Cable One has gotten torched over the last six months - since September 2024, its stock price has dropped 32.7% to a new 52-week low of $226.39 per share. This might have investors contemplating their next move.

Is now the time to buy Cable One, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Even with the cheaper entry price, we don't have much confidence in Cable One. Here are three reasons why there are better opportunities than CABO and a stock we'd rather own.

Why Do We Think Cable One Will Underperform?

Founded in 1986, Cable One (NYSE: CABO) provides high-speed internet, cable television, and telephone services, primarily in smaller markets across the United States.

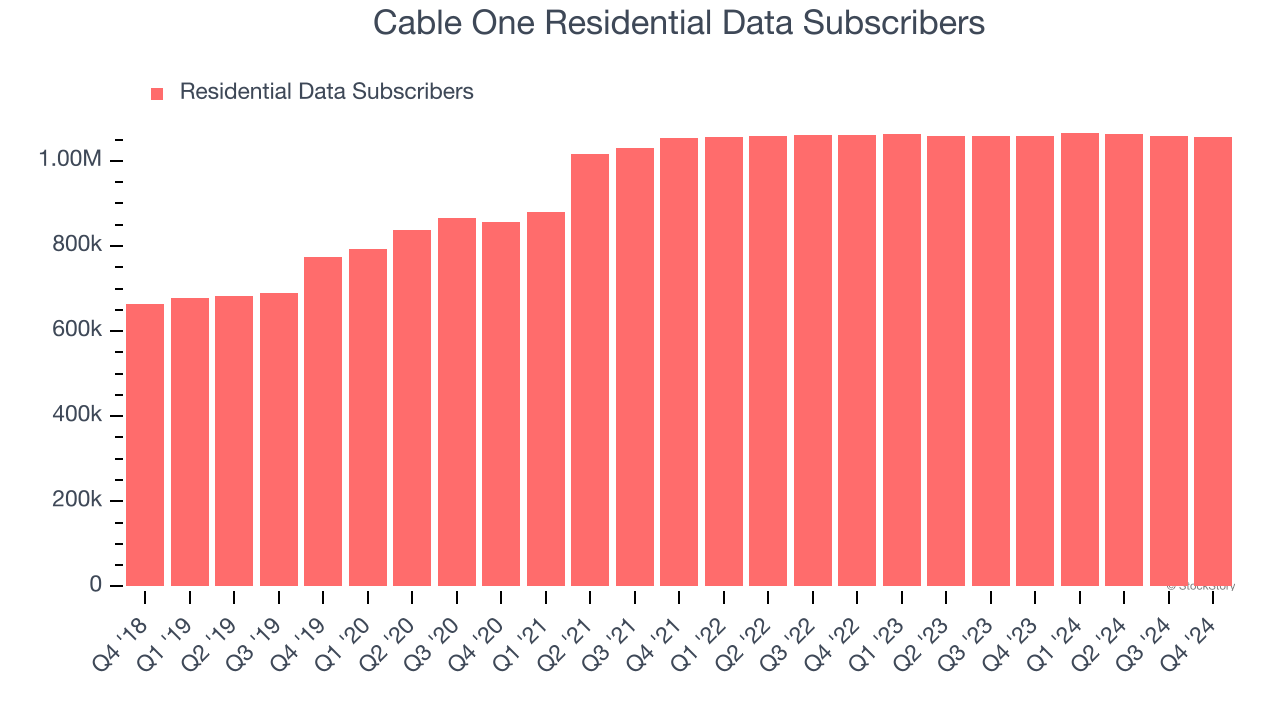

1. Inability to Grow Residential Data Subscribers Points to Weak Demand

Revenue growth can be broken down into changes in price and volume (for companies like Cable One, our preferred volume metric is residential data subscribers). While both are important, the latter is the most critical to analyze because prices have a ceiling.

Over the last two years, Cable One failed to grow its residential data subscribers, which came in at 1.06 million in the latest quarter. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Cable One might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Cable One’s revenue to drop by 2.5%, close to its 3.8% annualized declines for the past two years. This projection is underwhelming and suggests its newer products and services will not catalyze better top-line performance yet.

3. Cash Flow Margin Set to Decline

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Over the next year, analysts predict Cable One’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 23.9% for the last 12 months will decrease to 19.9%.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of Cable One, we’ll be cheering from the sidelines. Following the recent decline, the stock trades at 5.2× forward price-to-earnings (or $226.39 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are more exciting stocks to buy at the moment. We’d suggest looking at a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Like More Than Cable One

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.