Over the past six months, HNI’s shares (currently trading at $43.86) have posted a disappointing 17.9% loss while the S&P 500 was down 1.7%. This may have investors wondering how to approach the situation.

Is now the time to buy HNI, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Despite the more favorable entry price, we're swiping left on HNI for now. Here are three reasons why HNI doesn't excite us and a stock we'd rather own.

Why Is HNI Not Exciting?

With roots dating back to 1944 and a significant acquisition of Kimball International in 2023, HNI (NYSE: HNI) manufactures and sells office furniture systems, seating, and storage solutions, as well as residential fireplaces and heating products.

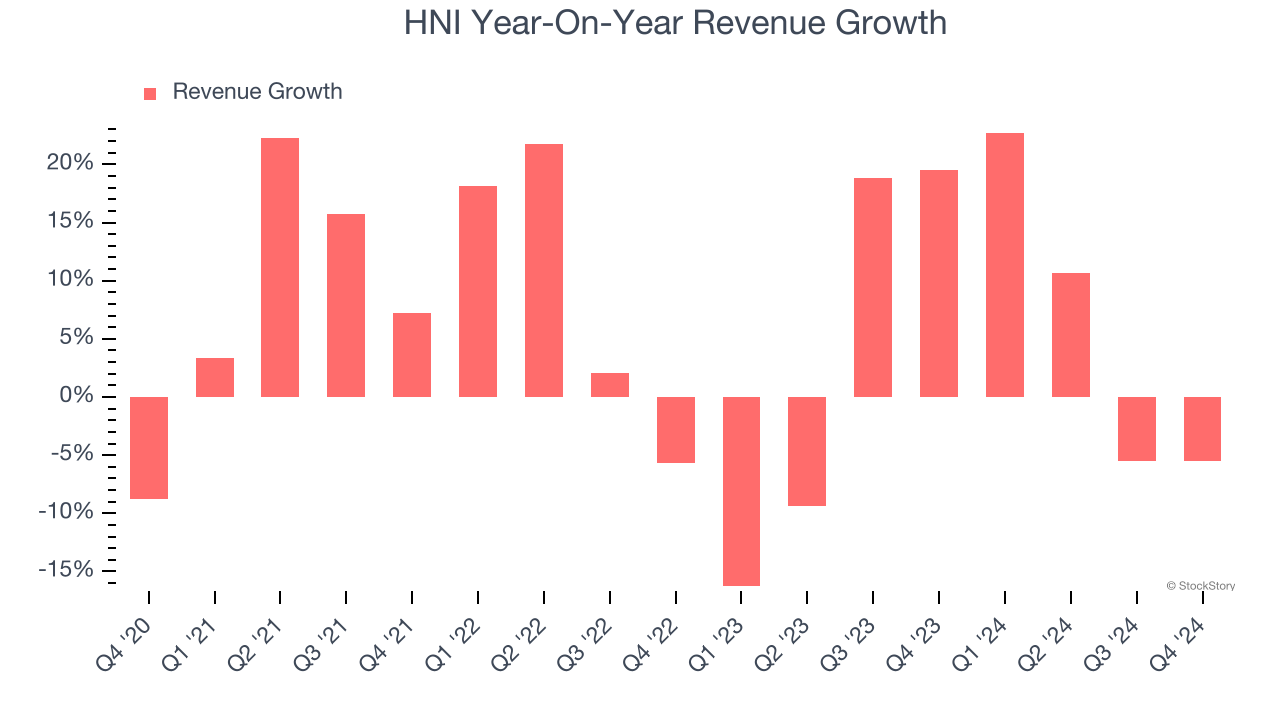

1. Lackluster Revenue Growth

Long-term growth is the most important, but within business services, a stretched historical view may miss new innovations or demand cycles. HNI’s recent history shows its demand has slowed as its annualized revenue growth of 3.4% over the last two years was below its four-year trend.

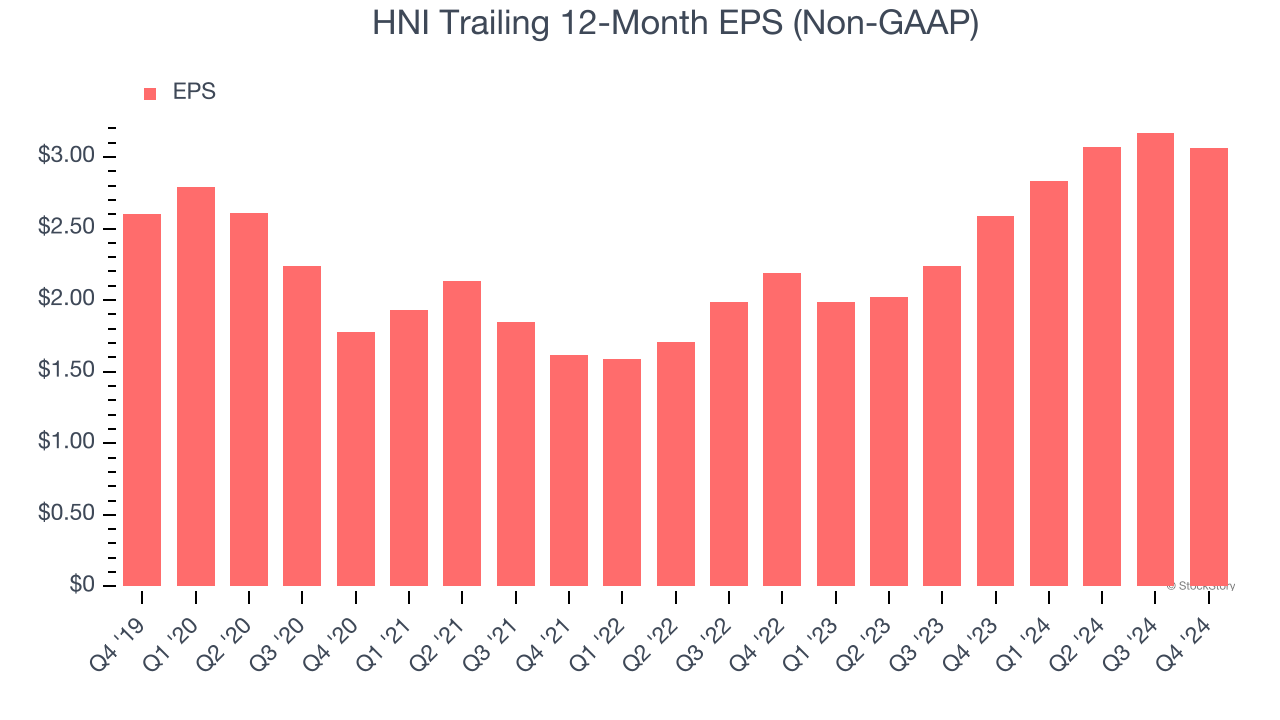

2. EPS Barely Growing

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

HNI’s full-year EPS grew at a weak 3.3% compounded annual growth rate over the last five years, worse than the broader business services sector.

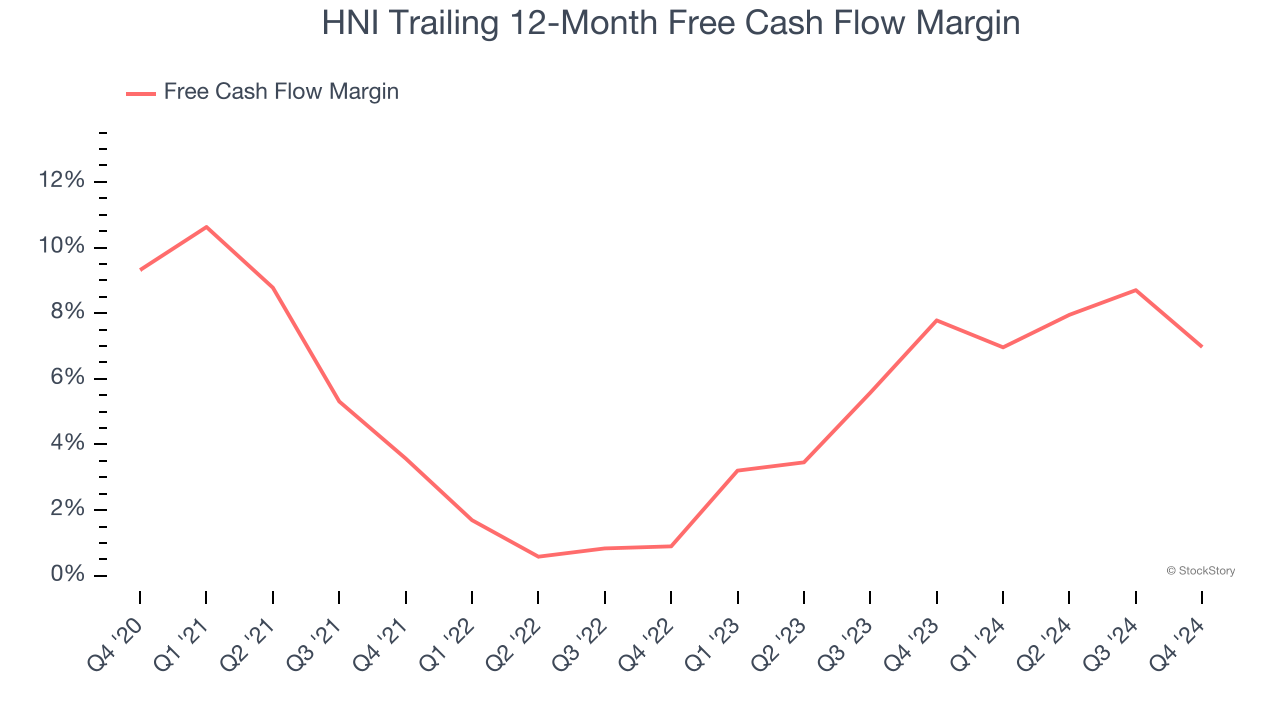

3. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, HNI’s margin dropped by 2.3 percentage points over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity. HNI’s free cash flow margin for the trailing 12 months was 7%.

Final Judgment

HNI’s business quality ultimately falls short of our standards. After the recent drawdown, the stock trades at 12.5× forward price-to-earnings (or $43.86 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better investments elsewhere. We’d recommend looking at the most dominant software business in the world.

Stocks We Would Buy Instead of HNI

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.