Video sharing platform Rumble (NASDAQGM:RUM) announced better-than-expected revenue in Q4 CY2024, with sales up 48.2% year on year to $30.23 million. On the other hand, next quarter’s revenue guidance of $22.17 million was less impressive, coming in 11.6% below analysts’ estimates. Its GAAP loss of $1.15 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Rumble? Find out by accessing our full research report, it’s free.

Rumble (RUM) Q4 CY2024 Highlights:

- Revenue: $30.23 million vs analyst estimates of $29.74 million (48.2% year-on-year growth, 1.7% beat)

- EPS (GAAP): -$1.15 vs analyst estimates of -$0.12 (significant miss but due to change in fair value of derivatives, a one-time, non-fundamental occurrence)

- Adjusted EBITDA: -$13.39 million vs analyst estimates of -$19.04 million (-44.3% margin, 29.7% beat)

- Revenue Guidance for Q1 CY2025 is $22.17 million at the midpoint, below analyst estimates of $25.08 million

- Operating Margin: -80.1%, up from -184% in the same quarter last year

- Market Capitalization: $2.54 billion

Rumble's Chairman and CEO Chris Pavlovski commented, “While I am pleased with our topline quarterly growth of 48% year over year, I am even more impressed with the third to fourth quarter growth in U.S. and Canada MAUs of 21% to 52 million. This demonstrates how powerful our North America platform is. Rumble cemented its place in the online media eco-system by setting multiple records on the night of the U.S. election. In addition, the fourth quarter included our biggest announcement since going public: a $775 million strategic investment from Tether, the largest company in the digital asset industry and the most widely used dollar stablecoin across the world. Rooted in this investment was the extremely strong commonalities between cryptocurrency and free speech communities, both built on a passion for freedom, transparency and decentralization. As I look ahead, with the Tether transaction now closed, I could not be more excited about the possibilities and the new era we are entering for Rumble.”

Company Overview

Founded in 2013 as a champion for content creator rights and free expression, Rumble (NASDAQ: RUM) is a video sharing platform that positions itself as a free speech alternative to mainstream platforms, offering creators more favorable revenue-sharing opportunities.

Digital Media & Content Platforms

AI-driven content creation, personalized media experiences, and digital advertising are evolving, which could benefit companies investing in these themes. For example, companies with a portfolio of licensed visual content or platforms facilitating direct monetization models could see increased demand for years. On the other hand, headwinds include growing regulatory scrutiny on AI-generated content, with many publishers balking at anything that gets no human oversight. Additional areas to navigate include the phasing out of third-party cookies, which could make traditional ways of tracking the online behavior of consumers (a secret sauce in digital marketing) much less effective.

Sales Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $95.49 million in revenue over the past 12 months, Rumble is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

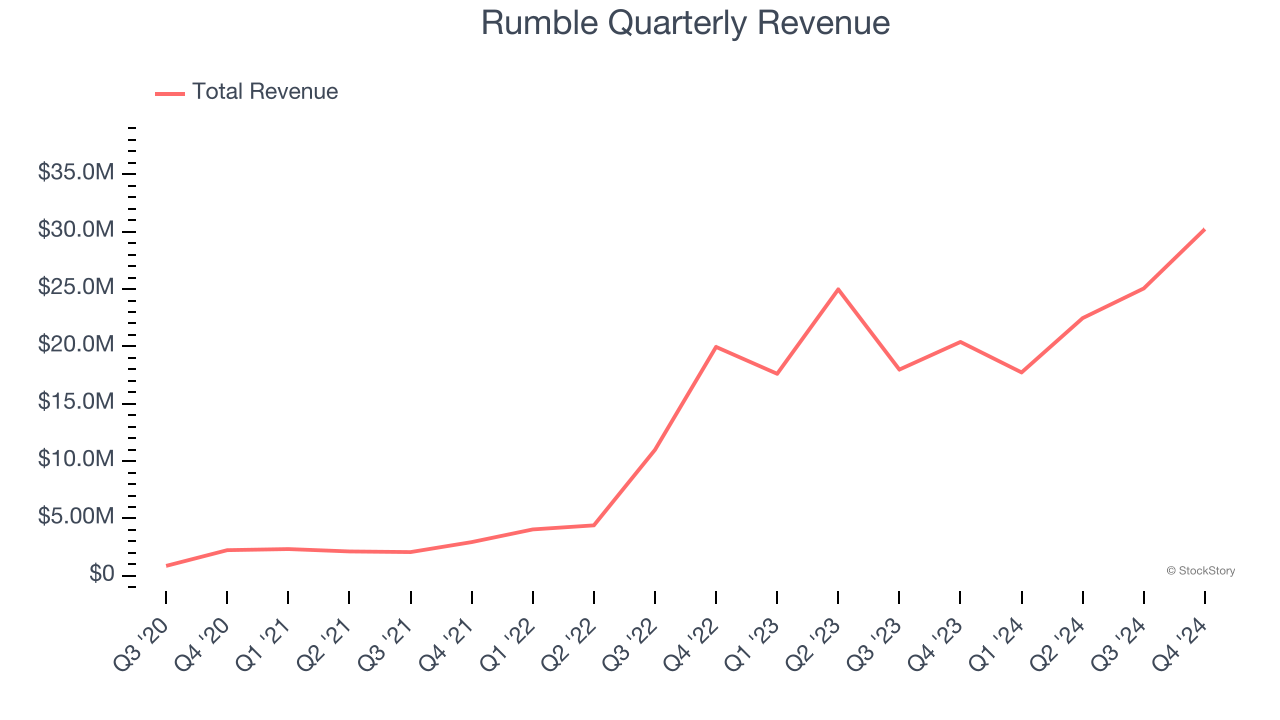

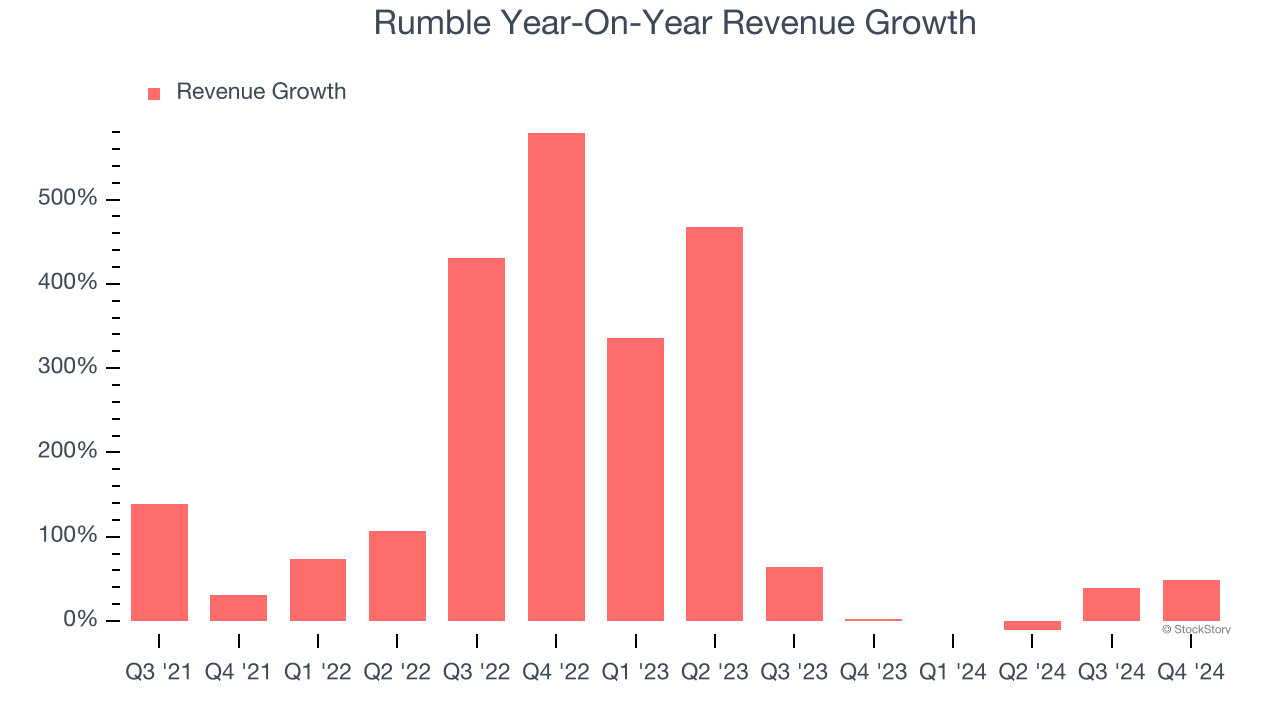

As you can see below, Rumble’s 105% annualized revenue growth over the last four years was incredible. This shows it had high demand, a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a stretched historical view may miss recent innovations or disruptive industry trends. Rumble’s annualized revenue growth of 55.7% over the last two years is below its four-year trend, but we still think the results suggest healthy demand.

This quarter, Rumble reported magnificent year-on-year revenue growth of 48.2%, and its $30.23 million of revenue beat Wall Street’s estimates by 1.7%. Company management is currently guiding for a 25% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 20.6% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is commendable and suggests the market sees success for its products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

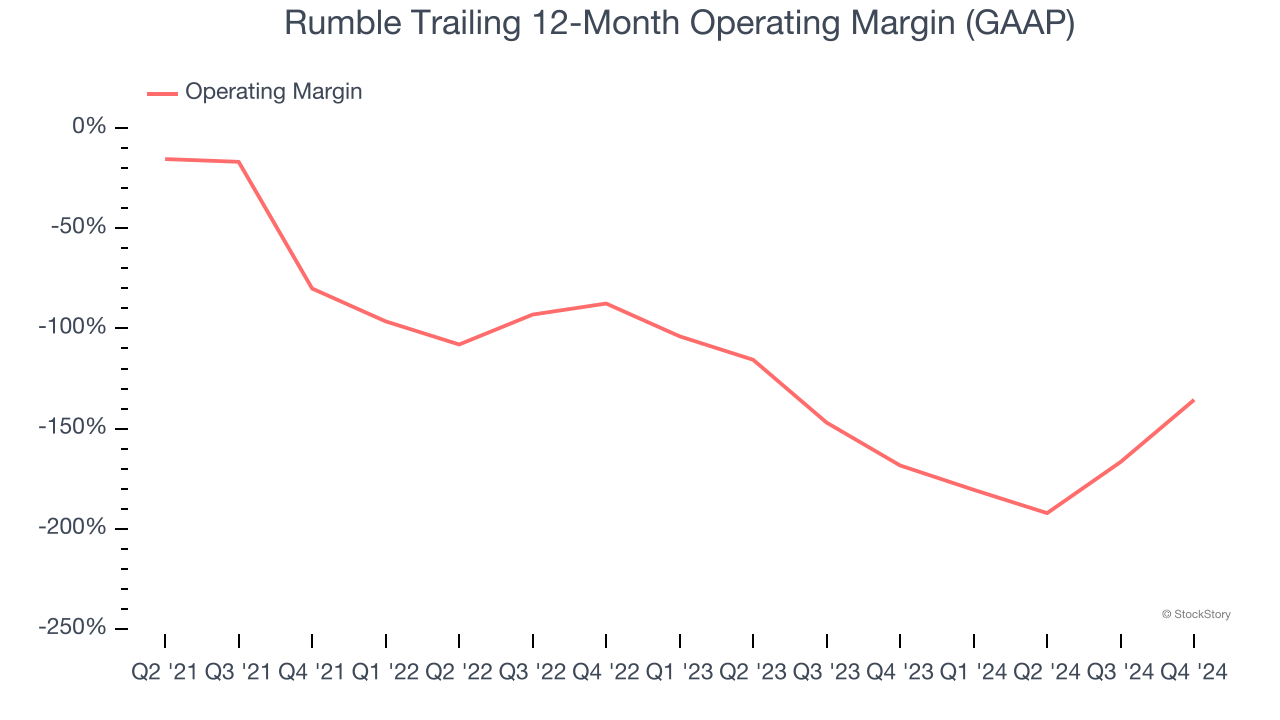

Rumble’s high expenses have contributed to an average operating margin of negative 135% over the last five years. Unprofitable business services companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Analyzing the trend in its profitability, Rumble’s operating margin decreased by 75.5 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Rumble’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q4, Rumble generated a negative 80.1% operating margin. The company's consistent lack of profits raise a flag.

Earnings Per Share

We track the change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

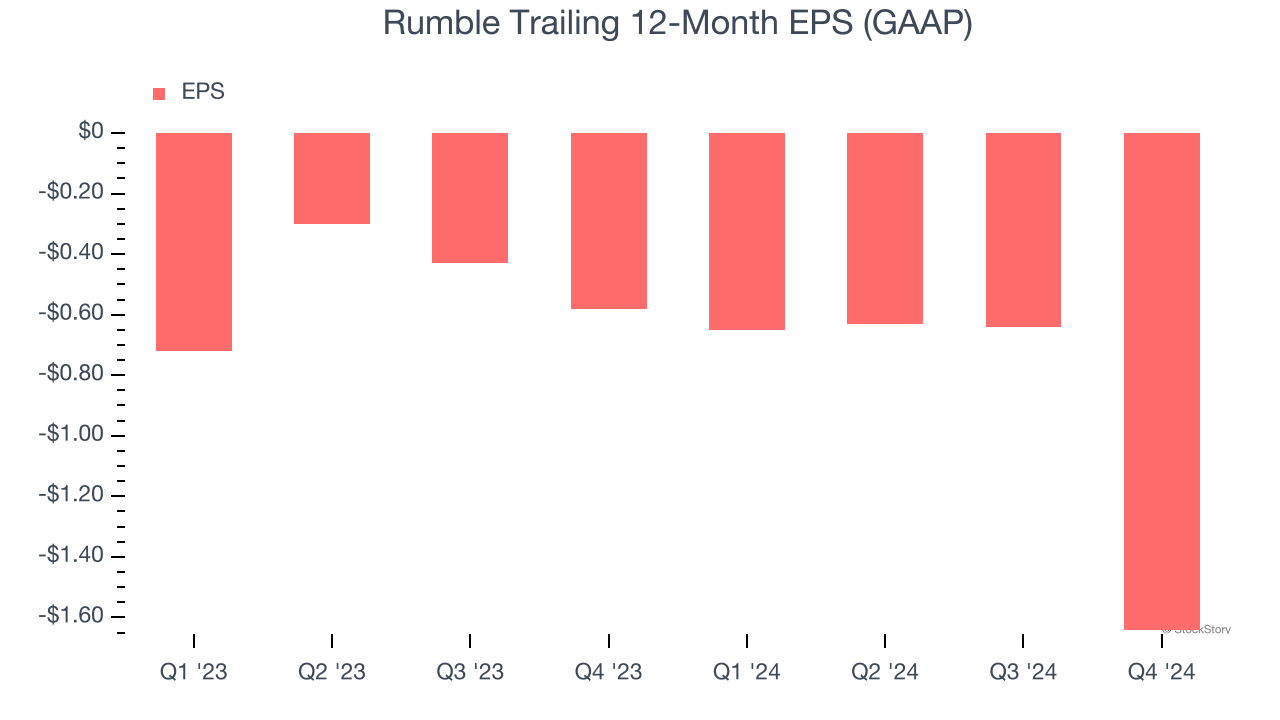

Rumble’s earnings losses deepened over the last two years as its EPS dropped 57% annually. We’ll keep a close eye on the company as diminishing earnings could imply changing secular trends and preferences.

In Q4, Rumble reported EPS at negative $1.15, down from negative $0.15 in the same quarter last year. This print missed analysts’ estimates. This was largely due to a change in the fair value of derivatives, a one-time, non-fundamental occurrence. Over the next 12 months, Wall Street is optimistic. Analysts forecast Rumble’s full-year EPS of negative $1.64 will reach break even.

Key Takeaways from Rumble’s Q4 Results

It was encouraging to see Rumble beat analysts’ revenue and EBITDA expectations this quarter. On the other hand, its revenue guidance for next quarter missed. Overall, this was a mixed quarter. The stock remained flat at $8.05 immediately following the results.

Is Rumble an attractive investment opportunity at the current price? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.