Although the S&P 500 is down 1.4% over the past six months, Alight’s stock price has fallen further to $6.01, losing shareholders 18% of their capital. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in Alight, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Despite the more favorable entry price, we're cautious about Alight. Here are three reasons why we avoid ALIT and a stock we'd rather own.

Why Do We Think Alight Will Underperform?

Born from a corporate spinoff in 2020 to focus on employee experience technology, Alight (NYSE: ALIT) provides human capital management solutions that help companies administer employee benefits, payroll, and workforce management systems.

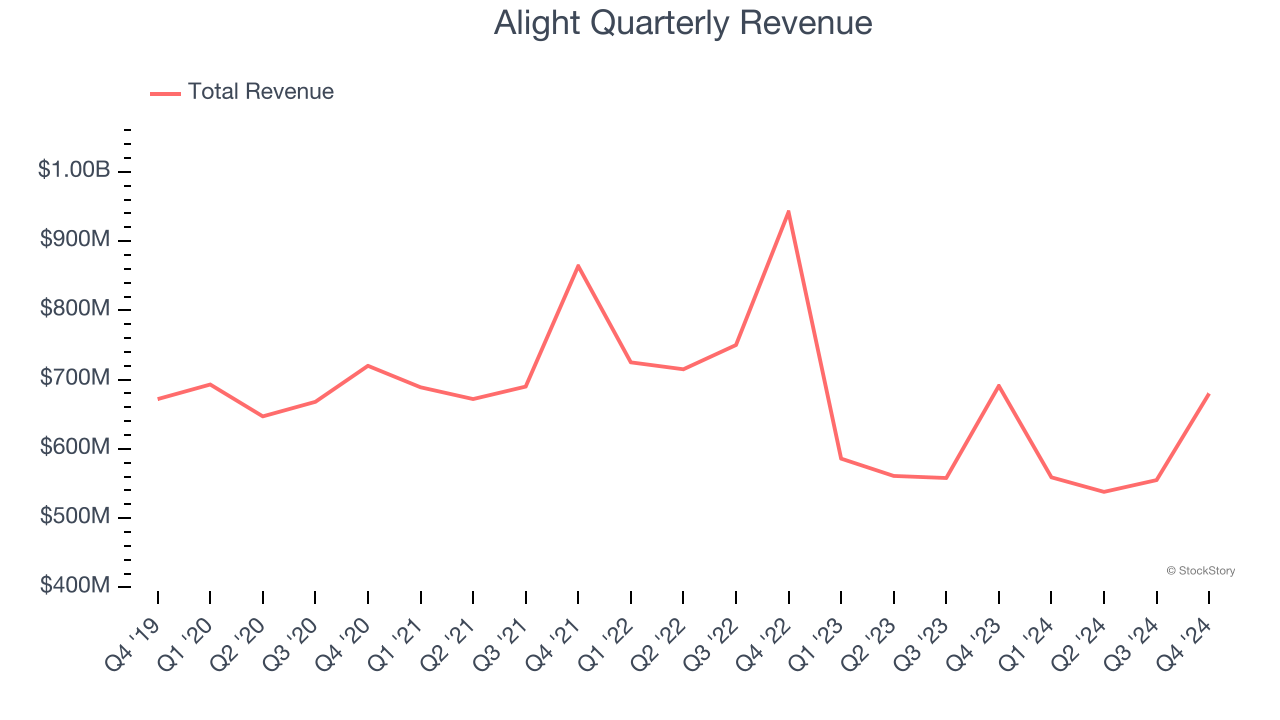

1. Revenue Spiraling Downwards

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Alight struggled to consistently generate demand over the last five years as its sales dropped at a 1% annual rate. This wasn’t a great result and signals it’s a low quality business.

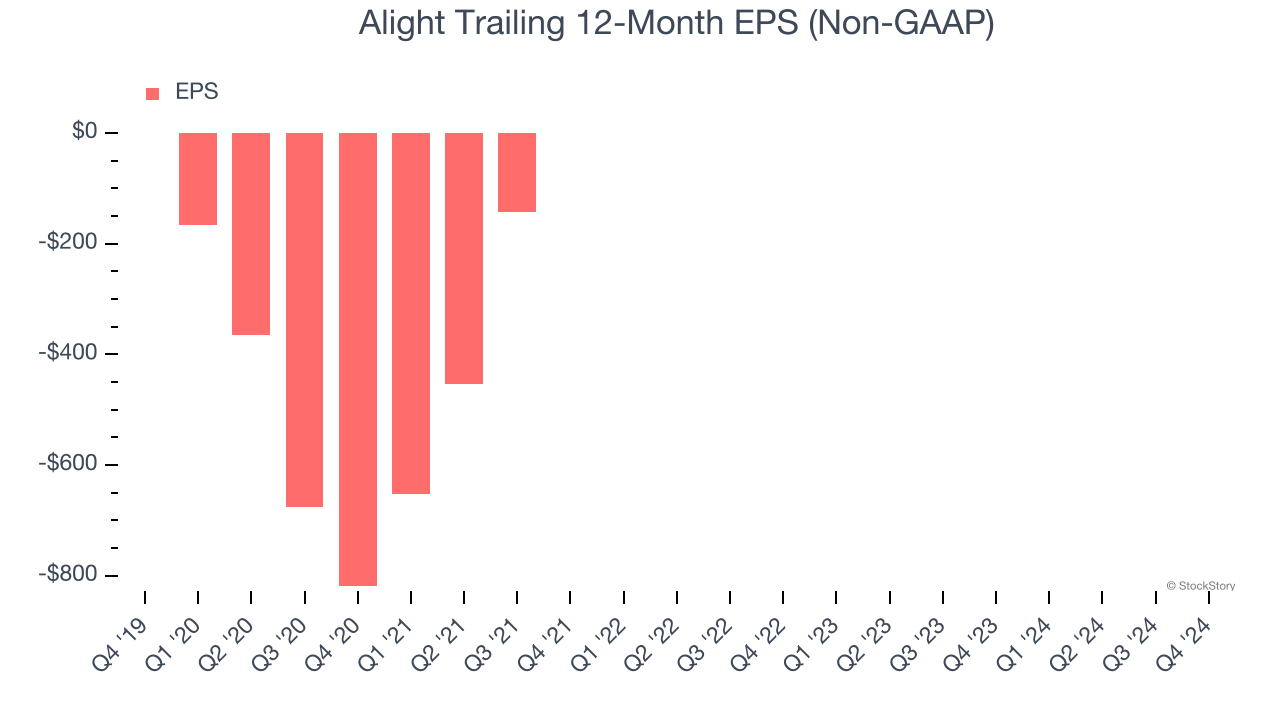

2. EPS Took a Dip Over the Last Two Years

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for Alight, its EPS and revenue declined by 2.3% and 13.7% annually over the last two years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Alight’s low margin of safety could leave its stock price susceptible to large downswings.

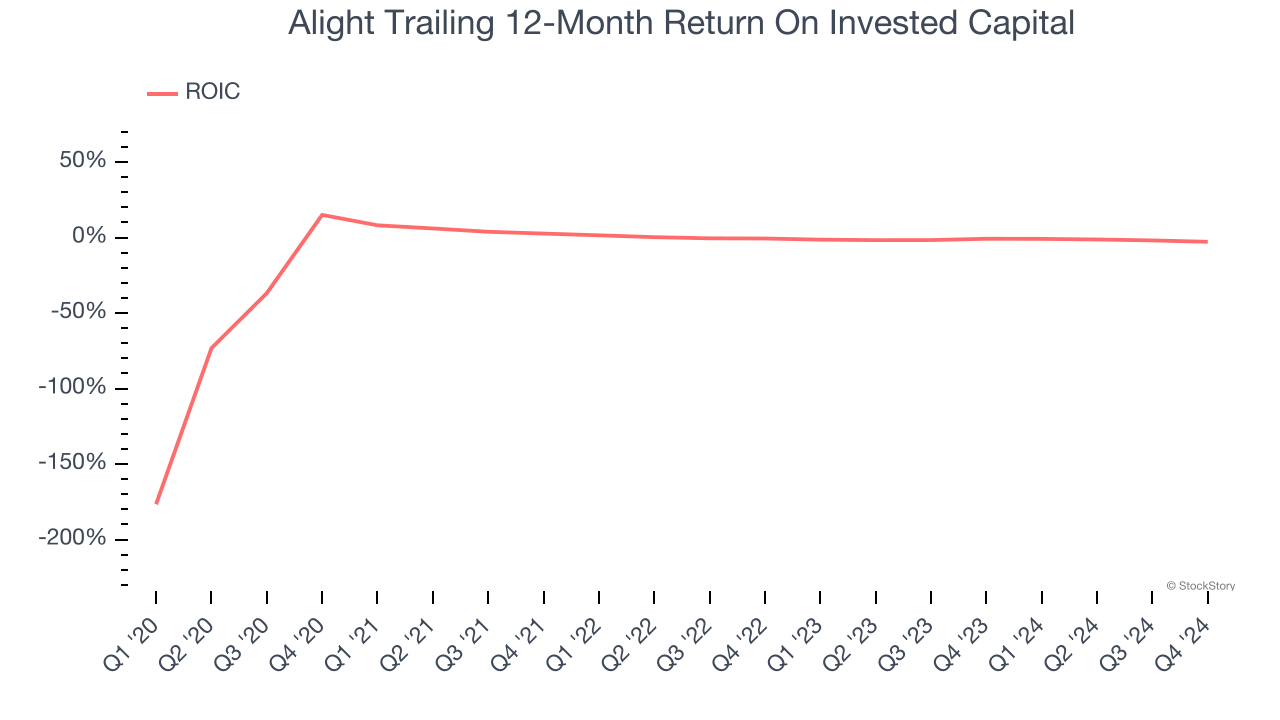

3. New Investments Fail to Bear Fruit as ROIC Declines

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Alight’s ROIC has unfortunately decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

We see the value of companies helping consumers, but in the case of Alight, we’re out. After the recent drawdown, the stock trades at 9.5× forward price-to-earnings (or $6.01 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are more exciting stocks to buy at the moment. We’d suggest looking at a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Like More Than Alight

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.