Alta’s stock price has taken a beating over the past six months, shedding 20.9% of its value and falling to $5.10 per share. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in Alta, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Even though the stock has become cheaper, we're swiping left on Alta for now. Here are three reasons why there are better opportunities than ALTG and a stock we'd rather own.

Why Is Alta Not Exciting?

Founded in 1984, Alta Equipment Group (NYSE: ALTG) is a provider of industrial and construction equipment and services across the Midwest and Northeast United States.

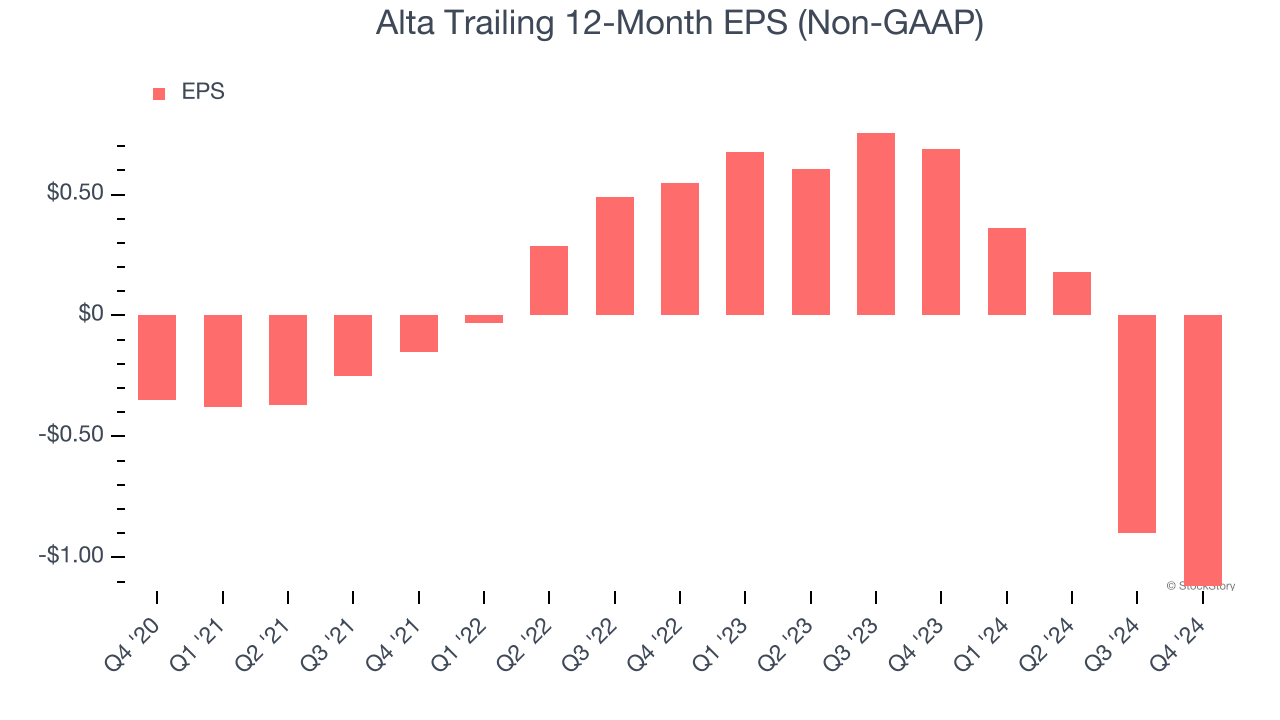

1. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Alta’s earnings losses deepened over the last four years as its EPS dropped 34% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Alta’s low margin of safety could leave its stock price susceptible to large downswings.

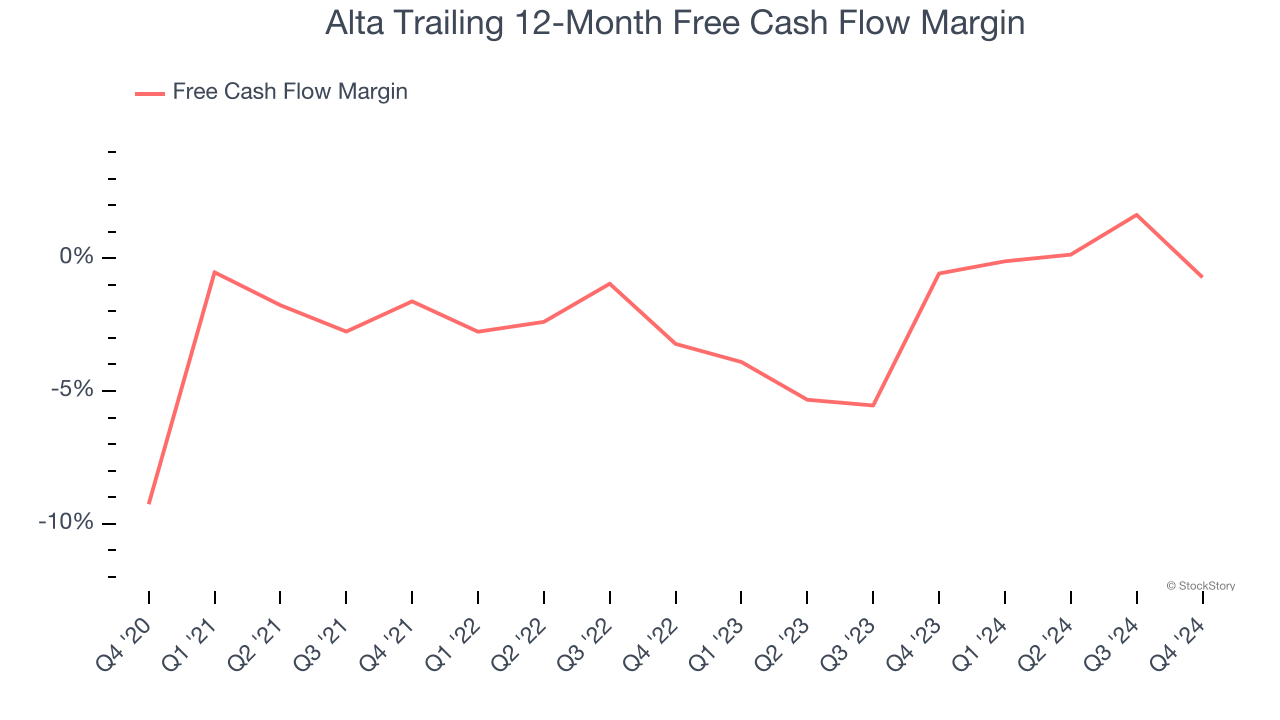

2. Cash Burn Ignites Concerns

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

While Alta posted positive free cash flow this quarter, the broader story hasn’t been so clean. Alta’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 2.4%, meaning it lit $2.37 of cash on fire for every $100 in revenue.

3. Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Alta historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 2.3%, lower than the typical cost of capital (how much it costs to raise money) for industrials companies.

Final Judgment

Alta isn’t a terrible business, but it doesn’t pass our bar. After the recent drawdown, the stock trades at 0.9× forward EV-to-EBITDA (or $5.10 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're fairly confident there are better investments elsewhere. We’d suggest looking at the most dominant software business in the world.

Stocks We Would Buy Instead of Alta

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.