Since September 2024, CarGurus has been in a holding pattern, floating around $29.75.

Is there a buying opportunity in CarGurus, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

We're swiping left on CarGurus for now. Here are three reasons why there are better opportunities than CARG and a stock we'd rather own.

Why Is CarGurus Not Exciting?

Bringing transparency to a sometimes opaque process, CarGurus (NASDAQ: CARG) is a digital marketplace where auto dealers can connect with potential customers and where car buyers can browse, purchase, and obtain financing.

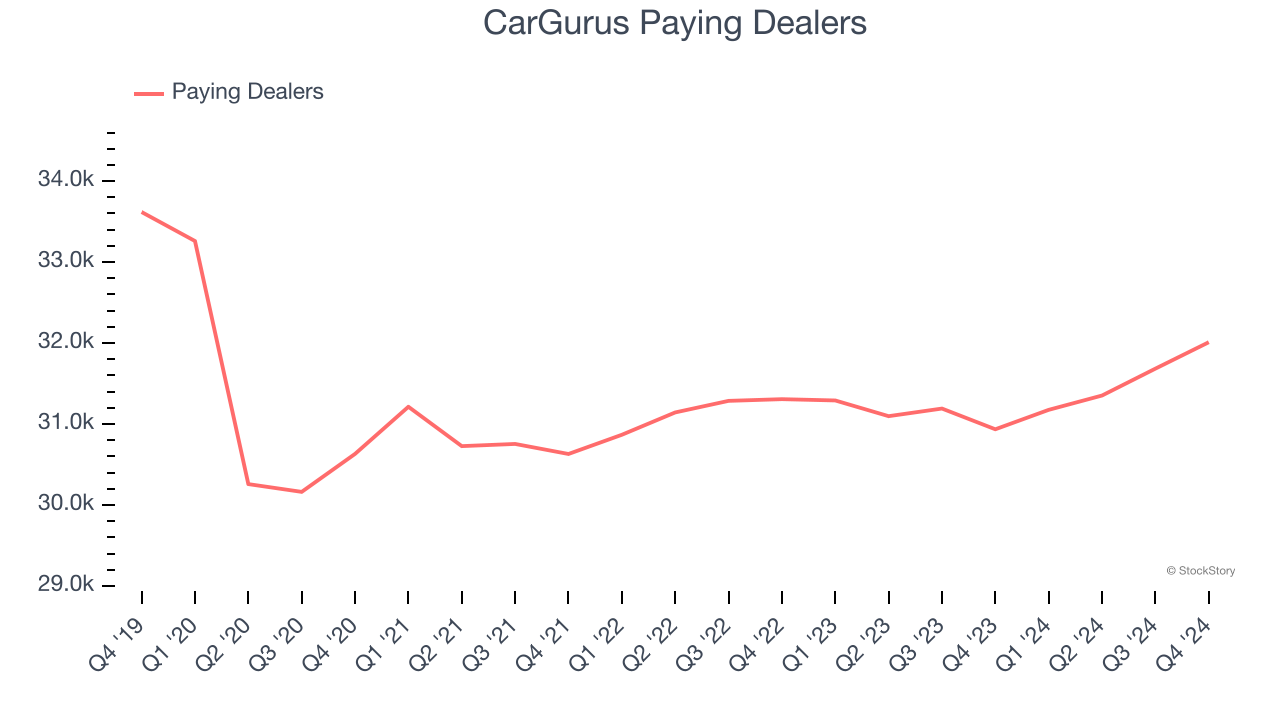

1. Paying Dealers Hit a Plateau

As an online marketplace, CarGurus generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

CarGurus struggled with new customer acquisition over the last two years as its paying dealers were flat at 32,010. This performance isn't ideal because internet usage is secular, meaning there are typically unaddressed market opportunities. If CarGurus wants to accelerate growth, it likely needs to enhance the appeal of its current offerings or innovate with new products.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect CarGurus’s revenue to rise by 5.7%. While this projection implies its newer products and services will fuel better top-line performance, it is still below the sector average.

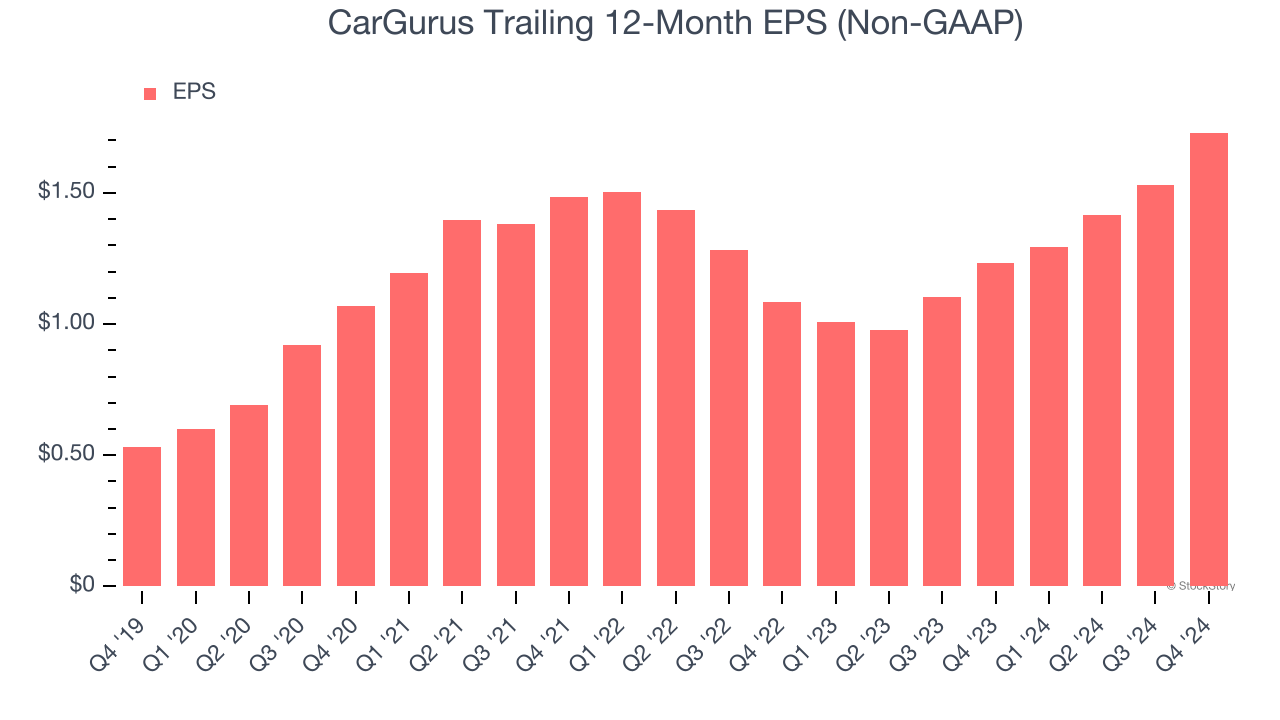

3. EPS Barely Growing

Analyzing the change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

CarGurus’s EPS grew at an unimpressive 5.2% compounded annual growth rate over the last three years. On the bright side, this performance was better than its 2% annualized revenue declines and tells us management adapted its cost structure in response to a challenging demand environment.

Final Judgment

CarGurus isn’t a terrible business, but it doesn’t pass our bar. That said, the stock currently trades at 11.4× forward EV-to-EBITDA (or $29.75 per share). Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere. We’d suggest looking at a fast-growing restaurant franchise with an A+ ranch dressing sauce.

Stocks We Like More Than CarGurus

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.