Over the last six months, Vital Farms shares have sunk to $29.92, producing a disappointing 12.8% loss - worse than the S&P 500’s 1.4% drop. This might have investors contemplating their next move.

Given the weaker price action, is now the time to buy VITL? Find out in our full research report, it’s free.

Why Are We Positive On Vital Farms?

With an emphasis on ethically produced products, Vital Farms (NASDAQ: VITL) specializes in pasture-raised eggs and butter.

1. Elevated Demand Drives Higher Sales Volumes

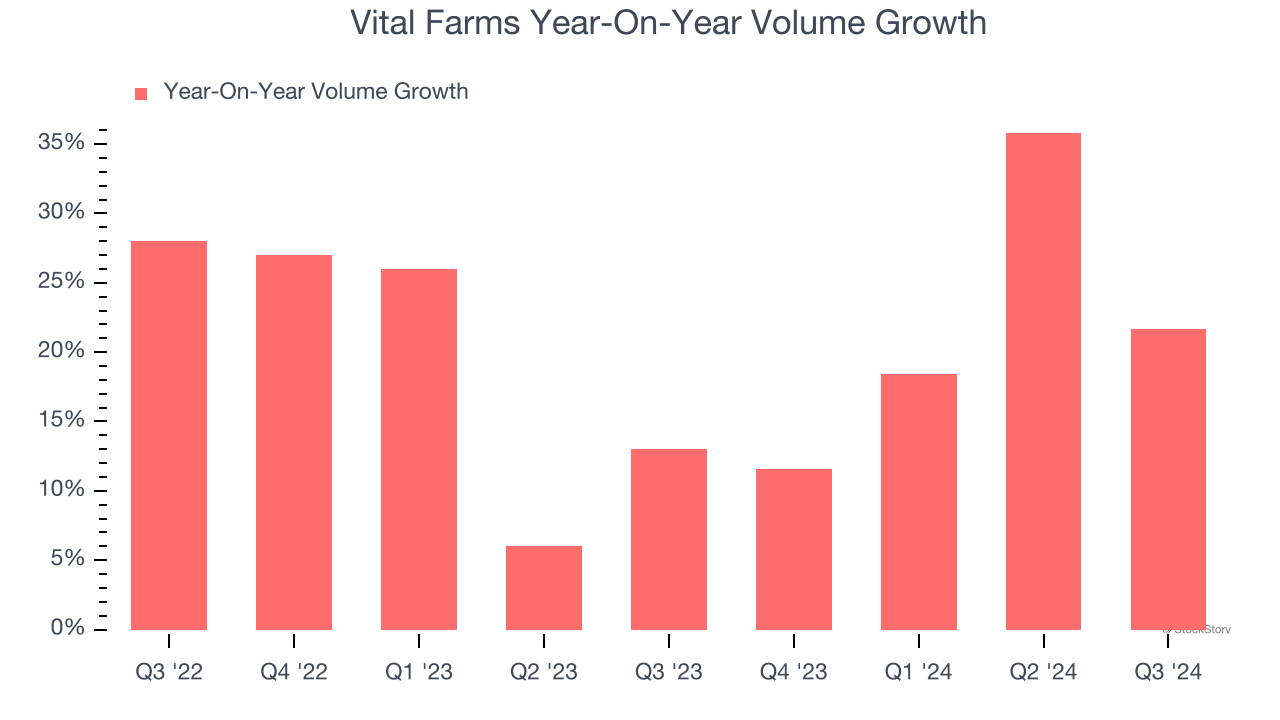

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Vital Farms’s average quarterly volume growth of 18.9% over the last two years has beaten the competition by a long shot. This is great because companies with significant volume growth are needles in a haystack in the stable consumer staples sector.

2. Projected Revenue Growth Is Remarkable

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses become larger.

Over the next 12 months, sell-side analysts expect Vital Farms’s revenue to rise by 22.2%. While this projection is below its 32.5% annualized growth rate for the past three years, it is eye-popping and suggests the market is baking in success for its products.

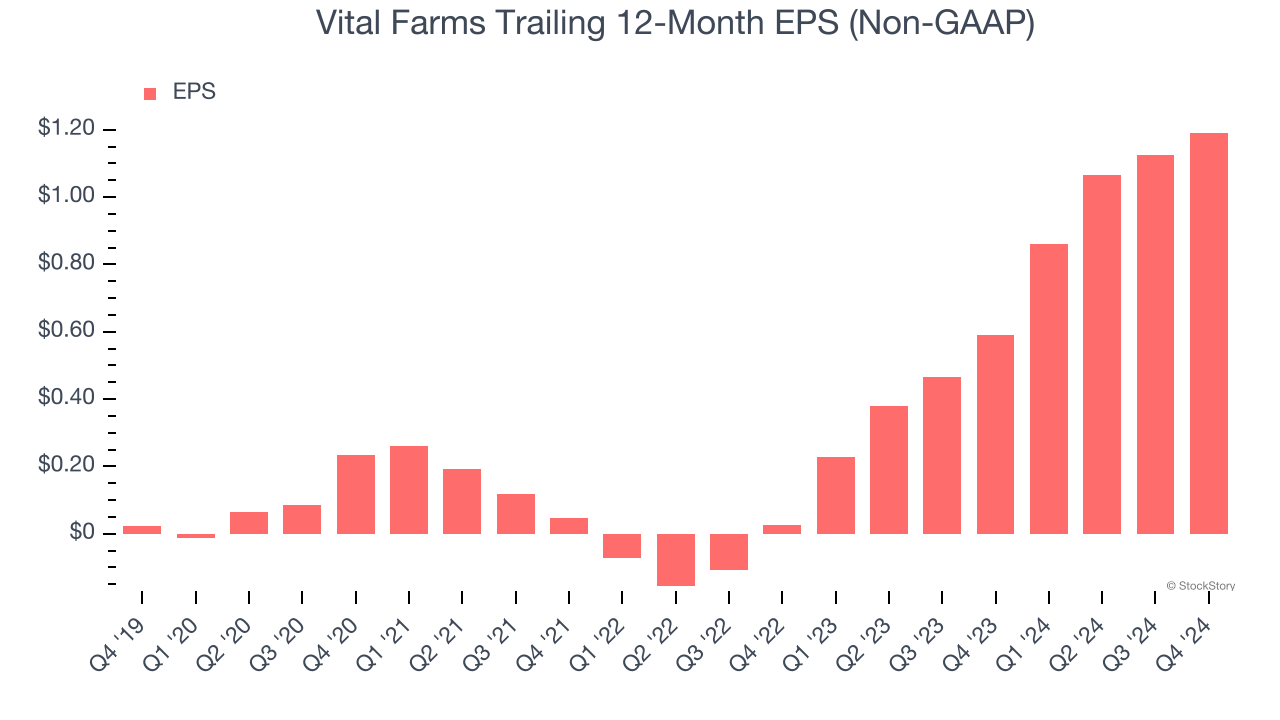

3. Outstanding Long-Term EPS Growth

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Vital Farms’s EPS grew at an astounding 194% compounded annual growth rate over the last three years, higher than its 32.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Final Judgment

These are just a few reasons Vital Farms is a high-quality business worth owning. With the recent decline, the stock trades at 24.4× forward price-to-earnings (or $29.92 per share). Is now the right time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Vital Farms

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.