Shareholders of Microchip Technology would probably like to forget the past six months even happened. The stock dropped 30.9% and now trades at $53.18. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Microchip Technology, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Even though the stock has become cheaper, we're swiping left on Microchip Technology for now. Here are three reasons why MCHP doesn't excite us and a stock we'd rather own.

Why Do We Think Microchip Technology Will Underperform?

Spun out from General Instrument in 1987, Microchip Technology (NASDAQ: MCHP) is a leading provider of microcontrollers and integrated circuits used mainly in the automotive world, especially in electric vehicles and their charging devices.

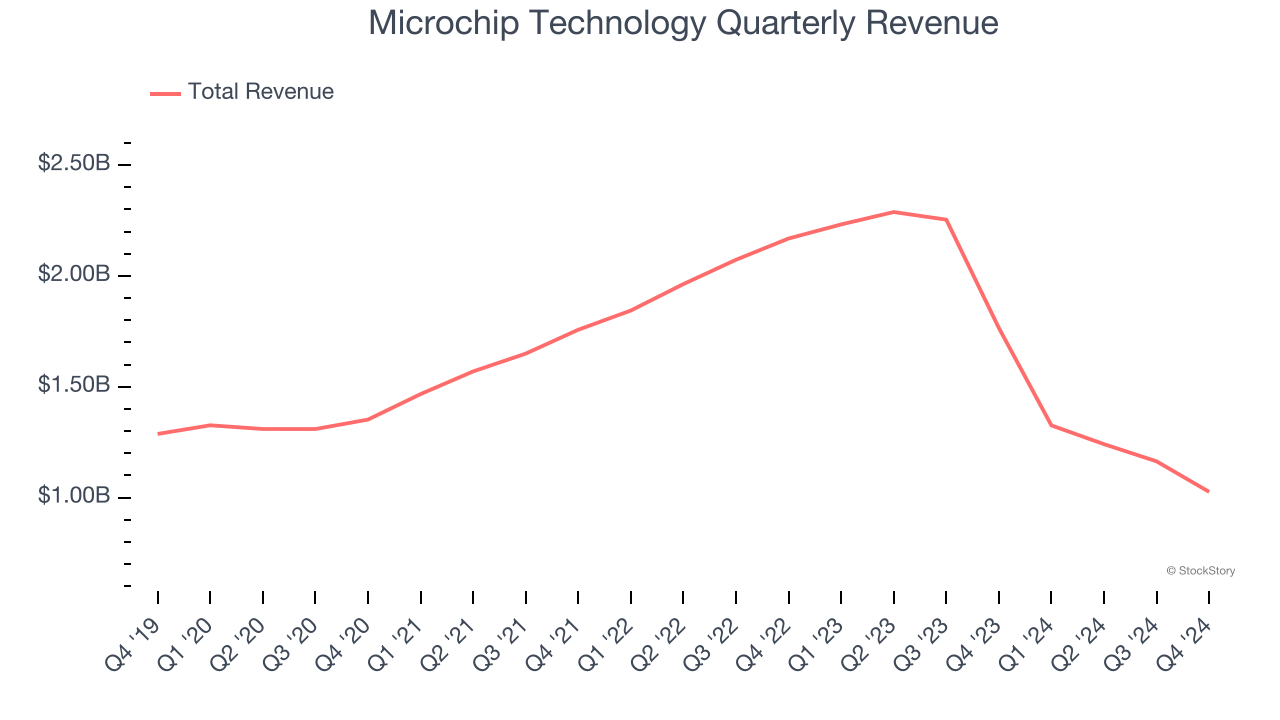

1. Revenue Spiraling Downwards

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Microchip Technology struggled to consistently generate demand over the last five years as its sales dropped at a 2.1% annual rate. This wasn’t a great result and is a sign of poor business quality. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Microchip Technology’s revenue to drop by 9%. While this projection is better than its two-year trend, it's tough to feel optimistic about a company facing demand difficulties.

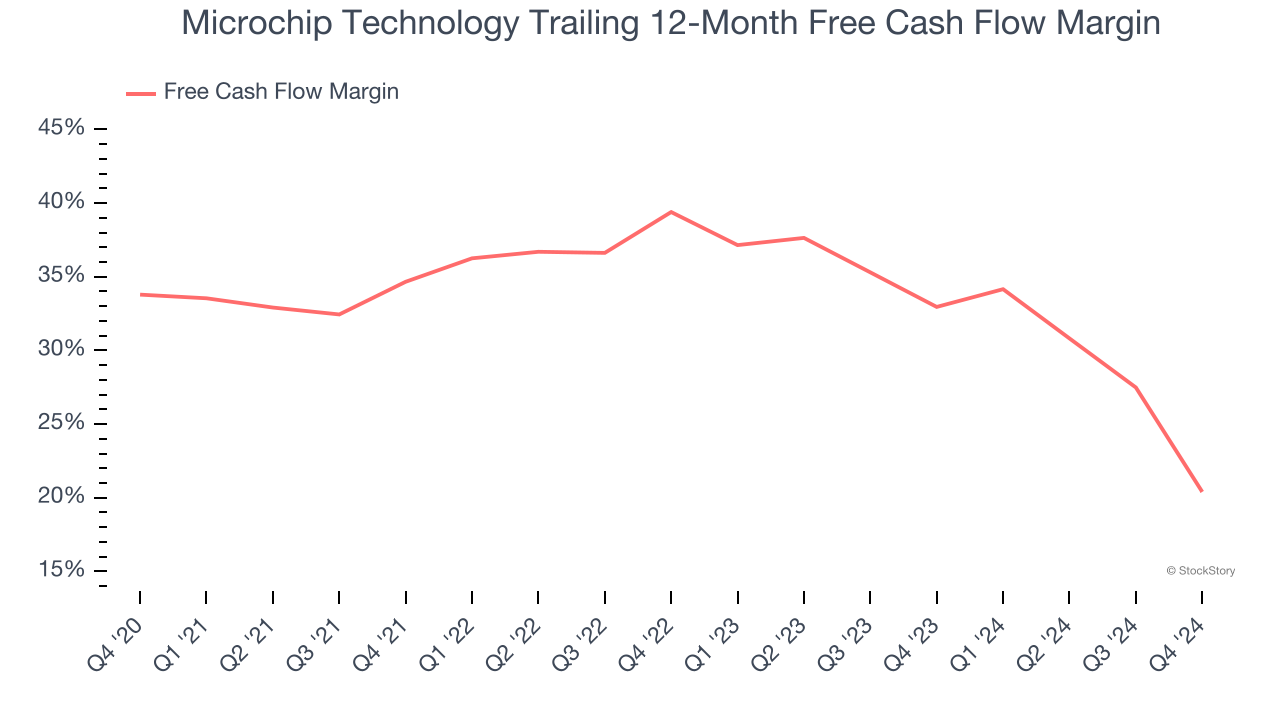

3. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Microchip Technology’s margin dropped by 13.4 percentage points over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity. Microchip Technology’s free cash flow margin for the trailing 12 months was 20.4%.

Final Judgment

Microchip Technology doesn’t pass our quality test. After the recent drawdown, the stock trades at 28.9× forward price-to-earnings (or $53.18 per share). This valuation tells us a lot of optimism is priced in - we think there are better stocks to buy right now. We’d suggest looking at one of our top digital advertising picks.

Stocks We Like More Than Microchip Technology

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.