Over the last six months, Vestis’s shares have sunk to $12.66, producing a disappointing 16.7% loss while the S&P 500 was flat. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Vestis, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

Despite the more favorable entry price, we don't have much confidence in Vestis. Here are three reasons why you should be careful with VSTS and a stock we'd rather own.

Why Do We Think Vestis Will Underperform?

Operating a network of more than 350 facilities with 3,300 delivery routes serving customers weekly, Vestis (NYSE: VSTS) provides uniform rentals, workplace supplies, and facility services to over 300,000 business locations across the United States and Canada.

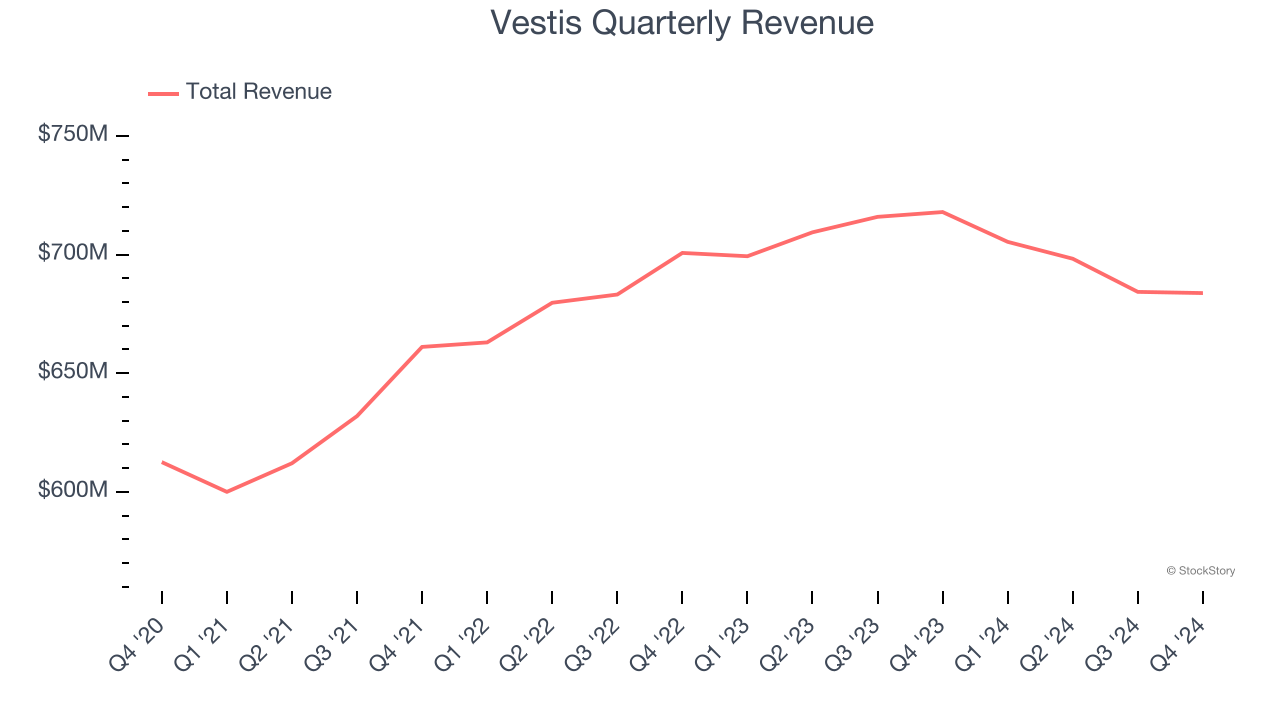

1. Long-Term Revenue Growth Disappoints

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Vestis’s 3.4% annualized revenue growth over the last three years was tepid. This fell short of our benchmark for the business services sector.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Vestis’s revenue to rise by 2.5%. While this projection indicates its newer products and services will catalyze better top-line performance, it is still below average for the sector.

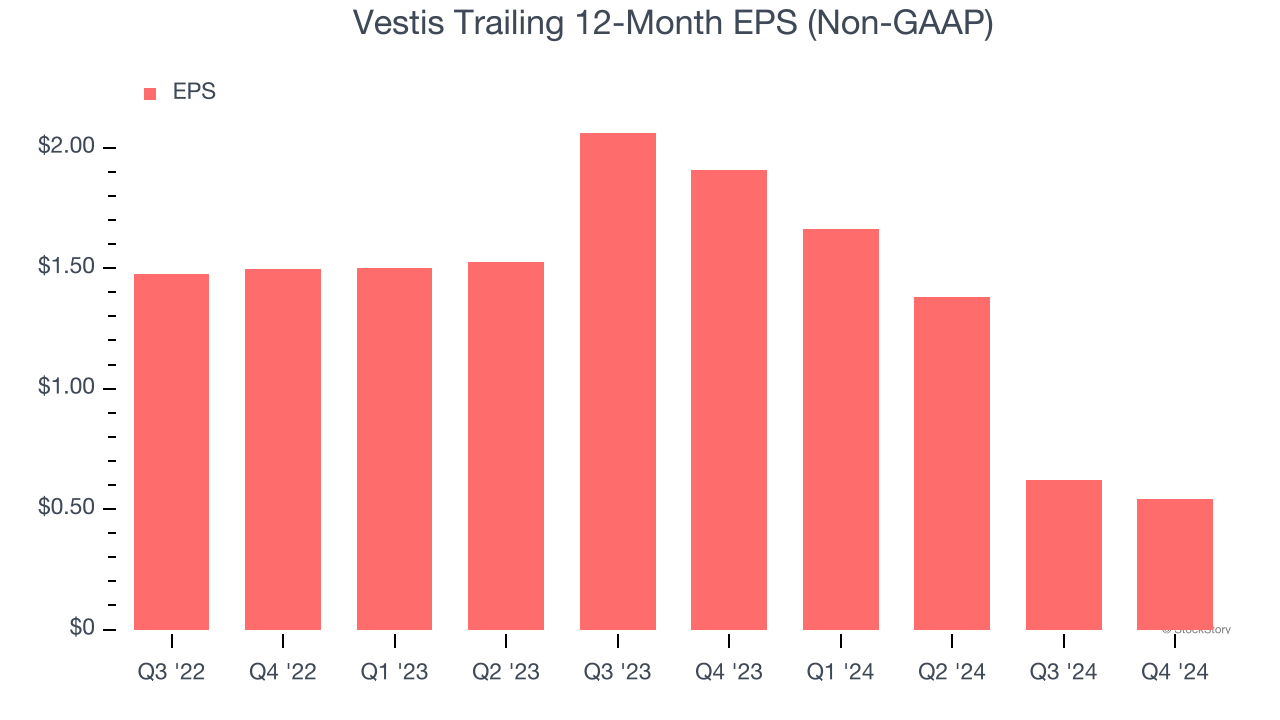

3. EPS Trending Down

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Vestis’s full-year EPS dropped 95.8%, or 39.9% annually, over the last two years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Vestis’s low margin of safety could leave its stock price susceptible to large downswings.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of Vestis, we’ll be cheering from the sidelines. Following the recent decline, the stock trades at 15.6× forward price-to-earnings (or $12.66 per share). This valuation tells us a lot of optimism is priced in - you can find better investment opportunities elsewhere. We’d recommend looking at an all-weather company that owns household favorite Taco Bell.

Stocks We Like More Than Vestis

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.