Looking back on industrial & environmental services stocks’ Q4 earnings, we examine this quarter’s best and worst performers, including Cintas (NASDAQ: CTAS) and its peers.

Growing regulatory pressure on environmental compliance and increasing corporate ESG commitments should buoy the sector for years to come. On the other hand, environmental regulations continue to evolve, and this may require costly upgrades, volatility in commodity waste and recycling markets, and labor shortages in industrial services. As for digitization, a theme that is impacting nearly every industry, the increasing use of data, analytics, and automation will give rise to improved efficiency of operations. Conversely, though, the benefits of digitization also come with challenges of integrating new technologies into legacy systems.

The 8 industrial & environmental services stocks we track reported a strong Q4. As a group, revenues beat analysts’ consensus estimates by 1.2% while next quarter’s revenue guidance was 1.2% above.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 5.4% since the latest earnings results.

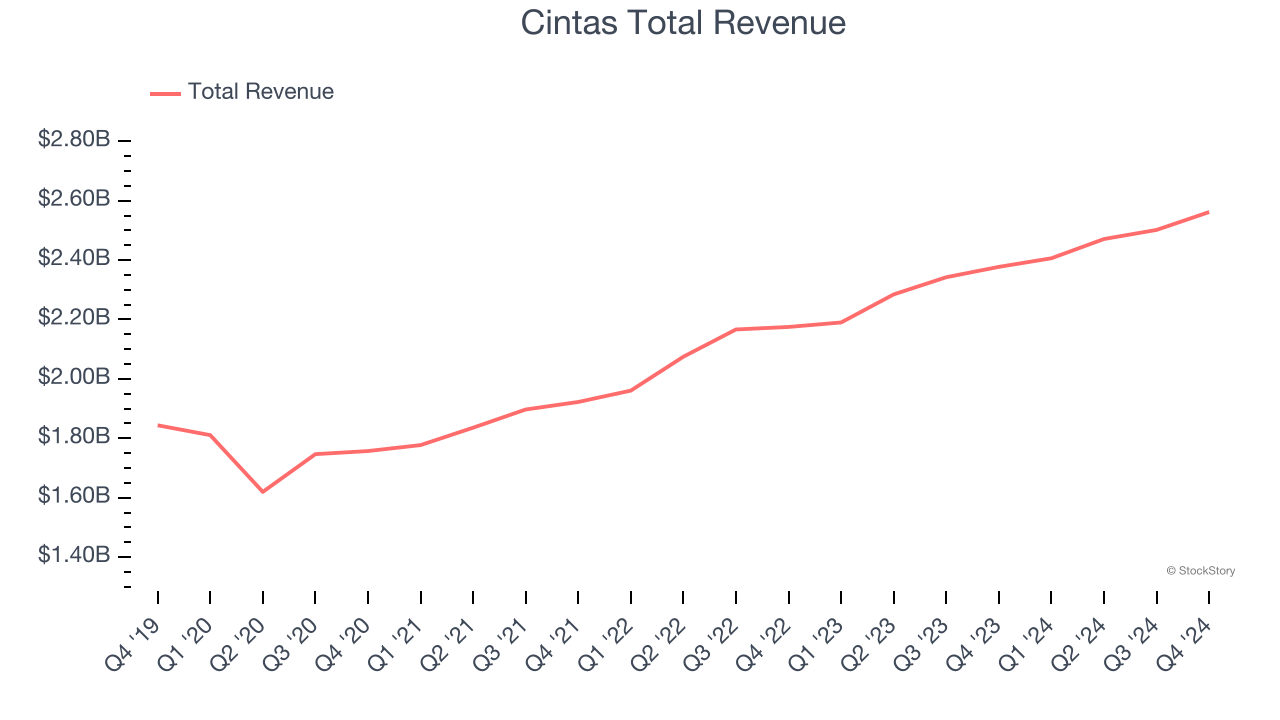

Cintas (NASDAQ: CTAS)

Starting as a family business collecting and cleaning shop rags in Cincinnati, Cintas (NASDAQ: CTAS) provides corporate identity uniforms, facility services, and safety products to over one million businesses across North America.

Cintas reported revenues of $2.56 billion, up 7.8% year on year. This print was in line with analysts’ expectations, and overall, it was a strong quarter for the company with a solid beat of analysts’ EPS estimates and a decent beat of analysts’ full-year EPS guidance estimates.

The stock is down 5.8% since reporting and currently trades at $192.61.

We think Cintas is a good business, but is it a buy today? Read our full report here, it’s free.

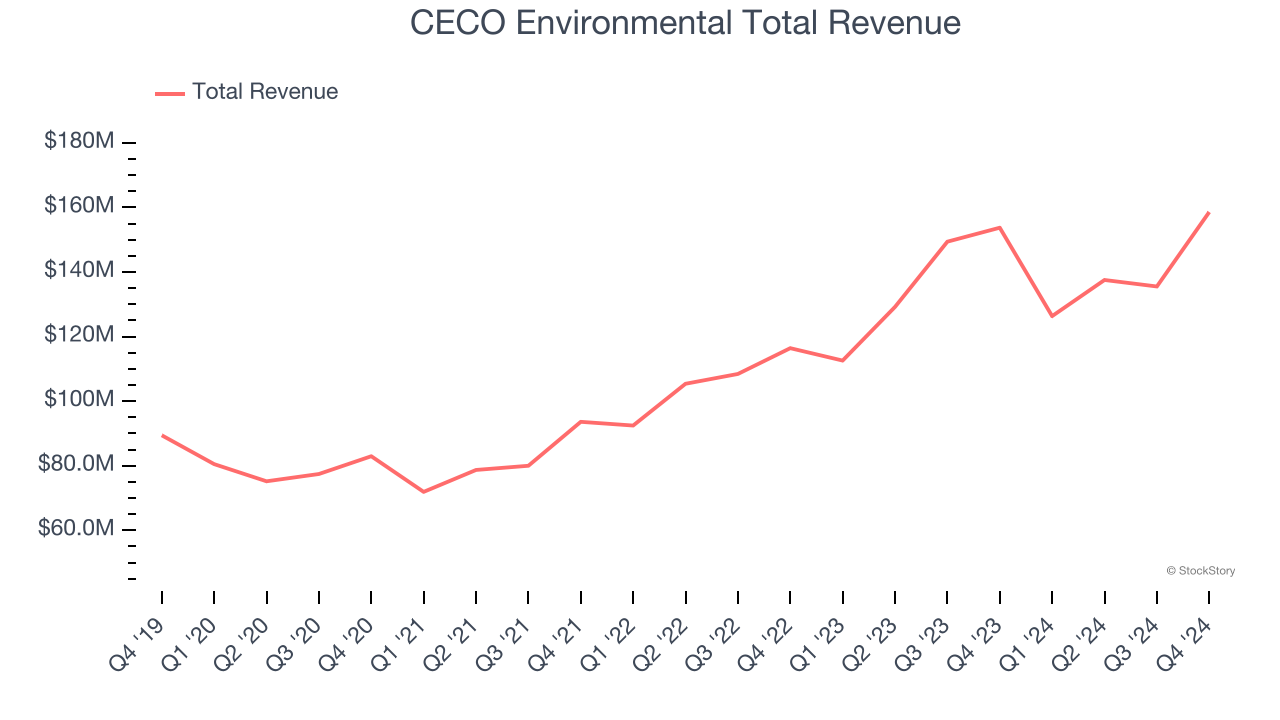

Best Q4: CECO Environmental (NASDAQ: CECO)

With roots dating back to 1869 and a focus on creating cleaner industrial operations, CECO Environmental (NASDAQ: CECO) provides technology and expertise that helps industrial companies reduce emissions, treat water, and improve energy efficiency across various sectors.

CECO Environmental reported revenues of $158.6 million, up 3.2% year on year, outperforming analysts’ expectations by 1.4%. The business had an exceptional quarter with a solid beat of analysts’ EPS estimates and full-year revenue guidance exceeding analysts’ expectations.

CECO Environmental achieved the highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 5.9% since reporting. It currently trades at $24.01.

Is now the time to buy CECO Environmental? Access our full analysis of the earnings results here, it’s free.

Slowest Q4: Driven Brands (NASDAQ: DRVN)

With approximately 5,000 locations across 49 U.S. states and 13 other countries, Driven Brands (NASDAQ: DRVN) operates a network of automotive service centers offering maintenance, car washes, paint, collision repair, and glass services across North America.

Driven Brands reported revenues of $564.1 million, up 1.9% year on year, falling short of analysts’ expectations by 1.6%. It was a slower quarter as it posted full-year revenue guidance missing analysts’ expectations.

Driven Brands delivered the weakest performance against analyst estimates and weakest full-year guidance update in the group. Interestingly, the stock is up 13.5% since the results and currently trades at $17.41.

Read our full analysis of Driven Brands’s results here.

Vestis (NYSE: VSTS)

Operating a network of more than 350 facilities with 3,300 delivery routes serving customers weekly, Vestis (NYSE: VSTS) provides uniform rentals, workplace supplies, and facility services to over 300,000 business locations across the United States and Canada.

Vestis reported revenues of $683.8 million, down 4.8% year on year. This number lagged analysts' expectations by 0.7%. Taking a step back, it was a satisfactory quarter as it also logged an impressive beat of analysts’ EPS estimates.

Vestis had the slowest revenue growth among its peers. The stock is down 35.5% since reporting and currently trades at $10.22.

Read our full, actionable report on Vestis here, it’s free.

Tetra Tech (NASDAQ: TTEK)

With a 50-year legacy of "Leading with Science" and operations on all seven continents, Tetra Tech (NASDAQ: TTEK) provides high-end consulting and engineering services focused on water management, environmental solutions, and sustainable infrastructure for government and commercial clients worldwide.

Tetra Tech reported revenues of $1.20 billion, up 17.9% year on year. This result surpassed analysts’ expectations by 8.6%. Overall, it was a strong quarter as it also logged revenue guidance for next quarter slightly topping analysts’ expectations and a decent beat of analysts’ EPS estimates.

Tetra Tech scored the biggest analyst estimates beat and fastest revenue growth among its peers. The stock is down 22% since reporting and currently trades at $29.40.

Read our full, actionable report on Tetra Tech here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.