Watsco currently trades at $513.39 per share and has shown little upside over the past six months, posting a middling return of 3.1%.

Is there a buying opportunity in Watsco, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

We don't have much confidence in Watsco. Here are three reasons why we avoid WSO and a stock we'd rather own.

Why Is Watsco Not Exciting?

Originally a manufacturing company, Watsco (NYSE: WSO) today only distributes air conditioning, heating, and refrigeration equipment, as well as related parts and supplies.

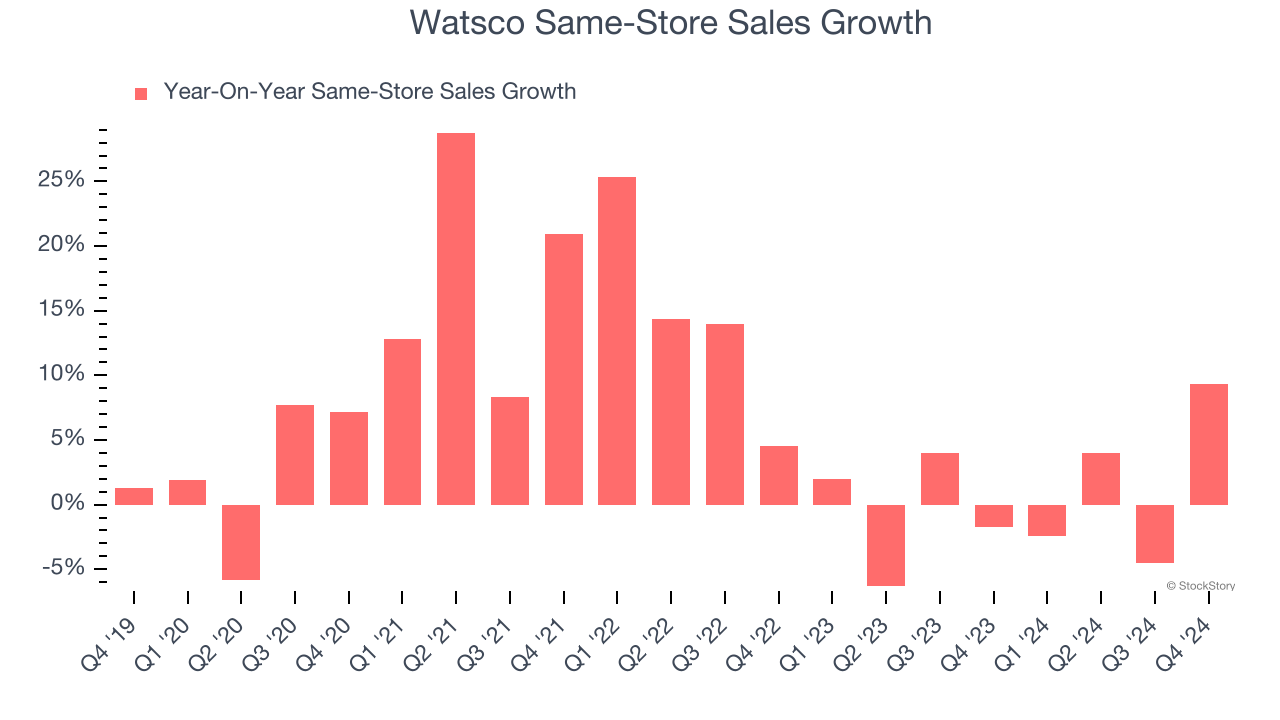

1. Flat Same-Store Sales Indicate Weak Demand

In addition to reported revenue, same-store sales are a useful data point for analyzing Infrastructure Distributors companies. This metric measures the change in sales at brick-and-mortar locations that have existed for at least a year, giving visibility into Watsco’s underlying demand characteristics.

Over the last two years, Watsco failed to grow its same-store sales. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Watsco might have to change its strategy and pricing, which can disrupt operations.

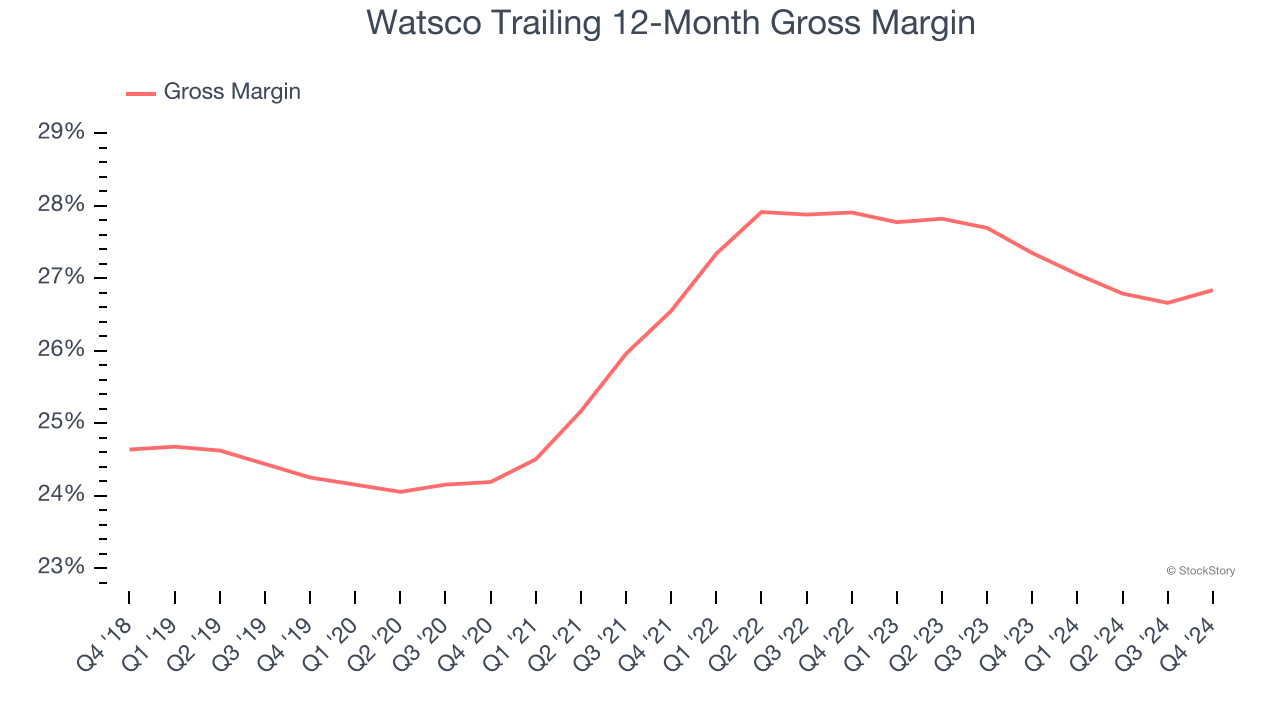

2. Low Gross Margin Reveals Weak Structural Profitability

Cost of sales for an industrials business is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics.

Watsco has bad unit economics for an industrials company, giving it less room to reinvest and develop new offerings. As you can see below, it averaged a 26.7% gross margin over the last five years. That means Watsco paid its suppliers a lot of money ($73.27 for every $100 in revenue) to run its business.

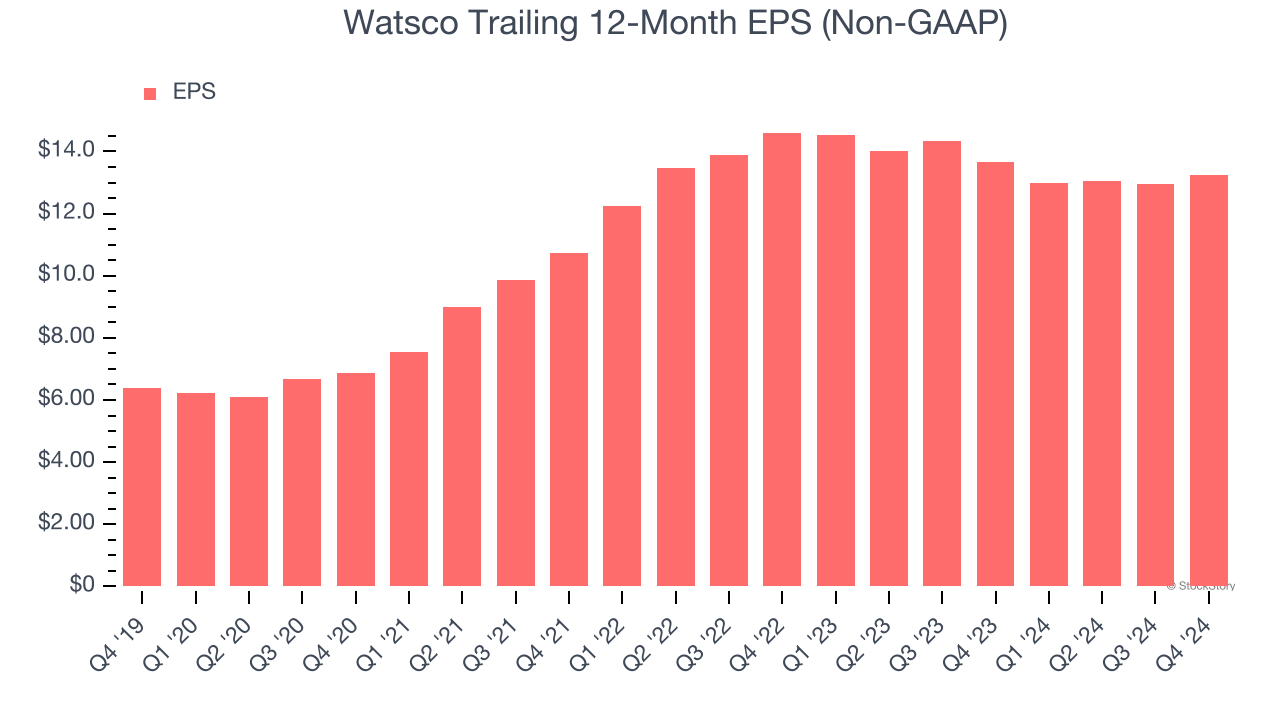

3. EPS Took a Dip Over the Last Two Years

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for Watsco, its EPS declined by 4.8% annually over the last two years while its revenue grew by 2.3%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Watsco’s business quality ultimately falls short of our standards. That said, the stock currently trades at 35.1× forward price-to-earnings (or $513.39 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - you can find better investment opportunities elsewhere. We’d suggest looking at our favorite semiconductor picks and shovels play.

Stocks We Would Buy Instead of Watsco

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.