Cruise ship company Carnival (NYSE: CCL) beat Wall Street’s revenue expectations in Q1 CY2025, with sales up 7.5% year on year to $5.81 billion. Its non-GAAP profit of $0.13 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Carnival? Find out by accessing our full research report, it’s free.

Carnival (CCL) Q1 CY2025 Highlights:

- Revenue: $5.81 billion vs analyst estimates of $5.76 billion (7.5% year-on-year growth, 0.9% beat)

- Adjusted EPS: $0.13 vs analyst estimates of $0.02 (significant beat)

- Adjusted EBITDA: $1.21 billion vs analyst estimates of $1.06 billion (20.7% margin, 14% beat)

- Management raised its full-year Adjusted EPS guidance to $1.83 at the midpoint

- EBITDA guidance for the full year is $6.7 billion at the midpoint, in line with analyst expectations

- Operating Margin: 9.3%, up from 5.1% in the same quarter last year

- Passenger Cruise Days: 24.3 million, up 803,146 year on year

- Market Capitalization: $27.42 billion

"Our first quarter was truly characterized by outperformance. This was across the board and led by incredibly strong demand throughout our portfolio including exceptional close-in demand that exceeded expectations for both ticket prices and onboard spending," commented Carnival Corporation & plc's Chief Executive Officer Josh Weinstein.

Company Overview

Boasting outrageous amenities like a planetarium on board its ships, Carnival (NYSE: CCL) is one of the world's largest leisure travel companies and a prominent player in the cruise industry.

Travel and Vacation Providers

Airlines, hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional airlines, hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

Sales Growth

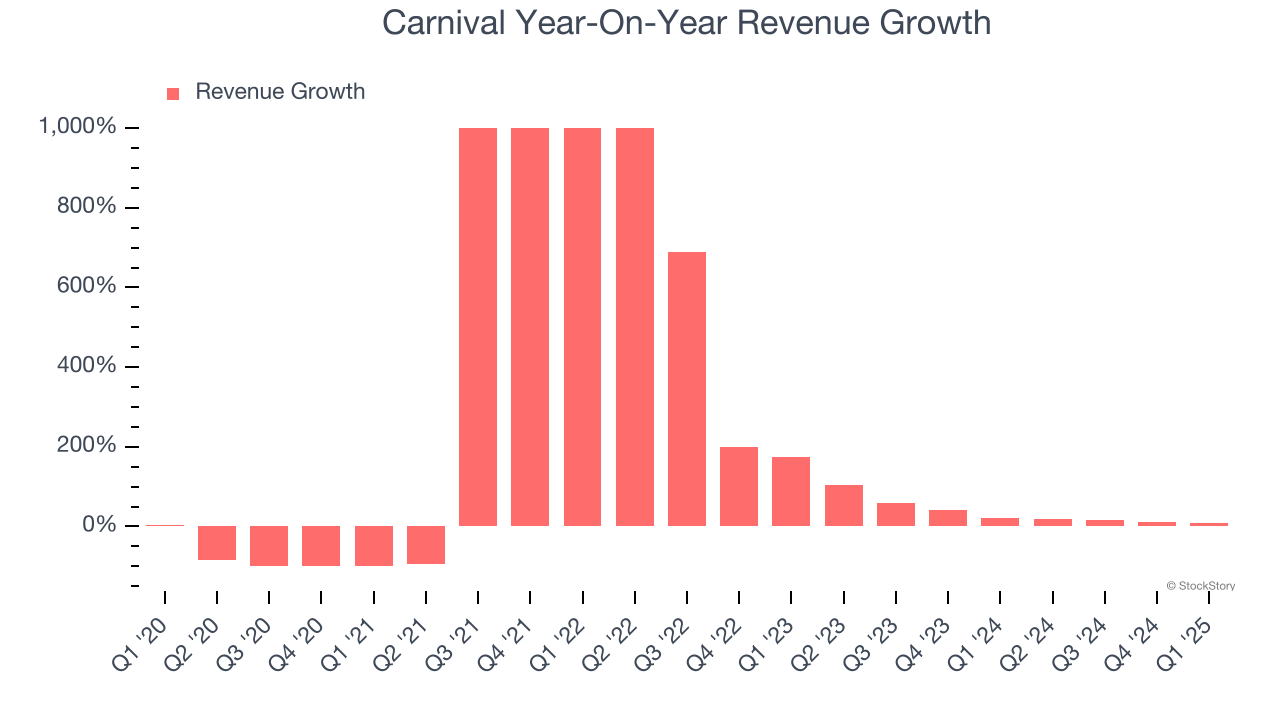

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Carnival grew its sales at a sluggish 4% compounded annual growth rate. This was below our standard for the consumer discretionary sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or trend. Carnival’s annualized revenue growth of 30.3% over the last two years is above its five-year trend, suggesting its demand recently accelerated. Note that COVID hurt Carnival’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

Carnival also discloses its number of passenger cruise days, which reached 24.3 million in the latest quarter. Over the last two years, Carnival’s passenger cruise days averaged 26.2% year-on-year growth. Because this number is lower than its revenue growth during the same period, we can see the company’s monetization has risen.

This quarter, Carnival reported year-on-year revenue growth of 7.5%, and its $5.81 billion of revenue exceeded Wall Street’s estimates by 0.9%.

Looking ahead, sell-side analysts expect revenue to grow 3.5% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and implies its products and services will see some demand headwinds.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

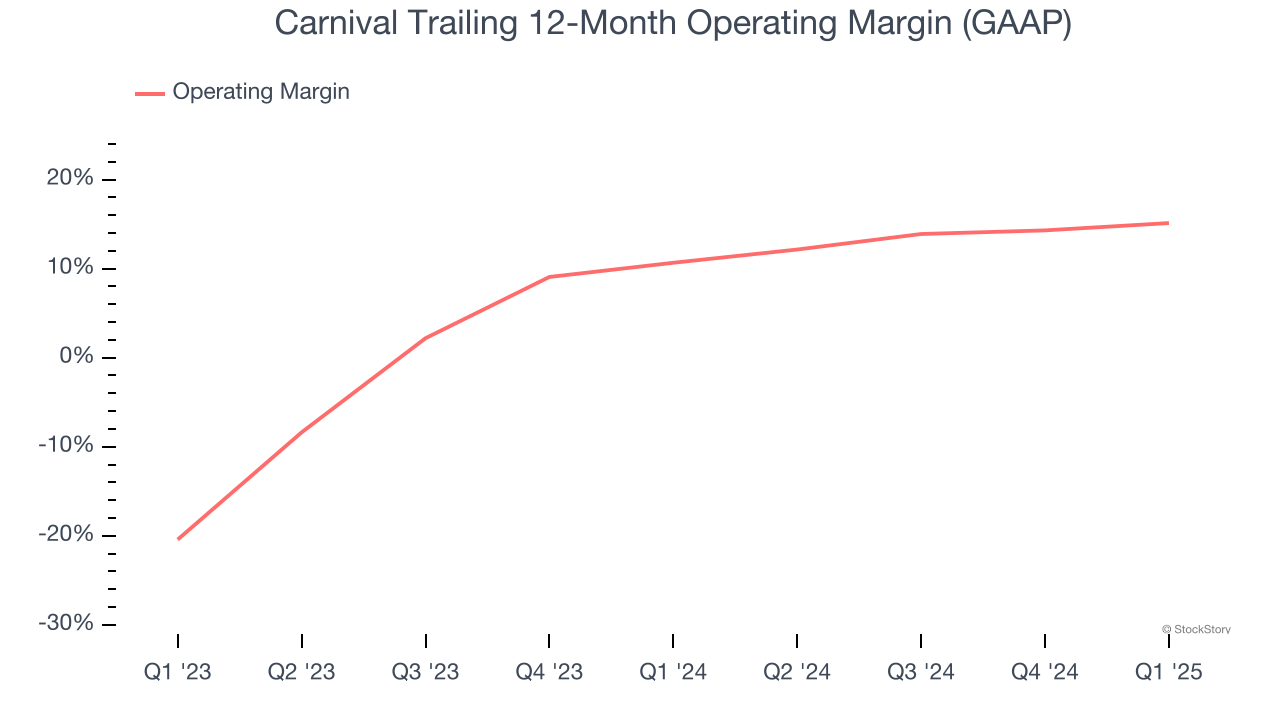

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Carnival’s operating margin has been trending up over the last 12 months and averaged 13% over the last two years. Its solid profitability for a consumer discretionary business shows it’s an efficient company that manages its expenses effectively.

In Q1, Carnival generated an operating profit margin of 9.3%, up 4.2 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

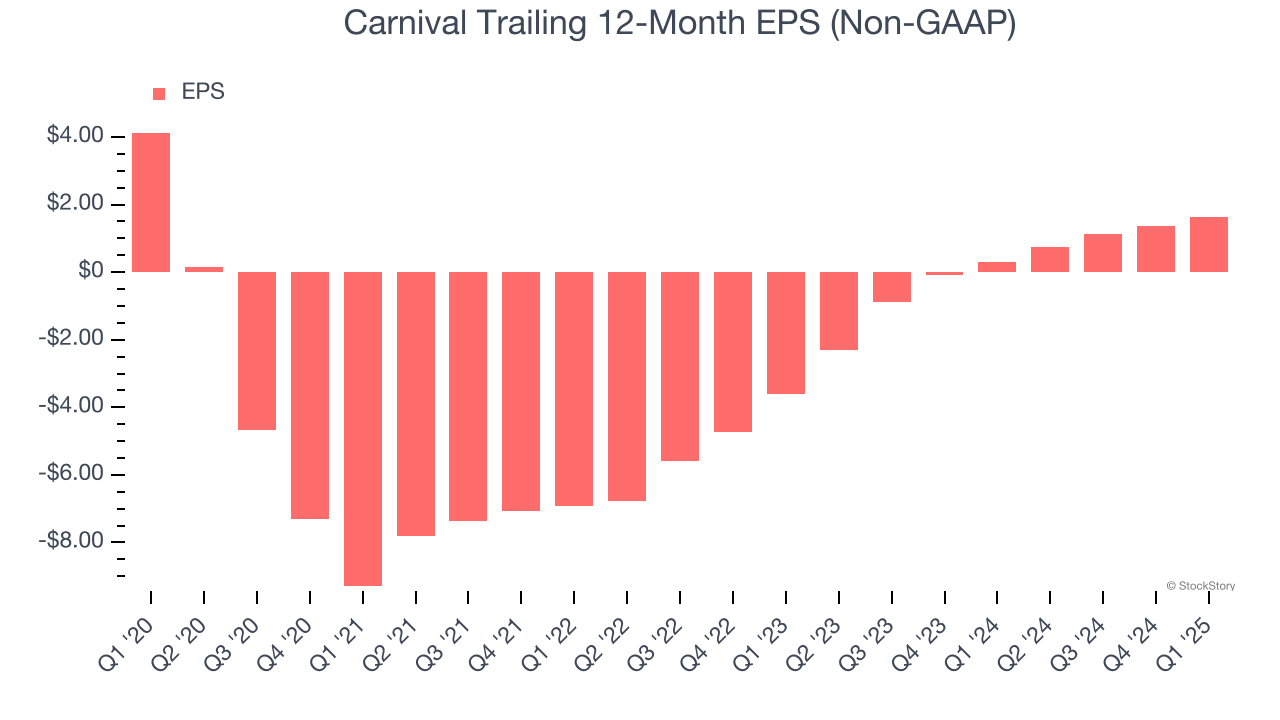

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Carnival, its EPS declined by 17% annually over the last five years while its revenue grew by 4%. However, its operating margin actually expanded during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

In Q1, Carnival reported EPS at $0.13, up from negative $0.14 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Carnival’s full-year EPS of $1.63 to grow 10.4%.

Key Takeaways from Carnival’s Q1 Results

We liked that Carnival beat analysts’ EBITDA expectations this quarter. On the other hand, its EBITDA guidance for next quarter missed. Overall, this quarter had some key positives. The market seemed to focus on the negatives, and the stock traded down 3.3% to $20.50 immediately after reporting.

Is Carnival an attractive investment opportunity at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.