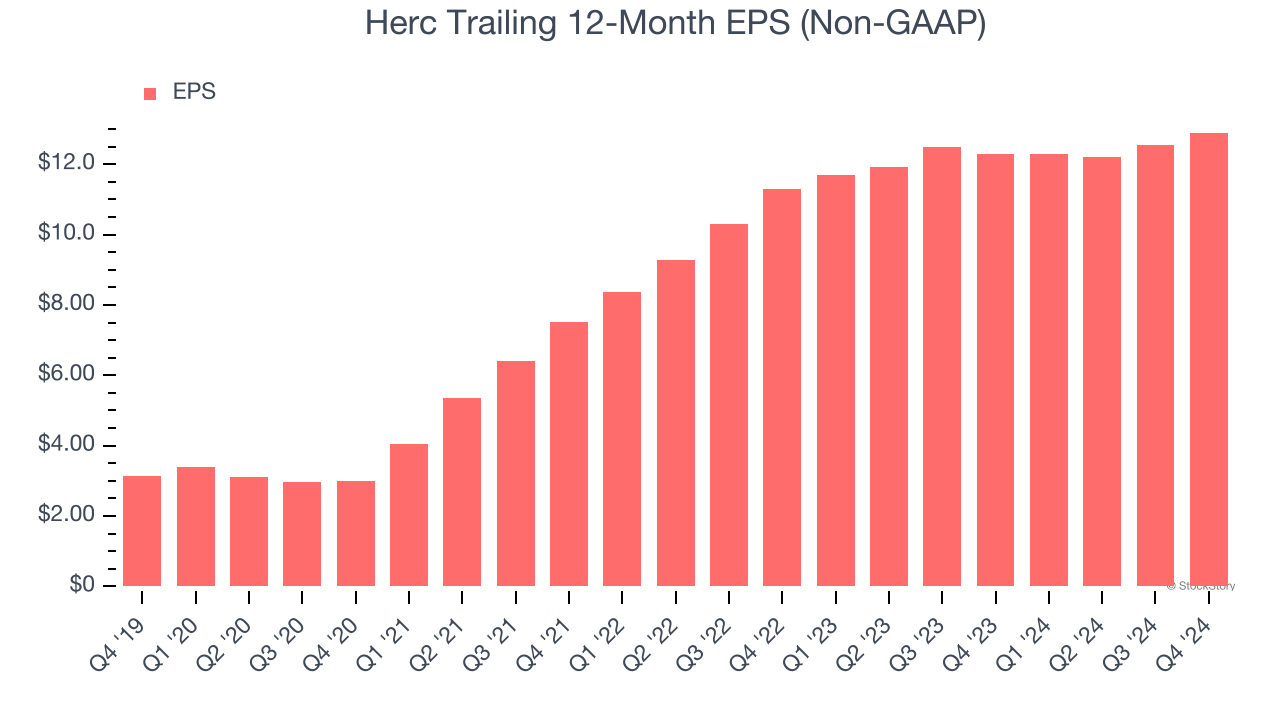

2. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Herc’s EPS grew at an astounding 32.7% compounded annual growth rate over the last five years, higher than its 12.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

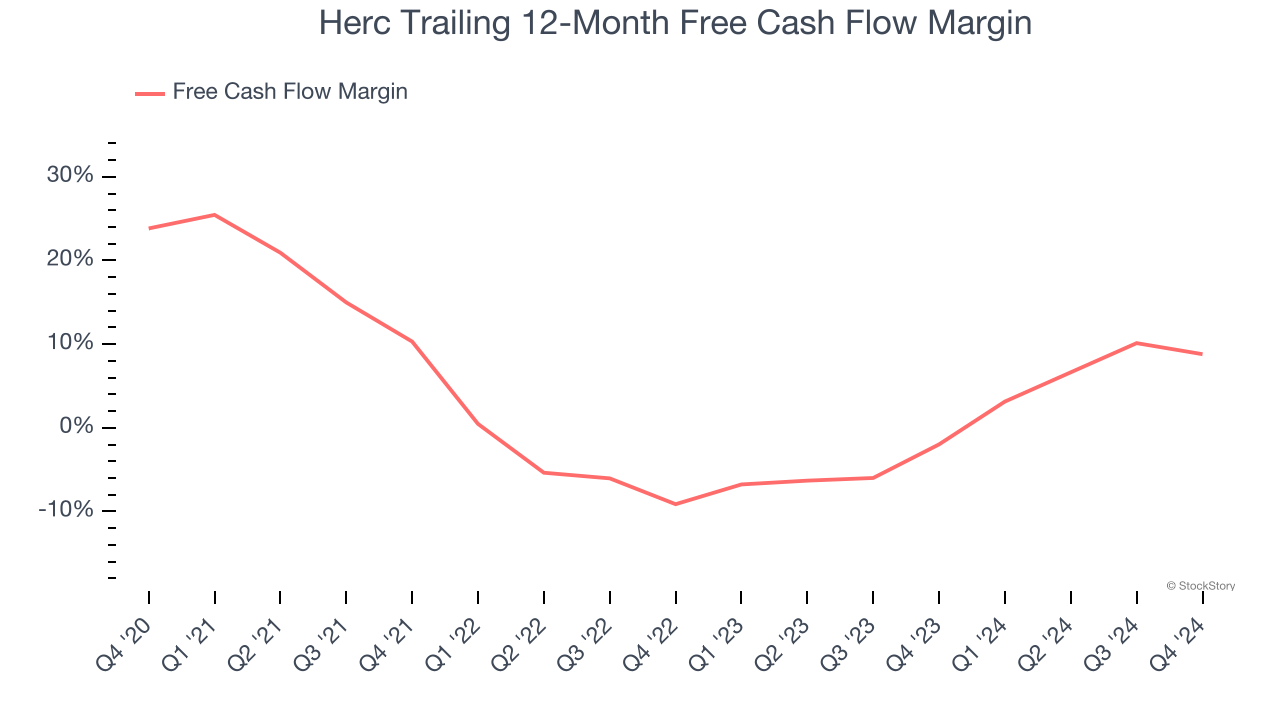

Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Herc’s margin dropped by 15 percentage points over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal it’s in the middle of a big investment cycle. Herc’s free cash flow margin for the trailing 12 months was 8.8%.

Final Judgment

Herc has huge potential even though it has some open questions. With its shares underperforming the market lately, the stock trades at 8.5× forward price-to-earnings (or $127.35 per share). Is now a good time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Herc

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.